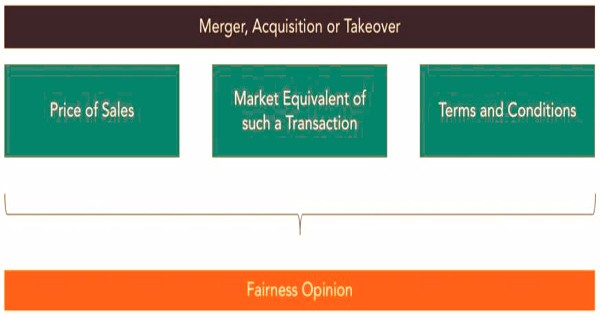

A fairness opinion is a professional evaluation of the price offered during an acquisition, takeover, or merger by an investment bank or other third party which assesses the fairness of the price offered. This opinion provides a shield to the board of directors of the selling company in the event that investors are later sued for fraud in selling the business for a sum that is too big. It is delivered for a charge. The assessment identifies with the cost offered by the purchaser and the decency of the terms to the organization’s investors. It is utilized in both neighborly and antagonistic exchanges. They are normally given when a public organization is being sold, blended, or stripped of all or a considerable division of their business. They may also be needed in private transactions not involving a publicly traded firm, as well as in situations other than mergers, such as a debt-to-equity exchange corporation.

A fairness opinion provides the parties involved in a merger, purchase, or acquisition with guidance. The opinion is usually in favor of the agreement during a friendly contract, but during a hostile takeover or unsolicited attempt to buy all or part of a company, directors frequently try to persuade shareholders not to approve the offer with an opinion of inadequacy. It is basically an expert assessment upheld by gathered information. The assessment is ordinarily aggregated late in the exchanges between the purchaser and dealer, since doing so any prior would be a misuse of cash if the arrangement were to self-destruct. A portion of the particular elements of a reasonableness assessment are to help in dynamic, moderate danger, and upgrade correspondence.

Example of Fairness Opinion

Fairness opinions, typically from an investment firm, are written by trained analysts or consultants and are provided for a fee to these main decision-makers. It does not state whether the bid price, only whether the price is fair, is the best one that could be obtained. Therefore, the opinion of justice just mitigates the board of directors’ liability. It additionally gives a guard in a courtroom should an investor or some other partner document a claim against the organization’s chiefs either for tolerating, or dismissing an offer. The experts inspect the particulars of the arrangement, including any conceivable business cooperative energies that advantage the objective/vendor if appropriate, the details of the understanding, and the cost offered for the supply of the objective/merchant.

Nevertheless, if a public corporation is involved in an investment deal, that may be an important defense, since there is a greater risk that one of its many shareholders will sue the board over the transaction. As one element of the duty of care in the fairness of a contract, controversy in financial and management circles surrounds the issue of the objectivity of fairness opinions. Reasonableness assessments are an especially smart thought if the exchange is forthcoming as the consequence of a threatening take over if there are numerous proposals for the organization at various costs if organization insiders are associated with the exchange, or if board individuals or investors have worries about the decency of the exchange.

In preparing an opinion on fairness, investment advisors must analyze the price, the terms of the sale, and the consideration to be obtained in comparison to the market rate for a similar transaction. Analysts tend to look at the terminology from the viewpoint of the investors of the company while analyzing transactions. A possibility exists for an irreconcilable circumstance when an element delivering an assessment may profit by the exchange either straightforwardly or in a roundabout way. Chiefs and officials of the organizations additionally may have an interest in the result of the proposed exchange. When there is a high probability of the deal being completed, the report is prepared late in the negotiations between the seller and the buyer. If the report was prepared before the terms were decided by the two parties, the agreement could be canceled in the middle of the transaction, and the report would be of no value.

Fairness opinion might be of specific significance where there have all the earmarks of being peculiarities in the obtaining exchange, for example, an arrangement with a connected gathering or where there was just a solitary offered. It helps to convince shareholders that management or administrators have behaved in the best interest of shareholders and that a report by independent experts retained by the company shows that the conditions were fair (or not, if the offer is being rejected). Without a decency assessment, there might be a segment of investors who are disappointed with the worth settled upon by the vendor and the purchaser.

There is also concern that some work on fairness opinion is turned over to investment firms already participating in an acquisition deal, which means that once the company is sold, they will also be paying a contingent fee. Some shareholders could search for details as to whether there were other alternatives to the arrangement, how better terms could have been accomplished by the deal, etc. An opinion prepared by a certified consultant can help ease such worries by avowing that the cost is a reasonable valuation. In a circumstance where disappointed investors record a claim against the organization, the heads of the organization can utilize the reasonable assessment report to show that they acted in compliance with common decency during the exchange. Therefore, an investment bank participating in both an acquisition and an opinion of justice is not inherently an objective observer.

Fairness opinions can also serve the interests of shareholders, according to the certification hypothesis, by minimizing knowledge asymmetries in corporate transactions. Informing an opinion on justice, independent advisors must practice due diligence to ensure that all the relevant information is gathered in order to draw a decision. They accomplish this by visiting the business premises of the selling organization and exploring documentation that will help in building up an assessment on the estimation of the selling organization. When transactions are between privately-held entities, fairness opinions are rarely used because there are so few shareholders involved that a complaint is much less likely.

Information Sources: