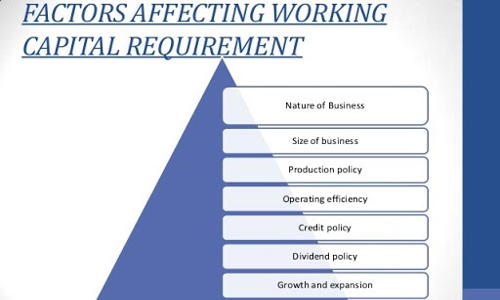

Factors that Affecting Working Capital

Requirements of working capital depend upon various factors such as the nature of the business, size of the business, the flow of business activities. It is the difference between a company’s current assets, like cash, accounts receivable, and inventories of raw materials and finished goods, and its current liabilities, like accounts payable. However, small organization relatively needs lesser working capital than the big business organization. Following are the factors which affect the working capital of a firm:

(1) Size of Business:

The working capital requirement of a firm is directly influenced by the size of its business operation. Big business organizations require more working capital than the small business organization. Therefore, the size of an organization is one of the major determinants of working capital.

(2) Scale of Operations:

There is a direct link between the working capital and the scale of operations. In other words, more working capital is required in the case of big organizations while less working capital is needed in the case of small organizations.

(3) Nature of Business:

Working capital requirement depends upon the nature of business carried by the firm. The type of business, firm is involved in, is the next consideration while deciding the working capital. Normally, manufacturing industries and trading organizations need more working capital than in the service business organizations. A service sector does not require any amount of stock of goods. In service enterprises, there are fewer credit transactions. The manufacturing company requires a huge amount of working capital because they have to convert raw material into finished goods, sell on credit, maintain the inventory of raw material as well as finished goods.

(4) Storage Time or Processing Period

The time needed for keeping the stock in store is called the storage period. The amount of working capital is influenced by the storage period. During the boom period, the demand for a product increases, and sales also increase. Therefore, more working capital is needed. If the storage period is high, a firm should keep more quantity of goods in-store and hence requires more working capital.

(5) Seasonal Requirement

Some goods are demanded throughout the year while others have seasonal demand. In certain businesses, the raw material is not available throughout the year. Such business organizations have to buy raw material in bulk during the season to ensure an uninterrupted flow and process them during the entire year. Goods which have uniform demand for the whole year their production and sale are continuous. Thus, a huge amount is blocked in the form of raw material inventories which gives rise to more working capital requirements.

(6) Potential Growth

If the business is to be extended in the future, more working capital is required. More amount of working capital is required to meet the expansion need of business.

(7) Changes in Price Level

Change in price level also affects the working capital requirements. Generally, the rise in price will require the firm to maintain a large amount of working capital as more funds will be required to maintain the sale level of current assets.

(8) Access to Money Market

If a firm has good access to the capital market, it can raise loans from banks and financial institutions. It results in the minimization of the need for working capital.

(9) Level of Competition:

A high level of competition increases the need for more working capital. In order to face competition, more stock is required for quick delivery and credit facility for a long period has to be made available.

(10) Inflation:

Inflation means a rise in prices. In such a situation more capital is required than before in order to maintain the previous scale of production and sales. Therefore, with the increasing rate of inflation, there is a corresponding increase in the working capital.