The debtor’s turnover ratio, also known as the accounts receivable turnover ratio, is an accounting metric that assesses a company’s ability to offer credit and collect debts. It’s a metric that determines how effectively a corporation collects income and, as a result, how effectively it uses its assets. This ratio estimates how well an organization utilizes and deals with the credit it reaches out to clients and how rapidly that transient obligation is gathered or is paid. A firm that is productive at gathering on its installments due will have a higher records receivable turnover ratio.

This ratio represents the number of times a company’s average accounts receivable is collected during a certain period. Each time a corporation collects its average receivables, it is referred to as a turn. On the off chance that an organization had $20,000 of normal receivables during the year and gathered $40,000 of receivables during the year, the organization would have turned its records receivable twice since it gathered double the measure of normal receivables.

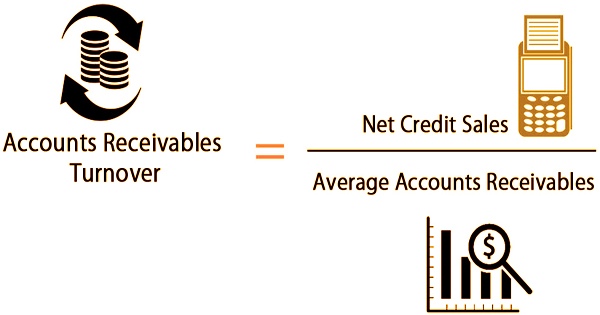

The ratio is used to assess a company’s capacity to efficiently extend credit to consumers and recover cash from them on schedule. Comparing a company’s ratio to that of its counterparts in the same industry might help determine whether it is competitive. The accounts receivable turnover ratio formula is as follows:

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

Where:

Net credit sales are sales where the cash is collected at a later date. The formula for net credit sales is = Sales on credit – Sales returns – Sales allowances.

Average accounts receivable is the sum of starting and ending accounts receivable over a time period (such as monthly or quarterly), divided by 2.

This ratio indicates how well a corporation collects credit sales from customers. Some organizations collect receivables from consumers in as little as 90 days, while others take up to 6 months. A high turnover ratio demonstrates a mix of a moderate credit strategy and a forceful assortments division, just as various top-notch clients. A low turnover ratio addresses a chance to gather exorbitantly old records receivable that are pointlessly tying up working capital.

The receivables turnover percentage of a corporation should be checked for any trends or patterns. A weak or nonexistent credit policy, an ineffective collections process, and/or a large proportion of clients in financial distress can all contribute to low receivable turnover. Organizations that keep up accounts receivables are by implication stretching out revenue free credits to their customers since records of sales is cash owed without revenue.

The receivables turnover ratio can also be considered as a liquidity ratio in some ways. The faster a company can convert its receivables into cash, the more liquid it is. If a corporation makes a transaction to a customer, it may offer 30 or 60-day terms, giving the customer 30 to 60 days to pay for the product. The records receivable turnover in days shows the normal number of days that it’s anything but a client to pay the organization for deals on layaway.

The formula for the accounts receivable turnover in days is as follows:

Receivable turnover in days = 365 / Receivable turnover ratio

Although not all organizations report cash and credit sales separately, net credit sales may normally be found on the company’s income statement for the year. The receivables turnover proportion estimates the productivity with which an organization gathers on its receivables or the credit it stretches out to clients. The proportion likewise gauges how frequently an organization’s receivables are changed over to trade out a period.

The ratio can be used to plot accounts receivable turnover on a graph to check if it’s slowing down; if it is, more money for the collections department, or at the very least a review of why turnover is worsening, may be required. An organization’s receivables turnover ratio ought to be checked and followed to decide whether a pattern or example is creating over the long haul. Additionally, organizations can track and relate the assortment of receivables to income to quantify the effect the organization’s credit rehearses have on benefit.

Because the receivables turnover ratio assesses a company’s capacity to collect receivables efficiently, it stands to reason that a greater ratio would be better. For financial backers, it’s critical to look at the records receivable turnover of numerous organizations inside a similar industry to get a feeling of the ordinary or normal turnover ratio for that area. It may be a safer investment if one company has a substantially greater receivables turnover ratio than the other.

A prospective acquiree’s accounts receivable turnover ratio can be employed in the study. When the ratio is too low, an acquirer may see it as an opportunity to use more aggressive credit and collection procedures, lowering the amount of working capital required to run the company. A high receivables turnover ratio can demonstrate that an organization’s assortment of records receivable is productive, and the organization has a high extent of value clients that pay their obligations rapidly.

Higher efficiency is also beneficial in terms of cash flow. If a corporation can receive cash from clients more quickly, it will be able to pay bills and other commitments more quickly. Then again, if an organization’s credit strategy is excessively traditionalist, it may drive away expected clients. These clients may then work with contenders who will expand them credit.

When employing the receivables turnover measurement, there are a few things to keep in mind:

- In the numerator, some organizations may utilize total sales rather than net credit sales. If the proportion of cash sales is large, this might lead to a false measurement, since the quantity of turnover will appear to be higher than it actually is.

- A high accounts receivable turnover number may suggest an overly stringent credit policy, in which the credit manager only allows credit sales to the most creditworthy clients while allowing competitors with more lenient credit policies to steal other sales.

- At the beginning and end of the story the receivable amounts are just for two dates within the measurement year, and the balances on those two dates may differ significantly from the average amount for the year. As a result, an alternative technique for calculating the average accounts receivable amount, such as the average ending balance for all 12 months of the year, is appropriate.

A low receivable turnover figure may not be the shortcoming of the credit and assortments staff by any stretch of the imagination. All things being equal, it is conceivable that blunders made in different pieces of the organization are forestalling installment. Customers may refuse to pay the corporation if the goods are damaged or the wrong goods are supplied, for example. As a result, the blame for a poor measurement result can be dispersed among a company’s several departments.

Accounts receivable turnover is also a good indicator of credit sales and receivables quality. Because of the time value of money, the longer it takes a firm to collect on its credit sales, the more money it effectively loses, or the less valuable the company’s sales become. As a result, a low or deteriorating accounts receivable turnover ratio is seen as a negative for a business. Credit sales from a company with a higher ratio are more likely to be collected than credit sales from a company with a lower ratio.

Information Sources: