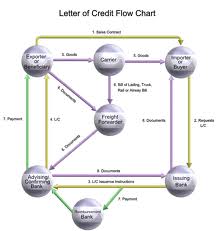

Definition of L/C:

A letter of credit is a letter issued by a bank (known as the opening or the issuing bank) at the instance of its customer (known as the opener) addressed to a person (beneficiary) undertaking that the bills drawn by the beneficiary will be duly honored by it (opening bank) provided certain conditions mentioned in the letter gave been complied with.

Classification of L/C:

- Revocable Credit

- Irrevocable ,,

- Transferable ,,

- Restricted ,,

- Red Clause ,,

- Green Clause ,,

- Confirmed ,,

- Divisible ,,

- Back to Back ,,

- LC without resource ,,

- LC with resource ,,

- Revolving ,,

- Anticipatory ,,

Revocable Credit:

A revocable credit is a credit which can be amended or canceled by the issuing bank at any time without prior notice to the seller.

Irrevocable Credit:

An irrevocable credit constitutes a definite undertaking of the issuing bank (since it can not be canceled without the agreement of all parties thereto). Provided that the stipulated documents are presented and the terms and conditions are satisfied by the seller. An irrevocable credit can be either confirmed or unconfirmed depending on the desire of the desire of the seller. Thus sort of credit is always preferred to revocable letter or credit.

Sometimes, letter of credits are marked as either ‘with recourse to drawer” or “without recourse to drawer”

Transferable Credit:

A transferable credit is one that can be transferred by the original beneficiary in full or in part to one or more subsequent beneficiaries. Such credit can be transferred once only. Fractions of a transferable credit can be transferred separately, provided partial shipments are not prohibited.

Revolving Credit:

The revolving credit is one, which provides for resorting the credit to the original amount after it has been utilized. How much time it will be taking place must be specifically mentioned in the credit. The revolving credit may be either cumulative or non-cumulative.

Back to Back Credit:

The back to back credit is a new credit opened on the basis of an original credit in favor or another beneficiary. Under back to back concept, the seller as the beneficiary of the first credit offers it as security to the advising bank for the issuance of the second credit. The beneficiary of the back to back to back credit may be located inside or the out side the original beneficiary’s country.

Anticipatory Credit:

The anticipatory credits make provision for pre-shipment payment to the beneficiary in anticipation of his effecting the shipment as per L/C conditions.

Red Clause:

When the clause of the credit authorizing the negotiating bank to provide pre-shipment advance to the beneficiary is printed typed in red, the credit is called “Red Clause letter of credit”