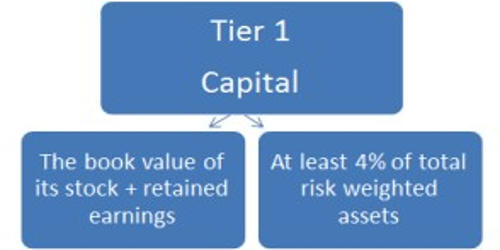

Tier 1 capital is the primary funding source of the bank. It is the core measure of a bank’s financial strength from a regulator’s point of view. It is a bank’s core capital and includes disclosed reserves—that appears on the bank’s financial statements—and equity capital. It is composed of core capital, which consists primarily of common stock and disclosed reserves (or retained earnings), but may also include non-redeemable non-cumulative preferred stock. This money is the funds a bank uses to function on a regular basis and forms the basis of a financial institution’s strength. The Basel Committee also observed that banks have used innovative instruments over the years to generate Tier 1 capital; these are subject to stringent conditions and are limited to a maximum of 15% of total Tier 1 capital. This part of the Tier 1 capital will be phased out during the implementation of Basel III. A bank’s total capital is calculated by adding its tier 1 and tier 2 capital together. Regulators use the capital ratio to determine and rank a bank’s capital adequacy. It’s the assets a bank holds in order to continue providing for the business needs of its customers.

Tier 1 capital consists of shareholders’ equity and retained earnings. Capital in this sense is related to, but different from, the accounting concept of shareholders’ equity. Tier 1 capital is essentially the most perfect form of a bank’s capital—the money the bank has stored to keep it functioning through all the risky transactions it performs, such as trading/investing and lending. Both Tier 1 and Tier 2 capital were first defined in the Basel I capital accord and remained substantially the same in the replacement Basel II accord. Tier 2 capital represents “supplementary capital” such as undisclosed reserves, revaluation reserves, general loan-loss reserves, hybrid (debt/equity) capital instruments, and subordinated debt. These funds are generated specifically to support banks when losses are absorbed so that regular business functions do not have to be shut down.

Under Basel III, the minimum tier 1 capital ratio is 10.5%, which is calculated by dividing the bank’s tier 1 capital by its total risk-weighted assets (RWA). RWA measures a bank’s exposure to credit risk from the loans it underwrites. Since banks typically provide capital for customers, this can include a substantial amount of risk. The capital held helps to ensure there is enough money to fulfill needs.

Tier 1 Capital is the core measure of a bank’s financial strength from a regulator’s point of view. Each country’s banking regulator, however, has some discretion over how different financial instruments may count in a capital calculation because the legal framework varies in different legal systems. Also, there are further requirements on sources of the tier 1 funds to ensure they are available when the bank needs to use them. Tier 1 capital includes common stock, retained earnings, and preferred stock. The amount of capital that is held shows the strength of that bank as a measure of financial preparedness in case of emergencies.