A flexible budget in business is one that can be adjusted based on changing costs and revenue. The importance of a flexible budget is heavily dependent on the accuracy with which expenses are classified as fixed, semi-fixed, or variable. At the start of the fiscal year, you create a budget that accounts for how much money your company has, needs, and expects to make.

The most important benefit of a flexible budget is that it more accurately reflects your financial situation. Static budgeting, on the other hand, cannot account for unexpected expenses or changing income. It will assist you in keeping track of where you can cut back on spending each month. It assists you in planning your budget based on your priorities. This is especially important if you want to save money or work toward a larger financial goal.

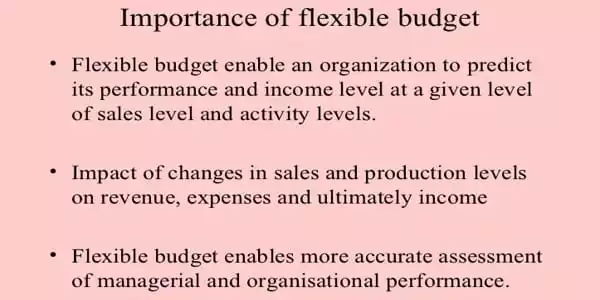

The importance of a flexible budget is as follows:

- The main benefit of a flexible budget is that it reflects the expenditure appropriate to different levels of output. The expenditure established through a flexible budget is appropriate for comparing actual expenditure incurred with the budgeted level applicable to the level of activity attained.

- A flexible budget allows management to examine the difference between actual and expected output. It provides a logical comparison of budgeted allowances with actual costs, i.e., a like-for-like comparison.

- Management can compare actual costs at actual volume to budgeted costs at actual volume. It is very useful for budgetary control because it corresponds to changes in activity level.

- The flexible budget provides an accurate basis for comparing actual and expected costs for a specific activity. When a flexible budget is created, the actual cost at the time of the activity is compared to the budgeted cost at the time of the activity, i.e., two things are compared on a like basis.

- A flexible budget can also assist you in maintaining a budget that is compatible with your lifestyle. Because a flexible budget is prepared for various levels of activity, cost determination at various levels of activity is possible. When unexpected expenses arise, it’s natural to react by cutting back on everything unnecessary in your life.

- Flexible budgeting aids in meeting cost-cutting objectives by revealing where actual performance deviates from planned performance. It is useful in evaluating the performance of department heads because their performance can be judged in relation to the organization’s level of activity.

- Flexible budgets represent the amount of money spent that is necessary to achieve each level of output specified. In other words, the allowances provided by the flexible budgetary control system serve as guidelines for what costs should be at each level of output.