To transform the four years theoretical knowledge of Business Administration in to a practical knowledge, the internship program is a must. These 12 weeks of our internship period help us a lot to realize the connection between our institutional knowledge and actual corporate scenario. Today, the people of Bangladesh are quite concerned about their present and future protection for various purposes. They are concerned about their health protection, educational protection and so on. Life Insurance companies are providing them those opportunities to make it real. MetLife Alico is such a Multinational Insurance Company which is playing a vital role in this sector in Bangladesh.

Their all products and services are covering a broad demand of our people. Here, the three payment plan policy or 3 P. P. policy for Health Insurance is very much attractive. So, I have decided to work with this policy and its’ field. During my project preparing time, I have learned how to deal with clients, how to make proper care of their money and how to maintain these all premium payment related activities in a branch office of MetLife Alico.

INTRODUCTION

MetLife, Inc. is the holding corporation for the Metropolitan Life Insurance Company, or MetLife, for short, and its affiliates. MetLife is among the largest global providers of insurance, annuities and employee benefit programs, with 90 million customers in over 60 countries. The firm was founded on March 24, 1868.

On January 6, 1915, MetLife completed the mutualization process, changing from a stock life insurance company owned by individuals to a mutual company operating without external shareholders and for the benefit of policyholders. The company went public in 2000. Through its subsidiaries and affiliates, MetLife holds leading market positions in the United States, Japan, Latin America, Asia’s Pacific region, Europe, and the Middle East.

MetLife is the largest life insurer in the United States of America and serves 90 of the largest FORTUNE5000 companies. (FORTUNE5000 is a registered trademark of FORTUNE magazine, a division of Time, Inc). The

company’s principal offices are located at 1095 Avenue of the Americas in Midtown Manhattan, New York City, though it retains some executive offices and its boardroom in the MetLife Building, located at 200 Park Avenue, New York City, which it sold in 2005.

On November 1, 2010, MetLife, Inc. completed its purchase of American Life Insurance Company (ALICO). This deal brings together two well-established, international businesses with proven track records of growth. The combination creates a global life insurance and employee benefits powerhouse and will give our customers even more ways to protect their future. Together, they are offering:

- a broader portfolio of products serving more people in more areas

- innovative products and services, delivered with a proven record of local know-how

- the financial strength of the premier global life insurer

Though ALICO is now known as MetLife-ALICO, but still the offers, benefits, products and services will be remain same for the clients of ALICO.

Products and Services Offerings

The life insurance needs differ from person to person. So, the offers here are so much versatile. At MetLife Alico, any individual client can find a range of Life Insurance, Accident and Health Insurance as well as Education and Retirement plans to suit their personal or family needs.

There are three major criteria in their offer list. These are “Life Insurance Policy”, “Savings and Retirements Plan” and finally “Accident and Health care Plan”. Every criteria here has divided again into several subdivisions according to the customers’ needs and requirements. These are as following:

1. Life Insurance Policy: Life insurance can take care of clients’ family and help them to maintain their standard of living. Apart from taking care of outstanding loans or mortgages, it can also protect their children’s education or

provide for their partner’s retirements. Here, I am going to describe about Education Process Plan [EPP] Plus and

Three Payment Plan [3PP] Plus offerings.

The Product Overview of EPP Plus:

- A flexible plan with terms ranging from 10 to 25 years

- On maturity, policy holder’s child will receive the full face amount along with the bonus

- In the unfortunate even of client’s death, protects the child’s financial future by paying out a monthly sum of 1% of the face amount every month for his/her education till the maturity of the policy. The policy also provides for a waiver of all future premiums in order to keep the policy active and in-force.

- Customers can choose to add a disability protection rider to this plan which will protect them in the event of a disability due to sickness or accident

- Like in all other life policies, the paid premiums are income tax deductible (subject to prevailing tax laws & rules)

- This EPP Plus plan also provides a personal accident coverage that ensures the financial future of client’s loved ones in case of his/ her death, disability or injury due to accident.

The Product Overview of 3PP Plus:

- This Plan is available for varying terms such as 12, 15, 18, 21 & 24 year and any clients can choose one that best suits their needs.

- 25% of the face amount is paid at the end of 1/3rd of the term and another 25% at the end of 2/3rd of the term. The policy holder can use this to finance his/ her goals.

- The remaining 50% of the face amount is paid along with a bonus at maturity

- In the unfortunate event of the death of the policy holder, at any time during the term of the policy, their nominees will receive the entire face amount along with the bonuses – NO DEDUCTION is made for the partial maturity amounts.

- Loans up to a maximum of 85% of cash value is available, if required

- Like in all other life policies, the paid premiums are income tax deductible (subject to prevailing tax laws & rules)

- The 3PP Plus also provides Personal Accident Coverage in case of client’s death, disability or injury due to accident.

2. Savings and Retirement Plan: Alico selection of savings and retirement

products mean that one can take steps towards the lifestyle he/ she really wants today, as well as plan for the future that they really want tomorrow. Here, I am going to introduce the Income Growth Plan Policy and DPS Super Policy:

The Product Overview of Income Growth Plan Policy:

- A unique plan that combines protection and savings

- Offers a maximum premium payment term of up to 30 years thereby giving the flexibility of choosing small payments to suit client’s budgetary needs

- The plan is split into 2 phases. The first phase is for a period of 7 years and then the second phase starts (from the 8th year) and includes the rest of the term.

- During the first 7 years client’s savings accumulate and grow and at the end of the 7th year a dividend is declared. This dividend could be up to 40% of the cash value of his/ her plan.

- In the second phase, the cash value and dividend are transferred to the Investment & Protection Account (IPA)

- From the 8th year onwards, the policy offers a range of flexible options such as changes to the amount of premium, insurance coverage, etc, subject to the policy terms and conditions.

- Maturity Benefits: On maturity, the policy owner can either withdraw the account (IPA) value; or convert it into a life time pension.

- Like in all other life policies, the paid premiums are income tax deductible (subject to prevailing tax laws & rules)

- Income Growth also provides Personal Accident Coverage in case of your death, disability or injury due to accident.

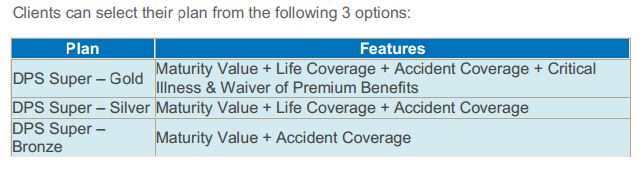

The Product Overview of DPS Super Policy:

Operational Network Organogram

PROJECT

MetLife Alico is playing a vital role in giving financial protection to the people of Bangladesh through their insurance policy system. By these policies, people have to pay a specific premium to this company in a specific rate which is called the premium rate. As a part of my graduation process, I had to work with the team of a branch of MetLife Alico and I have gathered a lot of experiences about this job field. In our country, people are more interested for buying any insurance policy for their health protection and education protection. In my internship period, I have got the chance to do work regarding the health insurance policy of MetLife Alico. This is one of the largest insurance companies in the world and they are following a very secured and organized way for their operation to provide the highest protection to their consumers. From my internship, I have learned how to convince people to understand about the necessity of health insurance, what the benefits of them are, how to create the balance sheet of the sold insurance policies and how to calculate the premium rate. Hopefully, these experiences will help me in the long run of my career.

Description of the Project

Objective of the project: Here, I have divided my project objective into two parts. They are as following:

Broad Objectives:

Firstly, I want to identify why people of Bangladesh are so much interested to purchase health insurance policy rather than other policies.

Secondly, I want to learn how to calculate all premium payments by the employers of life insurance companies which is very much convenient to policy holders as well.

Specific Objectives:

Firstly, to enlighten my career experience by doing this internship. Secondly, to recommend some strategies or ideas to attract more consumers in future for MetLife Alico in Bangladesh.

Methodology:

The report is the result of the knowledge and experience I have gained from my twelve weeks internship program of BRAC Business School under the organization called MetLife Alico in Bangladesh. Here, I am going to present all of my qualitative and quantitative information from two sources called primary and secondary sources. For most of the information I had to follow my secondary sources.

Primary Sources: this content bears face-to-face interviews, conversations and discussion with Branch Manager, Unit Manager, other employees and clients.

Secondary Sources:

- Annual reports of MetLife Alico.

- Web- site of MetLife Alico.

- Club Members Report of respective organization.

Data Collection method:

For the organization part, information has been collected through different website regarding this company. At the same time information was also collected through informal discussions with Unit managers & respective Branch Manager of this MetLife Alico Branch. A face-to-face interview also arranged with few clients of this organization to collect the data.

The characteristics of 3 Payment Plan policy

There are three specific characteristics by which MetLife Alico is successful today to make this policy attractive to their clients. The characteristics are describing here:

1. 3 Payment Plan policy can be hold for 12 years, 15 years, 18 years, 21 years or 24 years timeline period. Policy holder can purchase the policy for any of these maturity periods.

2. There are variable payment policies are included in 3 P. P. One can plan the policy from BDT 1, 00, 000 (One Lac) to BDT 1, 00, 00, 000 (Ten Million) for their payment according to his/ her income level.

3. Minimum 10 years age holders to maximum 60 years age holders, anyone can be the client of this 3 P. P. policy to take its whole coverage.

Thus, different people from different income level and age background can be the beneficiary of this 3 Payment Plan policy of MetLife Alico which is very much convenient to the people of developing countries like ours.

The benefits provided in the 3 P. P. policy of MetLife Alico in Bangladesh.

According to company’s rules and regulations, the benefits those are providing in this specific policy depend on the policy amount, policy maturity periods and so on. Here, I am trying to focus on the benefits of 3. P. P. policy with the amount of BDT 5, 00, 000 for 18 years maturity period:

i) If any client of this policy becomes hospitalized due to any accident, then he or she will get up to BDT 1, 47, 000 in every month for treatment purpose. If, the client gets his/ her treatment at home for any kind of accident, then that

person will get up to BDT 1, 05, 000 in every month for that purpose.

ii) There are 25 (twenty five) diseases in human body which are recognized as the most complicated and critical diseases according to MetLife Alico Health Insurance Policy. If, the policy holder gets affected by any one of them, then the company will help him with BDT 5, 00, 000 in advance at a time for starting the treatment. After that, because of that disease, if that person needs to be hospitalized, then he/ she will get BDT 63000 in first month for

bearing the treatment expenses and after that if he/ she stays in hospital for the same reason, then company will give them BDT 42, 000 for the same purpose in every month up to one year.

The 25 diseases which are considered to be highlighted are as following:

STROKE

- CANCER (Except Skin Cancer)

- FIRST HEART ATTACK

- CORONARY ARTERY SURGERY

- Other Serious CORONARY ARTERY Diseases

- HEART VALVE REPLACEMENT

- MAJOR BURNS

- BLINDNESS

- PULMONARY ARTERIAL HYPERTENSION (Primary)

- END-STAGE LUNG DISEASE

- KIDNEY FAILURE

- SURGERY to AORTA

- APLASTIC ANAEMIA

- MAJOR ORGAN TRANSPLANT

- LOSS of HEARING

- LOSS of SPEECH

- MUSCULAR DYSTROPHY

- ALZHEIMER’S DISEASE/ IRREVERSIBLE ORGANIC DEGENERATIVE BRAIN DISORDERS

- MOTOR NEURONE DISEASE

- PARKINSON’S DISEASE

- COMA

- BENIGN BRAIN TUMOUR

- MAJOR HEAD TRAUMA

- BACTERIAL MENINGITIS

- PARALYSIS

iii) For any normal disease, if the client becomes the victim and get hospitalized, then he/ she will get BDT 42, 000 monthly up to 1 year.

iv) This benefit is little bit different. When the policy will pass 6 years maturity, the policy holder will get 25% of original policy and that is BDT 1, 25, 000 at once. After that, when it will be matured of 12 years then the policy holder will get 25% of original policy again and that is BDT 1, 25, 000. It will happen at a time also. Finally, when the policy will fulfill 18 years maturity period, then the respective client will get 50% of his policy at a time and the amount is BDT 2, 50, 000. With this last amount, he/ she will receive the bonus amount also. For example: the Bonus rate of this running year is BDT 7000 in every BDT 1, 00, 000. So, for this policy of BDT 5, 00, 000 the company will pay that person BDT 35000 as bonus per year.

v) In case, if the policy holder dies due to unusual accident, then his/ her nominee will be paid with BDT 20, 00, 000 and bonus amount at a time by MetLife Alico. On the other hand, if that person dies in a normal way without any accident, then the nominee will get BDT 5, 00, 000 and bonus amount at a time by this organization as well.

vi) When the policy will pass 3 years maturity period, after that, the client will be able to take loan in any time from that policy. But, here the condition is, he/ she can take the loan up to 70% of their savings amount. After that,

client can repay his loan yearly, monthly, weekly and daily basis as well.

vii) After 3 years periods of maturity, if the client is unable to continue the policy but he/ she is interested to run that, in that case without paying any premium that person will be able to continue that policy till its full maturity

period. In that circumstance, policy holder needs to apply to the company by mentioning his/ her present financial problems and situations and has to show his/ her own interest to run that policy. If the reasons go under company’s consideration, that time company will take the responsibilities to continue that policy on behalf of that client until its 18 years maturity period without receiving any premium payment. This facility is called ETI which

stands for Extern Term Insurance.

The benefits under Extern Term Insurance are that, company will continue that policy without any premium payment till its maturity of 18 years period. In that case, if the client dies before the maturity of the policy, his/ her nominee will get compensation money due to this circumstance. Besides, if the client is alive till the maturity period, then he/ she will receive his/ her savings money back at that time with some profit amount.

Thus, we can conclude this chapter by showing these attractive benefits of this 3 P. P. policy of MetLife Alico Health Insurance Policy.

The Process of Premium Rate calculation

The premium rate is the most important thing for the operation of any Insurance policy of MetLife Alico. As I have mentioned before, any person from 10 years old to 60 years old can be the purchaser of this policy that is why; the premium rate is determined by the age of the client. Company uses their Premium Rate Chart for the calculation of this fact.

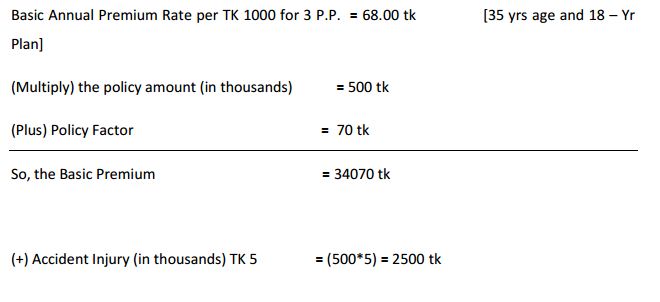

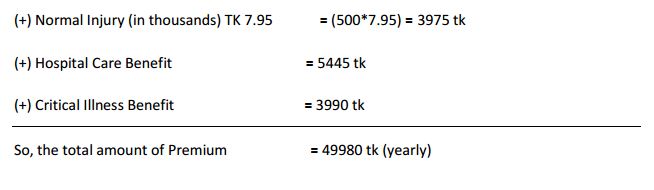

Here, the amount is determined in thousands according to the age of the client. Here, the procedure of this calculation is described following. I have chosen a 3 P. P. policy for a Health Insurance of MetLife Alico which is purchased by a 35 years old client for 18 years maturity and the policy amount is for BDT 5, 00, 000. The steps are as following:

This premium can be given annually, semi- annually or quarterly by the respective policy holders. But in this case, if any client is interested in to paying semi- annually or quarterly, then that person will have to pay little bit more than the annual payment of premium. The formula that is used for this semi- annually payment and quarterly payment is given here:

- Annual payment * .52 = Semi-annual payment.

- Annual payment * .27 = Quarterly payment.

In this given example, if the policy holder wants to pay his/ her premium at Semi-annually or Quarterly basis and the Annual Premium Payment is BDT 49, 980. Then the amount will be:

- BDT 49, 980 * .52 = 25989 tk (Semi-Annually)

- BDT 49, 980 * .27 = 13, 494 tk (Quarterly)

This rate has been determined by the Board of Directors of MetLife Alico. Besides, this overall process is being followed in every branch of MetLife Alico. They are applying these formulas internationally in all over the world.

The requirements and Process of having a Health

Insurance Policy in MetLife Alico.

Every Organization has their own procedure to operate their business. MetLife Alico is not excluded from that. When, any possible client wants to make an agreement on Health Insurance Policy with MetLife Alico, there are some steps which are being followed by the organization to make that policy secured for both the organization and the policy holder. The steps are describing here:

Step 01: First of all, clients need to fill-up a specific kind of application provided by MetLife Alico bearing some personal information of clients.

Step 02: With this form client needs to submit his/ her passport size photocopy, Secondary School Certificate (S.S.C.), photocopy of passport, photocopy of National Identity Card and photocopy of Driving License (if available) and the amount of premium to this company. These are mainly important for justifying the client’s age.

Step 03: After verifying all information, company will underwrite that form.

Step 04: Once the company underwrites the form, then the policy owner will be offered a written agreement by the company where all rules and regulations will be included. On that agreement paper, client has to sign on a Government Insurance Tax Stamp and the registrar or the Chairman of the company will also sign on that Stamp and agreement on the behalf of MetLife Alico.

This is how MetLife Alico makes contract of Health Insurance Policy with their service consumers. In this agreement, all benefits are also being written and after that policy owners can pay their all premiums in the company’s enlisted banks or in Customer Care Service Centre by cash or auto debit payment from their own account.

Analysis

After doing a 12 weeks internship in such a wonderful company, I have got the chances to know about the actual operational experience in the real life scenario. As, I have done my work in a project named “Health Insurance Policy of MetLife Alico in Bangladesh”, so I got to know the field in a close way.

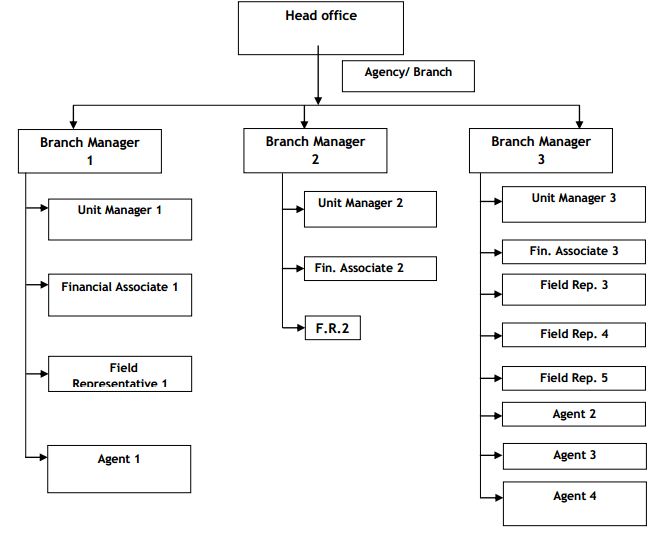

In our country, due to lower literacy rate, people are not so much conscious about their future health protection. But, there are number of people who are really concerned about this savings. MetLife Alico is doing well in this sector to satisfy people with their wants and demands in a well mannered way. The process and procedures, the benefits, the proper and clear way of premium calculations, an organized payment process etc are already got the popularity among the targeted customers. As, the organogram has shown that, every single employee has to report or discus about their performance or problems with their Agency Manager (also called Branch Manager), that is why; the curriculum of any Branch offices are very strict and organized which is very much essential for any multinational company to operate their all Agency offices.

On the other hand, all Agency offices have to make day to day report about their selling and premium collection record to the Country Head Office which also indicates a proper way to run such a large size Business.

So, in briefly, we can say that, MetLife Alico is going upward through the right track in the related competitive industry.

Results and Discussions

Though the market is so much competitive, but the performance of the team of MetLife Alico is really satisfactory. Their offerings, services, post purchase behavior with their valuable clients, regular notifications sent to the customers, organized way of making policies, available agencies or branches, available customer care services through the whole world etc are helping them to capture the maximum amount of customers in this field. On the other hand, as a multinational company, MetLife Alico has made a brand name in Life Insurance Policy industry. That is why, people feel more comfortable to save their money or to give their premium money to this

company without less hesitation.

According to this company, the middle class, upper middle class and upper class people are the targeted customers. Because of that reason, they are providing several kinds of payment systems with versatile benefits which are also very attractive and well known among their consumers.

The beneficiary of any policy is not only the policy holders but their nominees also so that people feel more secured about the process and procedures. As a result, MetLife Alico is doing a successful business in a proper way through more than 50 branches in our country by achieving the faith of their valuable clients and their families.

Conclusion

As a first multinational Insurance company in Bangladesh, MetLife Alico has completed more than 20 successful years in this country. Its efficient management team has made its proper progress in every step throughout these decades. All agencies are the core operational active places for their overall business. So, working in such agency is a remarkable experience. The working environment was very comfortable. The people were very friendly. Even the clients were very well behaved. So through the whole internship period I have got the opportunity to gather as much as experience I can. As I have selected Health Insurance Policy of this company in Bangladesh as my topic for internship, I have worked hard to get maximum information regarding this topic. Three payment plan (3 P.P.) for Health Insurance policy of this company is the most important and attractive policy. As this company deals with people’s money so it’s very important to take care of it properly. Agencies are the intermediaries between the people

and the company. So, it is very important to work properly in these branch or agency offices to minimize or reduce the risk and faults regarding the sold policies.

![Report on Corporate Social Responsibility and Small Medium enterprise of Southeast Bank LTD [PART-2]](https://assignmentpoint.com/wp-content/uploads/2013/03/SEB-110x55.jpg)