The unlevered cost of capital is the inferred pace of return an organization hopes to acquire on its resources, without the impact of obligation. It is an assessment utilizing either a theoretical or genuine obligation-free situation to gauge an organization’s expense to actualize a specific capital venture. Even, without the impact of debt, the expense of undertaking a capital project by a corporation is calculated. It is an approximation of equity returns without any debt as investors use the unlevered cost of capital. Unlevered cost of capital is a minor departure from the expense of capital estimation. Speculators may likewise utilize the unlevered cost of the capital strategy to decide whether the organization is a sound venture.

However, in the real world, investors do not directly offer companies this number. Instead, with a theoretical formula, the unlevered cost of capital is estimated to provide an estimate of what the market likely needs. The weighted average cost of capital (WACC) accepts the organization’s present capital structure is utilized for the investigation, while the unlevered cost of capital expects the organization is 100% value financed. Capital projects and expenditures with an unlevered capital cost are usually cost-effective, as the leveraged capital cost is not costly.

A speculative estimation is performed to decide the necessary pace of profit for all-value capital. This mathematical figure or capital is the value restores a speculator anticipates that the organization should produce to legitimize the venture, given its danger profile. Investors calculate the strength of a company’s investment by using the unleveraged cost of capital and equity returns they are expected to earn when they invest in the company. The correlation of higher rates with leveraged cost programs is attributed to the issuance of debt or preferred equity. Some peripheral expenses of turned activities incorporate endorsing costs, financier charges, and profit and coupon installments.

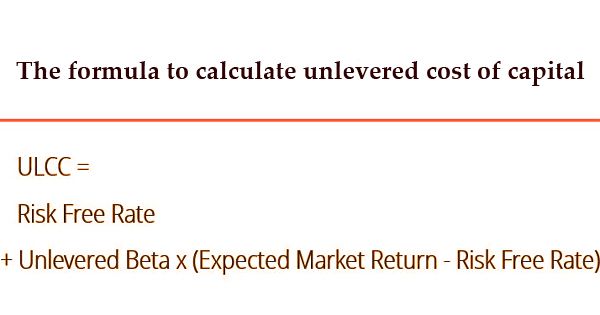

The formula for calculating the unleveraged capital cost of a company takes into account the risk-free yield rate of the market and the risk premium paid to invest in that company. Using a formula, the theoretical cost is calculated; this provides an estimate of the possible market demand. Some peripheral expenses of turned activities incorporate endorsing costs, financier charges, and profit and coupon installments. This offers an implicit rate of return, which allows investors to make informed choices about whether to invest. The following information is needed to measure the unleveraged capital cost of a business:

- Risk-free Rate of Return

- Unlevered beta

- Market Risk Premium

The market risk premium is determined by increasing the organization’s unlevered beta by the distinction in expected market returns and the danger-free pace of return. Beta is a proportion of a stock’s instability and subsequently hazard, throughout some stretch of time. Unlevered beta, by changing it based on the company’s tax rate, debt-to-equity ratio, and beta, excludes the impact of leverage from the company’s beta. As a criterion for calculating the soundness of the investment, this formula can be used.

Formula:

Unlevered Cost of Capital = Risk-free Rate + Unlevered Beta × (Expected Market Return – Risk Free Rate)

All in all, this formula theorizes that if investors view the stock as a higher risk, a business will have a higher unlevered capital cost. However, precisely how big, depending on external market conditions, can vary. Figuring the unlevered cost of capital accepts the organization has no obligation, whether or not it does or doesn’t in all actuality.

A business with low unlevered earnings can experience an investor downturn or investor rejection of investments. In leveraged cost projects and acquisitions, higher costs are generated due to debt issuance, but non-leveraged cost projects are assumed to be debt-free. The cost of minimal financing an undertaking without gathering any obligation is the unlevered cost of venture. Disregarding the obligation part and its expense is fundamental to ascertain the organization’s unlevered cost of capital, despite the fact that the organization may really have an obligation.

If the estimate results in an unleveraged capital cost of 10 percent and the return of the company drop below that level, then it might not be a wise investment. The real returns can be calculated by comparing the outcome to the current cost of business held debt. On the off chance that the unlevered cost of capital is discovered to be 10% and an organization has an obligation at an expense of simply 5% then its real expense of capital (WACC) will be lower than the 10% unlevered cost. This unlevered cost is still informative, but if the business fails to attain the 10% unlevered returns expected by investors in this market, investor capital can shift to alternative investments. This will lead to a decline in the stock price of the company.

Information Sources: