Auditing has become a compulsory task in the business organization. It is an important process for the company itself, the government, the investors, creditors, shareholders, etc. All the organizations like business, social, industries and trading organizations make an audit of books of accounts. Nowadays, the owner of a business and its management are separate. So, to detect and prevent frauds, auditing has become essential.

Advantages of Audit – Its advantages are as follows:

- An audit helps to Detect and Prevent Errors and Frauds

An error is something that is done without the intention to fraud the company. Fraud, on the other hand, is deliberate. An auditor’s main duty is to detect errors and frauds, preventing such errors and frauds and taking care to avoid such frauds. Thus, even though all organizations do not have a compulsion to audit, they make an audit of all the books of accounts.

- Helps to maintain Account Regularly

An auditor raises questions if accounts are not maintained properly. So, the audit gives moral pressure on maintaining accounts regularly. It determines the value of the business to claim for the other networks.

- Helps to get Compensation

If there is any loss in the property or business, the insurance company provides compensation on the basis of audited statements of valuation that made me the auditor. So, it helps to get compensation. It is very helpful for up-to-date accounting.

- Helps to Obtain Loan

Specially financial institutions provide loans on the basis of audited statements. The reputation of borrowers increases due to auditing. A business organization may obtain loans considering the audited statement of the last five years. So, an organization should make audits compulsory to obtain a loan. Thus audited accounts help the businessman to expand his activities.

- Facilitates the Sale of Business

The valuation of assets is made by the auditor. On the basis of the valuation of assets and liabilities, a businessman can sell his business. It helps to determine the price of the business.

- Increase Goodwill

An audit helps to increase the goodwill of the firm. It also helps to increase public image.

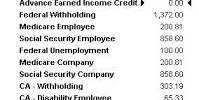

- Helps to Assess Tax

It is the process of calculating one’s property. Tax authorities assess taxes on the basis of profit calculated by the auditor. In the same way, sales tax authority calculates sales tax on the basis of sales shown in the audited statement. It has a specialization in the preview logics that specifically modify for the sake of insurance.

- Facilitates to Compare

An auditor instructs an accountant in the same way which helps to compare books of accounts of the current year with the accounting of the previous year. So, comparing the accounts of current with previous years helps to detect errors and frauds. On the basis of the review, weaknesses are found out and policies for the future period can be determined.

- Helps to Present a Proof

During the audit, one may collect the details from the person to ensure that every property has a legal proof. If any case is filed against the auditor regarding negligence, an auditor can present an audited report as proof to settle such a case. So, it helps to present proof to settle such cases. It helps in increasing the goodwill that might keep track of the collected data.

- Provides Information about Profit or Loss

Audited accounts are relied upon for the purpose of decision-making by the management. A businessman wants to know the profit or loss of his business after a certain period of time. So, the owner of the business can get information about profit or loss after auditing the books of accounts.

Information Source: