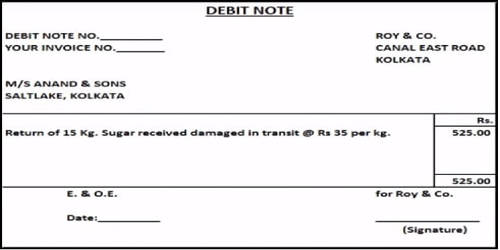

Debit Note is a document that reflects that a debit is made to the other party’s account. It is a statement sent by the seller to the buyer rectifying the invoice, which was wrongly cost i.e. the buyer was undercharged. It is sent to inform about the debit made in the account of the seller along with the reasons mentioned in it. The document provides information to the vendor that a debit has been made to his account in the buyer’s book. It is issued by the purchaser, at the time of returning the goods to the vendor. This is a document sent by a customer (your Company) to a supplier (your Supplier) when returning goods/items. It can provide information regarding an upcoming invoice or may serve as a reminder for funds currently due. They are generally used in business-to-business transactions.

The reasons for debiting the account are given as under:

- When the buyer’s account is overcharged, he sends a debit note to the seller.

- When the buyer returns the goods purchased by him, then also he delivers the debit note.

- When the buyer undercharges the seller’s account, then he issues a debit note.

Debit notes are separate from invoices in that they are generally formatted as letters, and they may not require immediate payment. When a Debit Note is made, the Company can either receive a payment from the Supplier or adjust the amount in another invoice. The intent is to notify the seller that they’ve been debited by the buyer against the goods returned. When a price is included on a debit note, it is the price that the customer was actually charged for those goods. In some cases, sellers are seen sending debit notes which should be treated as just another invoice. It is generally prepared like a regular invoice and shows a positive amount.

Characteristics –

- It is sent to inform about the debit made on the account of the seller along with the reasons mentioned in it.

- The purchase returns book is updated on its basis. (In case of return of goods)

- It is usually used by the buyer to return goods on credit.

- It is generally prepared like a regular invoice and shows a positive amount.