The average accounts receivable figure is required in certain situations to avoid measurement problems. An enterprise typically includes its ending accounts receivable balance in a variety of reports, but there are situations in which often this yields improper results.

The problems with using the stopping accounts receivable sense of balance include:

- The last day of the month tends to be the day with the highest accounts receivable sense of balance.

- The accounts receivable balance are different massively by 30 days, since sales may be seasonal.

- If you might be reporting accounts receivable only on an annual basis, then the just date used stands out as the year-end figure; since many companies structure his or her fiscal years to correspond with their lowest business amounts, this means that the year-end accounts receivable balance may be well toward the low end of what a company actually experiences during a year.

- A single account receivable amount on a particular day may be inordinately high or low, just because a single large invoice may have been paid too early or too late.

Given these concerns, it makes sense as an alternative calculate an average accounts receivable balance.

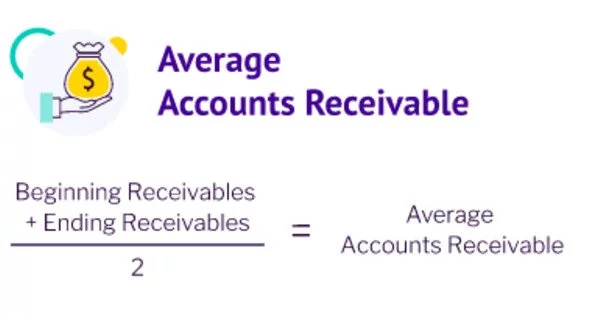

Average accounts receivable is the average amount of trade receivables on hand during a reporting period. It is a key part of the calculation of receivables turnover, for which the calculation is as follows:

Average accounts receivable ÷ (Annual credit sales ÷ 365 Days)

The method used to calculate it can have a profound impact on the resulting calculation of the average collection period.

When you calculate an average accounts receivable stability, it is easiest to utilize the month-end balance for each and every month measured, due to the fact this information is definitely recorded in the total amount sheet, and so is definitely available in the particular accounting records. As just noted, consequently the average amount could possibly be somewhat high. Nevertheless, it is the most accessible information, especially should you be compiling information via previous months or years the location where the receivable balance pertaining to other dates on the month simply just isn’t available.

If you do have a strongly seasonal business, the best means for calculating average accounts receivable is to average the stopping accounts receivable balance for any month of the past 12 months, thereby incorporating the full effects of seasonality in the calculation. Please note that this is the trailing one year calculation, so you in most cases be including the particular receivable balance via at least a few months in the previous fiscal year.

When you have a rapidly expanding business, then using the standard receivable balance going back one year will understate the quantity of receivables to be anticipated on a go-forward basis. Conversely, the average receivable reported for just a declining business can be overstated. In these kinds of cases, it can be more accurate in order to average the balances receivable over just 3 months.

When should you make use of the average balances receivable calculation? Lenders should know, so they can estimate an regular possible funding requirement. It may also be useful for the general opinion of budgeted operating capital levels. On the other hand, you should not apply it when conducting cash flow planning, since day-to-day variations in the actual receivable level may be very different from the actual long-term average. Additionally, always show the prospective lender your current estimated accounts receivable level in every period over that lending may occur, so the loan company can determine the best maximum funding degree – presenting a typical balance is not helpful with this situation.