The DEMA (double exponential moving average) is a technical metric that is superior to the EMA (exponential moving average) in that it gives more weight to recent data points. Patrick G. Mulloy first mentioned it in an article in the “Technical Analysis of Stocks & Commodities” magazine in January 1994, titled “Smoothing Data with Faster Moving Averages.” The aim is to reduce the amount of noise present in technical traders’ price charts.

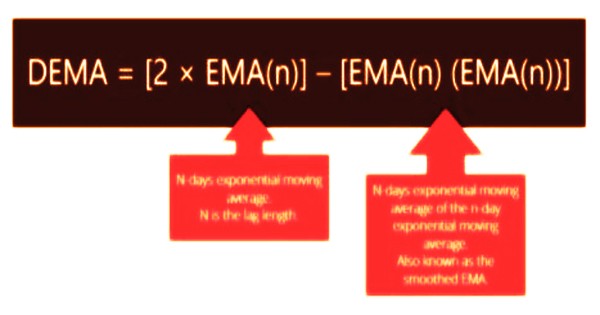

The Double Exponential Moving Average (DEMA) is a combination of smoothed exponential moving averages (EMA) and a basic EMA. The combination reduces the lag in the combined DEMA. DEMA can be represented as:

It endeavors to eliminate the natural slack related with Moving Averages by setting more weight on ongoing qualities. The name recommends this is accomplished by applying a twofold dramatic smoothing which isn’t the situation. DEMA gets its name from the fact that it uses an EMA of the EMA rather than 2*EMA. A common measure known as triple EMA, which uses the EMA of the EMA of the EMA, is also popular.

The DEMA is utilized along these lines to customary moving averages (MA). The normal affirms upswings when the cost is over the normal, and affirms downtrends when the cost is beneath the normal. When the price reaches the average, it could indicate a pattern change. Moving averages are often used to show where support and resistance are located. Due to the use of EMA in the calculation, DEMA requires 2 × period – 1 samples to begin generating values, as opposed to the period samples needed by a standard EMA.

Calculating the Double Exponential Moving Average (DEMA):

- Choose any lookback period, such as five periods, 15 periods, or 100 periods.

- Calculate the EMA for that period, this is EMA(n).

- Apply an EMA to EMA(n) with the same lookback period; this produces a smoothed EMA.

- Multiply two times the EMA(n) and subtract the smoothed EMA.

- The DEMA is used similarly to simple or exponential moving averages. They can be used in:

Trend Analysis: The use of historical asset price movement to forecast future movement is known as trend analysis. For technical research, the DEMA is an effective trend indicator. The DEMA’s trajectory indicates the way asset prices are likely to shift in the future. Rising DEMA means a likely rising cost, though falling DEMA implies a plausible resource value fall.

A value point of a resource over the DEMA is probably going to rise, and the value point beneath is probably going to fall. On the off chance that the resource value line moves over the DEMA, this demonstrates that the falling pattern in costs will turn around. Similarly, if the asset price line falls below the DEMA, the trend will be reversed, and prices will decline. Traders use the signals to determine whether to go long or short in order to benefit from directional trading strategies.

Support and Resistance: Another important use of exponential averages, such as DEMA, is to demonstrate stock price support and resistance levels. Support levels indicate that prices are unlikely to fall below, while resistance levels indicate where prices have little room to rise.

Albeit the marker is known as a Double Exponential Moving Average (DEMA), the condition doesn’t depend on utilizing a twofold remarkable smoothing factor. All things considered, the condition copies the EMA, however then counterbalances the slack by deducted a smoothed EMA. The simple moving average is the average of the asset prices over the previous n days. The exponential moving average gives the most recent observation more weight. The DEMA gives the most recent findings even more importance.

As demonstrated in the equation it lessens the load on the new qualities and by computing ema of the ema we are attempting to eliminate the load on the long more slow piece of the normal that has developed over the long run. It greatly speeds up decision-making compared to simple MA crossovers. Day traders and swing traders are more likely to use DEMAs than conventional MAs because they respond faster. Financial backers may likewise utilize them, however since some drawn out financial backers like to be less dynamic in the resources, they hold customary MAs may work better.

In conclusion, moving averages are a type of technical indicator. The more weight the most recent observation has, the more sensitive the moving average is to price shifts. Accessible on practically all the exchanging programming now, it is obviously superior to as it helps catch the pattern prior and settle on better choices as in assists one with improving section and leave focuses improving productivity. Traders primarily monitor price in relation to the DEMA to determine trend intensity and direction. It helps to confirm an uptrend when the price is above the DEMA and the DEMA is rising. A downtrend is confirmed when the price is below the DEMA and the DEMA is dropping.

Short-term traders prefer DEMA, whereas long-term investors prefer simple moving averages. When looking at a DEMA or some other moving average as possible support or resistance, make sure the MA (Moving Average) has previously provided support or resistance. If the MA hasn’t previously performed this role, it is unlikely to do so in the future.

Information Sources: