A joint venture is a form of business organization that is temporary in nature. It is a business formed by two or more than two persons for a limited period and a specific purpose. The partnership business is undertaken either by all the partners or by one partner acting on behalf of all the partners. It is a business arrangement where two or more persons agree to carry on business and have a mutual share in the profits and losses, is known as Partnership.

Example – Sony Ericsson is a joint venture to make mobile phones where Sony is a Japanese electronics company, and Ericsson is a Swedish telecommunication company.

Difference between the Joint Venture and Partnership – The differences between a joint venture and partnership are stated below:

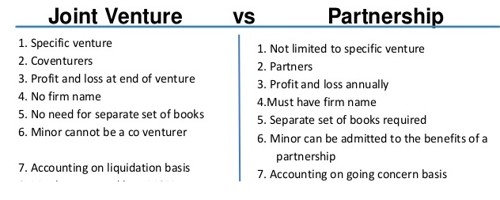

(1) Parties

- Joint venture: The participant in the joint venture is known as co-ventures. It is a type of business arrangement which is formed for accomplishing a particular project.

- Partnership: The participant in partnership is known as partners.

(2) Nature

- Joint venture: It is temporary in nature and is terminated as soon as the venture is completed. It is formed for a short duration, and that is why the going concern concept does not apply to it.

- Partnership: It is a going concern business. The agreement between two or more than two persons for carrying business and sharing the profits thereof is known as the Partnership.

(3) Name

- Joint venture: It does not need any single name to carry on the activity.

- Partnership: It always bears a first name. In Partnership, there is a specific trade name

(4) Profit

- Joint venture: Profits are ascertained after the completion of each venture.

- Partnership: Profits are ascertained annually.

(5) Basis of Account

- Joint venture: Cash basis account is followed. There is no specific requirement to maintain books of accounts,

- Partnership: Accrual basis of account is followed. In partnership the maintenance of books of accounts is compulsory.