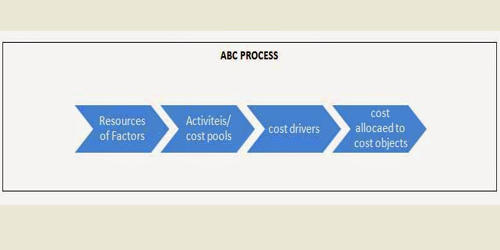

Working Procedures of Activity-Based Costing System

Activity-based costing (ABC) uses several cost pools, organized by activity, to allocate overhead costs. It is a costing method that assigns overhead and indirect costs to related products and services. This model assigns more indirect costs (overhead) into direct costs compared to conventional costing. In a business organization, the ABC methodology assigns an organization’s resource costs through activities to the products and services provided to its customers.

Stage I

An activity is any process or procedure that consumes overhead resources. The goal is to understand all the activities required to make the company’s products. In the first stage, major activities of a form for manufacturing finished products are required to be noted. Like material procurements, material handling, production runs, customers’ order execution, etc. needed by every product line.

Following are the few examples of the activities:

- Material procurement

- Customers’ order execution

- Inspections

- Production scheduling

- Employee’s related activity

- Material handling

- Dispatch of goods

- Machine operation

- Production runs

- Set-ups

Stage II

This step requires that overhead costs associated with each activity be assigned to the activity (i.e., a cost pool is formed for each activity). In the second stage, cost indicators, also called cost drivers, influence overheads needed to be listed in accordance with the major activities required by-products. Nature of activity or transaction decides a suitable cost driver

The activity-based costing system uses an appropriate cost driver that differs with the nature of activities that create costs.

A few examples of the activities and appropriate cost drivers are stated below:

- Activities or transactions………………………..Cost drivers

- Material procurement…………………………… Number of materials procured

- Material handling…………………………………..Quantity of input material

- Customers’ order execution……………………. Number of orders executed

- Dispatch of goods………………………………….. Number of dispatches

- Inspections……………………………………………. Number of inspections

- Machine operation…………………………………. Machine hours

- Production scheduling……………………………. Number of production scheduling

- Production runs……………………………………… Number of the production run

- Employees’ related activity………………………. Number of employees

- Set-ups…………………………………………………… Number of set-ups

Stage III

A cost driver is the action that causes (or “drives”) the costs associated with the activity. Analysis and collection of costs incurred for each cost pool are essential for determining the driver rate. A cost pool is like a center.

Illustration: If the inspection cost is $ 140,000 for assembling 100 ordinary and 100 automatic cameras. If one ordinary camera needs 2 inspections and one automatic camera needs 5 inspections, then find the inspection cost per inspection.

Solution,

Calculation of number of inspection:

Number of inspections of ordinary cameras = 100 cameras x 2 = 200

Number of inspections of automatic camera = 100 cameras x 5 = 500

Therefore, total number of inspections = 200+500 = 700

Now, inspection cost per inspection = total inspection costs/No. of inspections

= $ 140000/700 inspections = $ 200 per inspection.

Stage IV

Trace or allocate the cost of the activities or operations to the final products. This is done by dividing the estimated overhead costs (from step 2) by the estimated level of cost driver activity (from step 3).

Trace refers to the distribution of overheads to different product lines produced by using a cost driver rate. Overheads are recovered by different product lines based on the number of activities required by each product by using a driver rate.

Tracing refers to the recovery of inspection costs by the product lines by using the relevant cost drivers.

In the above illustration, $ 100000 and $ 40000 shared by automatic and ordinary cameras respectively i.e the ordinary camera required 200 inspections at the rate of $ 200 per inspection and automatic cameras required 500 inspections at the rate of $200 per inspection.

Thus, overheads are assigned to prevailing product lines by recognizing the relevant cost drivers for ascertaining product cost under activity-based costing.

Activity-based costing is a more refined approach to costing products and services than the traditional cost allocation methods. This accounting method of costing recognizes the relationship between costs, overhead activities, and manufactured products, assigning indirect costs to products less arbitrarily than traditional costing methods.

Information Source: