In finance, a convertible bond or convertible note is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value. It is a fixed-income corporate debt security that yields interest payments but can be converted into a predetermined number of common stock or equity shares. It is a hybrid security with debt- and equity-like features. The conversion from the bond to stock happens at specific times during the bond’s life and is usually at the discretion of the bondholder. It originated in the mid-19th century and was used by early speculators such as Jacob Little and Daniel Drew to counter market cornering. It is a hybrid security that possesses features of both debt and equity.

Convertible bonds are most often issued by companies with a low credit rating and high growth potential. It offers investors a type of hybrid security, which has features of a bond such as interest payments while also providing the opportunity of owning the stock. Issuing convertible bonds can help companies minimize negative investor sentiment that would surround equity issuance. It can also help provide investors with some security in the event of default. Similar to regular bonds, a convertible bond comes with a maturity date and pays interest to investors.

Advantages:

- Investors receive fixed-rate interest payments with the option to convert to stock and benefit from stock price appreciation.

- Investors get some default risk security since bondholders are paid before common stockholders.

Disadvantages:

- Due to the option to convert the bond into common stock, they offer a lower coupon rate.

- Issuing companies with little or no earnings—like startups—create an additional risk for convertible bond investors.

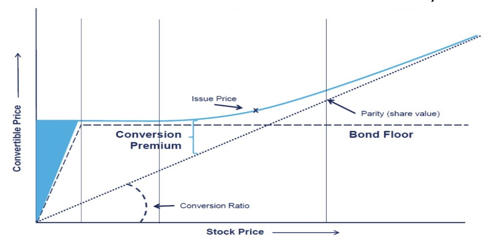

Convertible bonds are also considered debt security because the companies agree to give fixed or floating interest rates as they do in common bonds for the funds of investors. It protects investors’ principal on the downside, but allows them to participate in the upside should the underlying company succeed. Companies can force conversion of the bonds if the stock price is higher than if the bond were to be redeemed. To compensate for having additional value through the option to convert the bond to stock, a convertible bond typically has a coupon rate lower than that of similar, non-convertible debt.

Essentially, convertible bonds are corporate bonds that can be converted by the holder into the common stock of the issuing company. The investor receives the potential upside of conversion into equity while protecting downside with cash flow from the coupon payments and the return of principal upon maturity. Companies issue convertible bonds to lower the coupon rate on debt and to delay dilution. These properties—and the fact that convertible bonds trade often below fair value—lead naturally to the idea of convertible arbitrage, where a long position in the convertible bond is balanced by a short position in the underlying equity. A bond’s conversion ratio determines how many shares an investor will get for it.