The audit note book is usually a bound note book in which a large variety of matters observed during the course of an audit are recorded. It is a complete record of doubts and their clarification. It helps the auditor in his subsequent audits.

Contents of Audit Note Book

The audit notebook contains information about the nature of the business. It may relate to manufacturing, trading, financial or services. Generally, the following information is incorporated into the audit note book:

(1) The name of the client and the audit year.

(2) A list of the account books normally used and maintained.

(3) Names of principal officers, their duties and responsibilities.

(4) Particulars of the accounting and financial system followed and the internal check-in operation in the business.

(5) Details regarding accounting and financial policies followed in the business. Nature of business carried on and important documents relating to the constitution of business like Memorandum of Association, Articles of Association, Partnership deed, etc.

(6) A copy of the audit program.

(7) Details of errors and frauds discovered during the course of the audit.

(8) Details of all important information to be used as a reference for future audits.

(9) Date of commencement and completion of the audit.

(10) Information on permanent nature relating to the business and notes of all important technical transactions.

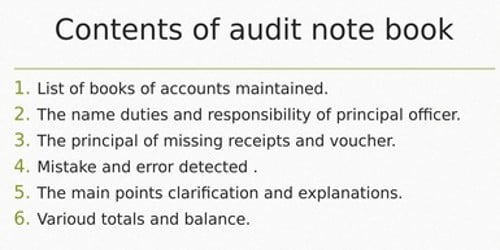

Special Matters to be recorded in the Audit Note Book –

1. Routine queries not cleared, i.e., missing receipts and vouchers, etc.

2. Details of mistakes and errors discovered.

3. The points raised during the course of an audit, to which the attention of the auditor must be drawn, i.e. failure of the company to comply with the provisions of the Companies Act or of the Memorandum of Association and other legal requirements.

4. Extracts from minutes books and contracts and other correspondence with various government agencies, financial institutions, debtors, creditors, etc.

5. The points to be incorporated into the audit report.

6. The points which need further explanation and clarification e.g., a change in the basis of valuation of finished stocks or in the computation of depreciation, etc.

7. Date of commencement and completion of the audit.

Information Source: