1.1 Introduction of the Report:

Banks play the most important role in the economy. Banks collect money from the individuals and lend them to others. Now banks offer the widest range of financial services and perform lots of financial functions. Thus banks have proven that they are the key factor for the business and economy as well.

Sonali Bank Limited is the largest banking institution in Bangladesh, dynamic in actions, honest in dealings, just in judgment, fair in approaches and devoted to high quality service to customers and thereby contribute to the growth of GDP of the country throughout stimulating trade and commerce, boosting up export, poverty alleviation, raising living standard of limited income group and overall sustainable socio-economic development in the country.

To achieve the aforesaid objectives of the Bank, different banking activities must play an active role to provide the financial assistance to the customer who also helps them by providing them with management assistance when needed. Sonali Bank Limited has played this role with their experiences in the banking sector where the others are not merely performed.

The internship report comprises a brief study on the Sonali Bank Limited during three months internship. The report is distributed in many parts according to nature and requirement of organization and according to the instructions of supervisor of report.

1.2 Justification of the study

Internship Program is a mandatory program for all students of B.B.A under National University. Practical orientation is a positive development in professional area. Recognizing the importance of practical experience, Department of Business Administration has introduced a one to three months practical exposure as a part of the curriculum of Bachelor of Business Administration.

For the completion of this internship program I have chosen a bank named “Sonali Bank Limited” and my internship report is based on “Financial performance analysis of Sonali Bank Limited”. I have prepared this report under Mr. Sohel Ahmed, Lecturer, Department of Business Administration, Dhaka City College. In the study period, mainly student gain theoretical knowledge but now a day, in the job market there is no substitute of principle work experience. Therefore, before getting into job, students should have some real world experience in the major field of study on the career choice that interest him/her.

1.3 Objective of the Study

The objective of the study is to gather practice of all knowledge regarding business sector and operations. Theory classes of B.B.A provide us theories regarding business sector and practical orientation gives us the chance of view those systems and their operations. More precisely we can identify those objectives:

To gather the practical experience base on the theoretical knowledge.

To habituated with the corporate environment and culture.

To serve the function of overall banker customer relationship.

To observe the function of general banking system.

To evaluate the financial performance of Sonali Bank Limited.

To observe the function of merchant banking operations.

To understand and analyze the financial strength of Sonali Bank Limited.

To observe the function of foreign exchange department.

To learn and acquainted to fulfill the academic purpose.

1.4 Scope of the Study

As I was an intern, my scope was limited and restricted for some purpose. I had maintained some official formality for the collection of data of my report. This study will give a clear idea about the financial performance of Sonali Bank Limited as well as the different section of different products and services of Sonali Bank Limited. At last the financial position of the bank in the banking industry based on its last couple of year’s performance.

Information availability.

Good communication system.

Have a wide area of gaining knowledge.

Good working environment.

1.5 Methodology of the Study

I have designed this report as an expletory research paper. Here I have discussed the general banking system of Sonali Bank Limited and critically analyze the banking procedure with the standard one as per theoretical framework. For this purpose I use my personal observation during my internship program. Through conversation with the different level officers of the Bank, I also gather knowledge about the general banking system. For theoretical framework, I go through a number of credit related books, financial management books, business communication book, foreign exchange manuals, Bangladesh Bank guidelines.

1.6 Sources of the Information

For smooth and accurate study everyone has to follow some rules and regulations. The study inputs were collected from two sources:

Primary Sources:

Practical desk work.

Face to face with officers.

Face to face conversation with the client.

Facing some practical situation related with the day to day banking activities.

Secondary Sources:

Annual Report of Sonali Bank Limited.

Brochures.

Websites.

1.7 Limitation of the Study

Any research work needs high degree of involvement regarding collection of information, creation of data base, literature review and analysis of data. While doing so, many limitations arise even though we always put our best effort to avoid them. In conducting the present study, the following limitation has been faced.

The personnel of the organization did not want to disclose the classified information to the outsiders.

Due to lack of experience, there is a chance of having some mistake in the report though best effort has been applied to avoid any kind of mistake.

I have faced major limitation in the financial projection as my estimate was rather informative base than of actual one.

Time was not sufficient to make an in depth study on such issue.

2.1 Definition of Bank

Generally Bank is refers to an Organization that deals with money. The definition of Bank may be as follows:

As per Bank Companies Act 1991:

Banking Company means any company which transacts the business of banking in Bangladesh and includes a new bank and specialized bank.

Banking means the accepting for the purpose of lending or institute of deposit of money from public repayable on demand or other wise and withdraw able by draft, order o otherwise.

Provided by Famous Encyclopedia:

A commercial banker is a dealer in money in substitutes for money, such as cheque or bill of exchange.–New Encyclopedia Britannica.

Establishment for custody of money which it pays out on customers order. – The New Oxford Encyclopedia Dictionary.

Provided by an Ordinances:

Banker includes a body of person whether incorporated or not, who carry on the business of banking.–English Bills of Exchange Act-1882.

A bank is a person or corporation carrying on bonafide banking business.– English Finance Act.

Provided by Banking Institutes:

A bank performs an essentially distributive task, service or acts as an intermediary between borrowers & lenders. In broader sense, however, a bank can be considered the heart of a complex financial structure. –American Institute of Banking.

Provided by Famous Economist:

A Bank is an institution whose debts are widely in sell element of other people debts to each other. – R.S. Sayers.

A Banker is a dealer in debt his own and other peoples. – Crowther.

A Bank is a financial intermediary a dealer in loans and debts. – Cairn Cross.

2.2 Objective of a Bank

The objectives of a Bank can be looked at from 3 different perspectives of the 3 key parties to the banking activities- Bank owners, the Government and The bank clients.

From the owner’s perspective:

i) Earning Profit: Just like any owner of a commercial institution, a bank owner’s main objective is to earn profit, which is achieved mainly through monetary exchanges.

ii) Rendering Service: Banks Provide Different types of services to the government and people of the country.

iii) Goodwill: In order to earn profit through rendering services, banks need to have a lot of goodwill, may be a bit more than other commercial institutions.

iv) Raising Efficiency: To earn maximum profit, banks need to provide efficient service, for which they require expert workforce.

From the Government’s Perspective:

i) Issue of Notes & Currencies: Since civilizations have moved along from the barter system, it has been the objective of the Government of different countries to provide its economy with a proper exchange media through issuance of notes & currencies through bank, which also take upon the duty of maintaining the system.

ii) Capital formation: The Government wants that bank assist in the macroeconomic objective of capital formation by encouraging people to participate in savings.

iii) Capital Investment & Industrialization: the Government, as a part of their secondary macroeconomic objective, wants the bank to assist in capital investment & industrialization by lending out their accumulated capital.

iv) Money Market Control: Government tries to stabilize the money market through banks.

v) Employment: As part of their primary macroeconomic objectives, they expect banks to provide employment for its people.

vi) Advice on Financial Matters: Since banks hire a lot of financial experts and advisors, it often seeks advice from banks to help them develop policies.

From the Bank Client’s Perspective:

i) Deposit: One of the bank’s main objectives is to accept its clients’ deposits. Like bank clients also want to deposit money with a competitive rate of interest.

ii) Safety: Providing safekeeping of its client’s monetary possessions and valuables is another one of banks essential objectives.

iii) Advisors & Consultants: Banks provide its clients with advisors and consultants to help them chalk out an appropriate savings plan.

iv) Representatives or Trustees: Both the clients and government rely on the bank to act as their representatives and trustees of monetary exchange activities.

v) Raising living standard: By providing interests against their deposits, banks help their clients to improve their living standards.

2.3 Business of Banking Company (BANK COMPANY ACT 1991):

In addition to the business of banking a bank company may engage in any one or more of the following forms of business:

a) the borrowing, raising or taking up of money;

b) the lending or advancing of money either upon or without security;

c) the drawing, making, accepting, discounting, buying, selling, collecting and dealing in bills of exchange, hoondees, promissory notes, coupons, drafts,bills of lading, railway receipts, warrants, debentures, certificates, participation term certificates, term finance certificates, musharika certificates, modareka certificates, such other instruments as may be approved by the Bangladesh Bank, and such other instruments and securities whether transferable or negotiable or not;

d) the granting and issuing of letters of credit, traveller’s checks, and circular notes;

e) the buying, selling and dealing in gold and silver coins and coins of other metals;

f) the buying and selling of foreign exchange including foreign bank notes;

g) the acquiring, holding, issuing on commission, underwriting and dealing in stocks,

funds, shares, debenture stock, obligations, participation term certificates, term finance certificates, musharika certificates, modareka certificates and such other instruments and investments of any kind as may be approved by the Bangladesh Bank;

h) the purchasing and selling of bonds, scrips or other forms of securities, participation term certificates, term finance certificates, musharika certificates, modareka certificates and, on behalf of the constituents of the Bangladesh Bank or others, such other instruments as may be approved by the Bangladesh Bank;

i) the negotiating of loans and advances;

j) the receiving of all kinds of bonds or other valuables on deposit or for safe custody or otherwise;

k) providing vaults for the safety of the deposits;

l) the collecting and transmitting of money against securities;

m) acting as agents for the Government, local authorities or any other person;

n) the carrying on of agency business of any description including the clearing and forwarding of goods and acting as a law agent on behalf of customers, but excluding the business of a managing agent or treasurer of a company;

o) contracting for public and private loans and negotiating and issuing the same;

p) the effecting, insuring and underwriting of shares, stocks, debentures, debenture stock of any company, corporation or association and the lending of money for the purpose of any such issue;

q) the carrying on and transacting of every kind of guarantee and indemnity business;

r) the buying and acquiring of any kind of property including merchandise, patents, designs, trademarks and copyrights, in addition to, at the normal business period of a bank, such or similar transactions as-

1) repurchase by the seller, or

2) selling in the way called purchase on rent, or

3) repayment of outstanding rates, or

4) leases, or

5) sharing out of revenues, or

6) financing in any other way;

s) bringing into possession any property which may satisfy or partly satisfy any of the claims of the banking company and the managing and borrowing of such property;

t) acquiring, holding and managing of any property or any right, title or interest in any such property which may form the security or part of the security for any loans or advances or which may be connected with any such security;

u) undertaking and executing trusts;

v) undertaking the administration of movable and immovable property as executor, trustee or otherwise;

w) for the benefit of employees or ex-employees of the banking company or the dependants and connections of such persons-

1) establishing and supporting, or aiding in the establishment and support of associations, institutions, funds, trusts or any other establishment;

2) granting pensions and allowances;

3) making payments toward insurance;

4) subscribing to any exhibition or any object generally useful;

5) guaranteeing money for all these purposes.

x) the acquisition, construction, maintenance and alteration of any building or works necessary or convenient for the purpose of the banking company;

y) selling, improving, managing, exchanging, leasing, mortgaging or otherwise transferring or turning into account or otherwise disposing of all or any part of the property or rights of the banking company;

z) acquiring and undertaking the whole or any part of the business of any person or company, when such business is of a nature enumerated or described in this subsection;

aa) doing all such other things as are incidental or conducive to the promotion or advancement of the business of the company;

ab) any other form of business which the Government may, by notification in the official Gazette, specify as a form of business in which it is lawful for a banking company to engage.

2.4 An Overview of Banking Operation in Bangladesh

The development process of a country largely depends upon its economic activities. Banking is a powerful medium among other spheres of modern socio-economic activities for bringing about socio-economic changes in a developing country like Bangladesh. Three different sectors like socio-economic changes in a developing country like Bangladesh. Three different sectors like Agriculture, commerce, and industry provide the bulk of a country’s wealth.

With the passage of time the functions of the bank has got a multi-dimensional configuration. Of all the functions of a modern bank, lending is by far the most important. They provide both short-term and long term credit. The customers come from all walks of life, from a small business a multi-national corporation having its business activities all around the world. The banks have to satisfy the requirements of different customers belonging to different social groups.

To regulate the activities of other banks, al the commercial private and/ or nationalized, and specialized banks perform service related activities within the jurisdiction of the Central Bank. In our Country, Bangladesh the role of the central bank is entitled to be executed by Bangladesh Bank. The banking system at independence consisted of two branch offices of the former State Bank of Pakistan and seventeen large commercial banks, two of which were controlled by Bangladeshi interests and three by foreigners other than West Pakistanis. There were fourteen smaller commercial banks. Virtually all banking services were concentrated in urban areas. The newly independent government immediately designated the Dhaka branch of the State Bank of Pakistan as the central bank and renamed it the Bangladesh Bank. The bank was responsible for regulating currency, controlling credit and monetary policy, and administering exchange control and the official foreign exchange reserves. The Bangladesh government initially nationalized the entire domestic banking system and proceeded to reorganize and rename the various banks. Foreign-owned banks were permitted to continue doing business in Bangladesh. The insurance business was also nationalized and became a source of potential investment funds. Cooperative credit systems and postal savings offices handled service to small individual and rural accounts. The new banking system succeeded in establishing reasonably efficient procedures for managing credit and foreign exchange. The primary function of the credit system throughout the 1970s was to finance trade and the public sector, which together absorbed 75 percent of total advances.

The government’s encouragement during the late 1970s and early 1980s of agricultural development and private industry brought changes in lending strategies. Managed by the Bangladesh Krishi Bank, a specialized agricultural banking institution, lending to farmers and fishermen dramatically expanded. The number of rural bank branches doubled between 1977 and 1985, to more than 3,330. Denationalization and private industrial growth led the Bangladesh Bank and the World Bank to focus their lending on the emerging private manufacturing sector. Scheduled bank advances to private agriculture, as a percentage of sectoral GDP, rose from 2 percent in FY 1979 to 11 percent in FY 1987, while advances to private manufacturing rose from 13 percent to 53 percent.

The transformation of finance priorities has brought with it problems in administration. No sound project-appraisal system was in place to identify viable borrowers and projects. Lending institutions did not have adequate autonomy to choose borrowers and projects and were often instructed by the political authorities. In addition, the incentive system for the banks stressed disbursements rather than recoveries, and the accounting and debt collection systems were inadequate to deal with the problems of loan recovery. It became more common for borrowers to default on loans than to repay them; the lending system was simply disbursing grant assistance to private individuals who qualified for loans more for political than for economic reasons. The rate of recovery on agricultural loans was only 27 percent in FY 1986, and the rate on industrial loans was even worse. As a result of this poor showing, major donors applied pressure to induce the government and banks to take firmer action to strengthen internal bank management and credit discipline. As a consequence, recovery rates began to improve in 1987. The National Commission on Money, Credit, and Banking recommended broad structural changes in Bangladesh’s system of financial intermediation early in 1987, many of which were built into a three-year compensatory financing facility signed by Bangladesh with the IMF in February 1987.

One major exception to the management problems of Bangladeshi banks was the Grameen Bank, begun as a government project in 1976 and established in 1983 as an independent bank. In the late 1980s, the bank continued to provide financial resources to the poor on reasonable terms and to generate productive self-employment without external assistance. Its customers were landless persons who took small loans for all types of economic activities, including housing. About 70 percent of the borrowers were women, who were otherwise not much represented in institutional finance. Collective rural enterprises also could borrow from the Grameen Bank for investments in tube wells, rice and oil mills, and power looms and for leasing land for joint cultivation. The average loan by the Grameen Bank in the mid-1980s was around Tk.2,000 (US$65), and the maximum was just Tk18,000 (for construction of a tin-roof house). Repayment terms were 4 percent for rural housing and 8.5 percent for normal lending operations.

The Grameen Bank extended collateral-free loans to 200,000 landless people in its first 10 years. Most of its customers had never dealt with formal lending institutions before. The most remarkable accomplishment was the phenomenal recovery rate; amid the prevailing pattern of bad debts throughout the Bangladeshi banking system, only 4 percent of Grameen Bank loans were overdue. The bank had from the outset applied a specialized system of intensive credit supervision that set it apart from others. Its success, though still on a rather small scale, provided hope that it could continue to grow and that it could be replicated or adapted to other development-related priorities. The Grameen Bank was expanding rapidly, planning to have 500 branches throughout the country by the late 1980s.

Beginning in late 1985, the government pursued a tight monetary policy aimed at limiting the growth of domestic private credit and government borrowing from the banking system. The policy was largely successful in reducing the growth of the money supply and total domestic credit. Net credit to the government actually declined in FY 1986. The problem of credit recovery remained a threat to monetary stability, responsible for serious resource misallocation and harsh inequities. Although the government had begun effective measures to improve financial discipline, the draconian contraction of credit availability contained the risk of inadvertently discouraging new economic activity.

Foreign exchange reserves at the end of FY 1986 were US$476 million, equivalent to slightly more than 2 months worth of imports. This represented a 20-percent increase of reserves over the previous year, largely the result of higher remittances by Bangladeshi workers abroad. The country also reduced imports by about 10 percent to US$2.4 billion. Because of Bangladesh’s status as a least developed country receiving concessional loans, private creditors accounted for only about 6 percent of outstanding public debt. The external public debt was US$6.4 billion, and annual debt service payments were US$467 million at the end of FY 1986.

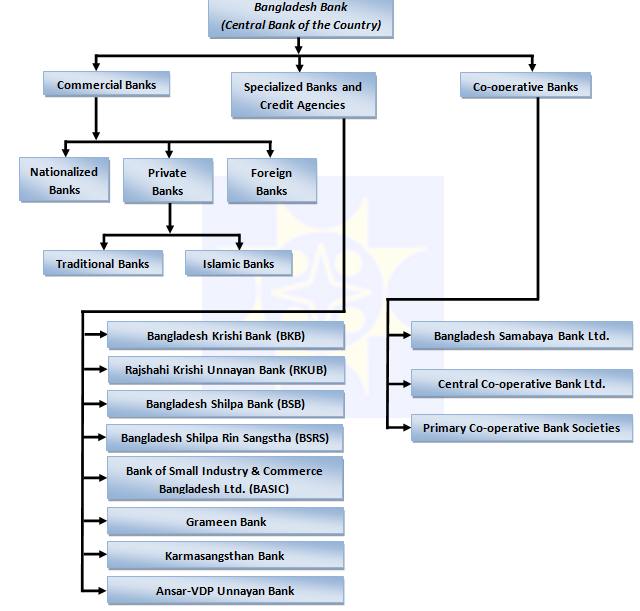

2.5 Current Structure of Banking Industry

Banks in Bangladesh can be classified into the following categories:

Figure-1: Types of Banks in Bangladesh

For more parts of this post, click the following links-

Financial Performance Analysis of Sonali Bank Limited.(part-1)

Financial Performance Analysis of Sonali Bank Limited.(part-2)

Financial Performance Analysis of Sonali Bank Limited.(part-3)

Financial Performance Analysis of Sonali Bank Limited.(part-4)

Financial Performance Analysis of Sonali Bank Limited.(part-5)

Financial Performance Analysis of Sonali Bank Limited.(part-6)