Introductory part:

Investment has acquired considerable emotive force in any country. It is viewed as beneficial on employment creator-as it brings about economic development. It can termed capital flowing from a firm or individual within the country or in one country to a business or businesses in another country involving a share of at least 10%. So the significance of investment in a country is:

- It increases the economic growth: sustain increase in real, per capita, national product. This brings -National income effect, Balance of payment effect& Public revenue effect.

- Accelerate the industrial innovation this develops in integrations take a variety form which is not necessarily mutually exclusive.

- Political modernization: sustain increase in the degree to which political functions are effectively collectively oriented, universalistic specific and achievement oriented.

- It also brings infrastructural development & modern nationalism.

From discussing the significance on investment it is two forms:

- Local (Domestic) investment.

- Foreign Investment.

Investments come from a firm or individual within the country is domestic or local investment. Investment or capital come from a firm in one country to a business or businesses in another country is called foreign investment.

The investment situation in Bangladesh is consisting of Private vs. Public and Local vs. Foreign investment. The economy in Bangladesh has been gradually drawing the attention of private sector investors since it’s opening up in early 90’s manufacturing is becoming increasingly vibrant Claiming a significant share in the total investment. During 1991-92 to 2002-07, cumulative private investment registered with Board of Investment (BOI), the apex private investment promoting and facilitating body, totaled US$ 25,933 million. The registered investments consist of 47.65 percent as local and 52.35 percent as foreign.

Rational of the Study:

Foreign investment carries enormous significance in a developing country like Bangladesh. Realizing the importance of foreign investment Bangladesh formulated its first industrial investment policy in 1973, revised it again in 1974, 1975, and in 1978. Foreign private investment (Promotion and protection) act, 1980 and the Bangladesh Export Processing zones authority act 1980 were enacted. To make the foreign investment more attractive new industrial policy was announced in 1982. However, the industrial policy 1999 is by far the most comprehensive document. Bangladesh has ever made for investment including foreign investment.

From the inception of the independence Bangladesh has been in the center of economic investment incentive for many countries and institutional bodies of the world. With the passage of time Bangladesh reform its regulatory structure in regard to the FDI to open up the new avenue and to dislodge the compliances related to the FDI. But the effort of this structural progress has back warded by sudden and unexpected political influence and changes. The situation becomes worse one in the September attack on US. During this period flow of FDI all over the world shrunken at a greater extend. Bangladesh had also severely affected by that unwanted changes in the world scenario. Before going for in depth analysis the flow of FDI in Bangladesh we have the privilege to have a look on the regional and worldwide flow of FDI in the recent period.

Objective of the study:

This study is conducted with the objective to get an overall insight in the flow of FDI in Bangladesh. The total objective is decomposed into several parts to get idea about the factors affecting the flow of FDI. The specific objectives of this study are:

To give an insight into the theoretical issues relating to Foreign Direct investment.

To highlight the role of multinational corporation in FDI.

To give an overview of FDI in Asian Countries.

To focus on the administration of FdI in Bangladesh.

To evaluate the status of FDI in Bangladesh

To identify the problem of FDI V & prescribe some issues for their solution.

Scope of the study:

The primary scope of this thesis paper is to get acquainted with the flow of foreign direct investment. The study will cover the scenario of FDI flow currently in Bangladesh. Comparative analysis of statement of sector wise distribution of FDI in Bangladesh and sources of FDI has been presented. The findings will be strictly structured upon the data provided by the Directorate of Board of Investment (BOI).

Sources of Information:

Primary & secondary sources are used for preparing this thesis paper. For collecting primary data the personnel in the Directorate of Board of Investment (BOI) were interviewed. For collecting secondary data various papers supplements like the Financial Express, the Daily Star etc newspapers, internet and books are studied. Exchange of views from different people also played a significant role to do the Study.

Methodology of the study:

Throughout the report I presented historical background of the flow of FDI and to get insight about the possible changes in the coming years. I have gathered information and data relevant to this analysis from several sources. The collected data are highlighted in the tabular analysis and trend analysis. This analysis helps me to know about the movement of FDI flow over the year. I also tried to find out the possible causes and factors that shaped the trend line of the flow. In a particular year the flow is upward moving at another time this is downward moving. So what are the reason behind that is the objective of the study as a whole. The analysis of the report is supported by some theoretical arguments that enhance the overall findings and guide towards a reasonable recommendation.

Limitations of the study:

Although I tried to find and set the causes that determine the shape of the flow of FDI, I believe I’m not at the best peak. I have relied extensively on published data and other secondary sources to precede the report. But some of those sources were not approachable and we lacked from data of that sources. In analyzing the report I have presented some factors that determine the shape of the flow of FDI. But these are not surely the only factors and many important factors may be omitted from the analysis. And another thing is that the underlying factors are mostly in qualitative factors in nature and therefore cannot be measured in numerical way. The consequences are that we failed to provide absolute guideline about restructuring policy and some other decisions. The finding of the report is based on some assumed scenario and changes on those scenarios may reshape the future flow of FDI. That is the analysis is situation and time based. The biggest problem we faced in the reporting period is the paradoxical data set. I have three sets of data in regard to the FDI, but all that provides us contradictory result. Board of Investment and UNCTD do not confirm what the Bangladesh bank published and vice versa. On the other hand the recording of FDI data is almost a new concept in our country. As a result we have FDI data for two periods only that is for the year 2006 and 2007.

Theoretical issues:

Foreign Direct Investment:

Foreign Direct Investment (FDI) is the acquisition of managerial control by a citizen or corporation of a home nation over a corporation of some other host nation. Corporations that widely engage in FDI are called multinational companies, multinational enterprises, or transnational corporations. FDI traditionally implies export of real capital from home to the host nation, but even when economic investment results from FDI, capital may not be transferred from the home nation to the host one. Rather, multinational corporation may acquire/utilize real capital from local (or a third-nation) sources foreign capital” means capital invested in Bangladesh in any industrial undertaking by a citizen of any foreign country or by a company incorporated outside Bangladesh. In the form of foreign exchange, imported machinery and equipment, or in such other form as the government may approve for the purpose of such investment;.Bangladesh invites FDI for industrial growth, in particular welcoming establishment of manufacturing firms and service sector enterprises that would sell their products within the country and also export outside it.

Factors Affecting Foreign Direct Investment:

Because Foreign Direct Investment can significantly affect a country’s economy, it is important to identify and monitor the factors that influence it. The most influential factors are:

- Inflation

- National income

- Government restriction

- Exchange rates

Impact of Inflation:

If a country’s inflation rate increases relative to the countries with which it invests, its capital account would be expected to decrease, other things being equal. Consumer and corporations in that country will most likely purchase more goods or invest more in overseas (due to high local inflation), while the country’s exports to other countries & flow of investment from foreign will decline.

Impact of National Income:

If a country’s income level (national income) increases by a higher percentage than those of other countries, its capital account is expected to decrease, other things being equal. As the real income level (adjusted for inflation) rises does consumption of goods. A percentage of that increase in consumption will most likely reflect an increased demand for foreign investment.

Impact of Government Restrictions:

A country’s Government can prevent or discourage investment from other countries. By imposing such restrictions, the Government disrupts investment flows. Among the most commonly used investment restriction are bureaucratic tangles, projection of intellectual property right and f\fiscal policy changes. In addition to these, a Government can reduce its country’s investment by enforcing laws, or a maximum limit that can be invested.

Impact of Exchange Rates:

Each country’s currency is valued in terms of other currencies through the use of exchanges rates, so that currencies can be exchanged to facilitate international transaction. The values of most currencies can fluctuate over time because of market and government forces. If a country’s currency begins to rise in value against other currencies, its capital account balance should decrease, other things being equal. As the currency strengthens, Investment by that country will become more expensive than the receiving countries.

Necessity of FDI for a country:

The world has seen a spectacular wave of global corporate activity particularly during the second half of the last decade. This has been facilitated by advances made in the information technology. This trend, strengthened with the direction toward border less-economies, is drawing more and more TNCs(Trans national corporation) into the global operation.FDI is no longer only a strategic option of corporations, it also plays a key role in the national economic development strategies. Various countries are attempting to attract foreign investors through a variety of measures, i.e. liberalization of investment environment, fiscal reforms and a package of incentive offers. FDI can transform a country’s economic scenario within shortest possible time. It is not merely access to fund, but also provide transfer of technical know-how and management expertise. It is also a stabilizing factor in any economy, because once TNCs have made an asset-based direct investment, they can not simply pull out overnight like in the case of portfolio investment. Normally the benefits accruable from FDI are inclusive of

(a) Transfer of technology to individual firms and technological spill-over to the wider economy,

(b) Increased productive efficiency due to competition from multinational subsidiaries

(c) Improvement in the quality of the factors of production including management in other firms, not just the host firm,

(d) Benefits to the balance of payments through inflow of investment funds,

(e) Increase in exports

(f) increase in savings and investment and

(g) faster growth and employment.

Thus ,Foreign direct investment is viewed as a major stimulus to economic growth in developing countries. Its ability to deal with two major obstacles, namely, shortages of financial resources and technology and skills, has made it the centre of attention for policy-makers in low-income countries in particular.

Foreign investment opportunity:

Private investment from overseas sources is welcome in all areas of the economy with the exemption of five industrial sectors (arms, production of nuclear energy, forest plantation and mechanized extraction within the bounds of reserved forests, security printing and minting, air transportation and railways) reserved for public sector. Such investments can be made either independtly or through joint venture on mutually beneficial terms and conditions. In other words, 100% foreign direct investment as well as joint venture bothwith local private sponsor and withpublic sector is allowed. Foreign investment, however, is specially desired in the following categories:

– export-oriented industries;

– industries in the Export Processing Zones;

– high technology products that will be either import-substitute or export-oriented;

– undertaking in which more diversified use of indigenous natural resources is possible;

– basic industries based mainly only on local raw materials;

– investment towards improvement of quality and marketing of goods manufactured and/or increase of production capacities of existing industries; and

– labour intensive/technology intensive/capital intensive industries.

An objective assessment of environment by a foreign investor for his decision making process:

In attracting investment, countries must recognize the main reasons that firms invest in developing countries:

firms locate in a specific country because of the natural resource wealth that can be exploited

Market access: firms set up production in a country because of its large domestic market or its preferential access to regional or global markets

Operating efficiencies: firms locate in a country because of competitive unit costs (typically labour and transportation costs)

Firms consider different options when selecting an investment site. Hence, countries compete to attract direct investment. The critical question for developing countries is:

What are the factors that determine where firm set up direct investments?

The determinants of investment are unique to each circumstance; nonetheless, there are common themes. Some of the questions that investors ask when considering investing in a developing country follow:

Are government policies supportive of investment?

Is there a well-managed economic framework?

Does the legal framework protect property rights and foreign investors?

How is the relevant industry regulated and structured?

Is the local work force sufficiently trained and healthy?

Is there adequate infrastructure in place?

Are there significant natural resource deposits?

How is the quality of life?

These nine issues are explored in greater detail in the Investment Checklist in Figure 13. This checklist contains questions that potential investors will consider. With each individual investment, there is a shifting emphasis as to which are the key factors, hence, the checklist does not rank the importance of each issue.

Role of Multinational Corporation of FDI

A review of MNCs activities related to FDI:

MNCs commonly consider direct foreign investment because it can improve their profitability and enhance shareholder wealth. In most cases, MNCs engage in DFI because they are interested in boosting revenues, reducing costs, or both.

Revenue – Related Motives:

The following are typical motives of MNCs that are attempting to boost revenues:

Attract new sources of demand:

A corporation often reaches a stage when growth is limited in its home country, possibly cause of intense competition. Even if it faces little competition, its market share in its home country may already be near its potential peak. Thus, the firm may consider foreign markets where there is potential demand. Many developing countries, such as Argentina, Chile, Mexico, Hungary and China, have been perceived as attractive sources of new demand. Many MNCs have penetrated these countries since barriers have been removed. Because the customers in these countries have historically been restricted from purchasing goods produced by firms outside their countries, the market for some goods is not well established and offer much potential for penetration by MNCs.

Enter profitable markets:

If other corporations in the industry have proved that excessive earnings can be realized in other markets, an MNC may also decide to sell in those markets. It may plan to undercut the prevailing, excessively high prices. A common problem with this strategy is that previously established sellers in a new market may prevent a new competitor attempts to break into this market.

Exploit monopolistic advantage:

Industrial organization theory states that firms may become internationalized if they possess resources or skills not available in competing firms. If a firm possess advanced technology and has exploited this advantage successfully in local markets, the firm may have a more distinct advantage in markets that have less advantage technology.

React to trade restrictions :

In some cases; MNCs use DFI as a defensive rather than aggressive strategy. Specially, MNCs may pursue DFI to circumvent trade barriers.

Diversify internationally :

Since economies of countries do not move perfectly in tandem over time, net cash flow sales of products across countries should be more stable then comparable sales if the products were sold in a single country. By diversifying sales (and possibly even production) internationally, a firm can make its net cash flows less volatile. Thus, the possibility of a liquidity deficiency is less likely. In addition, the firm may enjoy a lower cost of capital as shareholders and creditors perceived the MNCs risk to be lower as a result of more stable cash flows.

Cost – Related Motives:

MNCs also engage in DFI in and effort to reduce costs. The following are typical motives of MNCs that are trying to cut costs:

Fully benefit from economies of scale :

A corporation that attempts to sell its primary product in new markets may increase its earnings and shareholder wealth due to economies of scale (lower average cost per unit resulting from increased production). Firms that utilize much machinery are most likely to benefit from economics of scale.

Use foreign factors of production :

Labor and land costs can vary dramatically among counties. MNCS often attempt to set up production in locations where land and labor are cheap. Due to market imperfections (discussed in Chapter 1) such as imperfect information, relocation transaction costs, and barriers to industry entry, specific labor cost do not necessarily become equal among markets. Thus, it is worthwhile for MNCs to survey markets to determine whether they can benefit from cheaper costs by producing in those markets.

Use foreign raw materials :

Due to transportation costs, a corporation may attempt to avoid importing raw materials from a given country, especially when it plans to sell the finished product back to consumers in that country. Under such circumstances, a more feasible solution may be to develop the product in the country where the raw materials are located.

Use foreign technology:

Corporations are increasingly establishing over seas plants or acquiring existing overseas plants to learn the technology of foreign countries. This technology is then used to improve their own production process and increase production efficiency at all subsidiary plants around the world.

React to exchange rate movements – When a firm perceives that a foreign currency is undervalued, the firm may consider direct foreign direct foreign investment in that country, as the initial outlay should be relatively low.

Comparing Benefits of FDI among countries:

The optimal way for a firm to penetrate a foreign market is partially dependent on the characteristics of the market. For example, direct foreign investment by U.S. firms is common in Europe but not so common in Asia, Where the people are accustomed to purchasing products from Asians. Thus licensing arrangements or joint ventures may be more appropriate when firms are expanding into Asia.

Host Government views of FDI:

Each government must weigh the advantage and disadvantage of direct foreign investment in its country. It may provide incentives to encourage some forms of DFI, barriers to prevent other of DFI, and impose conditions on some other forms of DFI.

Barriers that protect local firms or consumers:

When MNCs consider engaging in DFI by acquiring a foreign company, they may face various barriers imposed by host government agencies. All countries have one or more government agencies that monitor mergers and acquisitions. The acquisitions activity in any given country is influenced by the regulations enforced by these agencies.

Barriers that restrict ownership:

Some governments restrict foreign ownership of local firms. Such restrictions may limit or prevent international acquisitions.

“Red Tape” Barriers – An implicit barrier to DFI in some countries is the “Red Tape” involved, such as procedural and documentation requirements. A MNCs pursuing DFI is subject is subject to a different set of requirements in each country. Therefore it is difficult for MNCs to become proficient at the process it concentrates on DFI within a single foreign country. The current efforts to make regulations uniform across Europe have simplified the paperwork required to acquire European firms.

Impact of the FDI decision on an MNC value:

An MNC’s foreign direct investment decision affects its value. Decisions on which countries to target for expansion affect the revenue generated by the foreign subsidiaries and the operating expenses of the foreign subsidiaries. Thus the FDI decisions determine determine the expected foreign currency cash flows that will be earn by each foreign subsidiaries and therefore affect the expected dollar cash flows ultimate receive by the U.S. parent.

Since the FDI decision by the U.S. parent determine the types of new operations and locations of foreign operations, they can affect the perceived risk of these operations that are supported by the parent’s FDI.Therefore FDI can affect the MNC’s cost of capital, which also affects the MNC’s value.

Where,

V= Value of the U.S.- based MNC

E(CFi,t)= Expected cash flows denominated in currency j to be received by the U.S. parent in period t.

E(ERi,t) = expected exchange rate at which currency j can be converted to dollars at the end of period t.

k = Weighted average cost of capital of the U.S. parent.

m = Number of currencies

n = Number of periods.

FDI: Bangladesh & World scenario Statement

Significance of foreign investment in Bangladesh:

Foreign investment carries enormous significance in a developing country like Bangladesh. Realizing the importance of foreign investment Bangladesh formulated its first industrial investment policy in 1973, revised it again in 1974, 1975, and in 1978. Foreign private investment (Promotion and protection) act, 1980 and the Bangladesh Export Processing zones authority act 1980 were enacted. To make the foreign investment more attractive new industrial policy was announced in 1982. However, the industrial policy 1999 is by far the most comprehensive document. Bangladesh has ever made for investment including foreign investment.

The major incentives for foreign direct investment in Bangladesh are:

Projection of Foreign investment from nationalization and expropriation

Abolition of ceiling on investment and equity share-holding by foreigners

Tax holiday between 5 – 10 years power generating companies

Accelerated depreciation in lieu of tax holiday on certain simple conditions

Concessionary duty and VAT on capital machinery and spares

Rationalization of import duties and taxes

Six month multiple visa for prospective investors

Citizenship by investing USD 500000 or transferring USD 1000000

Permanent relationship by investing USD 75000

Tax exemption on capital gains under certain simple conditions

Bonded warehouse and back to back L/C for exporting industries

Avoidance of double taxation with certain countries

Facilities for repatriation of capital, profit, royalty, technical fee etc.

Tax exemption on royalty, technical know-how and expatriates’ salary

Protection of intellectual property rights

Taka convertibility in current account

Treating reinvestment of repatriable dividend as new investment

FDI and Bangladesh:

Foreign Direct Investment (FDI) generates economic benefits to the recipient country through positive impacts on the real economy resulting from physical capital formation, transfer of technology and increased domestic completion. Bangladesh stands to gain from these inflows provided it is able to allocate and manage these resources efficiently keeping in view the concomitant liabilities of profit and income payments. in the Bangladesh context, the recent surge in FDI in energy and telecom sectors appear to have heavy import content with little impact on foreign exchange reserve accumulation. The concern that logically emerges is whether the real economy would be able to generate sufficient foreign exchange to finance the remittance of profits and income originating from the foreign investment. Further more, the private sector has been incurring foreign debt obligation of short, medium, and long term maturity to the tune of USD 60-70 million a year. These give rise to interest and principal payments in foreign exchange over and above the official debt obligations to bilateral and multilateral agencies.

Sect oral Distribution of private capital inflows into Bangladesh

(Foreign Direct Investment in Bangladesh)

Profile of Capital inflows (5 years average)

Million USD

| Sectors | FY 1996-00 | FY 2001-05 | FY2006-10 |

| Gas | 134 | 218 | 114 |

| Power | 113 | 193 | 174 |

| Telecom | 17 | 17 | 17 |

| FDI in EPZ | 58 | 123 | 199 |

| Other FDI | 150 | 205 | 241 |

| Total FDI inflow | 472 | 757 | 744 |

| Debt inflow | 149 | 154 | 159 |

| Total inflow: FDI+debt | 621 | 911 | 902 |

Source: Portfolio: A Review of Capital market and national economy by Chittagong stock Exchange.

(Foreign Direct Investment in Bangladesh)

Profile of Capital Outflows (5 years average)

Million USD

| Sectors | FY 1996-00 | FY 2001-05 | FY 2006-10 |

| Gas | 34 | 111 | 151 |

| Power | 13 | 156 | 340 |

| Telecom | 0 | 20 | 42 |

| Other FDI | 36 | 190 | 409 |

| Total profit & Income Remittance | 83 | 477 | 942 |

| Payment on Debt | 45 | 117 | 229 |

| Total profit & & outflow FDI+ debt | 129 | 594 | 1171 |

Source: Portfolio: A Review of Capital market and national economy by Chittagong stock Exchange.

The main question is, can the economy sustain the foreign exchange payments that will be needed to cover the profit repatriation, interest payment sand amortization of private debt? Clearly, in the Bangladesh context, the nature of private capital inflows has implied little augmentation of foreign exchange reserves. Thus three critical issues emerge from the nature of these capital inflows:

■ First, the high import intensity of FDI inflow and subsequent profit repatriation and interest payments, implies a worsening current account deficit associated with FDI.

■ Second, there is no discernible accumulation of foreign exchange reserves and consequently, no upward pressure on exchange rates (essentially ruling out the prospects of” Dutch Disease”)

■ Third this FDI together with private sector borrowing in foreign currency, which has risen to an estimated USD 600 million a year between FY 01-FY 05, and over a billion USD a year for the next 5 years.

Bangladesh Status:

From the inception of the independence Bangladesh has been in the center of economic investment incentive for many countries and institutional bodies of the world. With the passage of time Bangladesh reform its regulatory structure in regard to the FDI to open up the new avenue and to dislodge the compliances related to the FDI. But the effort of this structural progress has back warded by sudden and unexpected political influence and changes. The situation becomes worse one in the September attack on US. During this period flow of FDI all over the world shrunken at a greater extend. Bangladesh had also severely affected by that unwanted changes in the world scenario. Before going for in depth analysis the status of Of Bangladesh from different aspects are discussed. Bangladesh could be an attractive place of FDI. It is located between the growing markets of south Asia.

- Economic Status: The macroeconomic situation of the country is by large, stable, characterized by a manageable fiscal deficit and low current account deficit. In external trade, it has steady export growth. Foreign Exchange reserve is not bad.

- Political Status: Bangladesh is a developing country having a republic type democratic government. It has British style parliamentary system. After liberation in 1971 the then government nationalized all the key industries. As a result, aid from wesrn world remains as the means of survival. But development of Bangladesh through aid seems to have failed. We see hat Bangladesh is still poverty-ridden. As the effectiveness of aid declined very much demand arose about market access to the developed countries of the product & services of developing countries. But the market access of developed countries is faced with several problems of which politics seems to be prominent. A free trade policy other wise called globalization is seen as a lively remedy to solve both the problems of developed and developing countries.

- Investment Status: The present democratic government concentrates on more local & foreign investments in oil, gas, cement, infrastructure, textile sectors of Bangladesh to face the challenges of the twenty first century. Though prospects are there in Bangladesh, due to insufficiency of capital & technology greater investment is no taking place. However the recent trends o administrative, banking and infrastructure reform process, low rate of inflation compared to the neighboring countries( in Pakistan 11.2%, in India 8.5%, Srilanka 16.7 % and Bangladesh 5%) and separate export processing zones are some of the indicators of the countries development process. That may help in attracting local and foreign investors from developed countries.

Besides, the most important tasks is to revive the rural economy so that the migration of rural people will come down, because a country like Bangladesh has poor resources to meet the bargaining demand of the citizens already settled in the urban areas.

Investment Registration Statistics in Bangladesh:

Before going for full-length analysis of the FDI flow in recent period I have a short look on the industrial investment status. The industrial investment mainly consists of private versus public, and local versus foreign investment. The analysis of industrial investment status will provide us good information as to how we are using the FDI. The economy of Bangladesh has been gradually drawing the attention of private sector investors since it’s opening up in early ’90s. Manufacturing is becoming increasingly vibrant claiming a significant share in the total investment.

Table: Distribution of Private Investment Projects (Local and Foreign) Registered with BOI from FY 1994-95 to FY 2006-2007.

(In million US$)

| Fiscal year | Local investment | Foreign investment | Total investment | Growth |

| 1994-95 | 91 | 25 | 116 | — |

| 1995-96 | 90 | 53 | 143 | 23% |

| 1997-98 | 457 | 804 | 1261 | 782% |

| 1998-99 | 846 | 730 | 1576 | 25% |

| 1999-00 | 1171 | 1516 | 2687 | 70% |

| 2000-01 | 1108 | 1054 | 2162 | – 20% |

| 2001-02 | 1137 | 3440 | 4577 | 112% |

| 2002-03 | 1183 | 1926 | 3109 | – 32% |

| 2003-04 | 1324 | 2119 | 3443 | 11% |

| 2004-05 | 1420 | 1271 | 2691 | – 22% |

| 2005-06 | 1531 | 302 | 1833 | – 32% |

| 2006-07 | 2027 | 368 | 2395 | 31% |

| Total | 12385 | 13608 | 25993 | — |

| Share (%) | 47.65% | 52.35% | 100% | — |

Source: IIMC Board of Investment, June 2003

During 1994-95 to 2006-07, cumulative private investment registered with Board of Investment (BOI), the apex private investment promoting and facilitating body, totaled US$ 25,933 million. The registered investments consist of 47.65 percent as local and 52.35 percent as foreign (100 percent and Joint Venture). Table 8.3 presents the time-series data during FY 1994-95 to FY 2006-07. In FY 1994-95, total private investment registered amounted US$ 116 million, whereas in 2006-07, it reached US$ 2,395 million.

2004-05 experienced a 31 percent growth in the overall investment comprising of 32 percent growth in local and 22 percent in foreign investment. See table in above for more information.

Foreign Private Investment Projects Registrar with Bangladesh:

As per registration data, agro-based and chemical are the two most growing sectors in FY 2006-07. Manufacturing sector recorded 39 percent growth in FY 2006-07 compared to FY 2001-02.Simultaneously, total share of manufacturing grew from 55 percent to 62 percent in 2006-07..

Table: Sector-wise Distribution of Foreign Private Investment Projects register with BOI from FY 1999-00 to 2006-07.

(In million US$)

Sector | 1999-2000 | 2000-2001 | 2001-2002 | 2002-2003 | 2003-2004 | 2004-2005 | 2005-2006 | Share in 2006-07 | |||||||||

Agro based | 15.90 | 7.95 | 63.65 | 5.95 | 0.72 | 0.28 | 64.46 | 17.50% | |||||||||

| Food & allied | 48.89 | 346.47 | 19.97 | 2.41 | 0.62 | 4.34 | 21.46 | 5.82% | |||||||||

| Textiles | 106.91 | 92.76 | 50.28 | 41.03 | 201.57 | 50.64 | 37.83 | 10.27% | |||||||||

| Printing & packing | 9.00 | – | 2.00 | 0.18 | 122.01 | 2.35 | 0.58 | 0.16% | |||||||||

| Tannery & Rubber | 4.05 | 21.09 | 8.62 | 0.63 | – | – | 1.78 | 0.48% | |||||||||

| Chemical | 113.64 | 53.85 | 336.51 | 962.43 | 201.53 | 44.84 | 74.90 | 20.33% | |||||||||

| Glass & Ceramic | – | 99.39 | 53.26 | 142.13 | 17.11 | 5.30 | 3.19 | 0.87% | |||||||||

| Engineering | 21.31 | 10.62 | 96.84 | 20.98 | 29.77 | 57.86 | 25.65 | 6.96% | |||||||||

| Service | 596.59 | 2279.30 | 1290.85 | 770.99 | 650.70 | 134.93 | 137.25 | 37.25% | |||||||||

| Miscellaneous | 137.21 | 528.62 | 3.56 | 172.27 | 48.03 | 0.98 | 1.33 | .36% | |||||||||

| Total | 1053.50 | 3440.05 | 1925.54 | 2119.88 | 1271.88 | 301.52 | 368.42 | 100% | |||||||||

Source: IIMC Board of Investment, June 2003

Table depicts the time-series data during FY 1999-00 to 2006-07. See table in above for more information. Registration of local industries also grew substantially by 32 percent. Engineering, printing and packaging, agro-based and food and allied sectors have led the growth .The share of manufacturing in local investment registration is 95 percent of the total investment proposals in 2006-07 that grew by 37 percent over 2005-06.

The present investment trend indicates that the industrial growth would rise to 7 percent in the FY 2003-04. It may be noted here that the manufacturing sector maintained an average of 8.2 percent growth during 1999-00 to 2002-03, which however, sharply decelerated to 5.6 percent during 2003-04 to 2004-05. Because of market-oriented fiscal measures and restructuring of various facilitating agencies, the industrial growth in the FY 2006-07 has again increased to 6.62 percent.

Comparative statement of sector wise distribution

Table: Comparative Statement of Sector-wise Distribution of Local Private

Investment registered with the BOI from FY 2001-02 to 2002-03.

Sectoral Local Investment (In million Taka)

| Particulars | FY 2001 – 2002 | FY 2002 – 2003 | Growth |

| Agro based | 4900.17 | 9132.26 | 86% |

| Food and allied | 5285.93 | 8697.28 | 65% |

| Textiles | 50772.27 | 43374.80 | – 15% |

| Printing and packaging | 1054.07 | 3045.47 | 189% |

| Tannery and rubber | 794.23 | 874.00 | 10% |

| Chemical | 11449.49 | 5914.00 | – 48% |

| Glass and ceramic | 2451.83 | 506.04 | – 79% |

| Engineering | 4187.17 | 39031.65 | 832% |

| Service | 6065.48 | 4778.00 | – 21% |

| Miscellaneous | 1099.10 | 1172.72 | 7% |

| Total | 88059.74 | 116526.21 | 32% |

Source:IIMCBoardofInvestment,june2003

From the above table we can see that engineering sector got the priority over other sectors. Agro based, and printing and packaging got the attention of the investors. The higher percentage investments in the engineering sector indicate that industrial sector got the priority over others.

Recent FDI flows over the world:

Asia, for some time now, has been a major influence in the global economy. South Asia, however, lags far behind in comparison despite its huge potential. Opportunities abound in terms of prospective investment in the South Asian countries since they offer different sorts of incentives. Many countries do not show any discriminating attitude towards foreign investors and they are allowed to take home their profits. In fact, over the last few years, countries in South Asia have come to adopt Foreign Direct Investment (FDI)-specific regulatory frameworks to support their investment-related objectives. These have been reflected in recent trends of the FDI inflows in South Asia, which increased by 32% as a whole and amounted US$ 4 billion in 2001 while global FDI inflows plunged by 51%. South Asian countries received US$ 3 billion as FDI in 2000. UNCTAD’s World Investment Report (WIR) 2002 revealed that global FDI inflows, after reaching US$1492 billion, record high in 2000, declined sharply to US$ 735 billion in 2001. Such a plunge, for the first time in a decade, was mainly the result of weakening of the global economy, notably in the world’s three largest economies, all of which went into recession. A consequent drop in the value of cross-border merger and acquisitions, US$ 594 billion, completed in 2001, was only half of that in 2000 happens to be another reason as well. As a result, the downturn in FDI in developed countries was 59% against a 14% drop in developing countries.

| Ranking of FDI Recipient and Donors | ||||

| FDI Recipient | FDI Donors | |||

| Developd | Developing | 1. USA | ||

| 1.USA | 1.Mexico | 2.France | ||

| 2.UK | 2.India | 3.Germeny | ||

| 3.Netherlands | 3.China | 4.Japan | ||

4.8 Flow of FDI in South Asia:

| FDI Inflow by south Asian countries | |

| Country | FDI Inflow |

| India | $2300 million |

| Pakistan | $308 million |

| Sri Lanka | $217 million |

| Bangladesh | $170 million |

| Nepal | $13 million |

| Maldives | $12 million |

| Bhutan | Not Recorded |

| Source: Internet | |

FDI inflows into South Asia went up by 32% as a whole and amounted US$ 4 billion in 2001 while South Asian countries received US$ 3 billion as FDI in 2000. According to the WIR 2002, FDI inflows to India went up from US$ 2319 million in 2000 to US$ 3403 million in 2001, which is a 47% increase. Pakistan, too, experienced an increase in FDI inflow, where it reached US$ 385 million in 2001, a 26% increase over US$ 305 million in 2000.

In 2001, south Asian Countries received $3 billion in FDI, which is $100 million below that of the previous year.

Administration of FDI in Bangladesh:

Since market economy concept is accepted in Bangladesh and foreign exchange controls are relaxed, the international community has taken a keen interest in this region. When somebody intends to initiate joined venture in Bangladesh, he should look for regulatory support. That is here the Board of Investment (BOI) come in, this is a government agency.

Structure & Objectives:

Board of Investment (BOI) was established by the investment board Act 1989 to promote and facilitated investment in the private sectors both from domestic and overseas sources with a view to contribute to the social economic development of Bangladesh. It is headed by the Prime Minister and is a part of the Prime minister’s office. It’s membership included representatives (at the highest level) of the relevant ministries- industry finance, planning, textiles, foreign, commerce, telecommunications, energy power, science and information & communication technology et.al. As well as others, such as Governor of Bangladesh Bank, precedents of FBCCI and BCI.

Objective of BOI:

Broadly, the objective of BOI is to encourage and promote investment in the private sector both from domestic and overseas sources and to provide necessary facilities and assistance in the establishment of industrial sectors with a view to contribute to the socio-economic development of Bangladesh.

Functions & Facilities:

Broadly, BOI is responsible for facilitating private investment in the country. According to the BOI Act, its functions are:

- Providing all kinds of facilities in the matter of investment of local and foreign capital for the purpose of rapid industrialization in the private sector;

- Implementation of the government policy relating to the investment of capital in industries in the private sector;

- Preparation of investment schedule in relation to industries in private sector and its implementation;

- Preparation of area-schedule for establishment of industries in the private sector and determination of special facilities for such areas;

- Approval and registration of all industrial projects in the private sector involving local and foreign capital;

- Identification of investment sectors and facilities investment in industries in the private sector and giving wide publicity thereof abroad;

- Invention of specific devices for the purpose of promotion of investment in industries in the private sector and their implementation;

- Creation of infrastructural facilities for industries in the private sector;

- Determination of terms and conditions for employment of foreign officers and experts and others employees necessary for industries in the private sector in the private sector;

- Preparation of policies related to transfer of technology and phase-wise local production in the private sector and their implementation;

- Providing necessary assistance in the rehabilitation of sickly industries in the private sector;

- Financing and providing assistance in the financing of important new industries in the private sector;

- Adoption of necessary majors for creation of capital for investment in industries in the private sector;

- Collection, compilation, analysis and dissemination of all kinds of industrial data and establishment of data-bank for that purpose; and

- Doing such other acts and things as may be necessary for the performance of the above functions.

In addition to the above, recently BOI has been entrusted to give approval of foreign offices i.e. brunch, liaison , representative and buying houses.

Facilities Available from BOI:

To summarize, facilities and services available to the investors from BOI could be described in three stages.

Stage 1: Pre-investment Information and Counseling

At this stage, BOI provides all sorts information required by an investor to undertake initial investment move. Professional investment and business counselors provide cordial assistance upon visit to the BOI office over phone, by email & fax and express mailing. It also assists in company formation.

Stage 2: Special Welcome Service to Foreign Investors

BOI has a welcome service desk Zia International Airport (ZIA) operating round- the-clock. It assists in obtaining necessary immigration and Visa on Arrival / Landing Permit, hotel accommodation and counseling arrangement.

Stage 3: Investment implementation and Commercial Operation

Once the investor decides to invest and forms a company, BOI provides following specific facilities and comprehensive services upon confirmation of the first one i.e. / registration of the company with BOI.

- Registration of the company

- Obtaining Industrial plot

- Obtaining Utility Connections

- Registration / Approval for foreign loan, Suppliers’ Credit, PAYE

- Scheme etc.

- Import of Machinery & Raw Materials

- Obtaining Work Permit

- Remittance of Royalty, Technical know-How and Technical

Assistance Fees.

Business set up at a Glance:

Implementing a 100% foreign-owned or joint venture industrial project in Bangladesh is a rather simplified process. The entire Process is divided into 5(five) major steps as presented the following diagram. BOI supports are available in step 1 through 4.

Major Steps to set up a Plant in

Bangladesh & BOI Assistance:

Terms and Condition of BOI:

1) Investors shall have to take necessary safety measures as Factory Act, 1965;

2) Investors shall have to arrange sufficient fire fighting equipment as safety measures of the project;

3) Investors shall have to import the machinery, spare parts and raw materials as per existing Import Policy Order of the Government;

4) Investors shall have to obtain necessary clearance from the Deptt. Of Environment to ensure that the manufacturing process do not pollute the environment;

5) Investors shall have to arrange preservation of rain water for using in the factory to reduce pressure on ground water;

6) Investors shall have to should have to submit the quarterly report to BOI (IIMC) regarding progress of implementation of the project in every quarter till the unit goes into commercial production. After going into commercial production, half-yearly performance report regarding production and employment of the project shall have to be submitted ;

7) Investors shall have to take prior permission from BOI in case of any amendment of this registration letter including ownership or location of the project;

8) Any effluent of the industrial unit should not be discharged into the nearby river connecting lake or general water reservoir without proper treatment.

9) Investors shall have to provide/ create the following facilities, if applicable;

(1)Day care center;

(2)Maternity leaves;

(3)Low cost and safe housing facilities for the low paid female workers, near & around the factory;

(4)Equal space and allowances for male & female workers in the organization;

(5)Low prices canteen;

(6)Enact effective rules of conduct to enable favorable working atmosphere among the male and female workers;

10) All other terms and conditions the registration letter No. IP/ P&P / 9(1639)/ 243 dated 02-02-1998 will remain unchanged..

The Board of Investment reserves the right to cancel the registration of an investment if any of the above conditions or any part of the condition is violated

Trends OF FDI in Bangladesh

FDI Inflow survey in Bangladesh:

Foreign private capital flows into Bangladesh have taken three forms: FDI, portfolio investment, and foreign currency loans (supplier credit or commercial loan). But liberalization of the investment regime, while making foreign investment procedures simpler, has also made it difficult for the central bank to mobilize information on capital flows. The Bangladesh Bank has been experiencing difficulty reporting FDI accurately as private capital flows emerge as a significant component in the balance of payments.

FDI Inflow Survey 2002 was successfully conducted by BOI, for the first time in Bangladesh in February 2003.It was the first-ever attempt to gather credible data on actual FDI inflow on the basis of definition given by UNCTAD. The World Investment Report 2003 (UNCTAD-2003) mentioned that ”FDI flows to Bangladesh and other countries in the sub region declined. However, in the case of Bangladesh, FDI flows in 2002 would have been higher if investment in kind were included.

The FDI census in Bangladesh:

The Bangladesh Board of Investment (BOI) conducted a census of foreign direct investors in February 2003 to gather comprehensive primary data and actual FDI inflows based on projects registered with BOI and the Bangladesh Export Processing Zones Authority.

| Actual FDI Inflow in Bangladesh in 2002 and 2003 | ||||

| Components | 2002 | 2003 | Growth | Component |

Jan-Dec | Jan-Dec | (%) | Share | |

| 1.Equity | 133.8 | 198.36 | 48.30% | 45.90% |

| 2.Reinvstment | 116.8 | 186.47 | 59.60% | 43.20% |

| 3.Intra-Company Borrowing | 77.7 | 46.97 | -39.50% | 10.90% |

| Total | 328.3 | 431.8 | 31.50% | 100% |

Source: 1. Bangladesh Bank Enterprise Survey

2. Provisional of FDI inflow Survey by BOI and EPZA

•FDI inflows in 2002 were $328 million (compared with $ 58 million on a balance of payments basis reported by the Central Bank of Bangladesh). Half of it was financed by equity, 31% by reinvested earnings and 19% by intra-company loans. This is an example of how careful FDI statistics need to be interpreted, given the different ways in which they are compiled.

Summary of FDI inflow by components:

According to the commitments made in the Mid-term Strategic Promotional Plan 2003-04 of BOI, the first half yearly FDI Inflow survey of 2003 was undertaken by BOI in cooperation with BEPZA. This Report, the second of its kind, presents the findings of the survey in detail.

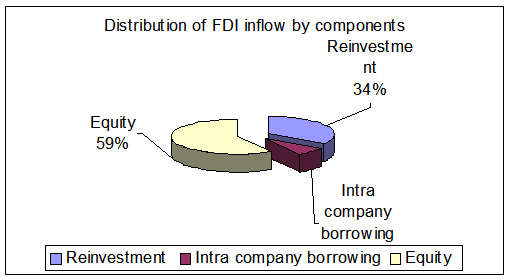

Distribution of FDI inflow by Components:

- Total FDI inflow during January-June 2003 is US$ 287.667 million.

- Equity is the major portion of the inflow constituting 59%.

- Reinvestment stands for about 34% of the total investment.

- Intra-company borrowing comprises of 7% of the FDI.

Equity capital is the foreign direct investor’s purchase of shares of an enterprise in a country other than its own.

Reinvested earnings comprise the direct investor’s share (in proportion to direct equity participation) of earnings not distributed as dividends by affiliates, or earnings not remitted to the direct investor. Such retained profits by affiliates are reinvested.

Intra-company loans or intra-company debt transactions refer to short- or long-term borrowing and lending of funds between direct investors (parent enterprises) and affiliate enterprises.

Table: Summary of FDI inflow in Bangladesh during January – June 2003

| FDI Component | BOI Registered | BEPZA Registered | Total |

| In million US $ | In million US $ | In million US $ | |

| 1. Equity | 126.316 | 42.339 | 168.655 |

| a. Capital machinery | 52.219 | 29.528 | 81.747 |

| b. Cash | 74.097 | 12.811 | 86.908 |

| 2. Reinvestment | 72.833 | 25.060 | 97.893 |

| 3. Intra Company borrowing | 6.819 | 14.300 | 21.199 |

| Total | 205.968 | 81.699 | 287.667 |

Source: 1. Bangladesh Bank Enterprise Survey

2. Provisional of FDI inflow Survey by BOI and EPZA

- FDI in the form of equity is significantly higher in BOI registered projects (61%) in comparison to BEPZA projects (51%).

In the above graph foreign Direct investment interns of component is higher increase of Equity is 59% and Re-investment is the 34% and third is enter company Borrowing 7% in year 2003.

Some more parts: