1.1 INTRODUCTION

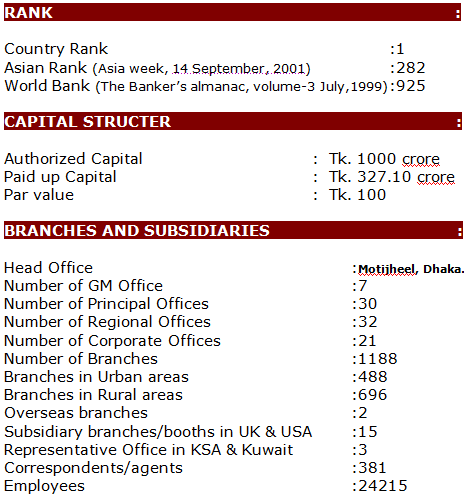

Sonali Bank Limited, the largest Commercial Bank in Bangladesh was established in 1972 under Presidential Order No. 26 of 1972. The bank is fully owned by the government of the People’s Republic of Bangladesh. The Bank had 1186 branches including two overseas branches(Kolkata and Siliguri in India) as on 31st December 2004. Out of total 1186 branches, 696 are operating in the rural areas and 488 in the urban areas. Besides, 25 booths under different branches are performing specialized functions at different locations.

Sonali Bank Limited discharge the treasury function as the agent of the Bangladesh bank. It collects tax, Stamp duty and registration fees, Operate special savings account, pay salaries to the teachers of Schools, madrashas and colleges and pension to the retired govt. employees. The bank provides funding to some income generating and economic development project namely, poverty alleviation credit programme, female special credit programme and agro based industrial programme in the rural areas. It has large participation in foreign Exchange business and off balance sheet activities.

Sonali Bank Limited performs all traditional banking functions including deposit mobilizations and lending under 3(three) main sections namely- General banking section, advanced banking section and Foreign Exchange section. Accounts Maintaining, Cash department and Remittance are the main section of general banking. All types of accounts like Current accounts, Saving accounts, Fixed Deposit Account, Short Term Deposit account, Deposit Pension Scheme Account, Call Deposit Account etc, their opening and closing procedure all this maintain in the Account Maintaining section. All types of cash receive and payment are done by the Cash Department and Inland and outland Remittance are done by the Remittance Section. Advanced banking section deals with different types of lending mainly Short-term loans; Mid and long-term loans and Industrial Credit. Short-term loans divided into various types of loans and advances, such as Overdrafts, Cash credit (Pledge, hypothecations), Small loans, Agriculture loans (crop hypothecations), Rural hosing, and Rural transportation etc. Mid and long term loans also divided several types of loans. Some of them are Agro based industries, Frozen food, Computer Software and Information Technology, Export oriented industries, CNG filling stations, Pharmaceutical industries, Chemical industries, Paper industries etc. Foreign Exchange section consists of three sections namely-Import Sections, Export Sections And Foreign Remittance Section.

1.2 Objective of the study

The specific objectives aimed for this study are:

To highlight and evaluate General banking and Advance banking system.

To discuss about foreign Exchange banking.

To highlight about Remittance Management System (RMS).

1.3 Research methodology

Information used to prepare this report has been collected basically from secondary data source. The secondary sources of information were collected from Central Accounts Department, IT Division, (head office), Wage Earners Corporate Branch, Dhaka, annual reports ,materials from various newspapers and articles and web sites.

1.4 Sources of Secondary data

Annual reports of the Sonali Bank Limited

Consolidated Income Statements and Balance Sheets

Official records of the bank

Some published research report, books, journals, articles and policy matters.

Web site

1.5 Limitations of the study

Difficulty in collecting existing data because of company secrecy etc.

The record system of the annual report is not efficient

Lack of access to many sections of the organization

Time is not sufficient to complete the study perfectly.

1.6 Coverage of the study

The report covered four major areas of Sonali Bank Limited, which are:

General Banking Section

Advanced Banking Section

Foreign Exchange section

Remittance Management System (RMS)

2.1 BACKGROUND

Sonali Bank, the largest Commercial Bank in Bangladesh was established in 1972 under Presidential Order No. 26 of 1972. The bank is fully owned by the government of the People’s Republic of Bangladesh. The Bank had 1186 branches including two overseas branches (Kolkata and Siliguri in India) as on 31st December 2004. Out of total 1186 branches, 696 are operating in the rural areas and 488 in the urban areas. Besides, 25 booths under different branches are performing specialized functions at different locations.

From 10 December 2002 Sonali Bank (UK) Ltd (a joint venture company of Sonali Bank And Govt. of Bangladesh) has been operating to channelise banking activities covering the whole Europe.

A subsidiary company named Sonali Exchange Co. Inc. was incorporated on 4 April 1994 under the laws of the State of New York; Department of State licensed on 17 October 1994 by the State of New York Banking Department and commenced operation as an International Money Transmitter from 12 December 1994 through which Bangladeshi citizens living in the USA are conveniently remitting money to Bangladesh. There are three representative offices of Sonali bank in Jeddah and Riyadh of KSA and another in Kuwait engaged in motivating Bangladeshi expatriates living there to remit money through banking channel.

In 15 november 2007 the bank started its new journey, changed its structure named Sonali Bank Limited. Now it is governed by a Board of Directors consisting of 09(nine) members headed by a Chairman. Mr. Ali Imam Majumder, who was posted as the Principal Secretary of the Government of Bangladesh on 31-10-2006 and serving in this position till date and Assumed the current responsibility of the Cabinet Secretary in the afternoon of 06-12-2006 when Mr. Sirajuddin Ahmed Chowdhury is the Chief Executive Officer / Managing Director. Slogan of Sonali Bank Limited-“ YOUR TRUSTED PARTNER IN INOVATIVE BANKING ”

2.2 Management of Sonali Bank

Sonali Bank is operated by a board of directors, which is composed of seven members. Of the seven members, one is the Chairman who is appointed by the Government. All the board members are given appointment for a term of three years.

List of Board Of Directors

| SLNo | Name | Designation |

1 | Mr. Ali Imam Majumder | Chairman |

2 | Mr. Sheikh Abdul Hafiz, FCA | Director |

3 | Mr. Md. Shafiqur Rahman Patwari | Director |

4 | Mr. Md. Humayun Kabir | Director |

5 | Brig. Gen. M. Zahirul Islam, PSC, G | Director |

6 | Dr. Md. Idris Ali Dewan | Director |

7 | Mr. Iqbal Mahmood | Director |

8 | Mr. A.K.M Nozmul Haque | Director |

9 | Mr. Abdul Waheed Khan | Director |

2.3 Mission Of Sonali Bank Limited

To Provide all kind types of banking service at the doorsteps of the people.

To establish a countrywide information network system to facilitate monitoring and to improve the quality of service of the bank.

To provide general advances in different sectors to up-gearing the economic activities.

To promote the economic development of the country as well as increase per capital income.

To provide term loan to establish new industries to create opportunities for new employment.

2.4 Vision of Sonali Bank Limited

The vision of the bank is to poverty alleviation with the collaboration of government participating in various social and development programs and takes part in implementation of various policies and promises made by the government.

2.5 Objectives of Sonali Bank Limited

The main objective of the Bank is to provide all types of banking services at the doorsteps of the people of the nation. The bank also participates in various Social and development programs and implements policies and commitments of the Government.

2.6 Corporate Profile of Sonali Bank Limited

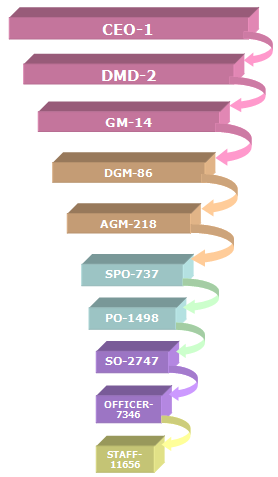

2.7 Organization Structure of Sonali Bank

2.8 Overview of the nature of business:

The principal activities of the bank are to provide all kinds of commercial banking services to its customers. It also performs Government Treasury functions as an agent of the Bangladesh Bank where there is no Bangladesh Bank. The export and import trade of Bangladesh with Socialist Countries under various barter agreements are mainly handled by the Bank. Summarizing below the activities taken up by the bank is:

To provide all kinds of commercial banking services to its customers authorized by Bangladesh Bank

To perform Government Treasury functions also as an agent of the Bangladesh Bank.

The export and import trade of Bangladesh with Socialist Countries under various barter agreements are mainly handled by the Bank.

International Banking.

2.8.1 Deposit and Other Accounts:

Total deposit of the Bank as on 31 December 2004 stood at Tk. 25,223 crore which shows an increase of Tk. 2,190 crore over that of the preceding year. The rate of increase in deposit was 9.50%. Total deposit-comprised demand deposit Tk. 6,644 crore and time deposit Tk. 18,579 crore . In terms of Govt., Public and Private Sector the deposits are Tk. 2,733 crore (10.84%), Tk. 4,432 crore (17.57%) and Tk. 18,058 crore (71.59%) respectively.

2.8.2 Advances:

The Bank has continued its lending operation in the productive and priority sectors covering Agriculture, Industry, Trade and Commerce. Total loans and advances of the bank as on 31 December 2004 stood at Tk. 16,828 crore which is 8.43% higher than that of the preceding year. Govt., Public and Private sector the total Loans and Advances are Tk. 346 crore (2.06%),Tk. 2,531 crore (15.04%) and 13,951 crore (82.90%) respectively. Loans and Advances in the preceding year was Tk. 15,520 crore.

2.8.5 Investment:

Besides sanctioning loans and advances the bank makes investment in various approved securities. Total amount of investment in Government, Public and Private sectors in 2004 was Tk. 6,758 crore that is 5,307 crore, 311 crore and 1140 crore respectively.

2.8.6 Foreign Exchange Business:

The bank with its 42 authorized branches including 2 wage earners branches and 381 foreign correspondents and agents located in different countries of the world is dealing in all types of foreign exchange business.

The total foreign exchange business of the bank for the year 2004 was Tk. 21,913 crore as against TK. 16,602 crore in 2003, which exceeds the previous year’s business by Tk. 1,454 crore.

2.8.7 RURAL BANKING & MICROCREDIT

Rural lending continues to be one of the core lending programs of Sonali Bank. Sonali Bank stepped into rural lending in 1973. Any comparative study would clearly depict Sonali Bank’s supremacy in the Rural Finance Market over other private or public sector commercial banks in Bangladesh. All the on-going rural and micro finance outlets of Sonali Bank aim at increasing agricultural output, promote agro-based Small and Micro Enterprises (SMEs), facilitate agro-based support services, create and sustain employment opportunities through linking the rural and urban poor to the various Income Generating Activitis (IGAs) and reduce poverty. Sonali Bank’s Rural / Microcredit has been channeled through a wide network of 1073 rural branches.

Broadly, Sonali Bank’s rural and micro credits are of following categories:

Program Credit:

These outfits aim at addressing the credit need of the mainstream agriculture ( viz. cereal crops, tubers, pulses, oilseeds, etc.) and agro-sub-sectors (viz. dairy, poultry, fisheries, hatchery, etc.) as well as agro-offshoots ranging from medium term as in small and medium agro-enterprises to long term as in agro-based industries.

The programs include Special Agricultural Credit Program (credit to subsistence and marginal farmers as well as share-croppers for raising seasonal crops )

Financing the poor and subsistence farmers grouped under formal cooperative societies.

Finance to agro-based Small and Micro Enterprises (SMEs) under a scheme named Special Investment

Finance to Agrobased Industries.

Finance to various farm and off-farm micro enterprises.

Credit to agro-support sectors (viz. various irrigation equipments, agricultural implements, tractors, powerteler etc.

Supervised Credit: These programs predominantly aim at reducing the level of poverty and generate self-employment opportunities with the core objective of improving the quality of life.

Linkage Credit: These credit outlets have been the collaborative efforts and eventually aim at reaching the targeted hardcore rural and urban poor, socially as well as technically mobilized and prepared by Partner Organizations (NGOs and

2.8.8 Computerization:

Sonali bank entered into the world of office automation system in order to keep pace with the rapid changing global market economy and to pave the way for materializing different policies adopted in internal banking activities. With a view to actualize these objectives Sonali Bank installed an IBM Mini computer at its Head Office in December 1989. Subsequently an IBM RISC System (RS/6000) and an OS/2 LAN System were added. Presently inter-branch reconciliation, loan classification, payroll of head office employees, treasury function, maintenance of provident fund accounts of bank’ staff and officers, maintenance of personal profile of all officers of the bank, preparation and sending of CIB information to Bangladesh Bank through diskettes, maintenance of data of Special recovery cell, preparation of Foreign exchange on daily basis, maintenance of credit information of big borrowers, clearing house operation etc. have been brought under the purview of computerization. Inter branch reconciliation, the biggest computerized job that had been run and processed in Mini Computer at Head office has been shifted to reconciliation Division in an IBM RISC based LAN there.

A total of 114 branches at home have been computerized of which 39 branches are providing ‘one stop service’. Sonali bank has joined the SWIFT network. At present 12 branches of the bank are connected with SWIFT network. Sonali bank recently launched ATM card also. All the employees of Sonali bank, head office now enjoy this facility.

2.8.9 IT PROJECT FINANCING

For growing international markets for software and data processing this scheme provides long term and short term credit facilities on easier terms to set up and run IT ased projects.

Eligibility: Entrepreneurs,of them at least two with recognized degree/diploma in Computer Science or Electrical Engineering / Telecommunication / Applied Physics & Electronics, forming a private limited company may apply. Experience in the related field will be preferred.

Loan Limit: Maximum Tk. 1.50 million. In deserving cases, upto Tk.10.00 million may be considered.

Debt-EquityRatio: 80:20.

Period: Maximum 6 years including 1 year grace

period.

Security:In case of Rented premises collateral of immovable at least covering prayed loan is needed. in case of project with own land & building no collateral security other than the personal guarantee of the loanees is required. Entrepreneurs offering collateral security will be preferred.Or Loan may be consider with personal guaranty of worthy person(s) (Third party) and in such case original certificates on academic achievements of the sponsor are required.

Interest Rate: 9% p.a.

2.8.10 IT EXPORT FINANCING

For export of software and processed data short term finance is extended to existing IT projects.

Eligibility : Feasibly implemented and properly staffed IT projects with export L/C or firm contract in hand may apply. Export through settlite, BTTB confirmation required.

Loan Limit : Tk. 1.00 million. For larger contract higher amount may be considered.

Debt-Equity Ratio: 90:10.

Period: L/C or Contract period plus 21 days but not exceeding 180 days from the date of disbursement.

Security: No collateral security other than the personal guarantee of the loanees is required.But for loan amount exceeding Tk. 1.00 million collateral will be required.

Interest Rate: 7% p.a.

2.8.11 UTILITY SERVICE

Sonali Bank offers multiple special services with its network of branches throughout the country in addition to its normal banking oper

Some More Parts-

Remittance Management System(RMS) of Sonali Bank Limited (Part-1)

Remittance Management System(RMS) of Sonali Bank Limited (Part-2)

Remittance Management System(RMS) of Sonali Bank Limited (Part-3)