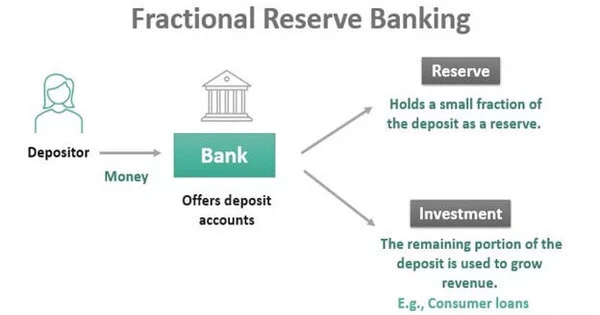

Fractional-reserve banking is a banking system in which banks hold only a fraction of their customers’ deposits as reserves and lend out the remainder. For example, if a bank has $100 in deposits, it might hold $10 as reserves and lend out the remaining $90. This practice allows banks to create new money by issuing loans and credit, which in turn stimulates economic growth.

Fractional-reserve banking is a banking system used in almost every country around the world in which banks that accept public deposits are required to hold a portion of their deposit liabilities in liquid assets as a reserve and are free to lend the remainder to borrowers. Bank reserves are held in the form of cash in the bank or balances in the bank’s account at the central bank. The country’s central bank determines the minimum amount of liquid assets that banks must hold, known as the “reserve requirement” or “reserve ratio.” Most commercial banks keep more than the bare minimum in excess reserves.

Under a fractional-reserve system, banks are required to hold a certain percentage of their deposits as reserves, which is set by the central bank. This reserve requirement helps ensure that banks have enough funds to cover withdrawals and other obligations. The remainder of the deposits can be used to make loans or invest in other assets.

Advantages

One of the advantages of fractional-reserve banking is that it allows banks to create credit, which can help stimulate economic growth by providing individuals and businesses with access to funds for investment and consumption. However, this system also carries risks, as banks may become overextended and fail to meet their obligations if too many depositors try to withdraw their funds at the same time. To mitigate these risks, governments typically provide deposit insurance to protect depositors and regulate the banking system to prevent excessive risk-taking.

A fractional reserve banking system is one in which only a portion of bank deposits must be available for withdrawal. Banks only need a certain amount of cash on hand and can make loans with the money you deposit. By releasing capital for lending, fractional reserves help to expand the economy. Today, the majority of economies’ financial systems employ fractional reserve banking.