Different Modes of Investment of IBBL:

The most important difference between the Conventional and Islamic bank is that both the banks operate to earn profit but they differ in the way of operation. Islami Bank emphasis on legitimate (Halal) business. On the other hand traditional bank is not operated by the following rules and regulations approved by Islam that is the most powerful contradiction between them. Islamic Bank does not invest in loans and fixed interest securities. It can invest in ordinary share only while interest based bank can invest in loans and different kinds of securities. Islami Bank establishes and participate projects with its client as a partner and bears the risk along with the client on a proportionate basis. Besides, other conventional banks sometimes finance projects but do not bear risk. Finally, the concept of Islamic Bank is to establish on egalitarian society based on principles of social justice and equity. Whereas traditional banks pay a fixed interest on savings, time deposit and grant loans with interest for any purpose. We have gathered the fact that investment management is the theme of IBBL. The bank takes deposits and invests the same based on the profit-loss sharing. Bank go for the investment mainly which are long term and profitable in nature. IBBL also give high concentration on the investment that will generate more employment. As investment is one of the most priority areas for the IBBL, so it needs to cautious in investment decision. To ensure proper investment IBBL always go with in-depth study before making the investment.

The objectives and principles of investment operations of the Banks are:

- The investment fund strictly in accordance with the principles of Islamic Shariah.

- To diversifies its portfolio by size of investment, by sectors (public and private), by economic purpose, by securities and by geographical area including industrial, commercial and agricultural.

- To ensure mutual benefit both for the Bank and the investment client by professional appraisal of investment proposals, judicious sanction of investment, close and constant supervision and monitoring therefore.

- To make investment keeping the socio-economic requirement of the country in view.

- To increase the number of potential investors by making participatory and productive investment.

- To finance various developments schemes for poverty alleviation, income and employment generation with a view to accelerating sustainable socio-economic growth and upliftment of the society.

- To invest in the form of goods and commodities rather than give out cash money to the investment clients.

- To encourage social upliftment enterprises.

- To shun even highly profitable investment in fields forbidden under Islamic Shariah and is harmful for the society.

- The Bank extends investments under the principles of Bai-Marabaha, Bai-Muazzal Hire purchase under Shairkatul Melk and Musharaka. The Bank is making sincere efforts to go for investment under Mudaraba principle in near future.

Investment operation of a Bank is very important as the greatest share of total revenue is generated from it, maximum risk is centered in it and the very existence of a Bank mostly depends on prudent management of its Investment Port-folio.

For efficient deployment of mobilized resources in profitable, safe and liquid sector a sound, well-defined and appropriate Investment Policy is necessary.

The important feature of the investment policy of the Bank is to invest on the basis of profit-loss sharing system in accordance with the tenets and principles of Islami Shariah. Earning of profit is not the only motive and objective of the Bank’s investment policy rather emphasis is given in attaining social good and in creating employment opportunities.

Pursuant to the Investment Policy adopted by the Bank a 7-year Perspective Investment Plan’ has been drawn-up for the year 1995 to 2002 and put into implementation. Recently a further 5-year perspective investment plan has been drawn up for the year 2003 to 2007 and put into implementation. The plan aims at diversification of the investment port-folio by size sector geographical area, economic purpose and securities to bring in phases all sectors of the economy and all types of economic groups of the society within the fold of Bank’s investment operations.

A sound well defined, well planned and appropriate investment policy frame work is a pre-requisite for achieving the goal of the Bank i.e. implementation and materialization of the economic and financial principles of Islam in the Banking area and justice in trade, commerce and industry and to build socio-economic infrastructure, create opportunity for income and sustained economic growth of the country.

Observance of the legal investment limit of the bank.

Observance of the legal investment limit of the client.

Optimum utilization of investible fund.

Profitability of the investments.

Safety and security of the investments.

Investment at minimum possible risk.

Liquidity of investments.

Conform to central bank’s investment restrictions.

Preference to short term investments.

Preference to the investments for small size.

Satisfactory return on investments.

To take in view, inter alia, the following points while considering an investment proposal.

Sector and sectoral performance.

Management of the company.

Location of the company.

Market demand/supply gap, import/export position, consumption trend.

Cash flow position.

Financial or internal rate of return.

Infrastructural facilities in and around the proposed project.

Risk in the investments and return thereon are interrelated. An investment policy that emphasizes a high return must accept relatively high risk. Conversely, an investment policy that will tolerate only small amount of risk must be prepared to accept a relatively low return.

As such, it is really difficult whether to select a high return port-folio on high risk or low risk port-folio with a low return.

Nevertheless, considering all aspects following guidelines shall be followed as strategy for banks investments.

- If two port-folios have the same risk but different returns, the port-folio having higher return shall be preferred.

- If the two port-folios have the same expected returns, but different degrees of risk, the port-folio with lower risk shall get preference.

- If one port-folio has both a higher return and a lower risk than another, the first port-folio shall be preferred.

- Keeping in view the risk factor, the bank shall maintain flexibility in determination of rate of return on investments on case to case basis in consideration of the risk element involved in the respective investment.

- Emphasis is given for expansion and strengthening cottage and small industries sector and rural industries. This immensely potential industrial sub-sector shall create employment opportunities to rural and semi-urban population and shall have positive contribution in employment and income generation and poverty alleviation of the low-income group.

- Investment facilities shall be extended for establishment and expansion of export oriented forward / back ward linkage and import substitute industries.

- The bank requires retaining 10% of its total deposit liability as Statutory Liquidity Ratio (SLR) including 4% Cash Reserve Ratio (CRR) with the Central Bank. The bank may go for investments up to 90% of its total deposit. The perspective investment plan is being formulated quantifying the allocation of investments size-wise, sector-wise, geographical area-wise, economic purpose-wise, security-wise and mode-wise keeping in view 20% projected growth of deposit each year.

- Taking into consideration the broad objectives of the bank, national priority, socio-economic need, growth level of the economy, the investments port-folio of the bank may gradually be diversified and allocated in term of size, sector, geographical area, economic purpose, security and mode.

- Safety, security, profitability and liquidity of Bank’s investments.

- Each branch invests, at least 50% of its deposits locally.

- Enhance of extending limit of good investment clients.

- Adopting of modern technology

So, banks investment policy, investment planning and investment budgeting, till situation changes / improves, shall aim at promotion of quality general investment.

In accordance with the investment policy, 5 year perspective investment plan from 2003 to 2007 is formulated. Deposit target of the bank as on 2002 plus 10% has been taken as base and 90% of the lyrar-wise estimated deposits have been taken as invest able fund. Size-wise, sector–wise, geographical area-wise, economic purpose-wise, security-wise, mode-wise allocation of estimated investable funds are made in accordance with the weightage given in the investment plan as shown in table A, B, C, D, E, F

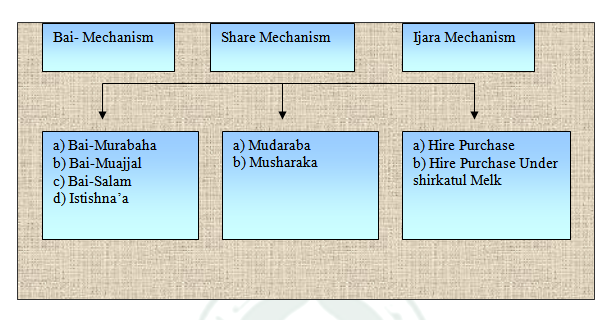

- Trading modes (Bai-Mechanism):

I. Bai-Murabaha:

Meaning:

The terms “Bai” and “Murabaha” have been derived from Arabic words Murabaha” and “Bai”. The word Bai means purchase and sale and the word Murabaha means a in cash” Bai-Murabaha means sale for which payment is in cash or in future fixed date or within a fixed period. In short, it is a sale on cash.

Definition

Bai-Murabaha may be defined as a contract between a buyer and a seller under which the seller sells certain specific goods (permissible under Islamic Shariah and the Law of the land), to the buyer at a cost plus agreed profit payable in cash or on any fixed future date in lump-sum or by installments. The profit marked-up may be fixed in lump-sum or in percentage of the cost price of the goods.

Types of Murabaha:

In respect of dealing parties Bai-Murabaha may be of two types.

Ordinary Bai-Murabaha:

If there are only two parties, the seller and the buyer, where the seller as an ordinary trader purchases the goods from the market without depending on any order and promise to buy the same from him and sells those to a buyer for cost plus profit, then the sale is called Ordinary Bai-Murabaha.

Bai-Murabaha on Order and Promise :

If there are three parties, the buyer, the seller and the Bank as an intermediary trader between the buyer and the seller, where the Bank upon receipt order from the buyer with specification and a prior outstanding promise to buy the goods from the Bank, purchases the ordered goods and sells those to the ordering buyer at a cost plus agreed profit, the sale is called “Bai-Murabaha on Order or Promise”, generally known as Murabaha.

This Murabaha upon order and promise is generally used by the Islami Banks, which undertake the purchase of commodities according to the specification requested by the Clients and sale on Bai-Murabaha to the one who ordered for the goods and promised to buy those for its cost price plus a marked-up profit agreed upon previously by the two parties, the Bank and the Clients

II. Bai – Muajjal:

Meaning:

The terms “Bai” and “Muajjal” have been derived from Arabic words Ajal and Bai. The word Bai means purchase and sale and the word Ajal means a fixed time or a fixed period” Bai-Muajjal means sale for which payment is made at a future fixed date or within a fixed period. In short, it is a sale on credit.

Definition :

Bai-Muajjal may be defined as a contract between a buyer and a seller under which the seller sells certain specific goods (permissible under Islamic Shariah and the Law of the Country), to the buyer at a agreed fixed price payable at a certain fixed future date in lump-sum or within a fixed period by fixed installments. The seller may also sell the goods purchased by him as per order and specification of the Buyer.

III. Bai – Salam:

Meaning:

The terms “Bai” and “Salam” have been derived from Arabic wordsBai and Salam. The word “Bai” means “sale and purchase” and the word Salam means “Advance”. “Bai-Salam” means Advance Sale and Purchase.

Definition:

Under this mode Bank will executive purchase contract with the client and make payment against purchase of product, which is under process of production. Bai-Salam contract will be executed after making any investment showing price, quality, quantity, time, place and mode of delivery. The profit is to be negotiated. The payment as the price of the goods is made at the time of Agreement / on the spot and the delivery of the goods is deferred.

Fixation of Purchase Price:

Points are to be considered at the time of bargaining with the client for fixation of price of the goods to be purchase under Bai-Salam. The time for taking delivery of the goods is anticipated time from the date of date of Bai-Salam price to final disposal of the goods. Taking delivery and costs for marketing, transportation charges, and selling commission etc. Godown Guard’s salary, insurance, godown rent etc. Present market price and the anticipated sale price at the time of disposal of the goods. Expected rate of returns is as per Head Office norms. All areas of appraisal should be carefully studied and the Appraisal forms (167B) should be completed properly. Purchase price shall be fixed-up with due study keeping in view that after sale of the goods the Bank gets profit as per expected Rate of Return.

Taking Delivery :

The client shall exclusively utilize the investment for the purpose for which he has taken it and shall deliver/export the goods as per Bai-Salam Agreement. The Bank shall take delivery of the goods from the client either by itself or through its representative as per Bai-Salam Agreement and Delivery Schedule. The bank shall not disburse the investment unless the client completes all necessary arrangements for the proposed production /manufacture. In case the Client tails to produce and deliver/export the goods, he will immediately refund the money received from the Bank. If necessary I Bank may authorize the Client in writing to sell/deliver/supply/export the Bai-Salam goods against his /their license /contract/sale agreement for and on behalf of the Bank as its agent at a price not lower than the price fixed by the Bank provided a separate agency agreement is executed between the bank and the Client (Agent).

Taking delivery of the goods after the due date of delivery as per schedule shall be at the absolute discretion of the Bank.

IV. Bai-Istishna:

Meaning:

The word Istishna has been derived from the word” Istishna” which means industry or Manufacturing enterprise. Istishna means to goods manufactured by placing orders to a manufacturer.

Definition :

Isteshna’a is a contract between a manufacturer/seller and a buyer under which the manufacturer/seller sells specific product(s) after having manufactured, permissible under Islamic Shariah and Law of the Country after haying manufactured at an agreed price payable in advance or by installments within a fixed period or on/within a fixed future date on the basis of the order placed by the buyer.

- Leasing mode (Ijarah mechanism):

- Hire purchase /Ijarah :

The term Ijarah has been derived from the Arabic works Ajr and Ujrat which means consideration, return, wages or rent. This is really the exchange value or consideration, return, wages, rent of service of an Asset. Ijarah has been defined as a contract between two parties, the Hiree and Hirer where the Hirer enjoys or reaps a specific service on benefit giant a specified consideration or rent from the asset owned by the Hiree. It is a hire agreement under which a certain asset is hired out by the Hiree to a Hirer against fixed rent or rentals for a specified period.

II. Hire Purchase Under shirkatul Melk:

Hire purchase under shirkatul Melk is a special type of contract which has been developed through practice. Actually, it is a synthesis of three contracts: Shirkat, Ijarah and sale. Shirkat means partnership. Shirkatul Melk means share an ownership. When two or more persons supply equity, purchase an asset, own the same jointly, and share the benefit as per agreement and bear the loss in proportion to their respective equity, the contract is called Shirkatul contract.

Stages of Hire Purchase under Shirkatul Melk:

Thus Hire Purchase under Shirkatul Melk Agreement has got three stages:

- Purchase under joint ownership.

- Hire and

- Sale and /or transfer of ownership to the other partner Hirer.

Types of sale contract in hire purchase under shirkatul melk

As per procedure of transfer of ownership and legal title of the part owned by the Bank is transferred to the other partner, the sale contract may be of various, some of the major forms are mentioned below:

3. Share Mechanism:

I. Mudaraba:

It is a from of partnership where one party provides the fund while the other provide the expertise, labor and the letter referred to at the Mudarib any profits accrued are shared between the two parties on a pre –agreed basis, while capital loss in exclusively born by the partner providing the capital.

II. Musharaka:

The term Shirkat and Musharakah have been derived from Arabic words “Shairkah” and “Sharika.” The word shirkah means a partnership between more than one partner. Thus the ward “Musharaka” and “Shirkat” means a partnership established between two or more partners for purpose of a commercial venture participate both in the capital and management where the profit may be shared between the partners as per agreed upon ratio and the loss. If any incurred, is to be borne by the partners at per capital /equity ratio.

In case of investment “Musharaka” meaning a partnership between the bank and the client for a particular business in which both the bank and client provide capital at an agreed upon ratio and bear the loss, if any in proportion to their respective equity.

Bank may move itself with the selected client for conducting any Shariah permissible business under Musharaka mode.

i. Household durable scheme:

Islami Bank Bangladesh Limited has introduced Household Durables Investment Scheme, which has already created great enthusiasm among the people and received tremendous response from them. Objectives are to assist the service holders with limited income in purchasing household articles such as

ii. Investment scheme for doctors:

A good number or newly graduated doctors from Medical Colleges are unemployed. Many of the medical graduates are waiting for job because the opportunity for Government service is limited. If these young doctors could be self-employed by extending investment facilities, they could make modern facilities available at the door-steps of rural people.

In view of the above facts, Islami Bank Bangladesh Limited has taken the initiative an introduced the ” Doctors Investment Scheme” to ensure modern treatment and medical facilities available to the people through extension of Bank’s investment facilities for self-employment of newly graduated doctors and at the same time extending investment facilities to the established medical practitioners to procure modern and sophisticated medical equipment.

iii. Small business investment scheme:

Bangladesh a third-wood developing country is rich in natural and human resources. In spite of vast possibilities, the majority people of the country live in hardship-below poverty tapped, explored and exploited. Physical labor is their only means of earning. A large segment of this populace is active youth force. Many of them are efficient, intelligent and energetic with initiative & drive and have courage to tale risks. But they can not uplift their socio-economic condition due to poverty, lack of financial support and other required facilities.

iv. Housing investment scheme:

One of the basic human needs is to have a house to live in. A house is in an abode of peace and happiness. Housing has now become an acute problem in the country, especially in the towns, cities and metropolis. With their limited income, it has become almost impossible on the part of the lower middle class, middle class and sometimes, even for upper middle class to solve their housing problem. To meet this basic human need, Islami Bank Bangladesh Limited is committed to contribute to this end to provide a peaceful and happy

v. Real estate investment program:

Professionals, Service-holders, Businessmen, Real Estate Developer and other categories of people who are not entitled for availing investment facilities under Housing Investment Scheme, shall be eligible under this programme Investment is to be extended to build new houses and for extension/ completion of the house already constructed, commercial building, shopping complex, flat apartment etc.

vi. Transport investment program:

Under this scheme, investment in being allowed to the existing successful businessmen and potential entrepreneurs in this sector for all types of road and water transport with simple and easy terms and conditions. The bank is also extending investment facilities to multinational companies, established, business houses and well to do officials and professionals for acquisition of private cars, microbus and jeeps.

vii. Car investment scheme:

Car is considered as on essential mode of transport in the modern society, particularly by a section of the officials, business houses and business executives and established professionals for movement in discharging their duties and responsibilities punctually and efficiently. Many of these categories of people cannot purchase a car on payment of entire purchase value at a time out of their own sources. To meet this need Islami Bank has introduced the ‘Car Investment Scheme’ for the mid and high ranking officials of government and semi-government organizations, corporations; executives and directors of big business houses and companies arid also for persons of different professional groups on easy payment terms and conditions.

viii. Rural development scheme of IBBL:

Islami Bank Bangladesh limited (IBBL) envisages an economic system based on equity and justice. Taking into consideration that majority of the population below poverty line lives in rural Bangladesh, the Bank has devised a Rural Development Scheme (RDS) with a view to creating employment opportunity for them and alleviates their poverty through income generation activities.

The IBBL through its RDS project has been implementing integrated programs for the landless poor, aged laborers and marginal farmers aimed at meeting their basic needs and promoting their comprehensive development. Consciousness among the poor needs should be enhanced so that they can lift their position in the socio-economic structure of the country. In order to consolidate their economic base, invested money should be used in income generating activities so the poorer section of the population can become self-reliant. RSD works for the realization of that objective.

ix. Agricultural implements investment scheme:

Bangladesh is predominantly an agricultural country with vast majority of people living in rural areas. Most of our people for their living are dependent on agriculture. Agriculture still contributes the lion share of the gross domestic product. But we could not as yet become self-sufficient in food production. We still import a bulk quantity of food grains from abroad to meet the deficit. We must modernize our agriculture and establish more and more industries in order to minimize imports

The Bank has introduced “Agriculture Implements Investment Scheme” to provide power tillers, power pumps, shallow tube-wells, thrasher machine etc. On easy terms unemployed youths for self-employment and to the farmers help augment production in agricultural sector.

x. Micro industries investment scheme:

Islami Bank Bangladesh Ltd. has been appreciably participating in this direction by financing industrial sector. With a view to creating wider base for industries, the Bank has decided to launch “Micro Industries Investment Scheme” through its Branches.

Strength of the Branch:

Strong Liquidity position

Stable source of fund

Largest Network of branches among the banks

Weakness of the Branch:

Marginal capital adequacy ratio.

Inadequate IT infrastructure

Lack of Islamic money market instrument

Opportunities of the Branch:

Rising awareness of Islamic banking

Regulatory environment favouring private sector development

Goodwill.

Threat of the Branch:

Increased competition in the market for public deposits

Shrinkage in export, import and guarantee business due to economic slump and war Government Rules and regulation.

A Comparison of Investment Mechanism between Islami and Traditional banks

| Investment Mechanism of Islami Banks | Investment Mechanism of Traditional banks |

| There are seven Islamic financing modes practiced by the most of the Islamic banks of the world: • Bai-Murabaha

• Bai-Muajjal

• Ijara

.

bank looks for a new lessee.

• Bai-Salam

.

• Qard Hasana It is loan without interest that plays a socially useful role engaging in income generating activities. It has a significant role to remove the financial distress caused by the absence of sufficient money in the face of dire need.

• Mudaraba It is a contract between two parties, in which one party supplies capital to other party carrying on some trade on the condition that the resulting profits be distributed in a mutually agreed proportion, while all losses be borne by the provider of the capital.

• Musharaka

.

| Traditional banks provide finance by using the following techniques:

•Loans:

.

Cash Credits

• Overdrafts

• Purchase or Discount of Bills

A customer at the time of opening an Letter of Credit signs an agreement with the bank assuring that the latter will pay the bill received on the former on a certain date onward in exchange for a specific rate of interest determined at the time of agreement. If the bill happens to reach well ahead of the date mentioned, the bank might purchase the bill, if requested, with a discount. In this case, the bank has made the return twice: firstly, by charging interest and then by discounting the bill.

• Advances for Hire-purchase

• The immovable properties might be kept as security.

|