The term “net operating income (NOI)” is widely used in real estate accounting to refer to the methodology for calculating a commercial property’s profitability. The net operating income (NOI) is calculated by subtracting all revenue from the property from all reasonably necessary operating expenditures. When making an investment decision, it aids investors in determining the property’s profitability. In any case, the estimation of the NOI avoids costs identifying with charges, deterioration, amortization, and other capital consumptions. All in all, it estimates the measure of incomes that a property has after all vital costs have been paid.

The NOI aims to isolate real estate assets’ fundamental operational income, avoiding non-operating elements like corporate overhead and substantial non-cash factors like depreciation from the equation. NOI is a preceding duty figure, showing up on a property’s pay and income proclamation, that avoids head and interest installments on advances, capital consumptions, deterioration, and amortization. More significant than what costs factor into NOI are the costs that don’t affect NOI.

All available revenue streams from the property are included in the overall revenue earned. The main source of income for real estate properties is the rent. Parking fees, vending machines, laundry machines, and other on-site services, on the other hand, might provide additional revenue. The working costs utilized in the NOI metric can be controlled if a land owner concedes or speeds up certain pay or cost things.

The formula for calculating net operating income (NOI) is to remove operating expenses from total revenues of a property.

Net Operating Income (NOI) = Gross Income – Operating Expenses

Gross income refers to the entirety of the pay produced by the property less the expense of merchandise sold. Working costs are just the costs expected to work the property. The working costs in the NOI equation comprise of all fundamental costs related with the income-creating exercises. To put it another way, they are all of the costs associated with maintaining the property and operating the rental business. Here are a few examples:

- Property management fees

- Insurance

- Utilities

- Property taxes

- Repairs and maintenance

The property’s operational expenses must be reduced from the income a property generates in order to compute NOI. It aids real estate investors in distinguishing between a good investment opportunity and one that is otherwise unprofitable. Most land organizations including REITs (Real Estate Investment Trust) just as land private value firms will claim various land properties so recognizing NOI is basic for disconnecting property-level productivity. A property’s amenities, such as parking structures, vending machines, and laundry facilities, may provide cash in addition to rental income.

The net operating income is the difference between the money earned by the property’s daily activities and the operating expenditure. It will also enable a business to examine the present financial health of its existing properties. This might be useful to decide how financial backers can more readily improve the incomes of business resources or which property would be an awesome sell. For financed properties, NOI is additionally utilized in the debt coverage ratio (DCR), which tells loan specialists and financial backers whether a property’s pay covers its working costs and obligation installments.

When it comes to interpreting the results of calculating a property’s net operating income, there are only two options: excellent or negative. Additional earnings from investments outside the property are not included in the total revenue. The total operating expenses avoid extra costs outside the normal running of the property, for example, charges, interest paid to agents, and other capital uses. NOI is likewise used to figure the overall gain multiplier, cash profit from the venture, and absolute profit from speculation.

Do not include income tax when computing net operating income (NOI). Subtract operational expenses from the revenue generated by a property to compute NOI. Rental income, parking fees, service modifications, vending machines, and washing machines are all examples of real estate revenue. Then again, net income is the last figure got after all costs are deducted from the all-out income.

All operating income, investment income, interest from loans given, and other sources of revenue are included in total revenue. Capital expenditure, taxes, and all operating expenses are all deducted. There’s much more that goes into assessing whether an investment property merits putting resources into than this computation, yet this condition gives us great knowledge into the incomes of the properties.

A cap rate (Capitalization rate) is used in conjunction with NOI to determine the value of a property. It aids the investor in more correctly assessing a valuation than traditional methods. Creditors and commercial lenders rely on NOI far more than they do on an investor’s credit history when determining the income generating potential of a property to be mortgaged.

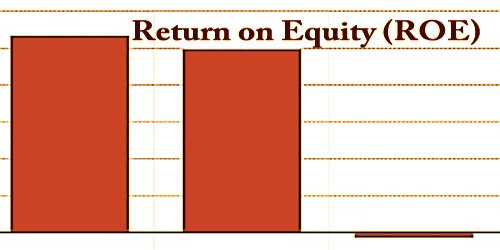

Maximizing the net operating income means an increment in productivity, which is the essential objective of the business. In the event that a property is considered beneficial, the moneylenders additionally utilize this figure to decide the size of the advance they’re willing to make. If the property, on the other hand, shows a net operational loss, lenders are more likely to turn down the borrower’s mortgage application outright. Because NOI is used to determine a company’s financial health, the higher the number, the better. It also aids in the identification of possible business tendencies throughout time.

Landowners can control their working costs by conceding certain costs while speeding up others. To augment the NOI, the proprietors should cut costs, decrease opening, and increment rental rates. The running expenses on the property are subtracted from all revenue generated by the property in this calculation. A property is more profitable if its revenues are higher and its expenses are lower.

Information Sources: