Introduction:

At first I would like to thank my instructor for giving me such an important task Sarbanes Oxley act as Intern project. I would like to place my gratitude to GrameenPhone Ltd. to enable me to complete my Internship project in their esteemed organization. My classmates Mr. Rayhan, Mr. Sumon helps me lot. I want to give my special gratitude to my mother to continuously support me.

Background of the Report:

GrameenPhone Ltd. is the pioneering GSM service provider in Bangladesh. It launched its mobile phone service on March 26, 1997 and since then has become the largest mobile phone operator in the country. Its number of subscribers has grown rapidly, as has its coverage throughout the country. The number of subscribers currently stands at 22 million. The mobile phone market is a part of the consumer service industry. GP, like any other successful company dealing with consumer commodity, has to keep a continual tap with the prevailing and potential subscribers. Due to this reason, GP has to undertake intensive branding activities to facilitate the attainment of short-term organizational goals and long-term objectives. GP as a part of Telenor group have to follow SOA act as Telenor is enlisted in NASDAQ stock exchange.

Objective of the Report:

The study has been undertaken with the following objectives:

To analysis the pros and cons of the conventional ideas about a Sarbanes Oxley Act .

To compare the existing policy with that of best practices guidelines.

To identify and suggest scopes of improvement.

To get an overall idea about the performance of GrameenPhone Ltd.

To fulfill the requirement of theØ internship program under MBA program

Scope of the Report:

This report renders a close analytical look at the operational and financial activities of GrameenPhone & examines its impact . It also sheds light on the future activities to be undertaken to enhance the financial condition of the company. The report is written from the point of view of GrameenPhone, as it is expected to augment the knowledge base of the Finance department of GrameenPhone Ltd.

Sources of Information:

Data for this report was collected through documents and observations. Printed reports, annual reports, brochures and the official web site were the sources of data.

Methodology of the Report:

The following methodology will be followed for the study:

This report is based on analysis and observation.

Limitation of the Report:

As Sarbanes Oxley Act has introduce in GP from the end of 2006 so guidelines may not follow accurately or for company information security all relevant information may not present.

Report Organization:

This report is divided in five sections.

The following section is the organization.

Section II will give an overview of GrameenPhone Ltd.

Section III, Sarbanes Oxley Act and practice of SOA in GP

Section IV Best practice guidelines

Section V deals with findings and recommendations.

THE ORGANIZATION:

Historical Background:

GrameenPhone received a cellular license in Bangladesh by the Ministry of Posts and Telecommunications on November 28, 1996 and started its operations on March 26, 1997, the Independence Day of Bangladesh.

In 1996, Bangladesh was preparing to auction off private cell phone licenses to four companies. Dr. Muhammad Yunus, founder of Grameen Bank, took to the initiative to set up a not-for-profit private company called Grameen Telecom which is completely independent of Grameen Bank. Grameen Telecom, in turn, created a for-profit company called Grameen Phone, found a foreign partner, and put in a bid. Grameen Phone received one of the four licenses. Grameen Phone’s total capital was US$120 million including around US$50 million from IFC/CDC, and the Asian Development Bank (ADB). It also received US$60 million in equity from the four Grameen Phone private partners. These were the Norwegian Telenor with a 51% share, Marubeni of Japan with a 9.5% share, and the American Gonophone at 4.5%. Grameen Phone’s fourth partner is Grameen Telecom (with 35%). Grameen Telecom borrowed US$10.6 million from the Open Society Institute to set up Village Phone. Among the four initial investors, only Norwegian Telenor & Grameen Telecom remain as the existing shareholders.

The two existing shareholders own shares of GrameenPhone in the following manner:

| Company | Percentage of Share (%) |

| Telenor | 62 |

| Grameen Telecom | 38 |

Table Shareholders of GrameenPhone Ltd.

Mission, Vision and Goals

Company Vision:

“We are here to help”

Company Mission:

“To be the leading provider of telecom services all over Bangladesh with satisfied customers, shareholders and enthusiastic employees”

Grameen Phone Ltd. aims at providing reliable, widespread, convenient mobile and cost effective telephone services to the people in Bangladesh irrespective of where they live. Such services will also help Bangladesh to keep pace with other countries and reduce her existing disparity in telecom services between urban and rural areas.

Objectives of Grameen Phone:

The Company has devised its strategies so that it earns healthy returns for its shareholders and at the same time, contributes to genuine development of the country. In short, it pursues a dual strategy of good business & good development.

Company Strategy:

Grameen Phone’s basic strategy is coverage of both urban and rural areas. In contrast to the “island” strategy followed by some companies, which involves connecting isolated islands of urban coverage through transmission links, Grameen Phone builds continuous coverage, cell after cell. While the intensity of coverage may vary from area to area depending on market conditions, the basic strategy of cell-to-cell coverage is applied throughout Grameen Phone’s network.

Organization Structure of Grameen Phone Ltd:

GrameenPhone is divided into several departments namely Technical, Sales & Distribution, Marketing, Customer Management, Administration, Human Resource, Finance, IT, FON (fiber optic network), Information & Supply Chain Management .

Staffing is one of the major functions of management. Selecting the right people to get the job done is very important for the effectiveness and efficiency of an organization. This job is performed by the Human Resource Department.

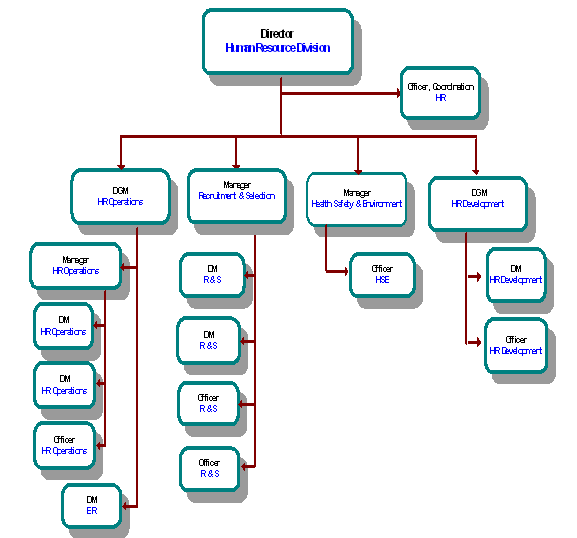

Human Resources Department:

Human Resources (HR) Department plays a vital role in the total functioning of GP. It conducts such activities as employee recruitment, selection, transfer, promotion, training, performance appraisal. . The informal structure of HR according to its functions can be classified into three main categories:

Human Resource Management (HRM)

Human Resource Development (HRD)

Human Resource Management Information system (HR- MIS)

Human Resource Management (HRM):

Manpower planning is an important function of HR management section. It performs two major activities:

Planning and forecasting the organization’s short term and long term human

resource requirements.

Analyzing the jobs in the organization and determining skills and abilities that are needed.

Performance appraisal is another main function of HR Management. Personnel decisions regarding the confirmation, increment, promotion, and transfer of an employee must be done in fixed or variable intervals of time.

Performance appraisal is done through:

Job analysis

Setting up performance standards

Appraisal interviews.

GP performance appraisal takes place in two stages-

On completion of probation

On completion of one year of service.

HR Management also deals with other personnel functions like leave management, show cause, termination, Dismissal, discharge, and resignation. It also issues circulars as and when required and conducts department inquiry among other functions.

Human Resources Development (HRD):

While employee performance must be evaluated in economic terms of efficiency and effectiveness, it can be best achieved through recognizing and enhancing the human dignity of each employee. The quality of the human resources can be effectively increased through education, training, and personal development.

Human Resources Development functions aim to increase the quality of the human resources especially through training.

GP training involves the following steps-

Assessing training needs

Selection of the participants

Conducting training programs.

GP provides both local and overseas training on the basis of the need analysis of the employee.

HR Management Information System (HR-MIS)

HR-MIS carries out activities such as:

Maintenance of employee related statistics

Maintenance & updating employee database

Other activities requiring employee data updating.

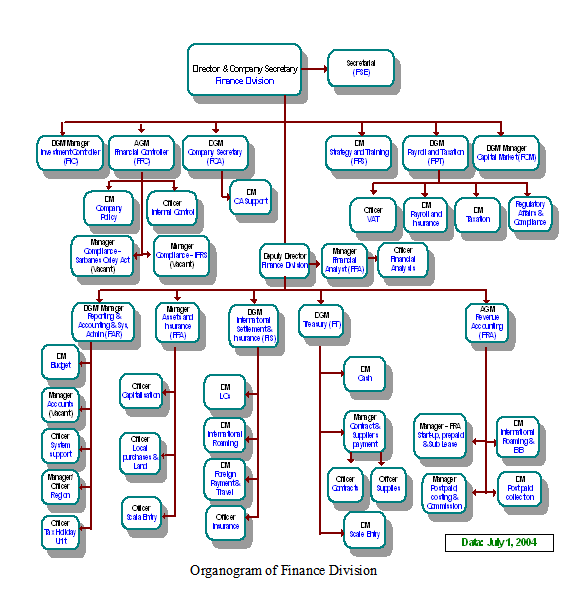

Finance Division:

The major task of the Finance department is budgeting, an important part of controlling.

Finance Department:

The main role of this department is financial planning and control and budgeting and control. In addition, it performs tasks such as methodology and development of the system, providing management information, analysis of financial statement for future action and co-ordination of information flow for inter-departmental and intra-departmental purposes.

Payroll, Tax and External Affairs Department:

This is a very sensitive and important segment in the finance department. This department is responsible for complying with the Companies Act and rules & regulations of the Bangladesh Government. It also works as legal advisory of tax, VAT and other external affairs. There is also an External Co-Ordination & Legal section, which is responsible for the regulatory obligation and legal findings of the Company. They handle both internal and external legal affairs. In addition there are the Accounts Department and the Cost and Budget Department. At present, the above departments are under supervision of the divisional director and manager of finance along with accounts officers for assistance.

Information System (IS) Department:

Daily activities of GrameenPhone like computer applications, PABX phone system, e-mails and other internet- related issues are all managed by the Information System Department. Whenever users face any problems in the above-mentioned activities, this department provides instant help.

IS mainly works with Switch and Customer Care Department. It maintains and manages the server oriented application software, which is known as CABS 2000. Billing and Customer Care use CABS 2000 and in this way they are closely related with IS Department.

Information Systems Department includes the Information Department, which is responsible for information flow both within and outside the organization.

In addition to the formal management structure, GrameenPhone provides a close, well-knit informal structure. Employees enjoy a recreational center with modern facilities and occasions such as GP nights celebrating achievements or rewarding competent employees. They have a well-organized Cafeteria, TV room and several other facilities for relaxation. A favorable environment to work together as a family is extremely important to GrameenPhone.

Problems Identified:

Grameen phone has a good owner structure and by now it has firmly established itself as the leader in Cellular phone sector. It covers all the 64 districts of Bangladesh and its service is the best among all the cell phone operators. It offers services to the villagers at a much lower late than the urban areas.

However, some problems have been identified through the interviews that were conducted. They are:

Insufficient Intra-organization Communication:

Sometimes there is inadequate communication between departments and this is used as an excuse not to solve problems.

Lack of Consideration for Urban Customers:

There are also many complaints from the urban customers. GrameenPhone has a complicated price structure and call rate in the urban areas is very high compared to that of the other countries in the Sub continent. Moreover, it has inadequate interconnection with BTTB and the other cell operators. As a result, sometimes it is difficult to call and receive calls from cell phones of other companies.

Recommendations:

The communication channels between the different departments need to be improved for better co-ordination. GrameenPhone should consider implementing a better inter-department information system.

As a company with the largest number of cell phone users, it should consider whether it can minimize the call rates in the urban areas. Recently it has worked with the other Cell phone companies to improve communication between them. It should continue to take such initiatives to improve its services.

It should also take initiatives such as introducing more reward programs, giving the employees stock options and so on, to improve the motivation of the employees to decrease the turnover rate.

Strength, Weakness, Opportunity and Threat (SWOT) of GrameenPhone

Strengths:

Good Owner Structure.

Availability of Backbone Network (Optical fiber).

Financial Soundness.

Market Leader.

Brand Name / Grameen Image

Skilled Human Resource.

Largest Geographical Coverage.

Good Human Resource and Infrastructure Installation all over the country through Bangladesh Railway and Grameen Bank.

Access to the widest rural distribution network through Grameen Bank.

High Ethical Standard.

Excellent relations with media & channel partners

Weaknesses:

Lack of co-ordination is used as an excuse not to solve problems

Different departments do not work together.

Inadequate interconnection with BTTB..

Complicated price structure

SMS platform has insufficient capacity.

Opportunities:

Economic growth of Bangladesh.

New and better interconnection agreement

Huge need for telecom services

Declining prices for handsets

Future privatization of the fixed network

New international gateway

Demand for inter-city communication

Growth in other operator will give more connection.

Threats:

More rigid government regulations.

More influence of competitors on the fixed network

Devaluation of Taka

National catastrophes.

Sabotage of installation.

Non-co-operation of government and fixed PSTN (Public Service Telephone Network).

Price war.

International Roaming:

International Roaming is an excellent feature offered only by GrameenPhone which gives the freedom of moving around the globe along with the GrameenPhone. It allows users to roam with own single GP mobile number with 202 GSM operators in 82 countries in 5 continents.

The benefits of International Roaming:

Reachable at one number!

Reduce high bill!

Tensionless traveling around the world!

Enjoying various facilities in other countries!

Brand Management Unit Overview:

The Brand Management unit within the Marketing department of Marketing Division is a very small & recently-formed unit, consisting of 5 full-time employees & 3 part-time employees. Within this unit, the sub-units are Corporate Brand planning, djuice brand planning & Value-added Services planning, Corporate Brand implementation, djuice brand implementation & value-added services implementation, and Reporting & documentation.

Main Branding Objectives:

To make the market aware of its coverage, products and new offerings.

To build up and hold strong organizational image (The image traits are: Market Leader, New Product Pioneer, Socially Responsible, Suave).

To create brand differentiation.

To keep the market aware of its continual presence.

To do market penetration.

To help the sales force.

To draw the attention of people by undergoing unorthodox branding activities.

To inform the market about its achievement.

To be the Trendsetter.

To create a strong lobbying panel.

To do public relation (PR).

Scope of Branding Activities:

Scope of GP’s branding activities includes the areas where the commercial operation is already going on. But under certain circumstances the branding activities are triggered off before launching commercial operation. Where and when to begin the branding operation depends on specific factors such as potential subscriber base, intensity of competition, previous track of branding activities.

Tools Used to Attain the Objectives:

Company profiling: This refers to display of various articles such as banners, festoons, posters, leaflets which have imprint of GP corporate logo and patch as per Telenor standard.

Advertisements in low level and high level media: GP goes for inserting various types of advertisements in print i.e. newspapers (and like) and electronic media i.e. television and radio. The types of ads include corporate ad, product ad, campaign ad and alliance ad. Alliance ad refers to the advertisements that are given on various occasions hailing the strategic/channel partners of GP.

Sponsoring various events: Sponsorship is one of the major branding tools of GP. Under this category certain events that have relevance to the fulfillment of corporate branding objectives are organized by GP.

Co-branding with other business and non-business entities: Co-branding is the tool that enables GP to affiliate itself with another business/non-business organization. In this respect, GP usually participate in a certain event with another body. This marketing tool is used by business body to position its brand image in the market thorough tagging its brand with that of the other’s. Thus while choosing a co-branding partner, GP follows a stringent set of criteria.

Criteria to Choose Strategic Partners or Affiliate:

The organization has to be socially responsible: The major criterion on which a great deal of emphasis is laid in selecting strategic partners (SP) is “how much socially responsible the company is?” GP tags itself only with the companies that have significant social commitment. The potential SP will have to have profound contribution in the socio-economic development of Bangladesh. For instance, GP has signed a MOU with UNICEF. UNICEF is a part of United Nations and is responsible for channeling funds to Bangladesh for various development purposes. Facilitating child education, banning child labor are a few to name among its major activities. This donor agency has an extremely good image of participating in the social welfare of developing countries across the globe. Through its participation in child education program UNICEF is contributing to the development of youth of the country. So, tagging its brand with that of UNICEF would enable GP to go for brand comparison.

The organization has to be a topper in its industry: Another criterion of selecting SP is the stand of the organization in its respective industry. The companies that have strong foothold in the industry become GP’s SP. When GP launched the service of making people aware of Dengue Fever, Beximco Pharma was selected to be the SP. Beximco Pharma is the topper in Bangaldeshi pharmaceutical industry in terms of annual sales turnover and market share.

The industry in which the organization is operating has to be environment friendly and non-injurious to human health: Industry in which the organization is working is also a part of the selection criteria. If the industry is not environment friendly, it is not selected to be the SP of GP. For example, GP has never tried to tag its brand name with British American Tobacco (BAT). Although BAT is the market leader and carries out profound promotional activities across the globe, GP does not co-brand with them because smoking is injurious to health and GP does not intend to collaborate with any organization whose main line of business causes harm to human health.

The organization has to be above any controversy: The SP has to have a very clean image in the market. It should not be involved in controversy. Getting into collaboration with any organization involved in any controversy hampers the pure image of GP. So, while choosing a SP a great deal of importance is laid on the matter that whether the potential SP is involved in any controversy or not.

Any organization that plays critical role to meet the strategic purpose of GP: Co-branding with other organizations also helps GP in attaining its strategic goals. For example, launching the news service with “The Daily Star” and “Prothom Alo”. Both of these newspapers are among the highest circulated national dailies. So, collaborating with them gives a strong partner to be vocal in GP’s favor at national level, when needed.

CSR at Grameenphone:

Grameenphone started its journey 10 years back with a believe that “Good development is good business”. Since its inception, Grameenphone has been driven to be inspiring and leading by example, when it comes to being involved in the community. At Grameenphone we believe that, sustainable development can only be achieved through long term economic growth. Therefore, as a leading corporate house in Bangladesh we intend to deliver the best to our customers, business partners, stakeholders, employees and society at large by ‘being a partner in development.’

Grameenphone defines CSR as ‘a complimentary combination of ethical and responsible corporate behavior as well as a commitment towards generating greater good in society as a whole by addressing the development needs of the country,’

To interact effectively and responsibly with the society and to contribute to the socio-economic development of Bangladesh, GP has adopted a holistic approach to CSR, i.e. Strategic and Tactical. Through this approach GP aims to, on the one hand involve itself with the larger section of the society and to address diverse segments of the stakeholder demography, and on the other remain focused in its social investment to generate greater impact for the society.

Grameenphone focuses its CSR involvement in three main areas – Health, Education and Empowerment. We aim to combine all our CSR initiatives under these three core areas to enhance the economic and social growth of Bangladesh.

We believe that Corporate Social Responsibility is a journey along which we will create a positive difference in the community and the development of the country; thus meeting the expectations of our customers and stakeholders.

Village Phone:

The internationally acclaimed Village Phone Program (VPP) continued to grow rapidly during 2006, providing telecommunications services in rural areas all over Bangladesh, covering even the remote off-shore islands in the Bay of Bengal.

Managed by Grameen Telecom in cooperation with Grameen Bank and GrameenPhone, the VPP further expanded to add nearly another 100,000 new VP subscribers, with the total year-end figure standing at around 191,000 in 2005.

As of today, there are more than 260,000 VP operators in over 50,000 villages in 439 Upazilas (sub-districts) of the country. Amongst GP subscribers, VP operators yielded the highest average revenue per month.

Commencing its operation in March 1997, the VPP is a unique initiative to provide telecommunications facilities in remote, rural areas where no such service was available before. It has brought about a quiet revolution in mobile telephony in Bangladesh, by putting cell phones in the hands of the rural poor, many of them women, who had never seen a telephone before.

The Village Phones work as an owner-operated pay phone. It has created a good income-earning opportunity for the VP operators, mostly poor women who are borrower members of Grameen Bank. Typically, a member of Grameen Bank takes a loan to buy a handset and a GP subscription and she is trained by Grameen Telecom on how to operate it.

VPP has received many international awards while it has also been extensively featured in the international media over the years and documented by researchers both at home and abroad. It was given the “GSM in the Community Award” by the GSM Association at the GSM Congress in Cannes, France in February 2000. It also received the “Commonwealth Innovation Award” in 2003 and the “Petersburg Prize” awarded by the Gateway Foundation in 2005.

The Village Phone Program has also been replicated in a number of countries including Uganda and Rwanda in Africa.

Research studies have found that the introduction of Village Phones has made a “tremendous” social and economic impact in the rural areas, creating a “substantial consumer surplus” for the users. It directly increases the household income of the Village Phone operator.

Findings showed that this modern technology has increased the social standing of the Village Phone Lady. The various studies have found that one of the most important contributions of Village Phones was to make market information accessible to all. It has also substantially empowered the women from the rural households, who can now access numerous services provided by the government and non-government organizations through a simple telephone call from her village.

Education is the key to prosperity and good life. Every human being should have the opportunity to make a better life for him or herself. One of the Millennium Development Goals (MDG) for Bangladesh is to achieve universal primary education; unfortunately too many children in Bangladesh today grow up without this opportunity, because they are denied their basic right to even attend primary school. The country’s low literacy rate of 41% (2004 UNESCO Report), may indicate that we are far away in pursuit of sustainable development, but at the same time the gradual increase in the adult literacy rate gives us the hope that our nation has the potential to improve in this sector.

The marginalized and disadvantaged groups in general — particularly the rural and urban-poor of Bangladesh — have significantly less access to education than other groups. Though initial enrollment in primary school is high, the completion rate is notably low; approximately 65% (World Bank 2004) and a smaller percent of that even complete secondary school. Bangladesh government has provided lot of incentives, such as, free distribution of textbooks in primary schools, secondary stipend program for 100% of the girls, Food for Education project, to encourage and improve the educational sector of the country, which has helped in improvement in the literacy rate. But still we have a long way to go to make our country illiteracy free, thus we look forward to support this sector, which will eventually help to build a developed country.

Providing access to education, especially for children from disadvantaged backgrounds who might not otherwise get the opportunity, is the main goal of Grameenphone’s CSR education initiatives. Many people in Bangladesh still lack the basic technological knowledge and marketable skills, thus we plan to focus further to develop an educated and skilled workforce through creating opportunity in capacity development; skilled workforce would in turn be able to create and share knowledge and contribute to the economy of Bangladesh.

Empowerment:

Lack of empowerment and poverty is a chronic and complex problem for Bangladesh. According to UNDP HDI report (2006), which measures the average progress of a country in human development, in terms of, life expectancy, adult literacy and enrolment at the primary, secondary and tertiary level, Purchasing Power Parity (PPP), etc., Bangladesh ranks 137th among 177 countries. Moreover, 50% of the total population of Bangladesh lives below the poverty line, defined by less than a dollar a day.

Some of the major factors contributing to this situation are inequality in income distribution, lack of access to resources, lack of access to information and inadequate infrastructure. The rural people of Bangladesh especially are deprived of these facilities, which is a major issue to break out from the shackles of poverty prevailing in the country.

Empowerment is a key constituent towards poverty reduction, and it is a key driver for sustainable economic development. Empowerment is a process of enhancing the capacity of individuals or groups to make choices and to transform those choices into desired actions and outcomes, which in turn helps them to secure a better life.

We acknowledge that development and poverty reduction depend on holistic economic prosperity; therefore our aim is to increase development opportunities, enhance development outcomes and contribute towards development of the quality of life of the people through our CSR initiatives and innovative services. We would like to facilitate empowerment opportunities to the vulnerable people of Bangladesh, so that it enables them to better influence the course of their lives and live a life of their own choice.

Health:

Helping and caring for the community is an essential component of Grameenphone’s Corporate Social Responsibility; therefore we endeavor to make a positive contribution to the underprivileged community of Bangladesh by helping in improvement of the health perils in the country as much as possible.

Healthcare is still inaccessible for many Bangladeshis. Almost half of the country’s population live below the poverty line and cannot even afford basic healthcare. Only 35% of the rural population use adequate sanitation facilities and 72% have access to clean drinking water. Moreover the people of the flood-prone areas suffer from many waterborne diseases.

Two of the Millennium Development Goals (MDG) are to; reduce the under-five mortality rate and to improve maternal health by reducing the maternal mortality rate. In Bangladesh, the infant mortality rate is 66 per 1000 and the maternal mortality rate is more than 315 per 1000 during child birth, which is one of the highest in Asia.

The major problem in this sector is the significant gap between healthcare knowledge and practice and availability of the healthcare services. Therefore, all possible sources, be it public or private, should mobilize their efforts to make healthcare services available to the people who need it most, and thus help in achieving the MDG goals.

Our plan is to engage in programs, especially in the rural areas, that will assist in creating awareness about healthcare and healthcare services and help improve the overall quality of life.

Keeping our vision in mind – we are here to help; we aim to extend our contribution to the development of the healthcare system and work to provide a brighter and healthier future for the people of Bangladesh.

SOME CORPORATE SOCIAL RESPONSIBILITY

ACTIVITIES

OF GRAMEEN PHONE

Distributing relief in coastal areas:

As a part of its corporate social responsibility and corporate citizenship, GrameenPhone Ltd. extended its hand to help the storm-surge affected people in the Barisal Division during October ‘06.

Relief items were distributed among 3,000 most-affected families in five areas of Patuakhali, Barguna and Bhola districts under Barisal Division. Each received 5 kg of rice, 2 kg of lentil, 1 liter of soya-oil and a cash contribution of Tk. 300. A good number of GP employees volunteered to take part in this relief effort, which took place on 2nd October’06.

GP launches development talk-show:

Grameenphone has launched a talk-show on development issues of Bangladesh in cooperation with Channel i. The premiere episode of the fort-nightly development talk-show Grameenphone Nayone Bangladesh 2021 was aired on the 8th December (Friday) at 6 p.m on Channel i.

In the year 2021, Bangladesh will be celebrating its 50th Anniversary of independence. In that context, the program aims to bring pundits and concerned citizens together to the discussion table to reach a consensus regarding a development road-map for the country.

The first six episodes brought together a panel of experts who discussed their views on identified issues. The 7th and 8th episodes featured students from various universities giving their perspectives on education and health issues of Bangladesh.

Helping Thalasaemia patients:

Grameenphone signed a letter of intent recently with Bangladesh Thalasaemia Hospital (BTH) on 24th December ’06 to address the problem of acute shortage of fresh, healthy blood supply as well as lack of wide awareness regarding this disease.

Like many countries across the world, a significant number of people suffer from thalasaemia in Bangladesh. But there is a general lack of awareness regarding this disease.

Regular fresh blood transfusion might help a thalasaemia patient to maintain almost a regular lifestyle. But this is not as simple as said. Bangladesh suffers from acute shortage of fresh, healthy blood supply.

Keeping in mind these two vital factors – lack of awareness and supply requirement of healthy, fresh blood – Grameenphone, as a responsible corporate citizen, aims to organize 3 blood collection campaigns every year among GP employees which will be donated for the treatment of the patients in BTH.

The first of these blood collection campaigns was organized on the 12th December’06, where 46 Grameenphone employees donated blood during the event. On this occasion, Emad-ul-Amin, Director, Human Resources Division of Grameenphone, said that, “We hope that our efforts will encourage others as well to fight this deadly disease that claims numerous lives worldwide every year.”

GP distributes winter clothes:

Grameenphone distributed blankets and winter clothes among the poor people throughout the country who were affected by the severe cold wave during the month of January this year.

In addition to Grameenphone’s contribution, the company called for donations from its employees, both centrally and regionally. Through this initiative, Grameenphone and its employees donated and then distributed some 12,400 blankets and 50 cartons of winter clothes among the affected poor people across the country.

Since the northern region was the worst affected, this initiative’s primary focus was Kurigram and Rangpur in Rajshahi division which is also a very economically-challenged zone. In the other divisions, Grameenphone had distributed blankets and winter clothes among the poor slum-dwellers and floating people in the divisional cities.

The number of beneficiaries in Rajshahi Division was 5200, 1900 in Khulna, 1500 in Sylhet, 1200 in Barisal, 1100 in Chittagong and 1500 in Dhaka. Each of these distribution programs was directly organized by the Grameenphone employees while necessary counseling was sought from local government offices in identifying the affected areas and the recipients.

During distribution of winter clothes in Kamrangir Char area of Dhaka, Erik Aas, CEO of Grameenphone commented, “Every year, Grameenphone organizes and distributes warm clothes and blankets among the affected people. But this year, realizing the ferocity of the cold-wave, we decided to extend our support in different affected parts throughout the country. We look forward to contribute in the community in the future as well and thus live by our vision to help.”

GP volunteers at Wari-Bateshwar:

As part of GP’s employee involvement program in social activities, volunteers were called in to take part in the excavation work at the Wari-Bateshwar on 16-17 February 2007.

Since 2005, Grameenphone has partnered with the organization named ‘Otihiya Onneshwon’ in the excavation work at Wari-Bateshwar, a historically significant site dating back to the 2nd urbanization (approx. 500 BC) in the Indian sub-continent.

This project is being implemented by the Archeological Department of Jahangirnagar University. GP commits long-term to be the sole and exclusive sponsor of this initiative and supports both through financial resources and assistance in raising public awareness.

Recently a team of 34 volunteers from Grameenphone got a first hand experience of the excavation work at Wari-Bateshwar on 16-17 February 2007. The volunteers were divided into two teams, and then taken to the main sites of work where they got the opportunity to help in the excavation work. The volunteers worked on-site with the supervision of the senior students of the Archeology Department of Jahangirnagar University.

Grameenphone sponsors International Conference on ICT:

Grameenphone has recently sponsored the International Conference on Information and Communication Technology (ICICT) 2007. The conference, organized by the Institute of Information and Communication Technology (IICT), Bangladesh University of Engineering and Technology (BUET), ran on March 7-9, 2007. This is the first time ever that Bangladesh had hosted such a prestigious ICT conference.

The ICICT is a bi-annual conference, dedicated to presenting and discussing scientific results, emerging ideas, practical applications, topical issues and new trends in the field of Information and Communication Technology (ICT). The conference brings together academia, researchers, scholars, and industry representatives.

Prof. Jamilur Reza Chowdhury, Vice Chancellor of BRAC University was the chief guest of the program. In his speech, he praised GP’s contribution in the ICT sector and highlighted programs like Village Phone (VP) and Community Information Center (CIC). He also added, that “while a lot of thoughts and dreams were shared by the Government and other organizations in the past years by identifying ICT as a powerful sector, it was only GP which, with about 300,000 Village Phone operators and more than 500 Community Information Centers across the country, that has made it a reality.”

GP organizes eye-camp in Cox’s Bazaar:

Grameenphone, jointly with Sight Savers International, organized a two-day eye-camp in Cox’s Bazaar Public Library Auditorium from 28th-29th March, 2007 to provide free eye-care support to the underprivileged people of that region.

Over 1100 patients were screened and given prescriptions. Among the patients, 141 were given prescription for refractive error and 114 were selected for cataract surgery. These cataract surgeries were conducted in thefollowing two days.

The Deputy Commissioner of Cox’s Bazaar District, Md. Aminul Islam, who was present at the inaugural session of the camp as chief guest, said that Grameenphone’s effort in incorporating humanitarian initiatives into its business is extremely commendable, as it clearly demonstrates Grameenphone’s commitment in taking Bangladesh forward.

This initiative undertaken by Grameenphone was greatly appreciated by all those present, especially considering that the program reached out to those who do not have access to proper health care. As a responsible corporate citizen, Grameenphone has always recognized its social responsibilities, especially to the less privileged sections of the society.

National Disability Day rally:

The National Disability Day was observed on April 4, 2007 to acknowledge and honor people with disabilities. This year, Grameenphone, jointly with the Center for Disabled Concern (CDC), a local support group in Chittagong, celebrated the day through a number of activities.

Established in 1997, CDC is run by Mr. Selim Nazrul, who is himself a physically challenged person. He was honored by Prothom-Alo and Grameenphone for his achievements and contribution in the community through an award giving ceremony of “Prothom Alo-Grameenphone Shommanona 2006” earlier this year. CDC is involved in a wide range of advocacy and counseling programs as well as treatment and rehabilitation services for the physically and mentally challenged individuals at Dampara, Chittagong.

The National Disability Day was observed with activities, aimed at raising awareness on the needs and rights of physically and mentally challenged individuals with special focus on their right to social security. A large rally was also organized on the occasion. Each year CDC observes this day, which is attended by both mentally and physically challenged people of Chittagong, along with the development activists and members of the local community.

Honoring unsung heroes:

Grameenphone in collaboration with Prothom Alo, a leading daily newspaper in Bangladesh, organized a program titled “Prothom Alo-Grameenphon Shommanona 2006” on 28th February ‘07 to pay tribute to those people in the country who, in their own way, have strived for betterment of their community.The aim of this program was to bring the little-known development practitioners to the limelight creating inspiration and confidence for others.

Since 2003, Prothom Alo, the leading national daily Bengali newspaper of the country, has been publishing weekly articles on lesser known development practitioners, who have been contributing directly to the socio-economic development of the country in different ways. These people have been selflessly working without any assistance from the Government or from any other organization – working from their social commitment to improve the quality of lives in their communities.

Fifty-two such individuals were recognized on the day. While, each of the recipients were overjoyed at the recognition, one of the recipients could not contain herself as she claimed that she felt as though she had received the Nobel Prize itself. She also added that she hopes Grameenphone and Prothom Alo continue their efforts in acknowledging those who deserve it, so that it encourages others to do the same.

CASE STUDY OF GRAMEEN PHONE’S CSR:

(20 May 2007) Grameenphone has signed an agreement to support the national “Safe Motherhood and Infant Care” program to provide free comprehensive primary healthcare services to the poorest segment of the population in order to ensure meeting the Millennium Development Goals (MDG) set for Bangladesh.

The agreement was signed yesterday between Grameenphone and the NGO Service Delivery Program (NSDP) of USAID. Erik Aas, Managing Director of Grameenphone, and Dr. Robert Timmons, Chief of Party of NSDP, signed the agreement on behalf of their respective organizations. Pathfinder International is the managing partner of NSDP. With this partnership for a nationwide project on Safe Motherhood and Infant Care, Grameenphone will provide all necessary assistance to NSDP to facilitate free comprehensive primary healthcare services to the poorest of the poor in the country for safe motherhood and infant care. Under this project, free services will be given to all poor pregnant mothers and infants in 61 districts of Bangladesh, with special focus on the hard-to-reach areas, particularly in the coastal areas.

“We believe we should work together to create means through which, we will not only assist in raising necessary awareness but also take the available services door-to-door and reach the mass population of the country,” observed Kafil H.S. Muyeed, Director of New Business Division of GP.

Grameenphone will also contribute towards the necessary infrastructure development and extension of basic healthcare services in these areas. In addition it will provide assistance in enhancing the service quality through recruitment and field placement of additional community-based health workers and up-gradation of some of the existing static clinics into emergency obstetric care centers. On the other hand, to address the complications relating to referral and hard-to-reach population, this project will also introduce motorized vans to facilitate better patients’ referrals between home-delivery and emergency obstetric care clinics; some clinic-on-wheels will also be deployed to increase the accessibility of the services to the hard-to-reach poorest segments of the population.

In his speech, Dr. Robert J. Timmons of NSDP said “It is the first nationwide sponsorship in the health sector by a leading corporation representing a long-term CSR strategy. A public-private partnership designed to utilize our existing infrastructure and expand it in selected areas to further meet the needs of the poorest families in Bangladesh.”

GRAMEEN PHONE’S INVESTOR COMPANY

TELENOR

Telenor is emerging as one of the fastest growing providers of mobile communications services worldwide. Telenor is also the largest provider of TV services in the Nordic region.

Telenor is organised into three business areas; Mobile operations covering 13 countries, and Fixed-line and Broadcast services covering the Nordic region.

The Telenor Group

More than 123 million mobile subscriptions worldwide

Strong position in the growing Scandinavian market for broadband services

Largest provider of television and broadcast services in the Nordic region

Revenues 2006: NOK 91.1 billion

Workforce: 32 150 man-years

Listed on the Oslo Stock Exchange and NASDAQ in New York

For over 150 years, telecommunications has played a vital part in the development of modern Norwegian society. As the incumbent provider, Telenor has been the driving force in the development of a highly sophisticated home market. The physical work has consisted in rolling out infrastructure and developing services over long distances and in harsh natural conditions. The real job, however, is building relations between people.

Grameenphone submits final IPO application:

Grameenphone Ltd. has filed its final application for an initial public offering (IPO) of US$65 million (BDT 449 crore) with the Securities and Exchange Commission (SEC) today (December 11, 2008).

Grameenphone’s Board of Directors had earlier approved a proposal for an IPO of its shares, subject to necessary approvals and market conditions. The price for the IPO has been proposed at BDT 7.00, subject to SEC approval.

The final prospectus was handed over by Grameenphone CEO Oddver Hesjedal to SEC Chairman Faruq Ahmad Siddiqi. SEC Executive Director Farhad Ahmed, Grameenphone Board Members Dipal Barua from Grameen Telecom, Per Erik Hyland from Telenor and Grameenphone CFO Arif Al Islam were also present on the occasion.

Grameenphone Ltd. has also successfully closed the marketing of a pre-IPO private placement of its shares amounting to US$60 million (BDT 413 crore) to local institutional investors on December 4, 2008. The pre-IPO placement offer was over-subscribed by three times due to strong support from more than 50 local institutional investors. In the pre-IPO offer, the company raised a total of USD 60 million at BDT 7.4 per share, which was increased from earlier size due to the strong demand.

“We are proud of our achievement in having reached this milestone. We remain committed to contributing to the development of the capital markets of Bangladesh and look forward to a successful completion of the largest IPO in the country” said Oddvar Hesjedal, CEO of Grameenphone.

Citigroup Global Markets Bangladesh Private Ltd. acted as the placement agent for the pre-IPO placement and has been appointed as the Issue manager for the IPO.

Grameenphone Pre-Public Offer receives strong support:

The Grameenphone Pre-Public Offer was over-subscribed by three times due to strong support from more than 50 local institutional investors.

On November 11, 2008, following the submission of its preliminary Initial Public Offer (IPO) application to Securities and Exchange Commission, Grameenphone launched the marketing of the Pre-Public Offer (PPO) of its shares to local institutional investors. This three-week long event, which concluded on December 3, 2008, included an informal “price discovery” process between BDT 7-9 per share and gave local institutional investors an opportunity to bid for their desired amount within this marketed range.

Commenting on the strong response received from over 50 local institutional investors to the Pre-Public Offer, Grameenphone CEO, Oddvar Hesjedal said, “We are humbled by the response received from institutional investors to participate in the Pre-Public Offer of our shares. We remain committed to serve each and every one of our existing and new shareholders to the best of our abilities to maximize their shareholder value”.

On November 30, 2008, based on the conclusion from the “price discovery” process, the Board of Directors of Grameenphone, approved the final Price, Size and Allocation of Pre-Public Offer (PPO) and Initial Public Offer (IPO) of its shares, subject to necessary approvals and market conditions.

The total issue size is expected to be up to USD 125 million for PPO and IPO combined. In the Pre-Public Offer, the company will raise up to a total of USD 60 million at BDT 7.4 per share, which was increased from earlier size due to strong demand. The allocation of shares in the PPO will be distributed in three tranches, namely to institutional investors, Grameenphone employees and Grameen Bank borrowers.

Grameenphone also intends to complete all formalities with the Securities and Exchange Commission for their Initial Public Offering at BDT 7.00 per share (a 5.4% discount to the Pre-Public offering).

Sarbanes-Oxley Act:

The Sarbanes-Oxley Act of 2002 also known as the Public Company Accounting Reform and Investor Protection Act of 2002 and commonly called Sarbanes-Oxley, Sarbox or SOX, is a United States federal law enacted on July 30, 2002 in response to a number of major corporate and accounting scandals including those affecting Enron, Tyco International, Adelphia, Peregrine Systems and WorldCom. These scandals, which cost investors billions of dollars when the share prices of the affected companies collapsed, shook public confidence in the nation’s securities markets. Named after sponsors Senator Paul Sarbanes (D-MD) and Representative Michael G. Oxley (R-OH), the Act was approved by the House by a vote of 334-90 and by the Senate 99-0. President George W. Bush signed it into law, stating it included “the most far-reaching reforms of American business practices since the time of Franklin D. Roosevelt.

The legislation establishes new or enhanced standards for all U.S.public company boards, management, and public accounting firms. It does not apply to privately held companies. The Act contains 11 titles, or sections, ranging from additional Corporate Board responsibilities to criminal penalties, and requires the Securities and Exchange Commission (SEC) to implement rulings on requirements to comply with the new law. Debate continues over the perceived benefits and costs of SOX. Supporters contend that the legislation was necessary and has played a useful role in restoring public confidence in the nation’s capital markets by, among other things, strengthening corporate accounting controls. Opponents of the bill claim that it has reduced America’s international competitive edge against foreign financial service providers, claiming that SOX has introduced an overly complex and regulatory environment into U.S. financial markets.

The Act establishes a new quasi-public agency, the Public Company Accounting Oversight Board, or PCAOB, which is charged with overseeing, regulating, inspecting, and disciplining accounting firms in their roles as auditors of public companies. The Act also covers issues such as auditor independence, corporate governance, internal control assessment, and enhanced financial disclosure.

Overview:

Sarbanes-Oxley contains 11 titles that describe specific mandates and requirements for financial reporting. Each title consists of several sections, summarized below.

Public Company Accounting Oversight Board (PCAOB)

Title I consists of nine sections and establishes the Public Company Accounting Oversight Board, to provide independent oversight of public accounting firms providing audit services (“auditors”). It also creates a central oversight board tasked with registering auditors, defining the specific processes and procedures for compliance audits, inspecting and policing conduct and quality control, and enforcing compliance with the specific mandates of SOX.

Auditor Independence:

Title II consists of nine sections and establishes standards for external auditor independence, to limit conflicts of interest. It also addresses new auditor approval requirements, audit partner rotation, and auditor reporting requirements. It restricts auditing companies from providing non-audit services (e.g., consulting) for the same clients.

Corporate Responsibility:

Title III consists of eight sections and mandates that senior executives take individual responsibility for the accuracy and completeness of corporate financial reports. It defines the interaction of external auditors and corporate audit committees, and specifies the responsibility of corporate officers for the accuracy and validity of corporate financial reports. It enumerates specific limits on the behaviors of corporate officers and describes specific forfeitures of benefits and civil penalties for non-compliance. For example, Section 302 requires that the company’s “principal officers” (typically the Chief Executive Officer and Chief Financial Officer) certify and approve the integrity of their company financial reports quarterly

Enhanced Financial Disclosures:

Title IV consists of nine sections. It describes enhanced reporting requirements for financial transactions, including off-balance-sheet transactions, pro-forma figures and stock transactions of corporate officers. It requires internal controls for assuring the accuracy of financial reports and disclosures, and mandates both audits and reports on those controls. It also requires timely reporting of material changes in financial condition and specific enhanced reviews by the SEC or its agents of corporate reports.

Analyst Conflicts of Interest:

Title V consists of only one section, which includes measures designed to help restore investor confidence in the reporting of securities analysts. It defines the codes of conduct for securities analysts and requires disclosure of knowable conflicts of interest.

Commission Resources and Authority:

Title VI consists of four sections and defines practices to restore investor confidence in securities analysts. It also defines the SEC’s authority to censure or bar securities professionals from practice and defines conditions under which a person can be barred from practicing as a broker, adviser or dealer.

Studies and Reports:

Title VII consists of five sections and requires the Comptroller General and the SEC to perform various studies and report their findings. Studies and reports include the effects of consolidation of public accounting firms, the role of credit rating agencies in the operation of securities markets, securities violations and enforcement actions, and whether investment banks assisted Enron, Global Crossing and others to manipulate earnings and obfuscate true financial conditions.

Corporate and Criminal Fraud Accountability:

Title VIII consists of seven sections and is also referred to as the “Corporate and Criminal Fraud Act of 2002”. It describes specific criminal penalties for fraud by manipulation, destruction or alteration of financial records or other interference with investigations, while providing certain protections for whistle-blowers.

White Collar Crime Penalty Enhancement:

Title IX consists of two sections. This section is also called the “White Collar Crime Penalty Enhancement Act of 2002.” This section increases the criminal penalties associated with white-collar crimes and conspiracies. It recommends stronger sentencing guidelines and specifically adds failure to certify corporate financial reports as a criminal offense.

Corporate Tax Returns:

Title X consists of one section. Section 1001 states that the Chief Executive Officer should sign the company tax return.

Corporate Fraud Accountability:

Title XI consists of seven sections. Section 1101 recommends a name for this title as “Corporate Fraud Accountability Act of 2002”. It identifies corporate fraud and records tampering as criminal offenses and joins those offenses to specific penalties. It also revises sentencing guidelines and strengthens their penalties. This enables the SEC to temporarily freeze large or unusual payments.

A variety of complex factors created the conditions and culture in which a series of large corporate frauds occurred between 2000-2002. The spectacular, highly-publicized frauds at Enron , WorldCom, and Tyco exposed significant problems with conflicts of interest and incentive compensation practices. The analysis of their complex and contentious root causes contributed to the passage of SOX in 2002.[4] In a 2004 interview, Senator Paul Sarbanes stated:

Auditor conflicts of interest: Prior to SOX, auditing firms, the primary financial “watchdogs” for investors, were self-regulated. They also performed significant non-audit or consulting work for the companies they audited. Many of these consulting agreements were far more lucrative than the auditing engagement. This presented at least the appearance of a conflict of interest. For example, challenging the company’s accounting approach might damage a client relationship, conceivably placing a significant consulting arrangement at risk, damaging the auditing firm’s bottom line.

Boardroom failures: Boards of Directors, specifically Audit Committees, are charged with establishing oversight mechanisms for financial reporting in U.S. corporations on the behalf of investors. These scandals identified Board members who either did not exercise their responsibilities or did not have the expertise to understand the complexities of the businesses. In many cases, Audit Committee members were not truly independent of management.

Securities analysts’ conflicts of interest: The roles of securities analysts, who make buy and sell recommendations on company stocks and bonds, and investment bankers, who help provide companies loans or handle mergers and acquisitions, provide opportunities for conflicts. Similar to the auditor conflict, issuing a buy or sell recommendation on a stock while providing lucrative investment banking services creates at least the appearance of a conflict of interest.

Inadequate funding of the SEC: The SEC budget has steadily increased to nearly double the pre-SOX level.[6]In the interview cited above, Sarbanes indicated that enforcement and rule-making are more effective post-SOX.

Banking practices: Lending to a firm sends signals to investors regarding the firm’s risk. In the case of Enron, several major banks provided large loans to the company without understanding, or while ignoring, the risks of the company. Investors of these banks and their clients were hurt by such bad loans, resulting in large settlement payments by the banks. Others interpreted the willingness of banks to lend money to the company as an indication of its health and integrity, and were led to invest in Enron as a result. These investors were hurt as well.

Investors had been stung in 2000 by the sharp declines in technology stocks and to a lesser extent, by declines in the overall market. Certain mutual fund managers were alleged to have advocated the purchasing of particular technology stocks, while quietly selling them. The losses sustained also helped create a general anger among investors.

Executive compensation: Stock option and bonus practices, combined with volatility in stock prices for even small earnings “misses,” resulted in pressures to manage earnings.Stock options were not treated as compensation expense by companies, encouraging this form of compensation. With a large stock-based bonus at risk, managers were pressured to meet their targets.

Analyzing the cost-benefits of Sarbanes-Oxley:

A significant body of academic research and opinion exists regarding the costs and benefits of SOX, with significant differences in conclusions. This is due in part to the difficulty of isolating the impact of SOX from other variables affecting the stock market and corporate earnings.Conclusions from several of these studies and related criticism are summarized below:

FEI Survey (Annual): Finance Executives International (FEI) provides an annual survey on SOX Section 404 costs. These costs have continued to decline relative to revenues since 2004. The 2007 study indicated that, for 168 companies with average revenues of $4.7 billion, the average compliance costs were $1.7 million (.036% of revenue). The 2006 study indicated that, for 200 companies with average revenues of $6.8 billion, the average compliance costs were $2.9 million (.043% of revenue), down 23% from 2005. Cost for decentralized companies (i.e., those with multiple segments or divisions) were considerably more than centralized companies. Survey scores related to the positive effect of SOX on investor confidence, reliability of financial statements, and fraud prevention continue to rise. However, when asked in 2006 whether the benefits of compliance with Section 404 have exceeded costs in 2006, only 22 percent agreed. Foley & Lardner Survey (2007): This annual study focused on changes in the total costs of being a U.S. public company, which were significantly affected by SOX. Such costs include external auditor fees, directors and officers (D&O) insurance, board compensation, lost productivity, and legal costs. Each of these cost categories increased significantly between FY2001-FY2006. Nearly 70% of survey respondents indicated public companies with revenues under $250 million should be exempt from SOX Section 404. Butler/Ribstein (2006): Their book proposed a comprehensive overhaul or repeal of SOX and a variety of other reforms. For example, they indicate that investors could diversify their stock investments, efficiently managing the risk of a few catastrophic corporate failures, whether due to fraud or competition. However, if each company is required to spend a significant amount of money and resources on SOX compliance, this cost is borne across all publicly traded companies and therefore cannot be diversified away by the investor. Institute of Internal Auditors (2005): The research paper indicates that corporations have improved their internal controls and that financial statements are perceived to be more reliable. Skaife/Collins/Kinney/Lefond (2006): This research paper indicates that borrowing costs are lower for companies that improved their internal control, by between 50 and 150 basis points (.5 to 1.5 percentage points). Zhang (2005): This research paper estimated SOX compliance costs as high as $1.4 trillion, by measuring changes in market value around key SOX legislative “events.” This number is based on the assumption that SOX was the cause of related short-duration market value changes, which the author acknowledges as a drawback of the study. Iliev (2007): This research paper indicated that SOX 404 indeed led to conservative reported earnings, but also reduced — rightly or wrongly — stock valuations of small firms. Lower earnings often cause the share price to decrease.

Lord & Benoit Report (2006): Do the Benefits of 404 Exceed the Cost? A study of a population of nearly 2,500 companies indicated that those with no material weaknesses in their internal controls, or companies that corrected them in a timely manner, experienced much greater increases in share prices than companies that did not. The report indicated that the benefits to a compliant company in share price (10% above Russell 3000 index) were greater than their SOX Section 404 costs.

Piotroski and Srinivasan (2008) examine a comprehensive sample of international companies that list onto U.S. and U.K. stock exchanges before and after the enactment of the Act in 2002. Using a sample of all listing events onto U.S. and U.K. exchanges from 1995-2006, they find that the listing preferences of large foreign firms choosing between U.S. exchanges and the LSE’s Main Market did not change following SOX. In contrast, they find that the likelihood of a U.S. listing among small foreign firms choosing between the Nasdaq and LSE’s Alternative Investment Market decreased following SOX. The negative effect among small firms is consistent with these companies being less able to absorb the incremental costs associated with SOX compliance. The screening of smaller firms with weaker governance attributes from U.S. exchanges is consistent with the heightened governance costs imposed by the Act increasing the bonding-related benefits of a U.S. listing The effect of Sarbanes-Oxley on non-US companies

Some have asserted that Sarbanes-Oxley legislation has helped displace business from New York to London, where the Financial Services Authority regulates the financial sector with a lighter touch. In the UK, the non-statutory Combined Code of Corporate Governance plays a somewhat similar role to SOX. See Howell E. Jackson & Mark J. Roe, “Public Enforcement of Securities Laws: Preliminary Evidence” (Working Paper January 16, 2007). The Alternative Investment Market claims that its spectacular growth in listings almost entirely coincided with the Sarbanes Oxley legislation. In December 2006 Michael Bloomberg, New York’s mayor, and Charles Schumer, a US senator, expressed their concern. The Sarbanes-Oxley Act’s effect on non-US companies cross-listed in the US is different on firms from developed and well regulated countries than on firms from less developed countries according to Kate Litvak. Companies from badly regulated countries benefit from better credit ratings by complying to regulations in a highly regulated country (USA) that is higher than the cost, but companies from developed countries only incur the cost, since transparency is adequate in their home countries as well. On the other hand, the benefit of better credit rating also comes with listing on other stock exchanges such as the London Stock Exchange.

The impact of SOX on foreign listings was also examined by Piotroski and Srinivasan (2008). They compared new foreign listings onto US and UK stock exchanges between 1995 and 2006. They found no impact of SOX on the listing preferences of large foreign firms choosing between US exchanges and the LSE’s Main Market. In contrast, they find that the likelihood of a US listing among small foreign firms choosing between the Nasdaq and LSE’s Alternative Investment Market decreased following SOX. The negative effect among small firms is consistent with these companies being less able to absorb the incremental costs associated with SOX compliance. This suggests that SOX had a mixed effect on the costs and benefits of a US listing based on characteristics of the foreign companies seeking a listing Implementation of key provisions

Sarbanes-Oxley Section 302: Internal control certifications

Under Sarbanes-Oxley, two separate certification sections came into effect—one civil and the other criminal. 15 U.S.C. § 7241 (Section 302) (civil provision); 18 U.S.C. § 1350 (Section 906) (criminal provision).

Section 302 of the Act mandates a set of internal procedures designed to ensure accurate financial disclosure. The signing officers must certify that they are “responsible for establishing and maintaining internal controls” and “have designed such internal controls to ensure that material information relating to the company and its consolidated subsidiaries is made known to such officers by others within those entities, particularly during the period in which the periodic reports are being prepared.” 15 U.S.C. § 7241(a)(4). The officers must “have evaluated the effectiveness of the company’s internal controls as of a date within 90 days prior to the report” and “have presented in the report their conclusions about the effectiveness of their internal controls based on their evaluation as of that date.” Id..

The SEC interpreted the intention of Sec. 302 in Final Rule 33-8124. In it, the SEC defines the new term “disclosure controls and procedures”, which are distinct from “internal controls over financial reporting”.

Under both Section 302 and Section 404, Congress directed the SEC to promulgate regulations enforcing these provisions.

External auditors are required to issue an opinion on whether effective internal control over financial reporting was maintained in all material respects by management. This is in addition to the financial statement opinion regarding the accuracy of the financial statements. The requirement to issue a third opinion regarding management’s assessment was removed in 2007.

Sarbanes-Oxley Section 404: Assessment of internal control

The most contentious aspect of SOX is Section 404, which requires management and the external auditor to report on the adequacy of the company’s internal control over financial reporting (ICFR). This is the most costly aspect of the legislation for companies to implement, as documenting and testing important financial manual and automated controls requires enormous effort. Under Section 404 of the Act, management is required to produce an “internal control report” as part of each annual Exchange Act report. See 15 U.S.C. § 7262. The report must affirm “the responsibility of management for establishing and maintaining an adequate internal control structure and procedures for financial reporting.” 15 U.S.C. § 7262(a). The report must also “contain an assessment, as of the end of the most recent fiscal year of the Company, of the effectiveness of the internal control structure and procedures of the issuer for financial reporting.” To do this, managers are generally adopting an internal control framework such as that described in COSO.

To help alleviate the high costs of compliance, guidance and practice have continued to evolve. The Public Company Accounting Oversight Board (PCAOB) approved Auditing Standard No. 5 for public accounting firms on July 25, 2007 This standard superseded Auditing Standard No. 2, the initial guidance provided in 2004. The SEC also released its interpretive guidance on June 27, 2007. It is generally consistent with the PCAOB’s guidance, but intended to provide guidance for management. Both management and the external auditor are responsible for performing their assessment in the context of a top-down risk assessment, which requires management to base both the scope of its assessment and evidence gathered on risk. This gives management wider discretion in its assessment approach. These two standards together require management to:

Assess both the design and operating effectiveness of selected internal controls related to significant accounts and relevant assertions, in the context of material misstatement risks;

Understand the flow of transactions, including IT aspects, sufficient enough to identify points at which a misstatement could arise;

Evaluate company-level (entity-level) controls, which correspond to the components of the COSO framework;

Perform a fraud risk assessment;

Evaluate controls designed to prevent or detect fraud, including management override of controls;

Evaluate controls over the period-end financial reporting process;

Scale the assessment based on the size and complexity of the company;

Rely on management’s work based on factors such as competency, objectivity, and risk;

Conclude on the adequacy of internal control over financial reporting.

SOX 404 compliance costs represent a tax on inefficiency, encouraging companies to centralize and automate their financial reporting systems. This is apparent in the comparative costs of companies with decentralized operations and systems, versus those with centralized, more efficient systems. For example, the 2007 FEI survey indicated average compliance costs for decentralized companies were $1.9 million, while centralized company costs were $1.3 million. Costs of evaluating manual control procedures are dramatically reduced through automation.

Sarbanes-Oxley 404 and smaller public companies

The cost of complying with SOX 404 impacts smaller companies disproportionately, as there is a significant fixed cost involved in completing the assessment. For example, during 2004 U.S. companies with revenues exceeding $5 billion spent .06% of revenue on SOX compliance, while companies with less than $100 million in revenue spent 2.55%.This disparity is a focal point of 2007 SEC and U.S. Senate action. The PCAOB intends to issue further guidance to help companies scale their assessment based on company size and complexity during 2007. The SEC issued their guidance to management in June, 2007. After the SEC and PCAOB issued their guidance, the SEC required smaller public companies (non-accelerated filers) with fiscal years ending after December 15, 2007 to document a Management Assessment of their Internal Controls over Financial Reporting (ICFR). Outside auditors of non-accelerated filers however opine or test internal controls under PCAOB (Public Company Accounting Oversight Board) Auditing Standards for years ending after December 15, 2008. Another extension was granted by the SEC for the outside auditor assessment until years ending after December 15, 2009. The reason for the timing disparity was to address the House Committee on Small Business concern that the cost of complying with Section 404 of the Sarbanes-Oxley Act of 2002 was still unknown and could therefore be disproportionately high for smaller publicly held companies. Sarbanes-Oxley Section 802: Criminal penalties for violation of SOX

Criticism:

Congressman Ron Paul and others contend that SOX was an unnecessary and costly government intrusion into corporate management that places U.S. corporations at a competitive disadvantage with foreign firms, driving businesses out of the United States. In an April 14, 2005 speech before the U.S. House of Representatives, Paul stated, “These regulations are damaging American capital markets by providing an incentive for small US firms and foreign firms to deregister from US stock exchanges. According to a study by the prestigious Wharton Business School, the number of American companies deregistering from public stock exchanges nearly tripled during the year after Sarbanes-Oxley became law, while the New York Stock Exchange had only 10 new foreign listings in all of 2004. The reluctance of small businesses and foreign firms to register on American stock exchanges is easily understood when one considers the costs Sarbanes-Oxley imposes on businesses. According to a survey by Korn/Ferry International, Sarbanes-Oxley cost Fortune 500 companies an average of $5.1 million in compliance expenses in 2004, while a study by the law firm of Foley and Lardner found the Act increased costs associated with being a publicly held company by 130 percent.” In a February 29, 2008 opinion column for WorldNetDaily, Ilana Mercer wrote, “The Sarbanes-Oxley Act of 2002, courtesy of the Republican Party, cost American companies upwards of $1.2 trillion. The capital flight it initiated caused the London Stock Exchange to become the new hub for capital markets.” Not mentioned in this critique is the fact that 119 Democrats voted for this Bill in the House of Representatives vs. 87 Democrats against. A research study published by Joseph Piotroski of Stanford University and Suraj Srinivasan of Harvard Business School titled “Regulation and Bonding: Sarbanes Oxley Act and the Flow of International Listings” in the Journal of Accounting Research in 2008 found that following the act’s passage, smaller international companies were more likely to list in stock exchanges in the U.K. rather than U.S. stock exchanges. In November 2008, Newt Gingrich and co-author David W. Kralik called on Congress to repeal Sarbanes-Oxley December 21, 2008 Wall St. Journal editorial stated, “The new laws and regulations have neither prevented frauds nor instituted fairness. But they have managed to kill the creation of new public companies in the U.S., cripple the venture capital business, and damage entrepreneurship. According to the National Venture Capital Association, in all of 2008 there have been just six companies that have gone public. Compare that with 269 IPOs in 1999, 272 in 1996, and 365 in 1986. Faced with crushing reporting costs if they go public, new companies are instead selling themselves to big, existing corporations. For the last four years it has seemed that every new business plan in Silicon Valley has ended with the statement ‘And then we sell to Google.’ The venture capital industry is now underwater, paying out less than it is taking in. Small potential shareholders are denied access to future gains. Power is being ever more centralized in big, established companies. For all of this, we can first thank Sarbanes-Oxley. Cooked up in the wake of accounting scandals earlier this decade, it has essentially killed the creation of new public companies in America, hamstrung the NYSE and Nasdaq (while making the London Stock Exchange rich), and cost U.S. industry more than $200 billion by some estimates Praise