Businesses use two types of costing methods: variable costing and full costing. Variable costing, also referred to as marginal costing, is primarily used for internal reporting. Full costing, also known as absorption costing, is used primarily for external reports.

Through an analysis of the cost-volume-profit relationship, management can determine a contribution limit that is useful for determining the planned profit and making short-term policy decisions. Management benefits from the ease of monitoring operational status, making assessments, and reporting to other departments within the company.

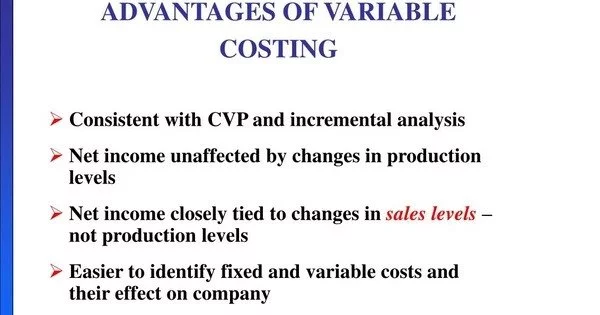

Companies require absorption costing to prepare financial statements for external parties, as well as variable costing for better management. Both costing methods have advantages and disadvantages. The following are the primary benefits of a variable costing system:

Advantages

- Operations planning

Due to the income statement’s inclusion of total fixed costs for the period, variable costing makes it easier to understand how fixed costs affect net profits. In order to make daily decisions about special orders, capacity expansion, and production shutdown, it gives management the information on variable costs and contribution margins they need.

- CVO analysis

The standard costing system and flexible budgets, among other cost-control strategies, are closely related to the variable costing system. When using the c-v-p analysis, income statements for variable costing show gross contribution margin, contribution margin, and total fixed cost. The use of those techniques is made simple by understanding the variable costing system.

- Product costs

Companies that use a variable costing system prepare income statements in contribution margin format, which provides the information needed for cost volume profit (CVP) analysis. A custom order’s selling price includes the variable cost of production. This information cannot be obtained directly from a traditional income statement prepared using the absorption costing system. As a result, variable costing can provide data on variable production costs quickly.

- Management decisions

Using variable costing income statements, management can better understand the impact of period costs on profits. Variable cost income statements allow management to see and understand the impact of period costs on profits, allowing for better decision-making.

- Management control

Variable costing reports are far more effective for management control than absorption costing reports because profit goals link with variable costing reports and can identify organizational responsibility. The reports based on variable costing are far more effective for management control than those based on absorption costing because; (a) Variable costing reports are related to profit objectives, (b) It can pinpoint responsibility according to organizational lines.

- Budgeting

To simplify cost control, the manufacturer only considers variable manufacturing costs. Variable costing produces net operating income that is typically close to cash flow. It is beneficial to businesses that are experiencing cash flow issues.

- Profit change

Sales have an impact on variable costing net income. The income of different periods changes with the change of inventory levels in the absorption costing system. As a result, it is clear how much additional profit the manufacturer will earn from increased sales. Income and sales can sometimes move in opposite directions. However, this does not occur with variable costing.