Methods of Recording Transactions under the Installment System

In the installment system, there is an immediate sale, in which the price, instead of being paid in one lump sum, is spread over a period, interest is charged on unpaid balances. An installment sale is a financing arrangement in which the seller allows the buyer to make payments over an extended period of time. Under this system, the property in goods is passed on immediately to the buyer on signing the contract. Revenue and expense are recognized at the time of cash collection and not at the time of sale. The use of the installment method requires an enhanced level of record-keeping for the duration of the associated installment payments.

There are two methods of recording transactions under the Installment System. These are:

- With Opening Interest Suspense Account

- Without Opening Interest Suspense Account

Journal entries under these two methods are as under:

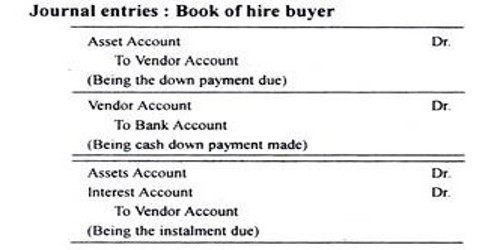

Journal entries in the books of the purchaser –

(1.) For purchasing goods under the installment system:

[First Method]

Assets A/C(total cash value)…………..Dr.

Interest suspense A/C(total interest)………Dr.

To vendor A/C

[Second Method]

Assets A/C (total cash value)…………Dr.

To vendor A/c

(2) For payment of cash down value (both method)

Vendor A/C………………Dr.

To Bank A/C

(3) For interest due

First Method

Interest A/C…………..Dr.

To Interest suspense A/C

Second method

Interest A/C……………Dr.

To vendor A/C

(4) For payment of installment (both methods)

Vendor A/c………….Dr.

To bank A/C

(5) For depreciation charges (both methods)

Depreciation A/C………….Dr.

To Asset A/C

(6) For transferring interest and depreciation

[First method]

Profit and loss A/C ………………Dr.

To interest A/C

To depreciation A/C

[Second method]

Profit and loss A/C…………….Dr.

To interest A/C

Journal Entries In The Books Of Vendor

(1) For selling goods on the installment system

[First method]

Buyer A/C………………Dr.

To sales A/C(total cash value)

To interest suspense A/C

[Second method]

Buyer A/C………..Dr.

To Sales A/C

(2) For receiving cash down value (both methods)

Bank A/C……….Dr.

To Buyer A/C

(3) For interest due

[First method]

Interest suspense A/C………..Dr.

To interest A/C

[Second method]

Buyer A/C……………..Dr.

To Interest A/C

(4) For receiving installment (both methods)

Bank A/C……………….Dr.

To Buyer A/C

(5) For transferring interest (both methods)

Interest A/C…………Dr.

To profit and loss A/C

(6) For transferring sales to the trading account (both methods)

Sales A/C ……………Dr.

To trading A/C

Information Source: