INTRODUCTION

Origin of the Report:

The preparation and submission of this report is partial requirement for the completion of the Master’s of Business Administration (MBA).This report is outcome of the three month long internship program conducted in Jamuna Bank Limited, one of the reputed private commercial banks of the country.

In Bangladesh today financial sector is one of the most established areas in the macro economic sector. Economy and finance is carrier of the country. So for the aspects of economic development, banking sector must be reform. In the process of forming a good economic system, private banks are paling an important role compare to the government banks in the country. For this reason I prepared my internship report titled” Credit Risk Management of Jamuna Bank Limited”. While working in the bank the standard operating procedures carried out by the bank were observed and understood.

Background of the Study:

Banking is one of the most important sectors for a country’s wealth building activities. At present the modern business industrialization, foreign trade, and investment almost all dependent on banks. But now a day the Banking sector of Bangladesh is suffering the disease of default culture, which is consequence, or result of bad performance of most of the banks in Bangladesh. EXIM BANK LTD. plays an important role towards the growth and economic development of Bangladesh.

This study is an attempt to produce a constructive report performance of EXIM BANK LTD. with special reference to the investment procedures, product, and differences with two banking systems.

Objectives of the Report:

This report is prepared primarily to fulfill the Master’s of Business Administration (MBA) degree requirement in MBA program of the faculty of business studies, department of management studies, Stamford University of Bangladesh. The secondary objectives of this report are:

ü To have exposure to the credit operation and other function of Jamuna Bank Limited.

ü To have a clear understanding of the business operation of Jamuna Bank Limited.

ü To discuss the services offered by Jamuna Bank Limitcd.

ü To assess and evaluate the growth trends of Jamuna Bank Limited.

ü To evaluate the profitability of Jamuna Bank Limited.

ü To identify the major strength and weakness of Jamuna Bank Limited in respect to other banks.

ü To recommend ways and means to solve problems regarding banking of Jamuna Bank Limited.

Rationale of the Study:

As it is the question of every concerned people that what is the difference between conventional banking and the Islamic banking and as the Islamic banking are spreading day by day in Bangladesh it is rationale to conduct the study.

Islamic banks can provide efficient banking services to the nation if they are supported with appropriate banking laws and regulations. This will help them introducing PLS modes of operations, which are very much conducive to economic development. It would be better if Islamic banks had the opportunity to work as a sole system in an economy. That would provide Islamic banking system to fully utilize its potential. This does not mean that the survival of Islamic banks operating within the conventional banking framework is altogether threatened. Evidences from Bangladesh indicate that Islamic banks can survive even within a conventional banking framework by which over from PLS to trade related modes of financing.

Methodology of the Study:

Mainly I have collected data from two sources. These two sources are as following.

● Primary source

● Secondary

The primary sources of my information are as below:

1. Direct observation

2. Investment Outlook

3. Questioning the concerned persons.

The secondary sources of my information are as below-

1. Annual report of JAMUNA BANK LTD.

2. Desk report of the related department

3. Different reference books

4.Some of my course elements as related to this report.

Limitation

Although the officials were so busy, they gave me wholehearted cooperation in the time of internship also in preparing this report. It was such a nice experience I have gathered from JBL. But I have faced the following that may be terns as die limitations of the study.

Lack of records : Sufficient books, publications and figures were not available. If this limitation were not been there, the report would have been more useful.

Lack of time :The time period of this study is very short. I had only three months in my hand to complete this report, which was not enough. So I could not go in depth of the study. Sometimes the officials were busy and were busy and were not able to give me much time.

Insufficient data : Some desired information could not be collected due to confidentially of business.

CHAPTER-02

Banking Overview of Bangladesh:

Banking Industry in Bangladesh: An Overview:

The banking industry in Bangladesh is one characterized by strict regulations and monitoring from the central governing body, The Bangladesh Bank. As the government is often the owner and regulator as well as the supervisor and customer of a bank, there has been ample opportunity for mismanagement over the years. The banking sector is plagued with a lack of credit discipline, archaic loan recovery law, corruption, inefficiency, overstaffing, etc. Several reform measures of the financial sector have been taken to improve the situation. Relative stability achieved by the support extended by both the central bank and the Government of Bangladesh in the past has restored public confidence in the country’s banking sector. Moreover, Nationalized Commercial Banks (NCBs) and old generation Private Commercial Banks (PCBs) would have to lower the rate of NPAs in their portfolios. Failure to do so would mean re-capitalization, at least for the NCBs. This may in turn lead to a further drain on the limited resources of the Government of Bangladesh at this time or in the immediate future this recapitalization would not be feasible. With these conditions in place, the World Bank anticipates the likelihood of a situation where the ever-increasing burden of non-performing loans and growing rate of debt servicing would place the economy under enormous strain and result in a crisis in the banking sector in the long term. The main concern is that currently there are far too many banks for the bank to sustain. As a result the market will accommodate only those banks that can transpire as the most competitive and profitable ones in the future.

- Bangladesh Bank

- Commercial Banks

- Islamic Banks

- Leasing Companies

- Finance Companies

Figure 1: Percentage different banking Sectors in Bangladesh:

Generally, the commercial banks and the finance companies provide numerous of banking products/services to cater to the needs of their customers. However, the Bangladeshi Banking industry is characterized by the tight Banking rules and regulations set by the Bangladesh Bank. All banks and financial institutions are highly governed and controlled under the Banking Companies Act 1993. The range of banking products and services is also limited in scope.

With the liberalization of markets competitions among the banking products seems to be growing more instances each day. In addition, the banking products offered in Bangladesh are fairly homogeneous in nature due to the tight regulations imposed by the central bank. Competing through differentiation is increasingly difficult and other banks quickly duplicate any innovative banking service.

These private banks are popularly known to public as First Generation Banks (9 banks opened during 1982-88), Second Generation banks (13 banks opened during 1992-96) and Third Generation banks (13 banks opened during 1999-2001).

The name of all the banks operating in Bangladesh and their date of incorporation are given below:

| Name of bank | Date of incorporation | Name of bank | Date of incorporation | ||

| Nationalized commercial banks | Specialized banks | ||||

| Sonali bank Ltd | 1972 | BKB | 1972 | ||

| Janata Bank Ltd | 1972 | BSB | 1972 | ||

| Agrani Bank Ltd | 1972 | BSRS | 1972 | ||

| Rupali bank Ltd | 1972 | RAKUB | 1987 | ||

| BASIC | 1988 | ||||

| Private Commercial Banks | |||||

| 1st generation private banks | 2nd generation private banks | ||||

| AB bank Ltd. | 1982 | Eastern bank Ltd | 1992 | ||

| Utara bank Ltd | 1983 | National credit and commerce bank Ltd | 1993 | ||

| National bank Ltd | 1983 | Prime bank Ltd | 1995 | ||

| Islami bank Ltd | 1983 | Dhaka bank Ltd | 1995 | ||

| IFIC bank Ltd | 1983 | Southeast bank Ltd | 1995 | ||

| United Commercial bank Ltd | 1983 | Al-Arafa Islami Bank Ltd | 1995 | ||

| The City bank Ltd | 1983 | Social Investment bank Ltd | 1995 | ||

| Pubali bank Ltd | 1984 | Dutch-Bangla bank Ltd | 1996 | ||

| Al-Baraka bank Ltd | 1987 | ||||

| 3rd generation private banks | Foreign commercial banks | ||||

| Bangladesh Commerce Bank Ltd | 1998 | Standard Chartered bank | 1948 | ||

| Mercantile Bank Ltd | 1999 | ||||

| Standard bank Ltd | 1999 | American Express Bank Ltd | 1996 | ||

| One Bank Ltd | 1999 | State Bank of India | 1975 | ||

| Exim Bank | 1999 | Habib Bank Ltd | 1976 | ||

| Premier Bank Ltd | 1999 | Muslim Commercial bank | 1994 | ||

| Mutual Trust Bank Ltd | 1999 | National Bank of Pakistan | 1994 | ||

| First security Bank Ltd | 1999 | CITI Bank N.A. | 1995 | ||

| Bank Asia Ltd | 1999 | HSBC | 1996 | ||

| The Trust bank Ltd | 1999 | Shamil Islami Bank | 1997 | ||

| Jamuna Bank | 2001 | Credit Agricol Indosuez | 1997 | ||

| Shahjalal Bank | 2001 | Hanvit Bank | 1999 | ||

| BRAC Bank | 2001 | Mashreq | 2001 | ||

| Bank of Silon | 2007 | ||||

Source: Bangladesh Bank

CHAPTER-03

Organizational Profile:

Organizational Profile:

Background Information of Jamuna Bank Limited:

Jamuna Bank Limited is one of the leading private commercial banks in Bangladesh that has achieved tremendous popularity and credibility among the people for its products & services. It is a public limited company and its shares are traded in Dhaka and Chittagong stock exchange. The bank undertakes all types of banking transaction to support the development of trade and commerce in the country. JBLs service is also available for the entrepreneurs to set up new ventures and BMM-,, of industrial units.

To provide clientele services in respect of international trade it has established wide, corresponded Banking relationship with local and foreign banks covering major trade and financial interest home and abroad.

Historical Background of JBL:

Jamuna Bank Limited (JBL) is a Banking Company registered under the Companies Act 1994 with its Head Office at Printers Building, 5 Rajuk avenue Dhaka-1000. The bank started its operation from 3rd June 2001. Jamuna Bank Limited (Jf31,) is a highly capitalized new generation Bank with an Authorized capital and paid-up capital of Taka 1600.00 million and Tk 390.00 million, Paid up capital of the Bank raised to Tk.429 million as of December, 2005 and the number of branches raised to 29.Thc bank gives special emphasis on export, import, trade finance SME finance Retail credit and finance to woman Entrepreneurs.

Corporate culture:

Employees of JBL share certain common values, which helps to create a JBL culture.

- The client comes first.

- Search for professional excellence.

- Openness to new ideas &new methods to encourage creativity.

- Quick decision-making.

- Flexibility and prompt response.

- A sense of professional ethics.

Corporate Slogan of JBL:

Your Partner For Growth:

Vision of JBL:

To become a leading banking institution and to play a pivotal role inthe development of the country.

Mission of JBL:

The Bank is committed to satisfying diverse needs of its customers through an array of products at a competitive price by using appropriate technology and providing timely service so that a sustainable growth, reasonable return and contribution to the development of the country can be ensured with a motivated and professional workforce.

Sponsors:

The sponsors of Jamuna Bank Limited are successful leading entrepreneurs of the country having stakes in different segments of the national economy. They are eminent industrialist and businessman having wide business reputation both at home and abroad.

Management:

JBL is managed by highly professional people. The present Managing Director of the Bank is a forward looking senior banker having decades of experience and multi discipline of knowledge to his credit both at home and abroad. He is supported by an educated and skilled professional team with diversified experience in finance and banking. The management of the bank constantly focuses on the understanding and anticipating customers’ needs and offer solution thereof. Jamuna Bank Limited has already achieved tremendous progress with in a short period of its operation. The Bank is already ranked as one of the quality service providers and known for its reputation.

Objectives of JBL:

- To earn and maintain CAMEL rating strong.

- To establish relationship banking and service quality through development of Strategic Marketing Plan.

- To remain one of the best banks in Bangladesh in terms of profitability and asset quality.

- To ensure an adequate rate of return on investment.

- To maintain adequate liquidity to meet maturity obligations and commitments.

- To maintain a healthy growth of business with desired image.

- To maintain adequate control systems and transparency in procedures.

- To develop and retain a quality work force through an effective Human Resources Management System.

- To ensue optimum utilization of all available resources.

- To pursue an effective system of Management by ensuring compliance to ethical norms, transparency and accountability at all levels.

Strategies of JBL:

- To manage and operate the Bank in the most efficient manner to enhance financial performance and to control cost of fund.

- To strive for customer satisfaction through quality control and delivery of timely services.

- To identify customers credit and other banking needs and monitor their perception towards our performance in meeting those requirement.

- To review and update policies, procedures and practices to enhance the ability to extend better services to customers.

- To train and develop all employees and provide adequate resources so that customer needs car, be responsibly addressed.

- To promote organizational effectiveness by openly communicating company plans, policies, practices and procedures to all employees in a timely fashion

- To diversify portfolio both in the retail and wholesale market

- To increase direct contract with customers in order to cultivate a closer relationship between the bank and its customers.

Corporate Governance:

Board Of Directors:

The Board of Directors consists of 13 members elected from the sponsors. The Board of Dirc-7 supreme body of the Bank.

Executive Committee:

All routine matters beyond the delegated powers of management are decided upon by or routed through the “ Executive Committee, subject to ratification by the Board of Directors.

Audit CommitteeIn line with the guidelines of Bangladesh Bank, a three-member Audit Committee of the Board of Directors been formed to assists the Board in matters related to Audit and Internal Control System of the Bank.

Chairman:

AI-Haj Nur Mohammed

Vice Chairman:

Mr. Md. Sirajul Islam Varosha

Directors:

Al-haj M. A. Khayer

Engr. A. K. M. Mosharraf Hussain

Mr. Arifur Rahman

Mr. Golam Dastagir Gazi

Bir Protik Mr. Fazlur Rahman

Mr. Md.Tajul Islam

Mr. Md. Mahmuclul Hoque

Mr. Md. Irshad Karim

Mr. Shaheen Mahmud

Mr. Mohammad Nurul Alam

Shariah Council:

Professor Dr. Mustafizur Rahman Mawlana

Mufti Ruhul Amin Mawlana Abdur Razzak

Professor Mowlana Md.Salahuddin & Mr. M Azizul Huq

Schemes offered by Jamuna Bank Limited:

- Monthly Benefit Scheme

- Monthly Saving Scheme

- Education Saving Scheme

- Marriage Deposit Scheme

- Double Growth Deposit Scheme

- Triple Growth Saving Scheme

- Lakhpoti Deposit Scheme

- kotipati Deposit Scheme

- Millionaire Deposit Scheme

- 3.13.Branches of JBL

| Code | Name of Branch |

| 0001 | Mohakhali |

| 0002 | Sonargaon Road |

| 0003 | Moulvi Bazar |

| 0004 | Goala Bazar |

| 0005 | Agrabad |

| 0006 | Dilkusha |

| 0007 | Beani Bazar |

| 0008 | Sylhet |

| 0009 | Shantinagar |

| 0010 | Gulshan |

| 0011 | Dhanmondi |

| 0012 | Nayabazar Islami Banking Branch |

| 0013 | Mohadevpur |

| 0014 | Naogaon |

| 0015 | Khatungonj |

| 0016 | Konabari |

| 0017 | Bhatiyari |

| 0018 | Foreign Exchange |

| 0019 | Jubliee Road Islami Banking Branch |

| 0020 | Chistia Market Branch |

| 0021 | Bogra |

| 0022 | Baligaon Bazar Branch |

| 0023 | Narayangonj |

| 0024 | Motijheel |

| 0025 | Rajshahi |

| 0026 | Basurhat |

| 0027 | Dholaikhal |

| 0028 | Bahaddarhat |

| 0029 | Sirajgonj |

| 0030 | Banani |

| 0031 | Ashulia |

| 0032 | Dinazpur |

| 0033 | Kustia |

| 0034 | Khatungong |

CHAPTER-4

Products and Services of Jamuna Bank Limited:

Products & Services:

The products and services can be classifying in two ways & those arc.

The deposit products & services

The lending products & services

| Deposits products & services | Lending/Investment products & services |

| Corporate Banking | Hi-her Purchase |

| Personal Banking | Lease Finance |

| Online Banking | Personal loan for woman |

| Monthly Savings Scheme | Project Finance |

| Monthly Benefit Scheme | Loan Syndication |

| Double/Triple Benefit Scheme | Consumer Credit |

| Marriage Scheme | Import and Export. Handling Financing |

| Education Scheme | |

| Lichgate Deposit Scheme | |

| Q-Cash ATM |

Corporate Banking:

The motto of JBL’s Corporate Banking services is to provide personalized solutions to their customers. The Bank distinguishes and identifies corporate customers’ need and designs tailored solutions accordingly.

Jamuna Bank Ltd. Driers a complete range of advisory, financing and operational combining trade, treasury, investment and services to its corporate client groups coin transactional banking activities in one package. Whether it is a project finance, term loan, import or export deal, a working capital requirement or a forward cover for a foreign currency transition, there Corporate Banking Managers will offer you the accurate solution, their corporate Banking specialists will render high class service for speedy approvals and efficient processing to satisfy customer needs.

Corporate Banking business envelops a broad range of businesses and industries.

Every one can leverage on our know-how in the following sectors mainly:

- Agro processing industry

- Industry

- (Import Substitute / Export oriented)

- Textile Spinning, Dyeing / Printing

- Export Oriented Garments, Sweater.

- Food & Allied

- Paper & Paper Products

- Engineering, Steel Mills

- Chemical and chemical products etc.

- Telecommunications.

- Information Technology

- Real Estate & Construction

- Wholesale trade

- Transport

Personal Banking:

Personal Banking of Jamuna Bank offers wide-ranging products and services matching the requirement of every customer. Transactional accounts, savings schemes or loan facilities from Jamuna Bank Ltd. make available to all a unique mixture of easy and consummate service quality.

They make every endeavor to ensure their clients’ satisfaction. Their cooperative & friendly professionals working in the branches will make your visit and enjoyable experience.

Online Banking:

Jamuna Bank Limited has introduced real-time any branch banking onApril 05, 2005. Now, customers can withdraw and deposit money from any of its 30 branches located at Dhaka, Chittagong, Sylhet, Gazipur, Bogra, Naogaon, Narayanganj and Munshigonj. Their valued customers can also enjoy 24 hours banking service through ATM card from any of Q-cash ATMs located at Dhaka, Chittagong, Khulna, Sylhet and Bogra. All the existing customers of Jamuna Bank Limited will enjoythis service by default.

Monthly Savings Scheme (MSS):

Savings is the best friend in bad days. Small savings can build up a prosperous future. Savings can meet up any emergences. JBL has introduced Monthly Savings Scheme (MSS) that allows saving on a monthly basis and getting a handsome return upon maturity. If anyone wants to build up a significant savings to carry out you’re cherished Dream, JBL MSS is the right solution.

Monthly Benefit Scheme (MBS):

Jamuna Bank Limited has introduced Monthly Benefit Scheme (MBS) for the prudent persons having ready cash and desiring to have fixed income on monthly basis out of it without taking risk of loss and without enchasing the principal amount. This scheme offers highest return with zero risk. Everyone can plan your monthly expenditure with the certain monthly income under the scheme.

Double/Triple Growth Deposit Scheme:

For people who have cash flow at this moment and want to get it doubled/tripled quickly JBL has introduced Double/Triple Growth Deposit Scheme that offers to make double/triple money within 6(six) years and 9.5 (nine and a half) years respectively resulting a high rate of interest.

Marriage Deposit Scheme:

Marriage of children, especially daughter is a matter of great concern to the parents. Marriage of children involves expense of considerable amount. Prudent parents make effort for gradual building of fund as per their capacity to meet the matrimonial expense of their children specially daughters. Parents get relief and can have peace of mind if they can arrange the necessary fund for marriage of their children, no matter whether they survive or not till the marriage occasion.It can be a great help to the parents if there is any scope of deposit of a modest mount as per their financial capacity, which groves very fast at high rate of interest yielding a sizeable amount on maturity.

With this end in view JBL has introduced Marriage Deposit Scheme, which offers you an opportunity to build – up your cherished – fund by monthly deposit ofserial, amount at your affordable capacity.

Education Savings Scheme;

Education is a basic need of every citizen. Every parent wants to impart proper education to their children. Education is the pre-requisite for socio-economic development of the country. As yet, there is no arrangement of free education to the citizens from the government level. As such, there should be pre-arrangement of fund to ensure higher educations the children. Otherwise higher education may be hindered due to change of economic condition, income of the parents at the future time when higher education shall be required. Today’s higher education is becoming expired day by day. Parents can get relief and can have peace of mind if they can arrange the necessary fund for higher education of their children. As such, JBI, has introduced ‘Education Savings Scheme’ which offers you an opportunity to build up your cherished fund’ by monthly deposit of small amount it at your affordable capacity or initial lump sum deposit to yield handsome amount on a future date to meet the educational expenses. Under this Scheme you have the different attractive options to avail the future benefit i.e. withdrawal of the total amount accumulated inlump sum or withdrawing monthly benefit to meet educational expense keeping die principal amount intact or to withdraw both principal and accumulated profit monthly for a certain period.

Lacpati Deposit Scheme:

To become a lakhpati is a dream to most of the people of Bangladesh especially to the lower and lower middle class income group. They experiences their expectations and wants are enormous in nature in our small span of life. To meet our deposit and wants we need right plan. Keeping the above in mind JBL has introduced “Lacpati Scheme” which has flexibility report of maturity and monthly installment as per affordable capacity.

Q-Cash Round The Clock Banking:

Jamuna Bank Q-Cash ATIM Card enables the costumers to withdraw- cash variety of banking transactions 24 hours a day. Q-Cash ATMs are conveniently located covering major shopping centers, business and residential areas in Dhaka and Chittagong. ATMs in Sylhet, Khulria and other cities will soon start be introduced. The network will expand to cover the whole country within a short span of time.

With customers Jamuna Bank Q-Cash ATM card they can:

- Cash withdrawal Round The Clock from any Q-Cash logo marked ATM booths.

- POS transaction (shopping malls, restaurants, Jewell Aries etc)

- Enjoy overdraft facilities on the card (if approved)

- Utility Bill Payment facilities

- Cash transaction facilities for selective branches nationwide

- ATM service available in Dhaka and Chittagong Withdrawal allowed from ATM’s of Jamuna Bank Ltd., AB Bank, The City Bank, Janata Bank, IFIC Bank, Mercantile Bank, Pubali Bank, Eastern Bank Ltd. Respectively.

Hire Purchase:

Hire purchase is a type of installment Credit wider which the Hire purchase agrees to take goods on hire at a stated rate, which is inclusive of the repayment of principle as well as interest for adjustment of the loan within a specified period.

Lease Finance:

Lease means a contractual relationship between the owner of the asset and its utter- fur a specified period against mutually agreed upon rent. The owner is called the Lessor and the user is called the Lessee.

Lease finance is one of the most convenient sources of financing of assets e.g. machinery, equipment vehicle, etc. The user of the assets i.e. Lessee is benefited through tax advantages, conserving working capital and preserving debt capacity. Moreover, Lease is an off-balance sheet item 1.e lease amount is not shown in the balance sheet of the lessee and does not affect borrowing capacity.

Leasing enables the lessee to avail the services of a plant or equipment without making the investment or incurring debt obligation. The Lessee car, use the asset by paying a series of periodic amounts called “lease payment” or “lease rentals” to the owner of the asset at the predetermined rates and generally in advance. The payments may be made monthly or quarterly.

Jamuna Bark Ltd., the highly capitalized private Commercial 1 Bank in Bangladesh has introduced lease finance to facilitate funding requirement of valued customers & growth of their business houses.

Personal loan for women Goal;

To make financially sound and solvent surd self dependent the women.

Three categories of women are under this loan-

1.Self Employed Women 2.Working Women 3.House Wife

Project Finance:

Project loan is considered as long-term investment of the bank. If the period is helpful to improve the economy and has a wide market then the bank thinks about giving project loan. To give this kind of loan the bank observes the willingness of the customer, his capacity and his ability to run the project. Having obtained this kind of information the bank makes a credit report about the customers loan proposal. Interest rate on loan varies from project Ratio of investment of customer and bank varies from customer to customer and the customer’s relationship with the bank.

Loan syndication:

Bank cannot invest more then 15% of its paid up capital on one individual. When the loan amount exceeds 15% of its paid up capital then the bank share the loan with other bank for giving one individual and this is call loan syndicate.

Consumer Credit:

Consumer credit scheme is relatively new field of micro-credit activities. People with limited income can avail of this credit facility to buy any household effects including car, computer and other consumer durable. It is a special credit scheme and the customers allow the loan on soft terms against personal guarantee and deposit of specified percentage of equity. The loan is repayable by monthly installment within a fixed period.

Import and Export handling and financing:

Import Financing:

Is the most important method of import -financing International trade take place between sellers and buyers located in different countries. The parties to a trade transaction are not always known to each other. Even if they are known to each other the seller may not have full confidence in the carried worthiness of the buyer or the buyer may not like to pay before he actually receives the goods. In letter of credit the bankers credit worthiness is substituted for the credit worthiness of the importer. Under a bank- cards letter of credit, the issuing bank gives a written undertaking on behalf of the buyer that the bank will honor the obligation of payment or expectance as the case may be on presentation of stipulated documents. As the request of the importers bank issue the letter of credit at a merging by the govt. instruction. Bail: does not generally issue the letter of credit less then 50% margin. JBL follow the margin prescribed by the government strictly.

Export Financing:

The Exporter needs finances at various stages, some at pre-shipment stage and the other at the post shipment stage.

CHAPTER-5

FINANCIAL PERFORMANCE OF JBL:

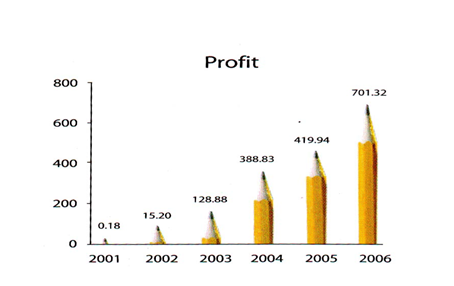

Profit:

In 2006 Jamuna Bank Limited posted an operating profit of Tk.701.32 million as against Tk.419.94 million in 2005 with a spectacular growth of 67.00 percent over the preceding year. After having made necessary provisions for loans and advances in accordance with the instructions of Bangladesh Bank Net Income Before Tax (NIBT) stood at Tk.499.97 million in the year under review against Tk.363.31 million in the preceding year registering a growth of 37.62 percent. An amount of Tk. 246.57 million has been kept as provision for payment of Tax. Thus Net Income after tax and provision stood at Tk.253.40 million in 2006 which was Tk.199.82 million in 2005.

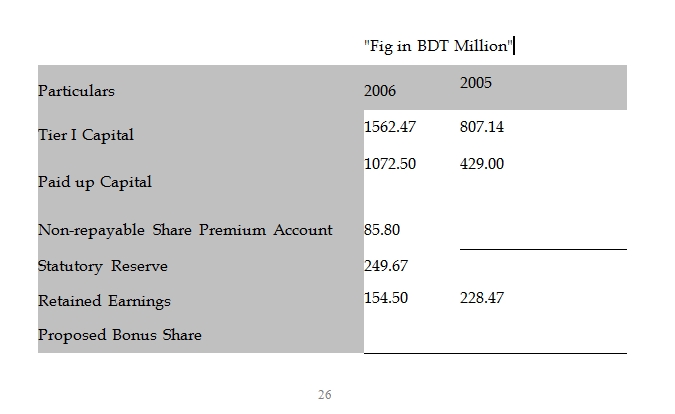

CAPITAL STRUCTURE:

Jamuna Bank Limited has a conviction of maintaining a strong capital base in carrying with a paid-up capital of Tk.390.00 million divided into 3.90 million o of Tk.100 each. The authorized capital of the Bank is Tk.1600 million divided into 16.00 million of Tk.100 each. The Bank’s paid-up capital as at 31st December 2006 stood at Tk.1072.50 million. Tk. was raised through initial public issue of 4.29 million ordinary shares of Tk100 each with a premium- each while Tk.214.50 million was raised by issue of Bonus Shares in the ratio of 1:4

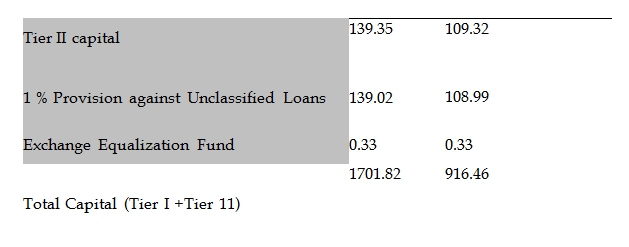

CAPITAL ADEQUACY RATIO:

The Bank adopted BIS risk adjusted capital standards to measure the capital adequacy in line with set by Bangladesh Bank. According to the instructions contained in Bangladesh Bank’s BRPD Circ dated September 07, 2002 relating to Capital Adequacy every commercial bank operating in the required to maintain at minimum 9 percent of its risk-weighted assets as capital.

Jamuna Bank maintain Capital Adequacy ratio of 14.79 percent as at 31.12.2006, which was higher than the require Adequacy Ratio. The amount of capital with break-up is given below:

From the table it reveals that Jamuna Bank Limited was able to increase its core capital by 93.58 percent from Tk.807.14 million to Tk. 562.47 million and supplementary capital by 27.47 percent from Tk.1 09.32 million to Tk. 39.35 million and total capital by 85.69 percent from Tk.916.46 million to Tk.1 701.82 million.

TREASURY OPERATIONS:

The Bank made its mark in Treasury operation. In money market the Bank played active role in local and foreign currency. Besides, it carried on operation as Primary Dealer. Having participated in local currency and foreign currency market and taken part in secondary trading of Govt. securities the Bank made significant growth. It would not be out of place to mention that Jamuna Bank Limited was the only third generation bank, which was selected as Primary Dealer by Bangladesh Bank owing to its excellent performance in money market. Treasury operation has been identified as one of the best sources for earning by the Bank through effective participation.

JBL’s dealing room is well equipped with modern and updated equipments like voice recorder, Reuter 3000xtra, CDBL electronic system etc. The activities of FX and local money market have been synchronized with complete segregation of activities of front and back offices. Intensive monitoring is ensured by the Bank’s Asset Liability Management Committee (ALCO) which sits in regular meetings to review the asset liability position and interest rates and takes important decisions thereon.

In the year 2006 there was a bit volatility in the local money market sometime in March-April but this market .vas more or less stable with a little fluctuations in interest rate during most of the time of the year. On the contrary, FX market was to a great extent volatile in 2006 having pressure on Taka against dollar. But our professionally skilled human resources were quite tactful in handling operations and could reap the benefits of local money market and FX market with significant growth. They were prudent enough to maintain the regulatory requirements of CRR and SLR of the Bank.

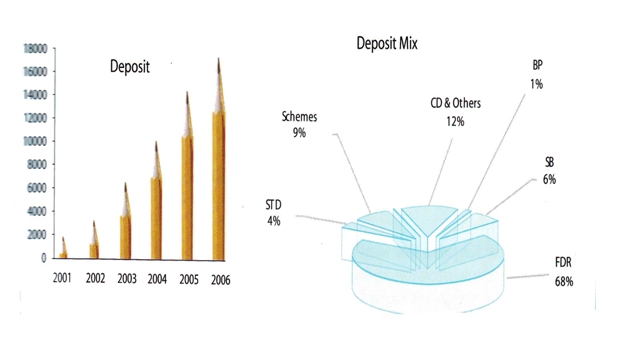

DEPOSITS AND DEPOSIT MIX:

In commercial banks operation starts with mobilization of resources i.e. tapping of deposits and then the said resources are deployed as loans, advances and investments for the purpose of maximizing wealth which -sans deposits have dominance in commercial bank’s operations. That is why, there is a common saying that deposit is the lifeblood of a bank. In keeping with this axiom JBL attaches utmost importance to the deposit mobilization campaign and to the optimal deposit mix for minimizing COF as far as practicable. A stiff competition persisted in the market as to deposit mobilization and there was a pressure on interest rate. 3esides, instability in political atmosphere was adversely affecting business, which stood as a hindrance to the smooth operation of banks including deposit mobilization.

Despite all these unfavorable factors JBL was able to instill confidence in customers as to its commitments to the depositors and borrowing customers and thereby could mobilize a total deposit ofTk.17284.81 million in 2006 against that ofTk.14454.13 million in the preceding year showing an increase of Tk.2830.68 million being 19.58 percent. Endeavor is underway for augmenting low cost deposit by accommodating good customers at competitive price. For healthy growth of business JBL puts emphasis on no cost and low cost deposit all the time.

A number of savings schemes are in place for mobilizing long term deposits which can be planned to be invested in term loans in-the area lease finance, project finance and consortium finance with a view to having better yields. JBL’s such move will motivate the people to have good savings habit, as well. The comparative position of deposit mix of the Bank as on 31.12.2006 and 31.12.2005 is depicted below:

| Types of Deposit | As on 31.12.2006 | As on 31.12.2005 | Changes | Changes in & over the year |

Current A/C & others | 2088.47 | 1543.06 | +545.41 | 35.35 |

| Bills Payable | 169.80 | 109.29 | +60.51 | 55.37 |

| Savings Deposit | 1084.01 | 749.52 | +334.49 | 44.63 |

| Short term Deposit | 636.87 | 384.03 | +252.84 | 65.84 |

| Fixed Deposit | 11804.01 | 10899.42 | +904.59 | 8.30 |

| Scheme Deposits | 1470.29 | 73107 | +739.22 | 101.11 |

Foreign currency Deposit | 31.36 | 37.74 | -6.38 | -16.91 |

| Total Deposits | 17284.81 | 14,454.13 | +2830.68 | 19.58 |

LOANS & ADVANCES:

Though there was an unfavorable business environment due to political turmoil throughout the year JBL was in constant efforts to explore different areas of credit operation and could raise the credit portfolios to Tk.12796.63 million in 2006 with an increase of Tk.1784.80 million (16.21%) over that of the preceding year. The total credit as on 31.12.05 was Tk.11011.83 million. In order to ensure compliance with regulatory requirements for avoiding risk of exposure to single borrower, concentration on large loans, to bring in excellence in credit operation in relation to risk management, yield, exposure, tenure, collaterals, security valuation etc. JBL strived for further diversification of credit portfolios. It’s credit facilities were concentrated on Trade Finance, Agriculture and related sector, project finance, wholesale and retail trade, transport sector, hospital & diagnostic centers and syndicate financing for big projects, capacity additions to the manufacturing sector and structured financing for developing infrastructure of the country. Initiatives are underway for helping small and medium entrepreneurs in the ventures for which, in JBL, we are developing SME credit products and strategies. JBL has also increased lending activities to small consumers through Consumer Credit Scheme.

RISK MANAGEMENT;

As a regulatory body Bangladesh Bank wants all banks to take effective measures for implementation of risk management in banking operations covering the major risks in asset-liability management, credit risk management, Foreign Exchange Risk Management, Internal Control & Compliance and Money Laundering Prevention. As these risks are integral parts of banking business JBL has put highest priority on management of such risks with intense monitoring of credit portfolios. We believe these will improve our operational and financial performance along with meeting the regulatory requirements. The Bank is in constant efforts to establish superior monitoring of credit risks and returns. For bringing in harmonious matching between assets and liabilities ALCO reviews these on a regular basis for keeping risk in this area to an acceptable level. The Bank’s credit policy guidelines and procedures are continuously reviewed and upgraded by its internal committees. The Bank also pursues an effective internal control system by establishing systems and procedures for scrutinizing the transactions periodically, encompassing key back-up supports and commissioning regular contingency plans. Through establishment of proper governance structure risk and returns are evaluated with a view to producing sustainable revenues, reducing volatility in earnings and enhancing value to shareholders. Maintenance of quality of assets is always the key issue to the JBL Management. Continuous efforts are made to maintain earning assets at the highest possible level so as to maximize profits and minimize cost of operation.

INVESTMENT:

The investment portfolio of the Bank as on 31.12.2006 rose to Tk.2552.67 million from Tk.2037.84 million as on 31.12.05 registering an increase of Tk.514.83 million being 25.26 percent. The investment portfolio was blended with Government treasury bills amounting to Tk.345.88 million, Treasury Bonds of Tk.1939.78 million, investment in primary shares and Zero Coupon Bonds. Its investment was made in acquisition of Preference Shares of (5.00-2.50) 2.50 million of After Automobiles Limited. Besides, Tk.2.00 million has been invested in acquisition of two shares of Central Depository Bangladesh Limited (CDBL). The Bank’s major portion of investment is in Govt. Treasury Bills and Bonds for the purpose of fulfilling Statutory Liquidity Requirement.

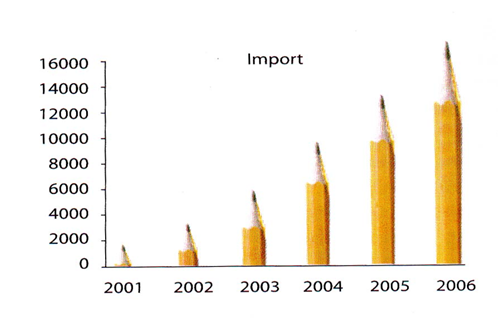

The total import business handled by the Bank in 2006 was Tk.15457.80 million compared to Tk.12151.90 million in the preceding year registering a rise of Tk.4305.80 million being 27.20 percent. A sizeable L/C’s were also opened by the Bank in the year under review. The import items included industrial raw materials, machinery, consumer goods, fabrics, accessories etc.

The Bank handled export business worth TO 1583.70 million in the year under report. In 2005 total export business handled by the Bank was Tk.6521.80 million. Thus there was an increase of Tk.5061.90 million in export business handled by the Bank, being 77.62 percent over the preceding year. The major export item was Ready-made Garments.

This section lends the fund what the bank mobilizes through its various deposit accounts. This is the second function of banks two generic function -deposit mobilization and credit creation. The majorpart of banks income is derived from credit and since the banks credit is customer’s fund, bank takes extreme caution in lending.

Sanctioning Loans and Advance:

To have a clear idea about the credit management of JBL the following points are essential.

a. Credit policy of the Bank

b. Credit Sanctioning Authority of JBL and

c. Processing and Screening of credit proposal

Credit Policy of the Bank:

JBL Credit Policy contains of total macro-economic development of the country as a whole by way of providing financial support to the trade, commerce and industry. Throughout its credit operation JBL goes to every possible corners of the society. They are financing large and medium scale business house and industry. At the same time they also take care entrepreneur through its operation of lease finance and some micro credit, small loan scheme etc. The bank has come up with a scheme where women will be 91% financial support for their self employment and development.

Credit Sanctioning Authority of JBL:

Delegated powers are expected to be exercise by the authorized executives sensibly keeping the bank’s interest in mind. In exercising the power so delegated authorized executives shah also have credit restriction, tools and regulations .as governed by Banking Company Act, Bangladesh Bank, and other usual credit norms . However, the following guidelines are laid down before the executives of JBL for exercising the delegated power.

- The borrower must be a man of integrity and must enjoy good reputation in the market.

- The borrower must have the capacity and capability for utilizing credit properly and profitably.

- The enterprise of the borrower must be viable and profitable i.e. proposal of (lie borrower must be evaluated properly and carefully so as to ascertain its profitability.

- The enterprise must generate sufficient fund for debt and servicing.”

A customer to whom credit is to be allowed should be faras possible within the command area. No sanctioning officer can sanction any credit to any of his near relatives and to any company where his relatives have financial interest.

Tools for Appraisal Credit:

The 10 C’s of Good and Bad Loan:

In addition to the formal credit appraisal, the credit an official of JBL tries to judge the possible client based on some criteria. These criteria are called the C’s of good and bad loan. These are described below:

Character: Make sure that the individual or company they are lending has outstanding integrity.

Capacity: Make sure that the individual or company they are lending has the capability of repaying the loan.

Condition: Understanding the business and economic conditions that whether it will change after the loan is made.

Capital: Make sure that die individual or the company they are lending has in appropriate level of investment in the company.

Collateral: Make sure that there is a second way out of a credit but do not allow that to drive the credit decision.

Complacency: Official do not rely on past. They remain alert every time whether any mistake is taking place or not.

Carelessness: They believe that documentation, follow up and consistent monitoring are essential to high quality loan portfolio.

Communication: They share credit objectives and credit decision making both vertically and laterally within the bank.

Contingencies: Make sure that they understand the risk, particularly the downside possibilities and that they structure and price the loan consistently with the understanding.

Competition: They do not get swept away by what others are doing.

Lending Risk Analysis (LRA):

Lending Risk Analysis is a financial tool to analyze the risk associate in a loan proposal. According to Bangladesh Banks order every bank has to conduct LRA. For every loan amounting Tk. I Core and above. JBL is frequent user of this technique.

Credit Monitoring and supervision Cell:

JBL is a unique characteristic in its loan management to make sure that there will be no bad loan in its-loan portfolio, JBL established a loan monitoring and supervision cell headed by an First Assistant Vice President. He along with other official frequently visit customer premises or business whether loan amount, which is taken is used properly or not. Sometimes customer need more fund or ether types of facilities to run business profitably, then the monitoring authority takes necessary steps to meet customer’s need.

COMPUTATION CREDIT RISK GRADING:

The following step-wise activities outline the detail process for arriving at credit risk grading.

Credit risk for counterparts arises from an aggregation of the following:

- Financial Risk

- Business/Industry Risk

- Management Risk

- Security Risk

- Relationship Risk

Each of the above-mentioned key risk areas require be evaluating and aggregating to arrive at an overall risk grading measure.

Evaluation of Financial Risk:

Risk that counter parties will fail to meet obligation due to financial distress. This typically entails analysis of financials i.e. analysis of leverage, liquidity, profitability & interest coverage ratios. To conclude, this capitalizes on the risk of high leverage, poor liquidity, low profitability & insufficient cash flow.

Evaluation of Business/Industry Risk:

Risk that adverse industry situation or unfavorable business condition will impact borrowers’ capacity to meet obligation. The evaluation; of this category of risk looks at parameters such as business outlook, size of business, industry growth, market competition & barriers to entry/exit. To conclude, this capitalizes on the risk of failure due to low market share & poor industry growth.

Evaluation of Management Risk:

Risk that counter parties may default as a result of poor managerial ability including experience of the management, its succession plans and teamwork.

Evaluation of Security Risk:

Risk that the bank might be exposed due ‘:o poor quality or strength of the security in case of default. This may entail strength of security & collateral, location of collateral and support.

Evaluation of Relationship Risk:

These risk areas cover evaluation of limits utilization, account performance, conditions/covenants compliance by the borrower and deposit relationship.

According to the importance of risk profile, the following weight ages are proposed for corresponding principal risks.

Principal Risk Components Weight:

Financial Risk 50%

Business/Industry Risk 18%

Management Risk 12%

Security Risk 10%

Relationship Risk 10%

Principal Risk Components: Key Parameters:

Financial Risk Leverage, Liquidity, Profitability & Coverage Ratio

Business/Industry Risk Size of Business, Age of Business, Business

Outlook, Industry Growth, Competition & Barriers to Business

Management Risk Experience, Succession & Team Work.

Security Risk Security Coverage, Collateral Coverage and Support.

Relationship Risk Account Conduct, Utilization of limit, compliance of Covenants/conditions & Personal Deposit.

Principal Risk components: Weight:

Financial Risk 50%

–Leverage 15%

-Liquidity 15%

-Profitability 15%

-Coverage 15%

Business Industry Risk – 18%

Size of Business 5%

Age of Business 3%

Business Outlook 3%

Industry growth 3%

Market Competition 2%

Entry/Exit Barriers 2%

Management Risk 12%

Experience 5%

Succession 4%

Team Work 3%

Security Risk 10%

Security coverage 4%

Collateral coverage 4%

Support 2%

Relationship Risk 10%

Account conduct 5%

Utilization of limit 2%

Compliance of

covenants/condition 2%

Personal deposit 1%

After the risk identification & weightage assignment process (as mentioned above), the next steps will be to input actual parameter in the score sheet to arrive at the scores corresponding to the actual parameters.

This manual also provides a well-programmed MS Excel based credit risk-scoring sheet to arrive at a total score on each borrower. The excel program requires inputting data accurately in particular cells for input and will automatically calculate the risk grade for a particular borrower based on the total score obtained.

The following is the proposed Credit Risk Grade matrix based on the total score obtained by an obligor.

Processing and screening of Credit Proposal:

There are some common regulations governed by Banking Company Act, 1991 Bangladesh Bank and the law of the State, which has to be followed strictly at the time of screening a credit proposal. In addition. Credit proposals are appraised critically by JBL credit officials from various angle to judge the feasibility of proposal.

The customer at the branch of the bank place credit proposals. When a customer comes with accredit proposal, the credit department officials of the branch make an open discussion with the customer on different issues of the proposal to judge.

Worthiness of tile proposal and customer. If theproposal scenes worthwhile in all aspect then the proposal is placed before credit committee of the bank. After threadbare discussion, if the committee agrees in principle the proposal is sanctioned as per the delegated business power of the branch.

However, if the magnitude of the proposal is beyond the delegated business power of the branch they forward it to the Head Office with, sanction of approval.

On receiving proposal, the Credit Division of Head Office places the proposal in the Head Credit Committee. The committee further analyzes proposals critically and if agree in principle they sanction the same as per delegated business power. Again if the merit and magnitude of the proposal is beyond the delegated business power of the Head Office Credit Committee or Managing Director forward proposal to the Board of the Bank with recommendation for approval.

If the proposal is found unviable at the branch level they decline the same from their desk. In the same way, proposals are also declined from the Head Office Credit Committee and from Board if it is not feasible.

Securities:

It is essential that the proposals define clearly thepurpose of. the sources of repayment. The agreed repayment schedules the value of security (land, machinery security papers, bond, sanchay patra etc.) and thecustomer relationships consideration implicit in the credit division in where the security is to be accepted as collateral for the facility all documentation relating to the security shall be in the approved from. All approval procedures and required documentation shall be completed and all securities shall be place prior to the disbursement of the facility. The borrower is requested to submit the above-mentioned papers inoriginal for Verification by the Bar-1n lawyer and creation on the property intended to mortgage against advance.

Documentation:

A document is a written statement of facts of proof. or evidence arising out of particular transaction, which on placement may bind the parties there to answerable and liable to the law for satisfaction of the charge in question.

The execution of documents in proper from and according to the requirements of the law is known as documentation. The documentation does establish a legal relationship between the lending bank and the borrower. The terms and conditions of loans and advances, the securities charged and the repayment schedule are recorded in writing Proper documentation is necessary to safeguard the future interest of the bank.

Documents are necessary for the acknowledgement of the debt by the borrower and charging of securities to the bank by him. Proper and correct documentation is essential not only for the safety of advance but also necessary for taking legal action against the debtors in case of non-repayment of dues. Depending on the types of loans and advances different documents are required. Such as

Documentation of Loan:

- Demand of Promissory (DP) Note

- Letter of partnership (in case of partnership concern) or resolution of the board of Directors (in case of Limited concern)

- Letter of Agreement

- Letter of Disbursement.

- Letter of Pledge (in case of pledge of goods)

- Letter of Hypothecation (in case of hypothecation of goods)

- Trust Receipt (in case –of LTR facility)

- Letter of Lien and Ownership (in case of advance against share)

- Letter of lien for packing credits (in case of packing credits)

- Letter of lien (in case of advance against FOR)

- Letter of Lien and transfer authority (in case of advance against PSP, SSP etc.

- Legal documents for mortgage of the property (as drafted by legal advisor)

Documentation of Overdraft:

- Demand of Promissory (DP) Note

- Letter of partnership (in case of partnership concern) or resolution of the board of Directors (in case of Limited concern)

- Letter of Agreement

- Letter of Continuity

- Letter of Lien and Ownership (in case of advance against share)

- Letter of Lien (in case of advance against FOR)

- Letter of Lien and transfer authority (in case of advance against PSP, SSP etc,

- Legal documents for mortgage of the property (as drafted by legal advisor)

Documentation of Cash Credit:

- Demand of Promissory (D.P) Note.

- Letter of partnership (incase of partnership concern) or resolution of the board of Directors (in case of Limited Concern.

- Letter of Agreement

- Letter of Continuity

- Letter of Pledge (in case of pledge of goods)

- Letter of Hypothecation (in case of hypothecation of goods)

- Letter of Lien and Ownership (in case of advance against share)

- Letter of Lien (in case of advance against (FDR)

- Letter of Lien and transfer authority (in case of advance against PSP, SSP etc,

- Legal documents for mortgage of the property (as drafted by legal advisor)

Documentation of Bills Purchased:

- Demand of Promissory (D.P) Note.

- Letter of partnership ( in case of partnership concern) or resolution of the board of Directors (in case of Limited Concern)

- Letter of Agreement

- Letter of Hypothecation of Bill

All required Documents as mentioned before should be obtained before any loan is disbursed. Disbursed of any credit facility requires approval of the component authority that should ensure before exercising such delegated authority that all the required documentation have been completed.

Credit Facilities Extended by JBL;

The man functions of a commercial bank are tow:1) to take deposit and 2) to make advance. Making advance is the most important function of a bank. The is expends the profitability of the bank. Moreover, Bank make advance out of the deposits to the public which are payable at demand. A Commercial Bank makes advances to different sectors for different purpose i.e. financing of trade and commerce, Export and import, industries Agriculture, Transport, House-Building etc.

Classification of loan:

Continuous Loan

CC Hypo (Cash Credit Hypothecation):

Cash Credit allowed against hypothecation of an asset is known as Cash Credit

(Hypo) of goods on which charge of lending bank is created.

For Cash Credit (Hypo) Bankers takes following precaution:

- The banker carefully verifies the stocks of the hypothecated assets and their market price

- Obtains periodical statement of stock duly signed by the borrower

- Ensure dial docks are duly insured against fire, burglary with bank clause

- Obtains sufficient collateral securities.

- Identify that whether the goods are ready saleable and whether they have good demand in the market.

- Ensure the borrowers trustworthiness.

CC Pledge (Cash Credit Pledge):

Cash credit allowed pledge of goods is known as “Cash credit (Pledge). For Cash Credit (Pledge) the borrower pledges his goods to the bankers as a security against the credit facility. The ownership of pledge goods remains with the pledged. The bank remains the effective control of the pledged goods. Pledged goods can be stored in the custody of borrower but under lock and key of the bank. Banks appointed guards are take care of those goods round the clock. The banks delivered the pledged gods to the party by turns against payment.

For Cash Credit Pledge following points arc taken into consideration before allowing.

- Whether the quality of goods is ascertained.

- Whether the goods are easily saleable and those goods must have good demand in the market.

- The quality of goods is ensured. The goods cannot be perishable and will not deteriorate in quality as a result for short and long duration.

- The borrower has the absolute title of goods.

- The prices of the goods have to steady and are not subject to violent change.

- Goods should be stored in the presence of a responsible bank office.

- Ensure that stocks are duly insured against fire, burglary, with bank clause.

- Stocks must be invocated regularly byresponsible bank office.

- The locks of the store are scaled and keys are kept in the bank.

Overdraft:

The overdraft is always allowed on a special A/C operated upon cheques. The customers may be allowed a certain limit up to which he can overdraw within a specific period of time. In an overdraft A/C withdrawal and deposit can be made any number of times within the limit and prescribed period. Interested is calculated and charged only on the actual debit balances on daily product basis.

Overdraft are three types

1) Temporary overdraft (TOD)

2) Clean overdraft (COD)

3) Secured overdraft (SOD)

Temporary overdraft (TOD):

Temporary overdraft (TOD) is allowed to honor cheques which is future dated for the valued client . without any prior arrangement. This kind of facilities is provided for short time.

Clean overdraft (COD) :

Sometimes Overdrafts are allowed with no other security except personal security of borrowers.

SOD Secured overdraft (SOD):

When Overdrafts are allowed against security is known as secured overdraft (SOD)

Purposes:

- To businessman for expansion of their business.

- To contractors and suppliers for carrying construction works and supply orders.

Securities:

- Lien on fixed/term deposits.

- Shares/Debentures/Protiraksha Sanchay Patra

- Insurance Policy.

- Mortgage on real estates and properties.

Interest Rate: 15 % per annum

Force/Demand

Payment against Document (PAD):

Eligibility:

PAD is generally granted to importer for import of goods.

Interest Rate: 16 % per annum

Internal Bills Purchased (IBP):

This kind of arrangements is allowed for purchase of internal bills. Some times Contractors need money to his liquidity problem. To avoid thus kind of situation they want to take loan against their future dated cheque.

Eligibility

Internal Bills Purchased is usually provided for future dated cheque against some service charge before 21 days of the maturity date.

Loan against Imported Merchandise (LIM):

This is as similar as CC Pledge. But these loans are provided to the selected customers with internal contract.

Eligibility:

This loans only fur old and some special customers.

Loan against Trust Received (LTR):

Under this arrangement, credit is allowed against trust receipt and the exportable goods remain in the custody of exporter but he is required to execute a stamped export trust receipt in favor of the bank. Where the declaration is made that he holds Purchased with financial assistance of the bank lit trust for the ‘bank.

Eligibility:

LTR is generally granted to exporter for exportation of goods.

Interest Rate: 16 % per annum.

Local/Foreign Documentary Bills Purchased (LDBP/FDBP):

Under this arrangement, credit is allowed for exporter for or exportable goods. Banks provide all the agency commission. Its pay back period is 21 days.

Eligibility:

LDBP/FDBP is generally granted to exporter for exportation of goods.

Interest Rate: 16 % per annum

Letter of Credit:

Issuing letter of credit is one of the important services for JBL. A letter of credit is a document authorizing by the bank for a specific amount of money. Two types of L/C are provided by JBL.

Eligibility:

This facility is given to the exporter/manufacturer /producer

Terms and Conditions:

- It should stipulate the name of the loan/credit/grant.

- It should bear the name of the designed bank.

- Item mentioned in the LCA form must contain with the permissible item.

Term Loan:

Hire Purchase:

The feature of hire purchase is that borrower pays his remaining amount over a period of 6 month to 2 years & some times more then 2 years. For this kind of credit tic goods, which has been purchased, registered to the bank- as owner. And after end of final payment goods are registered to owner formally.

Eligibility:

Hire purchase facility is allowed to [hose people who have either fixed source of income or desire to pay it in lump stun.

Interest Rate: 16 % per annum

Loans (General):

When an advance is made in a lump sum repayable either in fixed monthly installment or in lump sum and no subsequent debit is ordinarily allowed except by way in interest and incidental charges etc. This is loans (general). Loan is allowed for a single purpose where the entire amount may be required at a time or ina number of installments within a period of short Spam. After disbursement of the entire loan amount, there will be only repayment made by the borrower. Loan once repaid in full or in part cannot be drawn again by the borrower. Entire amount of the loan A/C in the name of the customer and is paid to hen through his SB/CD A/C. Sometimes loan amount are disbursed in cash.

This loan is repayable within few months or few years.

Securities:

- Lien on fixed/term deposits.

- Shares/Debentures/Protiraksha Sanchay Patra.

- Insurance Policy

4. Moftgaze of Real estates and properties

5. Hypothecation of stock/Stock/Machinery.

Interest Rate: 16 % per annum

Lease Finance:

Jamuna bank Ltd. is the first private commercial bank, in Bangladesh who introduced the following lease finance facilities for funding requirement of valued customers & growth of their business.

- Lease Items

- Vehicles like luxury bus, Mini bus, Taxi Cabs Cars, Pick-Up Van Etc.

- Factory equipment.

- Medical equipments.

- Machinery for agro based industry.

- Construction and office equipment.

- Sea or river transport and computer for IT education center.

Lease Period By Items:

| Sectors | Period Up to Years |

| Vehicles like luxury bus, Mini bus, Taxi Cabs Cars, Pick-UpVan Etc | 4 |

| Factory equipments | 5 |

| Medical equipments | 5 |

| Construction equipment. | 3 |

| Office equipment. | 3 |

| Generators, Lift & Elevators for Commercial place | 3-5 |

| Sea or river transport | 4 |

| Computer for IT education center | 2-3 |

| Machinery for agro based industry | 5 |

Maximum Limit:

70% of acquisition Cost,

Security /Collaterals:

The following securities are acceptable.

- Ownership of leased assets before the period of loan adjustment.

- Collateral securities in the form of land & building/Fixed Deposits/other cash collateral /Wage Earners Development Bond having liquidation value covering at least 100% amount of finance.

- Deposit Of A category shares, National Savings Certificates, ICB Unit Certificates, assignment of life insurance policies, Bank Guarantee also be allowed as collateral securities.

- Creation of charge of axed assets of file existing industrial units requiring BMRE. Creation of charge on the existing vehicle will also be acceptable as securities.

Charges:

Bank charges are modest and competitive.

Lease Deposit:

Before disbursement of lease finance, the lessee shall have to deposit 3 months rentals in advance, which will be adjusted at the end of the lease period.

Grace Period:

For capital machinery and equipment, maximum grace period of 6 (six) months may he allowed for installation/commercial production.

Payment Date:

Rental payments shall be made every month and there shall be three payment dates as detailed below.

If Lease executed.

Between 1st to 10th ………5th of subsequent months

Between I la‘ to 20th……15th of subsequent months

After 20th ………………25th of subsequent months.

Insurance Coverage:

The vehicle /Equipment /Lease asset shall have to be covered bya comprehensive insurance policy throughout the whole lease term at lessee’s own cost in the name of Jamuna Bank Limited. The premium shall be on account of lessee.

Repair and Maintenance of Leased items:

The lessee is obliged to maintain the vehicle/Equipment in good working order and is solely responsible for any loss or damage as long as it is in his possession.

Transfer price/Lease Renewal Rental:

On final adjustment of the lease finance, the lessee may have an option to purchase the equipment at 5% of the lease finance. Besides the above option, tile lessee may renew the lease on year-to-year basis or return, the equipment to the bank.

Personal Loan for Woman:

This is one of the new events in Bangladesh in credit sector. Woman who are interested and has the ability to pay it back in time those can get this kind facility To encourage the woman JBL provide loan with low interest.

Eligibility:

- The borrower must be the following profession.

- Service holder of Government Organization

- Service holder of Semi-Government Organization

- Service holder of Multinational Organization

- Service holder of Bank and Insurance Company

- Shop owner/has small business.

Interest Rate : 15.5% per annum:

Consumer Credit Scheme:

Consumer credit is recently new field of micro credit activities; people who have limited income can avail of this credit facility to buy any household effects including car, computer, household and other commercial durables. JBL plays a vital role in extending the consumer credit.

Eligibility:

The borrower must be the employee of the following organization.

ü Government Organization

ü Semi- Government Organization

ü Multinational Organization

ü Bank and insurance Company

ü Reputed Commercial Organization

Nature:

Mid term Micro Credit

Interest Rate: 16 % per annum

Terms And Conditions:

- Client will procure the specified articles from the dealer/agent /shop acceptable by the Bank.

- All of the papers /cash memo etc. related to the procurement of the goods will be in the name of bank ensuring ownership of the goods. The ownership will be transferred in the name of the client after full adjustment of Banks due.

- The clients will have to bear all the expenses of license, registration and insurance etc.

- The clients will have to bear the cost of repair and maintenance of the acquire articles.

CREDIT RISK GRADING SYSTEM:

Credit risk grading is an important tool for credit Risk management as if helps the Banks & financial institutions to understand various dimensions of Risk moved in different credit (transactions. The aggregation of such grading across the borrowers, activities and the lines of business can provide hello assessment of the quality of credit portfolio of abank or a branch The credit risk grading system is vital to take decisions both al the pre-sanctum stage as wellas post-sanction stage.

At the pre-sanction stage, credit grading helps the sanctioning authority to decide whether to lend or not to lend, what should be the loan price what should be the extent of exposure, what should be the appropriate credit facility what are the various facilities are the various risk mitigation tools to put a cap on the risk level. At the post-sanction stage, the bank can decide about the depth of the review or renewal, frequency of review, periodicity or the grading and other precautions to be taken.

The lending Risk Analysis (LRA) mammal introduced in 1993 by the Bangladesh Bank has been in practice for mandatory use by the Banks & financial institutions for loan size of BDT 1.00 core and above. However, file LRA manual suffers from a lot of subjectivity, sometimes creating confusion to the lending Bankers in terms of selection of credit proposals on the basis of risk exposure. Meanwhile, in 2003 end Bangladesh Bank provided guidelines for credit risk grade scorecard for risk assessment of credit proposals

Bangladesh Bank expects all commercial banks to have a well-defined credit risk management, which delivers accurate, and timely risk grading. This manual describes file elements of an effective internal process for grading credit risk. It also provides a comprehensive but generic discussion of the objectives and general characteristics of effective credit risk grading system In practice a banks credit risk grading system should reflect the complexity of its lending activities and the complexity of risk involved.

DEFINITION OF CREDIT RISK GRADING (CRG):

The Credit Risk Grading (CRG) is a collective definition based on the pre-specified scale and reflects the underlying credit-risk for a given exposure.

A Credit Risk Grading deploys a number/ alphabet/ symbol as a primary summary indicator of risks associated with a credit exposure.

Credit Risk grading is the basic module for developing for developing a credit risk management system.

FUNCTIONS OF CREDIT RISK GRADING:

Well-managed credit risk grading systems promote bank safety and soundness by facilitating informed decision-making. Grading systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. This allows bank management and examiners to monitor changes and trends in risk levels. The process also allows bank management to manage risk to optimize returns.

USE OF CREDIT RISK GRADING:

The credit risk grading matrix allows application of uniform standards to credits to ensure a common standardized approach to assess the quality of individual obligor, credit portfolio of aunt, line of business, the branch of the Bank as a whole.

As evident, the CRG outputs would be relevant for individual credit selection, wherein ether a borrower or a particular exposure/facility is rated. The other decisions would be relative to pricing (credit-spread) and specific feathers of the credit facility. These would largely constitute obligor level analysis.

Risk grading would also be relevant for surveillance and monitoring, internal MIS and assessing the aggregate risk profile of a Bank. It is also relevant for portfolio level analysis.

NUMBER AND SHORT NAME OF GRADES USED IN THE CRG:

The proposed CRG scale consists of 8 categories with Short names and numbers are prow\vided as follows:

| GRADING | SHORT | NUMBER |

| Superior | SUP | 1 |

| Good | GD | 2 |

| Acceptable | ACCPT | 3 |

| Marginal/Watch list | MG/WL | 4 |

| Special Mention | SM | 5 |

| Sub standard | SS | 6 |

| Doubtful | DF | 7 |

| Bad & Loss | BL | 8 |

CREDIT RISK GRADING DEFINITIONS:

A clear definition of the different categories of credit risk grading is given as follows:

Superior- (SUP)-1

- Credit facilities, which are fully secured i.e. fully cash covered.

- Credit facilities fully covered by government guarantee

- Credit facilities fully covered by the guarantee of a top tier international Bank

Good – (GD)-2

- Strong repayment capacity of the borrower

- The borrower has excellent liquidity and low

- The company demonstrates consistently strong earnings and cash flow.

- Borrower has well established, strong market share.

- Very good management skill &, expertise.

- All security documentation should bein place.

- Credit facilities fully covered by N, the guarantee of a top tier local Bank.

- Aggregate Score of 85 or greater basest oil the Risk Grade Score Sheet

Acceptable – (ACC19) – 3

These borrowers arc not as strong as COOD Grade borrowers, has still demonstrate consistent earnings, cash flow and have a good back record.

- Borrowers have adequate liquidity, cash flow and earnings.

- Credit in this grade would normally be secured by acceptable collateral (its charge over inventory / receivables / equipment / property).

- Acceptable management

- Acceptable parcel/sister company guarantee

- Aggregate Score of 75-84 based oil the Risk Grade Score Sheet

Marginal/Watch list – (MG/WL) – 4

These borrowers have an above average risk due to strained liquidity, higher thannormal leverage, thin cash flow and/or inconsistent canings.

- Weaker business credit &’ early warning; signals of emerging business credit detected.

- The borrower incurs a loss

- Loan repayments routinely fall past due

- Account conduct is poor, or other untoward factors arc present.

- Credit requires attention

- Aggregate Score of 65-74 based oil the Risk Grade Score Sheet

Special Mention – (SM) – 5

This grade has potential weaknesses that deserve• management’s ‘s close attention. If left uncorrected, these weaknesses may result in a deterioration of the repayment prospects of the borrower.

- Severe management problems exist

- Facilities should be downgraded to this grade if sustained deterioration in financial condition is noted (consecutive losses, negative net worth, excessive Leverage.

- An Aggregate Score of 55-64 based oil the Risk Grade Score sheet.

Substandard – (SS) – 6

Financial condition is weak and capacity or inclination to repayis in doubt.

- These weaknesses jeopardize the full settlement of loans.

- Bangladesh Bank criteria for sub-standard credit shall apply.

- All Aggregate Score of 45-55 oil the Risk grade Score Sheet

Doubtful – (DF) – 7

Full repayment of principal and interest is unlikely and Hic possibility of loss is extremely high. However, due to specifically identifiable pending factors. Such as litigation, liquidation procedure or capital injection, the asset is not yet classified as Bad & loss.

- Bangladesh Bank criteria for doubtful credit shall apply.

- An Aggregate Score of less than 35-44 based on the risk grade score sheet.

Bad & Loss – (13L) – 8

Credit of this grade has long outstanding wills no progress in obtaining repayment or on the verge of wind up/liquidation,

- Prospect of recovery is poor and options have been pursued.

- Proceeds expected from the liquidation or realization of security may be awaited. The continuance of the loan as a bankable asset is riot warranted, and the anticipated loss should have been provided for.

- This classification reflects that it isnot practical or desirable to defer writing off this basically valueless asset even though partial recovery may be affected in the future, Bangladesh Bank guidelines for timely write off of bad loans must beadhered to. Legal procedures /suit initiated.

- Bangladesh Bank criteria for bad & loss credit shall apply.

- An Aggregate Score of less than 35 based on the Risk Grade Score Sheet.

CREDIT RECOVERY:

The Recovery Department should directly manage accounts with sustained dc1crioralion (a risk Rating of Sub Standard (6) or worse). Hanks may wish to transfer EXIT accounts graded 4-5 to the RU for efficient exit based on recommendation of CRM and Corporate Banking. Whenever an account is handed over from Relationship Management to RU, a Handover/Downgrade Checklist should be completed

Down Grading process should be done nomadically and should not be postponed unit the annual review process,

The RU’s primary functions are:

- Determine Account Action Plan/Recovery Strategy

- Pursue all options to maximize recovery, including placing customers into receivership or liquidation as appropriate.

- Ensure adequate and timely loan loss provisions arc made based on actual and expected losses.

- Regular review of grade 6 or worse accounts.

- Management of classified loans and special mention

- Accounts and related works writing off’ B/L loans with the approval of the Board

The management of problem loans (NPLs) must be a dynamic process, and the associated strategy together with the adequacy of provisions muss be regularly reviewed. A process should be established to share the lessons learned from f1w experience of credit losses in order to update the lending guidelines.

CHAPTER-07

RECOMMENDATIONS & CONCLUSION:

Limitation of the study:

During internship period in Jamuna Bank Limited Dilkusha Branch tile following problems are observed.

Human resource of any organization is considered as a valuable asset. But human resources, in the branch, are not equipped with adequate banking knowledge. Majority of the human resources have lack of basic knowledge regarding money, banking finance and accounting. Without proper knowledge in these subjects, efficiency cannot be optimized. Bank can arrange training program on these subjects.

There is shortage of computer in general banking section. Sometimes the shortage of computer makes some unfortunate event in that section.