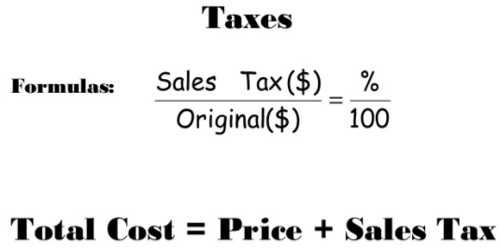

Total Price with Sales Tax

Many states and cities levy a sales tax on retail purchases. It is determined by finding a percentage of the purchase price. The percentage of tax called the tax rate varies between different cities and states.

If the sales tax is 6% and a $10.00 purchase is made, the sales tax is $10.00*6/100 or $0.60. The total sales price is $10.00+$0.60=$10.60.

In most cases, sales tax is charged after the total of items purchased is calculated. The sales tax percentage will be applied to the cost of everything a customer purchases. For example, if your local sales tax rate is 7.0 percent and a customer buys $100 worth of items, 7.0 percent on $100 is $7.00. The customer will be charged $107.00 for her purchases. The sales tax is usually printed last on the receipt or sales invoice.

Calculating sales tax at the time of purchase:

In order to calculate the sales tax of an item, we need to first multiply the pre-tax cost of the item by the sales tax percentage after it has been converted into a decimal. Once the sales tax has been calculated it needs to be added to the pre-tax value in order to find the total cost of the item. Let’s start by working with an example. If a magazine costs $ 2.35 and has a 6% sales tax, then what is the total cost of the item. First, we need to convert the sales tax percentage into a decimal by moving the point two spaces to the left.

6% → 0.06

Now, we need to multiply the pre-tax cost of this item by this value in order to calculate the sales tax cost.

Sales tax = 0.06 x $ 2.35

Sales tax = $0.141 Round to two decimal places since our total is in dollars and cents.

Sales tax = $0.14

Last, add this value to the pre-tax value of the item to find the total cost.

Total cost = Pre-tax value + Sales tax

Total cost = $2.35 + $0.14

Total cost = $2.49

Information Source;