Cost Reconciliation Statement

A manufacturing concern may adopt either an Integrated Accounting System or Non- Integral Accounting System. It is a statement recording the profit or losses shown by the cost accounts and financial accounts. Under the Integrated Accounting System, only one set of books is maintained to record both costing and financial transaction, therefore, under this system, both financial accounts and cost accounts give similar results. The statements are even more useful for clarifying substantial differences between the amounts recorded for a transaction. But in Non- Integral Accounting System, separate books are maintained for costing and financial transactions, which may exhibit different results i.e. profits or losses. In such a system, profit or loss shown by costing books may not agree with that shown by financial books.

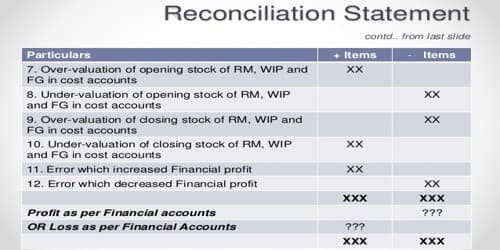

Reconciliation is an accounting process that compares two sets of records to check that figures are correct and in agreement. A statement that is prepared for reconciling the profit between financial account and cost account is known as a cost reconciliation statement. Therefore, it becomes necessary that profit or loss shown by the two sets of account is reconciled. It is part of a production report that shows what costs a department has to account for during a period and how those costs are accounted for. A cost reconciliation statement is a statement reconciling the profits or losses shown by cost accounts and financial accounts. It is a statement wherein the causes responsible for the difference in net profit or loss between cost and financial accounts are established and suitable adjustments are made to remove them. Businesses and individuals may reconcile their records daily, monthly, or annually.

Need for Reconciliation

Reconciliation between the results of two sets of accounts is necessary due to the following reasons:

- Reconciliation helps to check the arithmetical accuracy of both sets of accounts. It ensures managerial decision-making

- It explains the reasons for the difference which facilitate internal control.

- It ensures the reliability of cost data. Hence, there is a possibility of showing different figures of profit or loss in cost accounts and financial accounts.

- It promotes coordination between cost and financial departments.

- It ensures managerial decision-making.

Objectives

- To find the reasons for disagreement of profit or loss shown both in the financial books and cost books.

- To check the arithmetic accuracy of financial books and cost books.

- To establish the reliability of both financial and cost books.

Information Source: