In finance, convertible debt is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value. It is when a company borrows money from an investor or a group of investors and the intention of both the investors and the company is to convert the debt to equity at some later date. It is a hybrid security with debt- and equity-like features. Typically the way the debt will be converted into equity is specified at the time the loan is made. It originated in the mid-19th century and was used by early speculators such as Jacob Little and Daniel Drew to counter market cornering.

Convertible debt is a form of short-term debt that converts into equity, typically in conjunction with a future financing round; in effect, the investor would be loaning money to a startup and instead of a return in the form of principal plus interest, the investor would receive equity in the company. It offers investors a type of hybrid security that has features of a bond, such as interest payments, while also having the option to own the underlying stock.

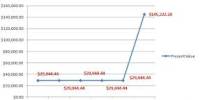

Convertible debts are most often issued by companies with a low credit rating and high growth potential. There are a number of reasons why the investors and/or the company would prefer to issue debt instead of equity and convert the debt to equity at a later date. Convertible debts are also considered debt security because the companies agree to give fixed or floating interest rates as they do in common bonds for the funds of investors. If the company believes its equity will be worth more at a later date, then it will dilute less by issuing debt and converting it later. To compensate for having additional value through the option to convert the bond to stock, a convertible bond typically has a coupon rate lower than that of similar, non-convertible debt. It is also true that the transaction costs, mostly legal fees, are usually less when issuing debt vs equity.

For investors, the preference for debt vs equity is less clear. The investor receives the potential upside of conversion into equity while protecting downside with cash flow from the coupon payments and the return of principal upon maturity. Sometimes investors are so eager to get the opportunity to invest in a company that they will put their money into a convertible note and let the next round investors set the price. These properties—and the fact that convertible bonds trade often below fair value—lead naturally to the idea of convertible arbitrage, where a long position in the convertible bond is balanced by a short position in the underlying equity. Finally, debt is senior to equity in liquidation so there is some additional security in taking a debt position in a company vs an equity position.