6.6 Risk Analysis

Interpretation: The business risk is that a bank will not have adequate cash flow to meet its operating expenses. The higher CV posses’ higher business risk. Sonali Bank Limited has negative CV which posses its business risk is lower.

Business Risk:

Standard Deviation of Operating Earnings

Mean of Operating Earnings

Year | Operating earnings |

2005 | 208038723 |

2006 | (36275634028) |

2007 | (1834170743) |

2008 | 1336450387 |

2009 | 2244267216 |

Mean | (6864209689) |

SD | 16511852169 |

CV | -2.405499383 |

Financial Risk:

Debt-Equity Ratio:

Total Long Term Debt

Total Equity

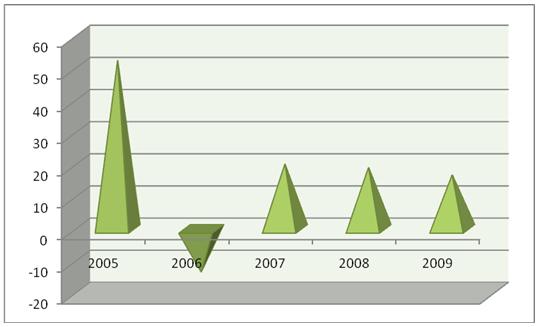

Year | Total Long term liability | Total Equity | Debt equity ratio |

2005 | 331380917072 | 6306200000 | 52.54 |

2006 | 381338188590 | (28444370219) | -13.41 |

2007 | 440222504040 | 21741728899 | 20.24 |

2008 | 468528434181 | 24417714137 | 19.18 |

2009 | 513493909752 | 30475358113 | 16.84 |

Graph-9: Debt-equity ratio

Interpretation:A high debt/equity ratio generally means that a Bank has been aggressive in financing its growth with debt. The debt equity ratio of Sonali Bank limited indicates that in 2005 it was highest and in 2006 it was lowest which posses that debt used more than equity.

6.7 Sensitivity Analysis

Particulars | Given Data (2009) | When Interest income is 10% increased | When Interest income is 10% decreased |

| Interest income | 17683108223 | 19451419045 | 15914797401 |

| Interest paid on deposit | (15800026939) | (15800026939) | (15800026939) |

| Net Interest income | 1883081284 | 35251445984 | 31714824340 |

| Investment income | 7709248980 | 7709248980 | 7709248980 |

| Commission, exchange & brokerage | 6889922752 | 6889922752 | 6889922752 |

| Other operating income | 283667424 | 283667424 | 283667424 |

| Total Operating Income (A) | 16765920440 | 50134285140 | 46597663496 |

| Salary and allowance | 7374257001 | 7374257001 | 7374257001 |

| Rent, Taxes, Insurance, electricity etc. | 410285295 | 410285295 | 410285295 |

| Legal expenses | 38782497 | 38782497 | 38782497 |

| Postage, stamp, telecommunication etc. | 70943693 | 70943693 | 70943693 |

| Stationary, Printing, Advertisement etc. | 138374104 | 138374104 | 138374104 |

| Chief Executive’s Salary and fees | 9600000 | 9600000 | 9600000 |

| Director’s fees | 1729240 | 1729240 | 1729240 |

| Auditor’s fees | 855000 | 855000 | 855000 |

| Charges on loan losses | – | – | – |

| Depreciation and repair of bank assets | 196779376 | 196779376 | 196779376 |

| Other Expenses | 1213847018 | 1213847018 | 1213847018 |

| Total Operating expenses before amortization | 9455453224 | 9455453224 | 9455453224 |

| Amortization of Intangible Assets | 5000000000 | 5000000000 | 5000000000 |

| Total operating expenses (B) | 14455453224 | 14455453224 | 14455453224 |

| Profit/ (Loss) before provision (C=A-B) | 2310467216 | 35678831916 | 32142210272 |

| Provision for loan | – | – | – |

| Provision for diminution in value of investments | (11200000) | (11200000) | (11200000) |

| Other provision | (55000000) | (55000000) | (55000000) |

| Total Provision (D) | 66200000 | 66200000 | 66200000 |

| Total Profit/(Loss) before taxes (C-D) | 2244267216 | 35612631916 | 32076010272 |

| Provision for taxation |

|

|

|

| Current tax | (981948567) | (981948567) | (981948567) |

| Deferred tax | 274447959 | 274447959 | 274447959 |

(707500608) | (707500608) | (707500608) | |

| Net Profit after Taxation | 1536766608 | 36320132524 | 32783510880 |

| Earnings Per Share (EPS) | 17.08 | 403.557028 | 364.261232 |

6.8 Scenario Analysis

Particulars | Given Data (2009) | Best Case | Worse Case |

| Interest income | 17683108223 | 19451419045 | 15914797401 |

| Interest paid on deposit | (15800026939) | (15010025592) | (16590028286) |

| Net Interest income | 1883081284 | 34461444637 | 32504825687 |

| Investment income | 7709248980 | 8480173878 | 6938324082 |

| Commission, exchange & brokerage | 6889922752 | 7578915027 | 6200930477 |

| Other operating income | 283667424 | 312034166.4 | 255300681.6 |

| Total Operating Income (A) | 16765920440 | 50832567709 | 45899380927 |

| Salary and allowance | 7374257001 | 7005544151 | 7742969851 |

| Rent, Taxes, Insurance, electricity etc. | 410285295 | 389771030.3 | 430799559.8 |

| Legal expenses | 38782497 | 36843372.15 | 40721621.85 |

| Postage, stamp, telecommunication etc. | 70943693 | 67396508.35 | 74490877.65 |

| Stationary, Printing, Advertisement etc. | 138374104 | 131455398.8 | 145292809.2 |

| Chief Executive’s Salary and fees | 9600000 | 9120000 | 10080000 |

| Director’s fees | 1729240 | 1642778 | 1815702 |

| Auditor’s fees | 855000 | 812250 | 897750 |

| Charges on loan losses | – | – | – |

| Depreciation and repair of bank assets | 196779376 | 186940407.2 | 206618344.8 |

| Other Expenses | 1213847018 | 1153154667 | 1274539369 |

| Total Operating expenses before amortization | 9455453224 | 8982680563 | 9928225885 |

| Amortization of Intangible Assets | 5000000000 | 4750000000 | 5250000000 |

| Total operating expenses (B) | 14455453224 | 13732680563 | 15178225885 |

| Profit/ (Loss) before provision (C=A-B) | 2310467216 | 37099887146 | 30721155042 |

| Provision for loan | – | – | – |

| Provision for diminution in value of investments | (11200000) | (10640000) | (11760000) |

| Other provision | (55000000) | (52250000) | (57750000) |

| Total Provision (D) | 66200000 | 62890000 | 69510000 |

| Total Profit/(Loss) before taxes (C-D) | 2244267216 | 37036997146 | 30651645042 |

| Provision for taxation |

|

|

|

| Current tax | (981948567) | (932851138.7) | (1031045995) |

| Deferred tax | 274447959 | 301892754.9 | 247003163.1 |

(707500608) | (672125577.6) | (42875638.4) | |

| Net Profit after Taxation | 1536766608 | 37709122724 | 31394520680 |

| Earnings Per Share (EPS) | 17.08 | 418.9902525 | 348.8280076 |

In best case, we considered all the income are calculated as an increasing rate of 10% and all the expenses as decreasing rate of 5%.

In worst case, we considered all the expenses as an increasing rate of 5%and all the income as decreasing rate of 10%.

For the considerable percentages in best case EPS has increased 2453.10% and in worst case the EPS is decreased 2042.31%.

IT Financing:

Name | About | Eligibility | Loan Limit | Debt-equity ratio | Period | Security | Interest Rate |

| Project Financing | For growing international markets for software and data processing this scheme provides long term and short term credit facilities on easier terms to set up and run IT based projects. | Entrepreneurs, of them at least two with recognized degree diploma in computer science or electrical engineering/ telecommunication/applied physics & electronics, forming a private limited company may apply. Experience in related field will be preferred. | Maximum Tk. 1.50 million. In deserving cases, up to Tk. 10.00 million may be considered |

80:20 | Maximum 6 years including 1 year grace period. | In case of project with own land & building no collateral security other than the personal guarantee of the loaners is required. Entrepreneurs offering collateral security will be preferred or loan may be consider with personal guaranty of worthy person(s) (third party). | 11% |

| Export Financing | For export of software and processed data short term finance is extended to existing IT projects. | Feasibly implemented and properly staffed IT projects with export L/C or firm contract in hand may apply. Export through satellite, BTTB confirmation required. | Tk. 1.00 million. For larger contract higher amount may be considered. | 90:10 | L/C or contract period plus 21 days but not exceeding 180 days from the date of disbursement. | No collateral security other than the personal guarantee of the loaners is required. But for loan amount exceeding Tk.1.00 million, collateral will be required. | 11% |

Findings

As a largest commercial bank and the agent of Bangladesh Bank Sonali Bank has to do various types of work without thinking about the profit. For this reason we have seen that in some cases bank has doing loss, but this loss we directly cannot say that bank failing los, this is happening only for helping the nation.

On the other hand we have seen that the bank profit increasing rate is poor but increasing. The bank is highly liquid and earns much profit on owner’s equity. Bank’s operating efficiency is good. EPS is increasing double per year and earning spread is also increasing.

So after all we can say that as a nationalized bank commercial bank Sonali Bank Limited is a bank which is earning better than other nationalized bank.

Conlusion & Recomendation

Conclusion:

As a bank Sonali Bank Limited has to do a lot of things for the betterment of the country. The Bank is strongly positioned in the market and with its core strengths it can match shareholders’ expectations and thus raise their wealth in future through ethical banking and best pricing. Thus, it has to take initiative so that it can fulfill the desire of the govt. as well as people. It will enhance more public services and build up working teams to provide the best services to its valuable customers. It must be run in organized way and discipline must be ensured in all sphere of its performance. Efficient export team, import team and remittance team must be formed and perform duties properly. More training, computerization, data collection, market analysis and swiftness in servicing are essentially required. To do these the recommended suggestions can be used. Although it is theoretical suggestions, it is not valueless. It has great impact on the banking business and other sectors of the economy. For this, govt. help is essential and it is expected that govt. will broaden its hand for implementing the recommendations for the welfare of the people of Bangladesh.

Recommendation:

- The Top management of Sonali Bank Limited should be more effective to the employee then current situation. Because they should take care the branch level employee’s benefits, opportunities etc.

- The bank has highly skilled employee in the branch level. But the bank should be able to utilize these employees at appropriate way to take out the bank’s output.

- The website design is need to improve. Therefore, the website should be changed and can put more information about the bank. The existing design cannot capture the customer’s attention.

- The cheque’s design is poor. The good looking cheque design can motivate the customer.

- The human resource division can be more effective. Because this human resource department should think about the employee benefit much.

- In the training institute, the training process should be used latest technology to provide to the trainee. The bank should give training about the office package, basic idea on computer and internet.

- In the branch level when employees could transfer to another department during that time that employee is needed at least ten days training according on the transfer position.

- The higher management should be more effective about the employee, to take right strategy, right decision making.

- In the branch level employee is working so many extra time, so management should provide some extra incentives to motivate the employee.

- On-line banking is coming soon so the responsible employee should be trained effectively.

- The training evaluation process and form is to be more modernized.

- Physical and technological facilities should be increased in evaluating credit proposals.

- Infrastructure should be modernized.

- The cost of fund needs to be minimized.

- The gap between employees and customers will be reduced through arranging meetings.

For more parts of this post, click the following links-

Financial Performance Analysis of Sonali Bank Limited.(part-1)

Financial Performance Analysis of Sonali Bank Limited.(part-2)

Financial Performance Analysis of Sonali Bank Limited.(part-3)

Financial Performance Analysis of Sonali Bank Limited.(part-4)

Financial Performance Analysis of Sonali Bank Limited.(part-5)

Financial Performance Analysis of Sonali Bank Limited.(part-6)