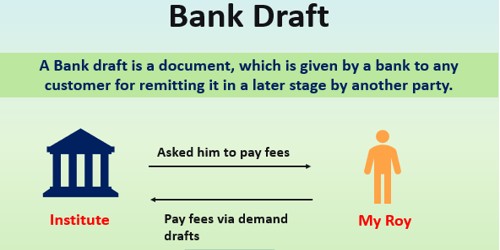

Bank Draft

A bank draft is a form 01 cheque or a bill of exchange drawn by one bank upon another directing to pay a certain sum of money. It is a check that is drawn on a bank’s funds and guaranteed by the bank that issues it. It is a payment instrument whose funds are guaranteed by your financial institution. Any person can buy a draft from his bank payable at the required places. It is used as a type of check which is more reliable than a personal check as it is backed by the bank itself on behalf of the payer. This is a convenient means of remitting money. It is a convenient and secure tool for paying a large sum, without having to withdraw cash from your account. It is a secure medium to pay they payer since the payment is guaranteed by the bank.

A bank draft has no expiry date. Normally, it has two parts. The first is the so-called negotiable part. This is what you give to the person you are paying. The second is non-negotiable. It contains various information relating to the transaction. The bank will freeze an amount from the account so that the payer cannot use that amount and the amount payable to the payee is secured. It is written by the bank on behalf of the payer.

Adv – It ensures the person receiving it that the funds are available. A draft ensures the payee a secure form of payment. In this way, it is more secure than a cheque. Issuing banks keep aside the stipulated amount so that the payment is secured.

Disadv – It is irrevocable once it is delivered to the recipient. Therefore, it cannot be canceled. It can only be canceled in case it has been lost or destroyed or stolen.