Audit Procedure of Verification of Alternative Cash

Assistance of ACNABIN Chartered Accountants

Business edification can only form a wholesome meaning if it goes beyond the boundaries of theoretical concept and into the real world so as to meet the demand of the present situation. This is where the importance of the internship program comes in. Such programs facilitate us to apply our understanding of the theoretical knowledge in the feasible, practical field. As a part of this program, I had an immense opportunity to work in ACNABIN Chartered Accountants – an independent a member of Baker Tilly International, which is the world’s 8th largest network – as my first exposure to professional world. ACNABIN has established a close working relationship with many international and national consulting firms for providing services to clients in Bangladesh. In this way ACNABIN has enriched its professional base for serving the clients interest in best manner. In November 2010 the Central Bank of Bangladesh (Bangladesh Bank) ranked ACNABIN as the number one audit firm in the country for audit of banks and financial institutions. In 1993 the United States Office of Regional Inspector General/Audit, Singapore, approved the firm to perform financial audits of USAID fund recipients in Bangladesh.

METHODOLOGY OF THE STUDY

The study has been initiated to explore the insight of the critical issues of the audit procedure on cash incentive. To complete the study both primary and secondary data has been used.

Data collection method

Relevant data for this report has been collected primarily by direct investigations of different records, papers, documents, operational process and different personnel. The interviews were administered by formal and informal discussion. Non-structured questionnaire has been used.

Data sources

The information and data for this report have been collected from both the primary and secondary sources. In order to prepare the assigned project paper I have collected necessary information from two types of sources as follows:

Primary sources of information:-

(i) Information collected by working with different audit teams.

(ii) Discussing with engagement partner, audit managers, audit staffs and articled students.

(iii) Interviewing the client about their cash incentive plan.

(iv) Observations during physical factory visit.

Secondary sources of information:-

(i) Collection of secondary data from Annual audit report, management audit report, accounting system & audit working papers audited by ACNABIN

(ii) Secondary data also have been collected from the different publications of the Institute of Chartered Accountants of Bangladesh (ICAB)

(iii) Other information was obtained from various corresponding files of the firm and various books especially from Bangladesh Standards of Auditing (BSA)

(iv) Internet was one of the important sources for secondary data collection

(v) Obtaining information from circulars published by Bangladesh Bank

(vi) Also collected data from check-list regarding cash incentives developed by ACNABIN

ACNABIN CHARTERED ACCOUNTANTS

- A BRIEF PROFILE

ACNABIN Chartered Accountants is one of the most highly regarded and leading independent accountancy and business advisory firm in Bangladesh with global affiliations. ACNABIN commenced its operation on 15th February, 1985 and is in public practice for almost 30 years. Currently, ACNABIN is managed by ten partners – all of whom have extensive working experience gained both locally and globally and have expertise in various fields of accounting, taxation, auditing, reviewing, business consultancy, technological solutions, trainings and so on.

In December 2013, the Central Bank of Bangladesh (Bangladesh Bank) ranked ACNABIN as the number one audit firm in the country for audit of banks and financial institutions.

Since its inception, ACNABIN has been appointed multiple times by various government and non-government organizations to perform consultancy and auditing services for a wide range of projects that are often funded by international agencies such as ADB, CIDA, ILO, The World Bank, USAID, UNCDF, CARE International, Save the Children and so on. Locally, ACNABIN has widespread practice working with clients belonging to various public and private sectors of the country including trade, finance, education, agriculture, microfinance, health, NGO, etc.

ACNABIN is highly skilled in carrying out market research and surveys as well by using its extensive logistics and personnel resources. ACNABIN is also an enlisted auditor of USAID and European Commission (EC).

At present, ACNABIN is an independent member firm of Baker Tilly International – an international accounting network consisting of 145 firms operating in 110 countries. Prior to this, ACNABIN was associated with ASNAF-ASEAN Accounting Firms (Singapore) since 18 February 2003 to 2010 and Arthur Andersen LLP, that was formerly one of the “Big Five” accounting firms globally, till the firm voluntarily surrendered its license in 2002. At the moment, ACNABIN is trying to enter into an affiliation contract with PricewaterhouseCoopers (PWC).

SERVICES OFFERED BY ACNABIN

- Statutory audit

- Internal audit

- Special audit

- Management audit

- Performance audit

- Financial review

- Accountancy

- Taxation – individuals, companies, banks, branch offices, liaison offices

- Accountancy and management training

- Company formation and secretarial work

- Investigation of frauds and irregularities

- Setting up branch office and setting up liaison office

- Companies’ registration with Board of Investment, Ministry of Industries etc.

- Work permits, visa, security clearance of expatriates

- Bank accounts opening for foreign clients

- Obtaining permission from the central bank regarding inward and outward remittance

- Obtaining trade license, factory license, Import Registration Certificate, Export

- Registration Certificate, Bonded warehouse facility, VAT registration, Membership of Trade Association/chambers etc.

- Providing services regarding setting up of office, drafting rent/lease agreement, recruitments of staff etc.

- Preparation of manual and policy guidelines in respect of finance, accounts, internal control, inventory, procurement, operation, administration, human resources etc.

- Services relating to fixed assets management, inventory management etc.

- Services with regard to share issue, right issue, initial public offering, prospectus

- Outsourcing of accounting services, payroll, internal audit etc.

- Helping clients in adopting international and local accounting standards

- Tax planning and tax management of expatriates

- Business plan developments

- System development

- Feasibility study of projects

- Management consultation/development

- Due Diligence Review

- Data processing with computers

- Privatization consultancy (includes pre-privatization review, restructuring, valuation in particular and privatization assistance in general)

- Company acquisition, merger, spin off, amalgamation etc.

- Liquidation and winding up of companies

- Micro-finance consulting

- Human Resource Development Issues

- Organizational consulting services

- Designing computerized systems for MIS and accounting and its implementation

- Share/asset valuation

- Other services as per needs of the clients

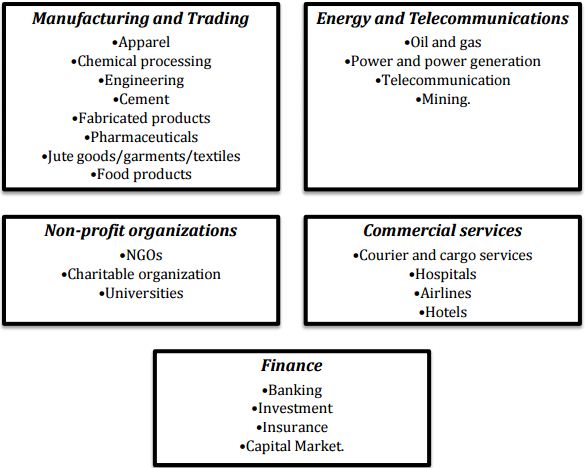

CLIENTS OF ACNABIN FROM DIFFERENT SECTORS

Fig. Clients of ACNABIN from Different Sectors

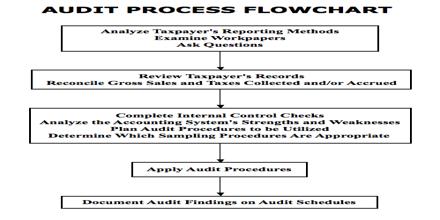

AUDIT PROCEDURES OF ACNABIN

ENGAGEMENT PROCEDURES

Before discussing the Audit Procedures followed by ACNABIN, I try to focus on the engagement procedures through which ACNABIN is engaged/ recruited by the client to perform the audit.

ACNABIN faces three kinds of situations in engagement process:

- Engagement with new client.

- Engagement with existing client

- Directly appointed by the client.

Before starting the audit work, some letters are exchanged between ACNABIN and clients.

NEW CLIENTS

In case of new clients, four letters are exchanged between ACNABIN and client including acceptance letter of appointment at the time of involving with the new client. Following stages are followed by both ACNABIN and client:

STAGE – 1: Client requires for technical and financial proposal from the ACNABIN Client generally gives circular with the newspaper or directly wants proposal for audit from the audit firm. In case of direct offer they request to the audit firm to submit a quotation for the cost of conducting audit of the client. They also mention the specific date to confirm the decision taken by the audit firm and completion date for audits. The client firm mentions here the key areas of the audit in the form of attachment. It assures that if ACNABIN audits client ‟s firm, they will supply the formal terms of reference/audit mandates to govern the conduct of audit.

STAGE – 2: The technical and financial proposal is sent by ACNABIN to the client After reviewing the client letter or paper’s circular, audit firm drafts a proposal letter to the client. The proposal letter contains technical and financial proposal for carrying out the subject of audit. ACNABIN estimates its personnel costs after considering the mandates to be utilized and using the minimum hourly rate of fees as prescribed by The Instituted of Chartered Accountants of Bangladesh (ICAB). The firm also mentions that as it is an estimate, the cost may vary with variation in number of mandates estimated to be utilized for the job.

STAGE – 3: Acceptance by the client on the basis of proposal of ACNABIN – A letter of contract

After receiving proposal letters from various audit firms, client then selects the one which is favorable to them, and it appoints the audit firm for audit purpose. From the technical and financial proposal of the ACNABIN the client company understands the nature of the audit (such as independent, external) to assess the organization’s internal control system in administering the audited matter.

STAGE – 4: A letter is sent by ACNABIN to the client confirming to work with the client –

Confirmation Letter

After receiving the acceptance letter from the client, ACNABIN provides confirmation letter describing the firm’s willingness to work with the client.

EX-CLIENTS OR CLIENTS FROM LAST YEAR

Three letters are exchanged between the ACNABIN and client:

- Willingness letter for reappointment: In this letter ACNABIN wants to audit this year. It can request to increase audit fee or change some other conditions.

- Client sends appointment letter.

- ACNABIN accepts this appointment.

CLIENTS WILLING TO APPOINT ACNABIN

If the client is interested to work with ACNABIN, then it directly sends an appointment letter to the firm which includes all terms and conditions. If all terms and conditions are favorable to the ACNABIN then it accepts the appointment and sends a letter to the client as an auditor.

VERIFICATION OF ALTERNATIVE CASH

ASSISTANCE

- INTRODUCTION TO ALTERNATIVE CASH ASSISTANCE

As a Third-World country, the economy of Bangladesh is yet heavily and unfavorably dependent upon foreign currency. Thereupon, to retain a Balance of Payment (BOP) that is more favorable and encourage the export related activities of the economy, the Government has undertaken several initiatives and granted incentives and facilities for industries to take.

Among these facilities, the most availed and frequently utilized by exporters is Cash Incentive. Generally, Government provides three alternatives to assist exporters –

a) Duty Drawback (Importer is exempted from paying any kind of duty in the port)

b) Bonded Warehouse (Rent free warehouse for Exporter/Importer to keep their inventory if they do not own one), and

c) Cash Incentive

Cash incentive is the assistance in the form of ‘cash’ given to any Client in case certain predetermined conditions are being fulfilled. Cash incentive scheme was first introduced in 1986 in garments factory, fish sector, jute mills, agro sector, and pet bottle & flakes plastic industry and new market exploration sector, etc of Bangladesh as a refund of part of the production cost of the local Exporter when Beneficiary completes the export process in compliance to all requirements of the Government that is mentioned in the Bangladesh Bank Circulars).

In case of Cash Incentive, Government gives a percentage of the total realized value from locally produced exported goods back to the producer/exporter. For instance, assuming an Exporter opened up a LC worth of USD 500,000. He exported locally produced fabric worth USD 350,000 and received a realization amounted to USD 300,000. For locally produced fabric, the Government grants an Incentive of 5 percent. Hence, assuming there is no wastage, the Exporter will receive an incentive of USD 12, 000 (USD 300,000*80%*5%) {Refer to Appendix for detailed Calculation}.

The incentive is issued by Bangladesh Bank. However, in order to justify whether the Client is indeed eligible to receive the claimed amount and to verify the authenticity of the export and production process and avoid any form of manipulation and fraudulent activities, an independent third-party is employed to express a reasonable assurance and to calculate the factual amount the Client is eligible to receive, as opposed to the amount they claimed. This is where the responsibility of an Audit firm comes in.

The audit procedure of verifying a Cash Assistance File is laid out in nine distinct steps, which is discussed further in the next section. After forming a valid conclusion, we were required to issue a Certificate that is signed and sealed by the concerned Partner as an Approval that states that the submitted application is eligible for receiving Cash Assistance and includes an attachment of the calculations that matches up the amount of incentive receivable by the Client.

- IMPORTANCE OF PROVIDING CASH INCENTIVE – THE COMPOSITE

INDUSTRY

Composite sector is one of the most prospective sectors of our economy and is considered one of the core contributors of our export income. At present, almost 76% of our total export income is earned by exporting RMG. However, in phase of recent MFA (Multi-fiber Arrangement) and quota phase out, the composite sector of Bangladesh is expected to face alarming threat of losing foreign market. The reason behind this is because gradually we are losing competitive advantage of our composite sector to countries such as India and China whose labor cost are comparatively getting cheaper from us. On the other hand, our material and other production costs are very high since we are tend to import almost all the raw materials (Yarn, Fabrics) and accessories from abroad, ironically from India and China, in order to produce higher quality of output. To make matter worse, this phase of quota system out might discourage these countries to stop supplying these accessories and other materials altogether as well and start using those for additional production to capture our market abroad. So, our composite sector is very much vulnerable as long as we cannot establish a strong backward linkage for composite sector within Bangladesh Cash Incentive is offered for numerous of different reasons. For instance, the reasons behind granting Cash Incentive for Composite yarn industries are as follows –

- To boost the export of composite yarn

- To establish and strengthen the backward linkage of composite industry

- To encourage investment in prospective industries of yarn production

- To support and add more value to the Composite sector of Bangladesh

- To motivate the use of locally produced yarn rather than yarn imported from foreign countries in order to support and establish a Global market for the local yarn producers

- To make such locally produced yarn, fabrics and RMG more competitive in foreign land by mass producing as well as keeping their cost lower

- To have a counter weapon against the undesirable practice of dumping by foreign countries

- CONDITIONS FOR ELIGIBILITY OF ALTERNATIVE CASH INCENTIVES

Alternative Cash Incentives will be payable only if the exported products are produced within Bangladesh with yarn collected from member mills of BTMA and no Duty Drawback facility or Bonded Warehouse facility is benefitted from at any phase of production. Cash Incentive facilities are given upon fulfillment of the following conditions:

- Only one party among the yarn manufacturer, fabrics supplier and exporter will obtain Cash Incentives.

- Applicant for Cash Incentives will submit his application to the negotiating bank within 180 days of the realization of export proceeds.

- Alternative Cash Incentives will be payable only after the export price is received in foreign currency (Realized value).

- If the Applicant’s name is not mentioned in L/C document, the Applicant will be rejected immediately.

- Authorized Auditor, after receiving all necessary information and certificates, will compute the payable amount as Alternative Cash Incentives to the applicant.

- As soon as Alternative Cash Incentive is approved, the Proceeds Realization Certificate will be sealed with “Alternative Cash Incentive Paid” and signed by the very person who has approved the payment. It is done so that the Proceeds Realization Certificate cannot be misused otherwise. All the cases of the payment of Alternative cash Incentives will be examined by the Internal Audit Team of the concerned Bank. Apart from this, all documents will have to be preserved for at least 3 years by the bank for the examination of Bangladesh Bank visiting team / Government Audit team.

- BENEFICIARIES FOR THE CASH INCENTIVE FACILITIES

From the commencement of “Cash Compensatory Scheme (CCS)” in 1986, this facility was made available to RMG, Hosiery and Special Textile Units which are not chosen to use the bonded warehouse facilities and duty drawback facilities. However, from 1997, the following parties or organizations were entitled to Cash Incentive facilities:

- Producer and direct exporter of fabrics i.e. producer and exporter of oven/knit/hosiery/fabrics/gray/dyed/printed fabrics and other specialized fabrics.

- Producer and exporter of different types of fabrics i.e. items like towel, bar, map, bathmat, grill pad, duster cloth, terry bag, bed shed cover, stocks and gloves.

- Producer and suppliers of fabrics from which RMG has been exported abroad after value addition done in the production process of the exporters.

- Producers of fabrics from yarn and RMG i.e. a composite mill (Bangladesh Bank, 1997). Although after March 5, 2001 (BB FE Circular No. 09), there was a slight change to the list. The Cash Incentives will be entitled to the following parties from that date:

- Producer and exporter of RMG from fabrics.

- Producers of fabrics from yarn and exporters of the RMG, i.e. a composite mill.

- Producer and direct exporter of fabrics.

- Producer and supplier of fabrics from which RMG has been exported in abroad by exporter after value addition.

- Producer and exporter of yarn (Bangladesh Bank, 2001 b). There are a number of industries who are eligible to receive a Cash Incentive, provided that all other conditions are effectively met. Some of such industries are as follows –

- New Market Exploration

- Export of Jute yarn and products

- Export of Leather

- Export of Handicraft items

- Export of Beef Omasum

- Export of Agro products

- Export of Fish

- Export of Potato

- Export of Terry Towel, etc.

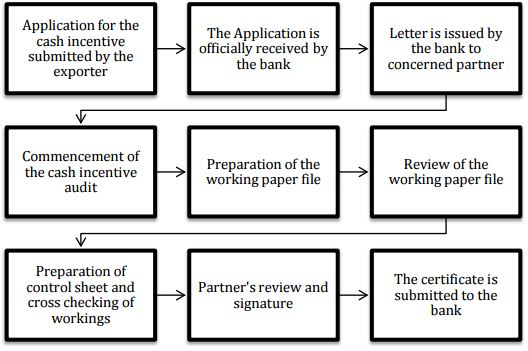

PROCEDURE OF CASH INCENTIVE AUDIT

The procedure of Cash Incentive Audit is illustrated in the following diagram and the steps are explained in details as follows –

Fig. List of steps undertaken to execute a Cash Incentive Audit

- SUBMISSION OF APPLICATION FOR CASH INCENTIVE BY EXPORTER

Application for Cash Incentives is submitted by the Exporter to the Bank where all the export transaction took place. The application for Cash Incentive can only be applied after the date of the Proceeds Realization calculations of Alternative Cash Assistance receivable by the exporter is based on their proceeds of the exported goods. The application is backed up by a number of different supporting documents required by different authorities, such as – GOB, Bangladesh Bank, the Bank of the exporter, Auditor etc. After proper attachment of all required document and attachment of all photocopies, a file is created by the exporter and is submitted, along with the application form, to the Export Division of their respective Bank.

- THE APPLICATION IS OFFICIALLY RECEIVED BY THE BANK

The Export Division of the concerned branch of the Bank officially receives the file of the application and necessary documents. Upon receiving, the authorized officer of the concerned branch of the Bank attest all those documents after making a thorough check. In case any error or incompleteness is identified in the documents, the exporter or the applicant is required to fulfill them and arrange the according to the format provided by the bank.

After all the documents are properly submitted, the Bank makes a rough calculation on the amount of Cash Incentives the applicant can receive. This is usually done directly on value of Proceed Realization of the exports of the applicant and the calculation does not generally deviate from our calculation unless there are wastages involved, which we are required to compute and deduct from the claim amount.

- LETTER ISSUED BY THE BANK TO THE CONCERNED PARTNER OF ACNABIN

After all the files and their respective calculations are prepared, the Head Office of the Bank issues a letter asking the ACNABIN to complete audit work regarding the application for Alternative Cash Incentives of this certain exporter.

- COMMENCEMENT OF THE CASH INCENTIVE AUDIT

Upon receiving the letter from the International Division of the Head Office of the bank, ACNABIN sends auditors to the concerned bank and the Cash Incentive Audit officially commences. After completing all the attestation, the authorized officer of the concerned branch of the Bank sends the file to the auditors and auditors starts their work as per the Terms of Reference (TOR) recommended by the Bangladesh Bank in the FE Circular no. 291

- PREPARATION OF THE WORKING PAPER FILE

As an auditor, our first work regarding the audit of cash incentive file is to prepare a working file for each file of the application. It is the first and foremost duty of an auditor to keep a physical record of all the work and calculations that is being done for review and future reference purpose. For this intent, we follow a standard format that is prepared and provided by ACNABIN. A specimen copy of this file is given in the annexure. We record all the necessary information of the application file in this working paper. The items that we check-in in the Application files are mentioned below as follows –

Application

- Name of the applicant

- Date of application

- Office address

- Factory address

- Claim amount

The date of Application is the date on which the Applicant’s Bank received the files prepared for the Audit firm and includes all the necessary documents, such as, BGMEA/BTMA certificates, Application forms, PRC Certificates, Back-to-back Bank Certificates and so on. If the date is missing, we send a query to the Client as well as to the respective Bank. However, the Application date must be within 180 days of the latest date of Realization, otherwise the Applicant becomes ineligible to receive a Cash Incentive – details of which are discussed in the next section.

In the Claim Amount, we take the amount from the Application that is claimed by the Applicant in USD and multiply it with the exchange rate that the Applicant’s Bank provided in the OD sight rate as well as in the Bank Calculation.

Value of Production/ Cost Sheet

- Cost of yarn

- Knitting and overhead cost

- Dyeing and over head cost

The Cost Sheet is provided by the Applicant where they give us a breakdown of the cost of yarn, which we match up against the consumed quantity and value that appears in BTMA certificate and Utilization Declaration (UD) document. The applicant’s knitting and dyeing cost rate is also provided in this Cost Sheet. However, there is a ceiling rate of $0.90 per kg of yarn for knitting and $1.90 per kg of yarn for dyeing. If the Applicant’s rate is below the ceiling, we take the provided cost amount for wastage calculation, but if their provided rates cross this threshold, we prepare a revised Cost Sheet according to the ceiling rate.

Master LC or Sales/Purchase Contract

- LC no. & date of issue

- Description of goods exported (RMG/ Jute/ Handicraft/ Fabrics etc.)

- Quantity (in pieces/yards)

- Terms of Conditions (FOB / C&F)

- Commission (if any)

- Original value of L/C (in USD)

- Transferred amount of the L/C (in USD)

- Notifying party

Original value of the L/C is the initial worth of the L/C while it was in its inception. However, sometimes the original amount of the L/C is transferred on behalf of the exporter. This is the Transferred amount. If the whole value is transferred, then both the original and transferred amount would be same. If the original amount, on the other hand, is partially transferred, then only the portion of the amount transferred will be the Transferred Amount.

In most cases, L/Cs contains a number of amendments. In such cases, we take the date of the L/C at its inception, but take the final revised amount from the last amendment.

If the Terms of Conditions of freight is C&F (i.e. freight is prepaid by the exporter), we require a freight certificate issued by the logistics authority where the value of freight is mentioned. We take this value and subtract it from the Realized amount, along with Commissions if there is any, from our calculations.

Notifying Party is the agent/carrier that is appointed by the Importer to receive and safely bring the goods to the Importer’s premises.

Back to Back (B2B/BTB) L/C

- L/C no.

- Date of the L/C

- Beneficiary of the L/C (the supplier of yarn or accessories)

- Items (Yarn/ Accessories/ Fabrics/ Dyeing Charges, etc.)

- Quantity (in kg or yds)

- Amount (in US$)

- Master L/C No.

- Name of the incentive receiver (the exporter)

B2B L/Cs are opened up against the Master L/C in order to help the Exporter finance the purchase of equipment or services from a subcontractor. The Exporter seller goes to his own bank with the original L/C from the Importer’s bank and has a second L/C issued with the Subcontractor as Beneficiary. The subcontractor is thus ensured of payment upon fulfilling the terms of the contract.

B2B L/Cs can be either of two types – Local or Foreign. Local B2B L/Cs are those where the Beneficiary belongs from the Exporter’s country where as the Beneficiary of foreign B2B L/Cs are from outside the Exporter’s country. For instance, if the Exporter buys Fabrics to produce RMG from a local supplier, he can purchase so by issuing a local B2B L/C. On the other hand, if the Exporter imports accessories, such as Fabrics, Buttons, Chains, Dyeing, etc. from another country using B2B L/C, then it would be a foreign B2B L/C. We can determine whether the B2B

L/C is local or foreign by inspecting the L/C no. – all local B2B L/Cs have a code equal to or less than ‘04’ and anything above code ‘05’ is a foreign B2B L/C.

For example – if a B2B L/C’s no. is 2016 0060 1324, then it is a foreign B2B L/C because the code, that is contained within the 6th and 7th digit of the L/C no. , is above ‘04’. All foreign B2B L/Cs are multiplied 1.25 times and the acquired value is subtracted from the Net FOB from our calculations as per Bangladesh Bank circulars. Hence, it is very essential to figure out whether a B2B L/C is local or foreign because a miscalculation can lead to overestimated Claim amount as well as the amount that we would calculate that would be receivable by the Applicant.

While examining B2B L/Cs for Yarn, we make sure that the value matches up with the values provided in BTMA certificate, Applications, UD and Cost Sheet. We also make sure the yarn is obtained through local suppliers with Certificates of Origin and Beneficiary Certificates issued from the supplier, otherwise the file will be ineligible to receive a Cash Incentive. Yarn and Fabric B2B L/Cs are backed up with supporting documents including Pro-forma Invoice (the no. of which is mentioned in the B2B L/C document), Commercial Invoice, Packing List, Mushak Challan, Delivery Challan, Certificates of Origin (Original), Beneficiary Certificates (Original), GSP certificate and BTMA certificate (Original and issued for Cash Incentive purpose only). It is crucial for Applicants to provide an original copy of the required documents and failure to do so would make the file ineligible for Cash Incentive. Any form of manipulation, erasing or correction in the original documents would make them void and again, if a accurate reissued document is not presented, the files become annulled.

B2B L/Cs for accessories are only supported by Pro-forma Invoice. We match up the B2B L/Cs alongside the B2B Bank Certificate which provides a list of B2B L/Cs the Applicant opened up using the applied Master L/C. The Applicants must provide a copy of all the B2B L/Cs listed, especially if the file is applied for Composite or the Applicant is the direct exporter, or else the file would be invalid.

BTMA Certificate (Original Copy Issued For Cash Incentive Purpose Only)

- Items (yarn)

- Quantity (in kg)

- Commercial Invoice no.

- Commercial Invoice number & Date

- Date of Delivery

- Gate Pass date

- Certificate No.

- Date of the Certificate

- Export L/C no. or Sales/Purchase Contract no.

- Date of that Export L/C or Contract

- Back to Back L/C (for yarn) number

- Date of Back to Back L/C (for yarn)

If any of the above information is missing or inconsistent with other documents, the certificate must have to be changed to that effect. The Gate Pass date must be on or before the Date of Delivery. To ensure the Gate Pass date, we need to check this date of BTMA certificate with the date of Challan Patra attached with the certificate and if there is any inconsistency, we ask the Applicant to correct it.

Beneficiary Certificate and Certificate of Origin (Original Copy)

- Date of the Certificate

- Back to Back L/C no.

- Date of Back to Back L/C

- Name of the beneficiary (the supplier of yarn/fabric)

- Quantity of supplied materials (yarn/fabric)

- Master L/C No.

- Date of Master LC

The Beneficiary Certificate is a certificate issued by the local Supplier of yarn or fabric declaring that the Beneficiary, that is, the Supplier, has not availed and will not apply for any other facilities other than Cash Incentive, such as duty drawback facilities and bonded warehouse facilities. In this document, the Declaration is the most important part for us to check. We need to make sure that the declaration is complete and unambiguous. The term “Beneficiary” is used for the Supplier since the yarn Supplier benefits from the Alternative Cash Incentives System offered by the GOB. It is for this very reason that exporters become interested in using local yarn which in turn directly increases the business of the local yarn manufacturer and supplier.

The format of Certificate of Origin is identical, with an additional Declaration from the Beneficiary is included which states that the supplied yarn or fabric is of Bangladesh Origin and is spun in their own mills.

Proceeds Realization Certificate (Original Copy Issued For Cash Incentive Purpose Only)

- Reference no. of the certificate

- Export L/C no.

- Date of the Export L/C

- EXP no.

- Date of Realization

- Realized value in US$

The PRC is issued especially for Cash Incentive purpose by the Applicant’s Bank is their official letterhead pad and is signed and sealed by the relevant authority representing the Bank. Generally, only original copy of PRC is accepted but in dire and selective cases, attested photocopy might be acceptable as well. In such cases, the original copy is requested to be submitted as early as possible, if not, we will not issue cash incentive certificate for that very application file.

PRC is one of the main documents that is essentially required to apply for Cash Incentive benefit. This is because PRC is the main source of Realization value and date and we match up these figures with the ones that appear in Applications. In case there is any mismatch in the Application, we send up query to the Applicant and ask for a revised Application. In case there is any error in the PRC itself, we ask for a reissued copy of PRC or a attested correction seal and signature from the Bank.

Export Invoice / Commercial Invoice

- Export Invoice / Commercial Invoice No.

- Date of issuing the Export Invoice I Commercial Invoice

- Quantity / Unit (in pieces)

- No.

- Gross amount (in US$)

- Net amount (in US$)

- Commission (if any)

- Gross weight (from the Packing List)

- Net weight (from the Packing List)

In the above list, we record all the information except the gross and net weight directly from the Export Invoice. To record these, we need to check the Packing List attached with the Invoice. These weights should ensure the gross and net weights of the entire piece shown in the Quantity column. Sometimes part of the total units’ weight is shown in Packing List. In such a case, the exporter is asked to correct the List so that it shows the gross and net weight of the total quantity.

Bill of Lading (B/L)

- B/L no.

- Date on which the goods were shipped on board

- EXP no.

- Freight (if prepaid, from freight certificate)

- Gross weight

- Master LC no.

- Name and address of the notifying party

In this document, the date of shipment is the most important information for the auditor regarding cash incentive. It is because, based on the date of shipment, we will decide the rate of cash incentive applicable for the Exporter. We also note the freight from this document. If, according to B/L, the freight is prepaid, we immediately ask for freight certificate to the Applicant if it is not provided.

Shipping Bill

- Master LC No.

- Master LC date

- No.

- Short shipment pieces (if any)

- Quantity /Unit (in pieces)

- Gross weight

- Net weight

- Name and address of the notifying party

If the quantity or invoice value of this document is lesser than the quantity or value that appears in the EXP form or Commercial Invoice, it implies that there was a shortage in shipment. To match up the discrepancy, the Applicants must provide us with a Short Shipment Certificate that lists the quantity, weight and/or value of shipment that was sent out, the amount that was received and the value that was short in the shipment. After consulting the Short Shipment certificate, we record the lower quantity, weight and/or value.

REVIEW OF THE WORKING PAPER

In cash incentive, we work as a team of three, consisting of a senior, a semi-senior and a junior. The seniority of each student is determined by their individual joining date in the firm. After recording all required information in the working paper, a senior articled student reviews the whole file to determine any calculation error and ensure that it is true and fair. He makes sure the mathematical accuracy of the certified amount. He also verifies that the certified amount is calculated considering all relevant items mentioned in the Bangladesh Bank circulars.

- PREPARATION OF CONTROL SHEET AND CROSS CHECKING OF THE WORKING FILE

In this next step, we are required to prepare a Control Sheet containing the most important and relevant information from the files. It is solely for the purpose of the Audit Firm. This is a summary of all the application’s files. It acts as a database which facilitates the systematic controlling of our working files and the application files.

After this, the control sheet is cross checked by the In-charge personnel of the Cash Incentive audit. He compares the control sheet with the working files and if he finds any discrepancies, he goes for the original file to sort and correct the inconsistency.

- PARTNER’S REVIEW AND SIGNATURE

At the very end, the concerned Partner of the audit conducts one final check of the whole audit. If he gives his final consent on the accuracy of the audit, then we start preparing the certificates of cash incentives. If the partner, on the other hand, has any queries, he asks the In-charge to resolve the matter. After all these steps, we prepare the final copy of Alternative Cash Incentives Certificate as per the Attachment-“Ga” of the FE Circular no. 291 dated June 02, 2002. For every single application, a separate certificate is prepared. Finally the concerned Partner of the firm issues these Cash Incentives Certificates by duly signing them.

- THE CERTIFICATE IS SUBMITTED TO THE BANK

After signature of the partner, the Cash Incentive certificate is issued. Then this certificate is submitted to the Head Office of the bank along with the application. The Head Office of the negotiating bank will receive this certificate and the certified amount will be paid to the applicant in accordance with the Bangladesh Bank.

CRITICAL OBSERVATIONS

Based on the Case Study that was prepared based on six Companies whose files I have worked on during my Internship period, I have determined a number of both constructive and negative observations. Some of such remarks, based on various standards namely BB Circulars, TOR, Import Policies, BSA and so on, are listed below –

- We have saved BDT 1,395,923 of Bangladesh Bank on the files of the six companies.

As of earlier times, Bangladesh Bank used to consider the Bank’s Calculation as their final payable claim. However, Banks seldom go into depths of these files and verify the authenticity of the provided documents. Due to reasons such as wastages and other numerous reasons, our calculation often comes lower than the claimed amount. This had lowered the liability of Bangladesh Bank towards these Cash Incentive Applicants.

After deducting our Audit fees of these six companies’ files, we have saved Bangladesh Bank BDT 1,395,923, that is, these Clients have over-claimed almost 14 Lakh Taka. Appointing us has saved Bangladesh Bank this huge amount of money.

- There is drastic amount of Audit delay.

As per the agreement with negotiating Banks, we are required to go through the Incentive files and provide a list of missing documents and other queries if any to the Bank or the Client within a week’s time. However, due to shortage of Audit in our department and huge work load, we can seldom meet the deadline. According to the Case Study, we have made a delay of 35 to 65 days on meeting up the files’ queries whereas the benchmark was 7 days. This radical holdup of files has created a number of complications that lead to huge amount of pressure from the Clients.

- There is less significance provided on verifying the authenticity of provided documents.

As an Auditor, it is possible to verify the documents, but it is nearly impossible to identify whether these documents are acquired legally or in align with the rules and regulations. Hence, we are only capable to giving out a reasonable opinion on how much Alternative Cash Assistance the Clients deserve to receive. Therefore, we are not pressurized to forcefully determine the originality of the source of the documents. Nevertheless, we do have the capacity to verify whether the provided documents are manipulated or falsified in any way or not.

For instance, there are a number of techniques through which we can identify whether, say, an Export document or a BTMA certificate is manipulated or not. However, there is no formal training provided by the seniors or Managers of the firm regarding the ways in which we can identify manipulation. Whatever we have learnt about classifying such maneuvers are by learning it from colleagues and team members on-the-job. I believe this is an important aspect of fraudulency and such misconducts should be controlled. For this, the firm should give more emphasis on determining such fraudulent activities and arrange intensive training on this.

- Possible fraudulent activities on behalf of the Bank and Clients are not doublechecked quite enough.

During my work period, I have often detected falsified documents that was signed and attested by negotiating Bank’s authority. This highly suggests a fraudulent activity on behalf of the Bank, or that the Client may have reproduced seals and signatures of the Bank without their prior knowledge. However, we seldom go through the trouble of verifying all these documents per file due to its time consuming nature.

These deceptions are often caught in documents such as Bank calculations, PRC and Back to back Bank Certificates and there are means of identifying such con. Each Bank maintains a PRC and Back-to-Back LC register and if we visit the Bank physically and go through the registers, we can easily match up any discrepancies between the provided documents and the Bank’s record.

In reality, it is indeed impossible to ascertain each file’s validity of documents in such manner. Yet, the firm should try its best to minimize such kind of fraud.

- Verification of origin of Yarn and Fabric is not ensured

One of the basic requirements of receiving Cash Incentive is that the yarn or fabric acquired by the Applicant to produce RMG must be acquired through local suppliers. Quite often, to meet the quality standard requirements provided by foreign Buyers, Applicants often use foreign yarn and fabric, replicate the Certificate of Origin and Beneficiary Certificate of local yarn and fabric suppliers and apply for Cash Assistance.

Now, we make Factory visits to make certain that the machineries and working labors are capable of producing the export volume that the Applicant’s file exhibits. Yet, we do not visit the yarn and fabric suppliers to determine whether the Applicant really acquired the materials from them or not. As this is one of the crucial prerequisite of receiving Cash Incentive, we should go in depth to verify the origin of these raw materials.

RECOMMENDATIONS

The audit conducted in Cash incentive audits is not a complete authentication by far. There are numerous loopholes in the system through which copious amount of Clients gets away with fraudulency. As an audit firm and having the authority to provide as valid an opinion as possible, we, along with Bangladesh Bank and other regulatory bodies, must work together to fill up any such gaps.

On my behalf, I would like to propose a few solutions according to my point of view that, I believe, would settle the complications that I faced and observed during my time here (as mentioned in the previous chapter). The recommendations are explained below –

- Audit delay can be contained by assigning more manpower to the Cash Incentive department and allocating fewer Bank branches to each team. In this way, each team can work under lesser pressure and instead focus on the quality of their audit rather than quantity of files. That is, Auditors can concentrate more on determining fraud and verifying the documents rather than working in a rush to meet up deadlines and skipping the basic checking and reviewing procedures.

- Audit delay can also be contained by allocating Negotiating Bank more responsibility. A major amount of time squanders away just to find out missing documents, creating a query for those, mailing the list and waiting for the Clients to meet up the query. Before accepting any Incentive files, if the Bank goes through the files and ensures that all the required documents are provided, we can easily reduce the time gap.

- Trainings and seminars should be arranged for Auditors of Cash Incentive to teach us formally how to identify manipulation of original documents such as BTMA/BGMEA/BKMEA certificates, Utilization Declaration (UD), EXP forms and so on.

- Factory visits are usually conducted by a team of two consisting one senior and one junior Auditor. However, this is a very sensitive concern and vast swindling actions are caught here where Applicants demonstrated other’s factory as their own and provide manipulated ownership and other documents. Hence, factory visits should be accompanied by Experts and also verifying origin of Yarn and Fabrics should be made a part of Factory visit.

- Exporters’ bank should not be given the autonomy power for the whole thing because bank always wants to hold on to its existing clients and for this they often attest all the documents of the Client without checking its legality. With the collaboration of banks exporter can go for malpractice.

CONCLUDING REMARKS

In this report, I have tried my level best to wrap up all of the aspects audit procedure as followed by ACNABIN Chartered Accountants in offering service to its Clients. After scrutinizing the regulations and policies prerequisite by the Bangladesh Bank as per the BRPD Circular and other regulatory authorities, I came to believe that ACNABIN Chartered Accountants are executing the audit in an outstanding manner. Although there are certain drawbacks as mentioned in the previous chapters, yet comparing to other Audit firms and ACNABIN’s work load, they are indeed giving out an exemplary service.

Thanks to their seamless internal control, disciplinary policies and strong chain of command, the Auditors of ACNABIN are seldom involved in any form of double-deal or swindling with the clients. Their impeccable quality and strong and uncompromising ethical-moral stand of has earned them a brand reputation in the market. Now, only by Affiliating with a foreign International regulatory body and Audit firm, ACNABIN can gain unbeatable competitive advantage.

In the precedent times, we have seen a boom in the RMG sector of Bangladesh. The aggregate number of textile and spinning mills has increased in the last decade. All these are, to a great degree, consequences of Cash Assistance given in the RMG sector of Bangladesh. So, backward linkage of RMG Sector has been reinforced by the Cash Assistance. Hence, we can conclude by saying that indeed Cash Incentive is a reasonable as well as a rewarding project of the GOB in order to promote the export of RMG using local raw materials. We can say that in the forthcoming days of quota-free world, cash incentive will act as a catalyst to the survival of the RMG sector of Bangladesh in the global market. The correlation coefficient between cash incentive and export of RMG is highly positive representing that cash incentive is fetching in huge foreign currencies for Bangladesh. So, while cash incentive is required to amplify the inflow of foreign currencies into the country, Independent Cash Incentive Audit is also required to save public money. In the absence of independent audit of cash incentive files, deserving exporters will be deprived of cash incentive while false exporters will enjoy the misuse benefits of cash incentive.