Total costs that vary in direct proportion to changes in productive output or activity are referred to as variable costs. Direct materials, direct labor, and sales commissions are examples of common variable costs. Variable costing system is a costing method that includes only variable manufacturing costs as inventoriable costs. All fixed manufacturing costs are excluded from inventoriable costs.

Variable costing is an essential component of management decision-making. These costs are more important and necessitate direct management involvement because they are fixed and irreversible. It makes comparisons of profitability of different business units more meaningful because it focuses on variable cost factors and aids in overcoming problems related to the allocation of fixed costs, which can be difficult to divide at times.

The main characteristics or features of the variable costing system can be expressed as follows:

(1) Cost Differentiation

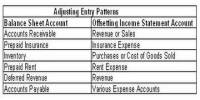

Variable costing separates manufacturing overheads into fixed and variable costs. Variable costs are considered product costs, while fixed costs are considered period costs. Variable costing is simple to calculate because all costs are easily identifiable.

(2) No Difference in Unit Cost

Variable costing does not show differences in the average unit cost of production as output varies. Variable costing can be attributed to units produced, and there is a linear relationship between production increase and variable costing.

(3) Decrease in Cost Of Production

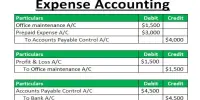

Unit cost of production decreases with an increase in output. Here, fixed factory overhead is regarded as a period cost and is charged against revenue in the period it is incurred, Since fixed factory overhead is not included in the cost of production, the cost of inventory is lower as compared with absorption costing.

(4) Cost Separation

Separate of mixed costs into fixed and variable proportions. Under variable costing, all costs are bifurcated into Fixed and Variable and only variable costs are accounted for.

(5) Decision Making

Variable costing aids decision-making by providing necessary information and data. It gives management information about cost behavior and how it affects profitability.

Even if there is no production, fixed costs such as rent, depreciation, and salaries are incurred. As a result, they are not considered product costs but rather period costs. As a result, fixed costs are treated as period expenses. They are not transferable to the following period and thus are not included in inventories.