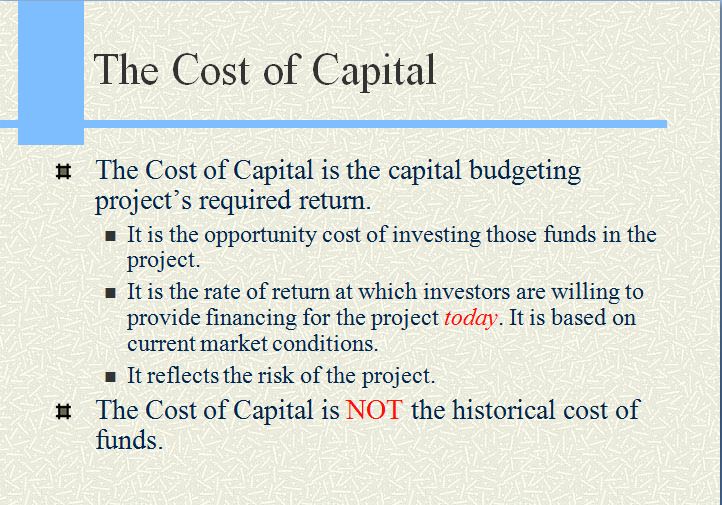

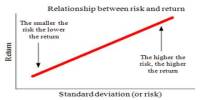

The cost of capital determines how a company can raise money (through a stock issue, borrowing, or a mix of the two). This is the rate of return that a firm would receive if it invested in a different vehicle with similar risk. The required return necessary to make a capital budgeting project, such as building a new factory, worthwhile. Cost of capital includes the cost of debt and the cost of equity. The Cost of Capital is not the historical cost of funds.

Lecture on The Cost of Capital