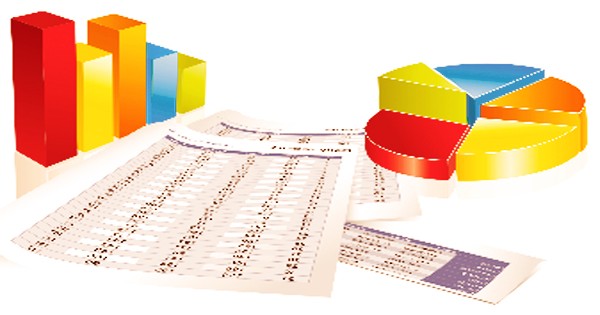

The quantitative assessment of the discrepancy between actual and planned behavior is known as variance analysis. The total of all deviations depicts the overall over-performance or under-performance for a certain reporting period. For every time, organizations survey their positivity by contrasting genuine expenses with standard expenses in the business. This examination is utilized to keep up power over a business. The essential target of change investigation is to practice cost control and cost decrease.

For instance, if the real expense is lower than the standard expense for crude materials, accepting similar volume of materials, it would prompt a good value difference (i.e., cost investment funds). Nonetheless, if the standard amount was 10,000 bits of material and 15,000 pieces were needed underway, this would be a troublesome amount fluctuation since a bigger number of materials were utilized than expected.

Through variance analysis, the management by exception principle is used within the standard costing method. The identification of diverse explanations for the difference in income and spending during a particular time from the budgeted standards is typical of variance analysis. The variances are linked to efficiency; when efficiency is demonstrated, favorable variance results. Variance analysis can be broken down into 2 steps:

- Calculating and recording individual variances

- Understanding the cause of each variance

The discrepancy between standards and actual performance numbers is referred to as “variance.” Variances are calculated and reported to management for both the price and quantity of materials, labor and variable overhead. Be that as it may, not all variances are significant. A variance is the deviation of real from standard or is the distinction among real and standard. The board should just focus on those that are strange or especially critical.

As a result, variance analysis can be defined as the division of total cost deviations into separate pieces in order to clearly identify or discover the reason of the variances and the people who are responsible for them. It features the reasons for the variety in pay and costs during a period contrasted with the spending plan. The board should just focus on those that are strange or especially critical. Companies can often utilize this information to identify a problem and rectify it, or just to improve overall company performance, by examining these deviations.

There are several problems with variance analysis that keep many companies from using it. They are:

- Time delay. At the end of each month, the accounting team compiles the variances before reporting the results to the management team. In a fast-paced setting, management requires feedback much more frequently than once a month, and hence relies on different data or warning flags created on the fly (especially in the production area).

- Variance source information. Because many of the causes of variations aren’t found in accounting records, accounting personnel must sift through data such as bills of materials, labor routings, and overtime records to find the root of the problem. Only when management can actively rectify problems based on this information is the extra work cost-effective.

- Standard setting. Variance analysis is basically a correlation of real outcomes to a subjective standard that may have been gotten from political bartering. Therefore, the subsequent variance may not yield any valuable data.

Before assessing variations, it is necessary to understand the different types of variations. The following is a general classification of variations.

- Material Cost Variance: It’s the gap between the real cost of materials and the typical cost of the finished product.

- Labor Cost Variance: It’s the difference between the actual direct wages paid and the direct labor costs allowed to accomplish the real production.

- Overhead Variance: The difference between the standard cost of overhead permitted for actual output (in terms of production units or labor hours) and the actual cost of overhead incurred is known as overhead variance.

- Controllable Variance: When an individual, a department, a section, or a division is held responsible for a deviation, it is controllable.

- Uncontrollable Variance: Uncontrollable variations are caused by external sources. The management has no influence over external circumstances or is unable to do so. Uncontrollable variations are those that cannot be traced back to a single person, department, area, or division.

- Favorable Variances: When real costs are lower than standard costs for a given level of activity, such variances are referred to as favorable variances. The management is concentrating on achieving genuine results at a lower cost than usual. It demonstrates the effectiveness of a company’s operations.

- Unfavorable Variances: When real expenses exceed standard costs at a preset level of activity, such deviations are referred to as unfavorable variances. These variations suggest inefficiencies in corporate operations and require more investigation.

- Basic Variances: Basic variances are those that develop as a result of monetary rates (e.g., raw material prices or labor rates) as well as non-monetary elements (such as physical units in quantity or time). Material price variance, labor rate variance, and expenditure variance are the three basic monetary variances. Material quantity variance, labor efficiency variance, and volume variance are all examples of basic variance caused by non-monetary factors.

- Sub Variance: Basic variances deriving from non-monetary elements are further studied and divided into sub-variances, with the causes that cause them taken into account. Material usage variance and material mix variance are examples of sub variations in material quantity variance.

The simplest method for computing variances is to use the column technique and input all necessary data. This method is best shown through the example below:

ABC Company produces gadgets. Overhead is applied to products based on direct labor hours. The denominator level of activity is 4,030 hours. The company’s standard cost card is below:

Direct materials: 6 pieces per gadget at $0.50 per piece

Direct labor: 1.3 hours per gadget at $8 per hour

Variable manufacturing overhead: 1.3 hours per gadget at $4 per hour

Fixed manufacturing overhead: 1.3 hours per gadget at $6 per hour

During January, the company produced 3,000 gadgets. The fixed overhead expense budget was $24,180. Actual costs in January were as follows:

Direct materials: 25,000 pieces purchased at the cost of $0.48 per piece

Direct labor: 4,000 hours were worked at the cost of $36,000

Variable manufacturing overhead: Actual cost was $17,000

Fixed manufacturing overhead: Actual cost was $25,000

The use of variance analysis in an organization’s information system is critical. The following are some of the functions of variance analysis:

- Planning, Standards and Benchmarks: To compute variances, benchmarks and financial targets must be established ahead of time against which the organization’s performance may be measured. As a result, it emphasizes foresight and a proactive approach to setting performance goals.

- Control Mechanism: By revealing departures from standards that are influencing an organization’s financial performance, variance analysis promotes “management by exception.” Such exceptions may ‘slip through’ if variance analysis is not undertaken on a regular basis, causing a delay in management action that is required in the circumstances.

- Responsibility Accounting: At the level of responsibility centers, variance analysis makes performance monitoring and control easier. For example, in the event of a significant increase in the purchase cost of raw materials, the procurement department will be held accountable, whereas the production department will be held accountable in the event of an increase in raw material usage. As a result, each responsibility center’s performance is tested and assessed against budgetary standards in just those areas over which they have direct authority.

Many businesses prefer to explore and evaluate their financial findings using horizontal analysis rather than variance analysis. The results of various periods are shown side by side in this method, making it easy to spot trends.

Information Sources: