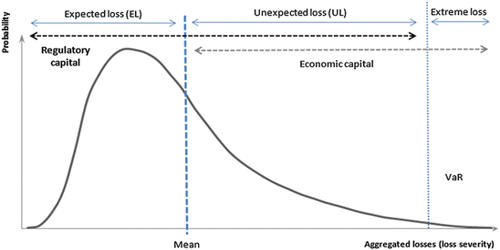

A Regulatory Capital (also known as capital adequacy) is the amount of capital a bank or another financial institution has to have as required by its financial regulator. These are standardized regulations in place for banks and other depository institutions that determine how much liquid capital must be held viv-a-vis a certain level of their assets. These are regulatory standards for banks that determine how much liquid capital (easily sold assets) they must keep on hand, concerning their overall holdings. This is usually expressed as a capital adequacy ratio of equity as a percentage of risk-weighted assets. Its aim not only to keep banks solvent but, by extension, to keep the entire financial system on a safe footing.

These standards are set by regulatory agencies, such as the Bank for International Settlements (BIS), the Federal Deposit Insurance Corporation (FDIC), or the Federal Reserve Board (the Fed). These requirements are put into place to ensure that these institutions do not take on excess leverage and risk becoming insolvent. When banks calculate their regulatory capital requirement and eligible capital, they must consider regulatory definitions, rules, and guidance. Total eligible capital according to regulatory guidance under Basel II is provided by three tiers of capital:

- Tier 1 (core) capital broadly includes elements such as common stock, qualifying preferred stock, and surplus and retained earnings.

- Tier 2 (supplementary) capital includes elements such as general loan loss reserves, certain forms of preferred stock, term subordinated debt, perpetual debt, and other hybrid debt and equity instruments.

- Tier 3 capital includes short-term subordinated debt and net trading book profits that have not been externally verified.

Regulatory Capitals governs the ratio of equity to debt, recorded on the liabilities and equity side of a firm’s balance sheet. They should not be confused with reserve requirements, which govern the assets side of a bank’s balance sheet—in particular, the proportion of its assets it must hold in cash or highly-liquid assets. They also ensure that banks and depository institutions have enough capital to sustain operating losses (OL) while still honoring withdrawals. Capital is a source of funds not the use of funds. Regulatory Capitals are often tightened after an economic recession, stock market crash, or another type of financial crisis.

Pros

- Ensure banks stay solvent, avoid default,

- Ensure depositors have access to funds,

- Set industry standards,

- Provide a way to compare, evaluate institutions.

Cons

- Raise costs for banks and eventually consumers,

- Inhibit banks’ ability to invest,

- Reduce the availability of credit, loans.