The word receivable refers to the payment not being realized. Accounts receivable are legally enforceable claims for payment held by a business for goods supplied and/or services rendered that customers/clients have ordered but not paid for. This means that the company must have extended a credit line to its customers. They are the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. These are generally in the form of invoices raised by a business and delivered to the customer for payment within an agreed time frame. They are created when a company lets a buyer purchase their goods or services on credit. These are goods and services delivered by a business on credit to their customer with an understanding that payment will come at a later date.

Accounts receivable is an asset account on the balance sheet that represents money due to a company in the short-term. It is shown in a balance sheet as an asset. It is one of a series of accounting transactions dealing with the billing of a customer for goods and services that the customer has ordered. The unpaid balance in this account is reported as part of the current assets listed on the company’s balance sheet. These may be distinguished from notes receivable, which are debts created through formal legal instruments called promissory notes.

Overview

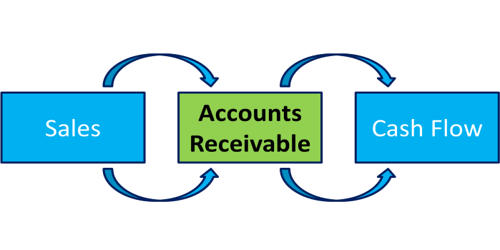

Accounts receivable is an important aspect of a businesses’ fundamental analysis. It represents money owed by entities to the firm on the sale of products or services on credit. The term refers to accounts a business has the right to receive because of goods and services delivered. In most business entities, accounts receivable is typically executed by generating an invoice and either mailing or electronically delivering it to the customer, who, in turn, must pay it within an established timeframe, called credit terms or payment terms. Receivables represent an extended line of credit from a company to client that requires payments due in a relatively short time period, ranging from a few days to a fiscal year.

- The sales a business has made.

- The amount of money received for goods or services.

- The amount of money owed at the end of each month varies (debtors).

The accounts receivable team is in charge of receiving funds on behalf of a company and applying it towards their current pending balances. The amount of account receivable depends on the line of credit which the customer enjoys from the company. Collections and cashiering teams are part of the accounts receivable department. Usually, this is offered to customers who are frequent buyers. While the collections department seeks the debtor, the cashiering team applies the monies received.