Capital Adequacy Ratio (CAR) is the ratio of a bank’s capital in relation to its risk-weighted assets and current liabilities. It is also known as Capital to Risk (Weighted) Assets Ratio (CRAR), which is the ratio of a bank’s capital to its risk. It is a measurement of a bank’s available capital expressed as a percentage of a bank’s risk-weighted credit exposures. National regulators track a bank’s CAR to ensure that it can absorb a reasonable amount of loss and complies with statutory Capital requirements. It is the ratio of a bank’s capital in relation to its risk-weighted assets and current liabilities. A bank that has a good CAR has enough capital to absorb potential losses.

In the banking system, the term “capital adequacy ratio” refers to the assessment of the bank capital to be maintained corresponding to the risk-weighted credit exposures. It is a measure of a bank’s capital. It is expressed as a percentage of a bank’s risk-weighted credit exposures. It is decided by central banks and bank regulators to prevent commercial banks from taking excess leverage and becoming insolvent in the process. The enforcement of regulated levels of this ratio is intended to protect depositors and promote the stability and efficiency of financial systems around the world. It is a measure to find out the proportion of banks capital, with respect to the total risk-weighted assets of the bank.

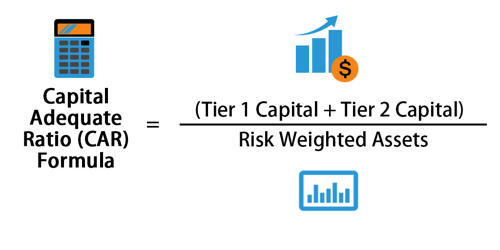

Two types of capital are measured: tier one capital, which can absorb losses without a bank being required to cease trading, and tier two capital, which can absorb losses in the event of a winding-up and so provides a lesser degree of protection to depositors.

The formula used to measure Capital Adequacy Ratio is = (Tier I + Tier II + Tier III (Capital funds)) /Risk-weighted assets)

The risk-weighted assets take into account credit risk, market risk, and operational risk.

Use

Capital adequacy ratio is the ratio that determines the bank’s capacity to meet the time liabilities and other risks such as credit risk, operational risk, etc. Banking regulators in most countries define and monitor CAR to protect depositors, thereby maintaining confidence in the banking system.

- It is used to protect depositors and promote the stability and efficiency of financial systems around the world.

- It is used by regulators to determine capital adequacy for banks and to run stress tests.

- CAR is similar to leverage; in the most basic formulation, it is comparable to the inverse of debt-to-equity leverage formulations. Unlike traditional leverage, however, CAR recognizes that assets can have different levels of risk.

- It helps make sure banks have enough capital to protect depositors’ money.

- It helps in measuring the financial strength or the ability of the financial institutions in meeting its obligations using its assets and capital and it is calculated by dividing the capital of the bank by its risk-weighted assets.