Introduction

Generally by the word “bank” we can easily understand that the financial institution dealing with money. The whole scenario of the economy of a country can be ascertained by examining the condition of the banking sector. Banking sector has a vital role to play in the economic activities and development of any country. There are different types of banks like Central Banks, Commercial Banks, Savings Banks, Investment Banks, Industrial Banks, and Co-operative banks etc. But when we use the term “bank” without any prefix or restriction, it refers to the Commercial Banks. Commercial Banks are the primary contributors to the economy of a country like Bangladesh. In Bangladesh, the commercial banks are dominating the financial sector and macroeconomic management largely depends on the performance of the commercial banks as well as banking sector. Banking grew primarily in the public sector with main emphasis on restructuring of the financial system and development needs of the war-torn economy with gradual liberalization in subsequent years. It was increasingly felt that banks should be allowed in the private sector for giving a fillip to development process on the basis of private initiative. In the 80’s for the first time a number of banks in the private sector were allowed. Dhaka Bank is one of them. Today the banking concept is not continuing inside the branches or the cabin of the branches. The bankers are now practicing the non-cabin banking. The assurance of the availability of the service provider is main factor in bank service. As a result, it has become essential for every person to have some idea on the bank and banking procedure. At present, there are 56 scheduled banks operating all over the country. Out of these, 9 are state-owned (including five specialized banks), 38 are private commercial banks and the rest 9 are foreign commercial banks.

Even though banking sector in Bangladesh is going through a radical change, it still suffers from chronic inefficiency. The biggest problem of Bangladesh banking system is the bank loan default problem. Various initiatives have been undertaken to tackle the loan default problem in Bangladesh. One of them is to have a credit policy and procedures guideline mandated by the Bangladesh Bank.

Objective of the report

The objective of the report can be viewed in two forms:

• General Objective

• Specific Objective

General Objective

This internship report is prepared primarily to fulfill the Bachelor of Business Administration (B.B.A) degree requirement under the Department of BRAC Business School, BRAC University.

Specific Objective

More specifically, this study entails the following aspects:

• To provide a brief overview of Dhaka Bank and their historical background.

• To analyze the financial performance of Dhaka Bank Limited in the last three years.(2010-2012)

• To present my observation and suggestion to the bank.

• To identify the strength and weakness of bank based on the financial performance in the last three years. (2010-2012).

Methodology

In order to generate this report only secondary data has been used. The source that have been used to gather and collect data is given below-

Secondary Sources

• Annual Report of Dhaka Bank Limited from 2010-2012.

• Brochures of Dhaka Bank Limited

• Different written document of Dhaka Bank Limited

• Newspaper

• Web site

An Overview of Dhaka Bank Limited (DBL)

Dhaka Bank Limited is the leading private sector bank in Bangladesh offering full range of Personal, Corporate, International Trade, Foreign Exchange, Lease Finance and Capital Market Services. Dhaka Bank Limited is the preferred choice in banking for friendly and personalized services, cutting edge technology, tailored solutions for business needs, global reach in trade and commerce and high yield on investments, assuring Excellence in Banking Services.

Background of Dhaka Bank Limited

Dhaka Bank Limited is a scheduled bank that was incorporated under the Companies Act 1994, started its operation on July 1995 with a target to play the vital role on the socio-economic development of the country. Aiming at offering commercial banking service to the customers’ door around the country. This organization achieved customers’ confidence immediately after its establishment. Within this time the bank has been successful in positioning itself as progressive and dynamic financial institution in the country. This is now widely acclaimed by the business community, from small entrepreneur to big merchant and conglomerates, including top rated corporate and foreign investors, for modern and innovative ideas and financial solution.

Business Units

There are seven different business units generating business Dhaka Bank Limited:

• Small & Medium Enterprise (SME)

• Corporate Banking

• Personal Banking

• Islamic Banking

• Information Technology

• International Trade and Foreign Exchange

• Capital Market Services

All the units are being operated in a centralized manner to minimize costs and risks.

Small & Medium Enterprise (SME)

Dhaka Bank was among the first commercial banks to initiate SME banking in Bangladesh. Over the years continuous time and effort has been put in to understand the target market and their needs. The SME unit has worked on risk management system to cover the typical needs that the clients might have and has come up with flexible payment patterns which will help all the clients in the long run.SME Banking at Dhaka Bank Limited is now able to meet all sorts of working capital requirements relating to bidding for, obtaining and executing work orders.

The product range has been extended to cover guarantees, bid bonds and working capital requirements for different work/purchase orders issued by Government, Autonomous, Multinational and Private Sector Companies. In addition, clients are able to avail Trade finance products that facilitate export, import and distribution of goods, Leasing for power generation, equipment and machinery as well as working capital loans aimed at supporting business needs An interesting feature about the SME portfolio is that 52% of clients are rural, borrowing between Tk.12.00 Lac to Tk.15.00 Lac and thus consists mainly of small enterprises across Bangladesh. This has resulted in being appreciated by the Central Bank, who regulates the Small Enterprises Refinance Scheme, wherein, Dhaka Bank is a major recipient. During 2008, Dhaka Bank has extended its SME Banking network by setting up SME Service Centers. These service centers are expected to provide basic general banking services as well as loan facilities to SME clients. Dhaka Bank Limited participated in the recently conducted SME Fair 2009 at Bangabandhu International Convention Center from May 24-27, 2009.

Corporate Banking

Dhaka Bank’s Corporate Banking team provides banking services as well as financial support to local large and medium organization. Corporate Banking is the most conventional mode of business in low risk sectors. Dhaka Bank Limited has also designed a comprehensive risk management system to monitor and control their asset quality. Services that corporate team provides are:

• Letter of Credit

• Guarantee

• Import and Export Finance

• Syndicated Loan

• Project Finance

• Leasing

• Working Capital Finance

Dhaka Bank recognizes that corporate customers’ needs vary from one to another and a customized solution is critical for the success of their business. Dhaka Bank offers a full range of tailored advisory, financing and operational services to its corporate client groups combining trade, treasury, investment and transactional banking activities in one package, which has made Dhaka Bank Limited the favorable option in the corporate sector.

Personal Banking

Dhaka Bank Limited exerts special effort to develop and introduce new products and services through extensive market research to meet every facet of modern business. Dhaka Bank Limited introduced its personal banking division in 2003 which included restructuring the existing products and services and introducing new products, particularly electronic banking products like DHAKA BANK LTD Credit Card, ATM card and automated Phone Banking service from selected branches. Such services were highly appreciated by our customers. Different products

of Personal Banking are as follows:

• Deposit Accounts

• Forex Transaction

• E-Cash 24 hour banking

• Online Banking

• Credit Card

• Personal Loan

• Lockers

Amongst Private Sector banks, Dhaka Bank has already made its mark in the retail banking segment. The promotions like “Baishakhi Offer”, a strategic tie up with Electra International Limited, distributor of Samsung brand products, and “Freeze the Summer Campaign” a strategic tie-up with Esquire Electronics Limited, distributor of Sharp/General Brand electrical appliances saw Dhaka Bank to experience more than a reasonable growth on the Retail Banking business in 2004. The Personal Banking Division of Dhaka Bank Limited has 4 sections: Product Development, Operations, Personal Loan and Cards. The Depository Products and services that are currently available are given below:

• Savings A/C

• Current A/C

• STD A/C

• Fixed Deposit A/C

• DPS A/C

• Salary A/C

Islamic Banking

Islamic Banking is based on interest-free economic transactions; mutual participation and sharing of profit and loss through various modes of finance with its unique human face approach. Islamic banking has become quite popular in Bangladesh and due to that Dhaka Bank Limited opened its first Islamic Banking branch on July 02, 2003 at Motijheel Commercial Area, Dhaka. These Islamic Banking branches offer fully Sarah-based, interest free, Profit-loss sharing Banking Services. Dhaka bank Limited has shown tremendous performance in Islamic Banking. The operating profit of Islamic Banking Branches, Import & Export business generated by the Islamic Banking Branches showed remarkable performance and which has increased the overall profitability of Dhaka Bank to a great extent. Dhaka Bank Limited is also an active member of Islamic Banks Consultative Forum [IBCF], Dhaka and Central Shariah Board for Islamic Banks of Bangladesh. Dhaka Bank, operating 2 Islamic Banking Branches in complying with the rules of Islamic Shariah, which absolutely prohibits receipts and payments of interest in any form. The modus operandi of these two branches is totally different from other conventional branches. A separate balance sheet and income statement are being maintained as recommended by the Central Shariah Board for Islamic Banking in Bangladesh.

Information Technology

Dhaka Bank Limited is currently running countrywide true online fully automated banking system. The system allows their customers to do transactions all around the country. The bank cheques are all marked with Barcodes that makes each cheque unique and disallows it to be duplicated. All the signature and customer information with their pictures can be verified from any console at any branch on the bank. Dhaka Bank Limited’s Goal is to provide a true online banking system, which will not only fulfills the demand of time but also set new benchmarks in twenty-first centuries banking world.

International Trade and Foreign Exchange

International Trade forms the major business activity undertaken by Dhaka Bank Limited. The Bank with its worldwide network of correspondents and close relationships with key financial institutions provides an extensive trade services network to handle the required transactions efficiently. The key branches in Dhaka are Narayanganj, Chittagong and Sylhet deals with this. These offices are the focal point for processing Import and Export transactions for both small and large corporate customers Dhaka Bank Limited offers a complete range of Trade Finance services. Dhaka Bank Limited offers professional advice on all aspects of International Trade requirements, namely:

• Issue, advising and confirmation of Documentary Credits

• Arranging forward exchange cover.

• Pre-shipment and post-shipment finance

• Negotiation and purchase of Export Bills.

• Discounting of Bills of Exchange.

• Collection of Bills.

• Assist customers to insure all risks.

Capital Market Services

Dhaka Bank Limited has a significant presence in the country’s capital market operations. A specialized unit of the Bank, the ‘Investment Division’, deals in the sale and purchase of shares in the stock market and manages the Bank’s own portfolio. Investment Division offers clients the latest updates on the stock prices and trading of stocks. The facility may be availed by maintaining an account with the Investment Division. A minimum balance is required to be maintained in the account at the same time as a Commission is charged for undertaking the trade deals.

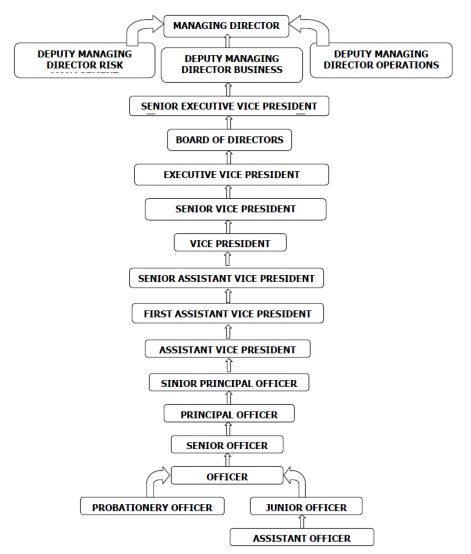

Organizational Hierarchy

SWOT Analysis

SWOT analysis is done for a company, to find out its overall Strengths, Weaknesses, Threats and opportunities leading to gauging the competitive potential of the company. The SWOT Analysis enables a company to recognize its market standing and adopt strategies accordingly. Here SWOT analysis of DHAKA BANK is made to understand the positioning of the bank better.

Strengths

• Strong corporate identity

According to the customers, DBL is the leading provider of financial services identity worldwide. With its strong corporate image and identity, it has better positioned itself in the minds of the customers. This image has helped DBL grab the personal banking sector of Bangladesh very rapidly.

• Strong employee bonding and belongings

DBL employees are one of the major assets of the company. The employees of DBL have a strong sense of commitment towards organization and also feel proud and a sense of belonging towards DBL. The strong organizational culture of DBL is the main reason behind its strength.

• Young enthusiastic workforce

The selection & recruitment of DBL emphasizes on having the skilled graduates & postgraduates who have little or no previous work experience. The logic behind is that DBL wants to avoid the problem of ‘garbage in & garbage out’. And this type of young & fresh workforce stimulates the whole working environment of DBL.

• Empowered Work force

The human resource of DBL is extremely well thought & perfectly managed. As from the very first, the top management believed in empowering employees, where they refused to put their finger in every part of the pie. This empowered environment makes DBL a better place for the employees. The employees are not suffocated with authority but are able to grow as the organization matures.

Weaknesses

• High charges of L/C

Presently DBL charges same rates for all types of import L/C. But for import L/C of exportsoriented industry, DBL should reduce the charge of L/C. As a result, exporter will be benefited and the country will earn more foreign exchange. The commission often even rises up to 30%.

• Discouraging small entrepreneurs

DBL provides clean Import Loan to most of its solvent clients. But they usually do not want to finance small entrepreneurs whose financial standing is not clean to them.

• Absence of strong marketing activities

DBL currently don’t have any strong marketing activities through mass media e.g. Television. TV ads play vital role in awareness building. DBL has no such TV ad campaign. Although they do a lot of CSR activities compared to other banks.

• Not enough innovative products

In order to be more competitive in the market, DBL should come up with more new attractive and innovative products. This is one of the weaknesses that DBL is currently passing through but plans to get rid of by 2010.

• Diversification

DBL can pursue a diversification strategy in expanding its current line of business. The management can consider options of starting merchant banking or diversify it to leasing and insurance. As DBL is one of the leading providers of all financial services, in Bangladesh it can also offer these services.

• High Cost for maintaining account

The account maintenance cost for DBL is comparatively high. Other banks very often highlight this. In the long run, this might turn out to be a negative issue for DBL.

Opportunities

• Distinct operating procedures

Repayment capacity as assessed by DBL of individual client helps to decide how much one can borrow. As the whole lending process is based on a client’s repayment capacity, the recovery rate of DBL is close to 100%. This provides DBL financial stability & gears up DBL to be remaining in the business for the long run.

• Country wide network

The ultimate goal of DBL is to expand its operations to whole Bangladesh. Nurturing this type of vision & mission & to act as required, will not only increase DBL’s profitability but also will secure its existence in the log run.

• Experienced Managers

One of the key opportunities for DBL is its efficient managers. DBL has employed experienced managers to facilitate its operation. These managers have already triggered the business for DBL as being new in the market.

• Huge Population

Bangladesh is a developing country to satisfy the needs of the huge population, a large amount of investment is required. On the other hand, building EPZ areas and some Govt. policies easing foreign investment in our country made it attractive to the foreigners to invest in our country. So, DBL has a large opportunity here.

Threats

• Upcoming Banks/Branches

The upcoming private, local, & multinational banks posse’s serious threats to the existing banking network of DBL: it is expected that in the next few years more commercial banks will emerge. If that happens the intensity of competition will rise further and banks will have to develop strategies to compete against and win the battle of banks.

• Similar products are offered by other banks

Now-a-days different foreign and private banks are also offering similar type of products with an almost similar profit margin. So, if all competitors fight with the same weapon, the natural result is declining profit.

• Default Loans

The problem of non-performing loans or default loans is very minimum or insignificant. However, this problem may rise in the future thus; DBL has to remain vigilant about this problem so that proactive strategies are taken to minimize this problem.

• Industrial Downturn

Bangladesh is economically and political unstable country. Flood, draught, cyclone, and newly added terrorism have become an identity of our country. Along with inflation, unemployment also creates industry wide recession. These caused downward pressure on the capital demand for investment.

An Overview of General Banking

General banking is the front-side banking service department. It provides those customers who come frequently and those customers who come one time in banking for enjoying ancillary services. The officers of this department have to perform several kinds of tasks. These are as follows:

• Account opening and close.

• Collection of cash, cheques from customers.

• Issuing of FDR, pay orders, cheque books and demand draft.

• Assisting customer to open various deposit scheme.

• Conducting clearing house activities.

• Collection of local and outward bills.

DBL General banking is divided into five sections

• Account opening section

• Bills and clearing section

• Remittance section

• Deposit section

• Cash section

Account Opening Section

Under this section, DBL Officer opens different types of accounts on the request of clients. The procedure of opening account is given below:

Procedure for Opening of Accounts

Before opening of a current or savings account, the following formalities must be completed by the customer:

• Application on the prescribed form

• Furnishing photographs

• Introduction by an account holder

• Putting specimen signatures in the specimen card

• Mandate if necessary

• National ID Card

After fulfilling the above formalities, DBL provides the customer a pay-in-slip book and a cheque book.

Application Form for Current/ Savings Account

Followings are the contents of the application form for opening Savings or Current account in DBL-

• Type of the Account: Individual/ Joint/ Proprietorship/ Partnership/ Limited Company/ Club/ Society/ Co-operatives

• Name of the Applicant(s)

• Father’s/ husband’s Name

• Present Address

• Permanent Address

• Number, Date of issue, Date of Expiry & Place of Issue of Passport (if any)

• Date of Birth

• Nationality

• Occupation

• Nominee (s)

• Special Instruction of Operation of the Account (if any)

• Initial Deposit

• Specimen Signature (s) of the Applicant (s)

• Introducer’s Information (Name, Account Number, Specimen Signature)

• In case of Joint Account

The following formality along with the documents is to be completed before opening an account:

• Two copies of photograph of the Applicant duly attested by the Introducer.

• Two copies of photograph of the Nominee duly attested by the Applicant.

• Passport No/ Voter Id No / National Id No/ TIN No/ VAT Reg. No/ Driving License No.

• Introducer’s signature on Account Opening Form to be verified by an officer under full signature.

• Work permits license no.

• In case of joint account, operational instructions are to be signed by the Joint Account Holders.

• In case of Club/ Society

General conditions of governing current/savings account

• Minimum Balance to be maintained in current account Tk.5,000 /- and in Savings account Tk. 500/-

• A suitable instruction by an introducer acceptable to the Bank is required prior to opening an account.

• Recent photographs of the Account openers duly attested by the Introducer must be produced.

• Recent photographs of the nominee duly attested by the account opener.

Deposits Accepted By DBL

Deposits that are taken by DBL are:

• Current Deposit

• Saving Deposit.

• Fixed deposit Receipts (FDR).

• Short Term Deposit (STD).

• Bearer Certificate Deposit (BCD).

• Deposit Pension Scheme (DPS).

Current Deposit, Saving Deposit, Fixed deposit, Short Term Deposit

Theoretically, total deposits are divided into categories on the basis of withdrawal procedure. Time deposit & demand deposit. In case of demand deposit money is withdrawn on demand. It includes current deposit & saving deposit. On the other hand, a deposit which is payable at a fixed date or after a period of notice is a time deposit; DBL accepts time deposit, for example, FDR. Short Term Deposit (STD) is hybrid A/C in which the features of current and saving account exist. In short Term Deposit account the deposit should be kept for at least seven days to

get interest. The interest offered for STD is less than that of saving deposit. In DBL, various big companies, Organizations, government departments keep money in STD accounts. Frequent withdrawal is discouraged and requires prior notice. Interest rate for STD Account – 5.00% (Half years compounding). In DBL, usually customers

give an instruction the Bank that their current account will be debited whenever its deposited amount crosses a certain limit and this amount will be transferred to the STD account. So bank follows this instruction by giving following entries.

- Customer’s Current A/C —————Debit.

- Customer’s STD A/C ——————Credit.

Bearer Certificate of Deposit

The objective of BCD is to convert black money into white and to reduce Hundi business. Bearer Certificate of Deposit account is almost same as Fixed Deposit account. But in case of BCD account no name and address are mentioned, the customer opens this type of account as a bearer, any person who bears the BCD receipt can en-cash it. Another difference of BCD with FDR is that the customer deposits the money deducting the interest. At the maturity he withdraws the total money for which he opened the BCD account. Interest rate on BCD account is same as Fixed Deposit Account.

- For 3 months @ 10.75%

- For 6 months @ 10.75%

- For 1 Year or above @ 10.50%

Project part

Introduction

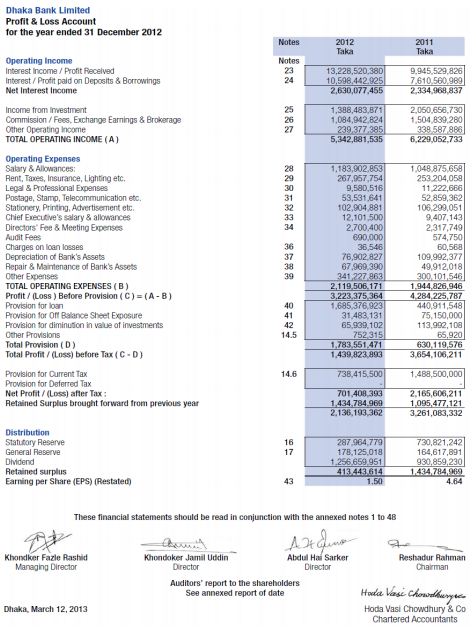

Financial statement Analysis involves a comparison of a firm’s performance with that of other firms in the same line of business, which usually is identified by the firm’s industry Classification. Generally speaking the analysis is used to determine the firm’s financial position so as to identify its current strengths and weakness and to suggest action the firm might pursue to take advantage of the strength and correct any weakness.

Project Objective

The main objective of the project is to analyze the financial performance of Dhaka Bank Limited in the last three years (2010-2012) by using ratio analysis. So that, I can identify the strength and weakness of bank based on the financial performance in the last three years(2010-2012) and present my observation and suggestion to the bank.

Project summary

Mainly here I want to show a vivid picture of financial performance of Dhaka Bank Limited (DBL) and for this reason it is necessary to know how Dhaka Bank is performing through any specific financial performance analyzing tool. Since I have already mentioned about the background of Dhaka Bank Limited so now to evaluate performance I have gone through ratio analysis which will help to make proper evaluation. Basically for analysis I have chosen some ratios and gather the information to calculate the ratios from income statement and balance sheet for last three years. Lastly I have interpreted the result and recommended where the improvement might take place.

Project Analysis

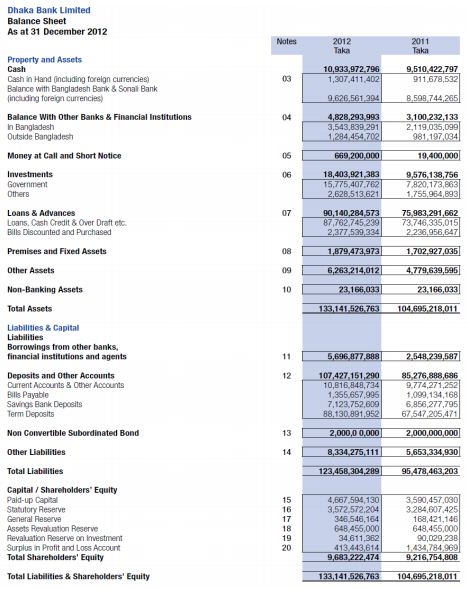

The financial performance analysis of Dhaka Bank is given below:

Core Deposit Ratio

Core deposit ratio is the ratio of core deposits to total assets. Core deposits are primarily small denomination accounts from local customers that are considered unlikely to be withdrawn on short notice and so carry lower liquidity requirements. Dhaka Bank’s core deposit ratio is given below:

The higher the core deposit ratio, the better for the bank. So the core deposit ratio has improved for Dhaka Bank over the years, improving its liquidity position. The continuous growth of the ratio can be attributed to a steady growth in core deposits (DPS) over the period of three years.

Deposit Composition Ratio

Deposit composition ratio is the ratio of demand deposits to time deposits, where demand deposits are subject to immediate withdrawal by check writing, while time deposits have fixed maturities. It measures how stable a funding base, the bank possesses. Dhaka Bank’s deposit composition ratio is given below:

The lower the deposit composition ratio, the better. In 2010, the ratio worsened for a considerable increase in demand deposits, which affected the bank’s liquidity position but the ratio improved for Dhaka Bank from 2010 to 2012.

Cash Position Indicator

Cash position indicator is the ratio of cash and deposits due from depository institutions, to total assets, where a greater proportion of cash implies the bank is in a stronger position to handle immediate cash needs. Dhaka Bank’s cash position indicator is given below.

The higher the cash position indicator, the better. Consequently, Dhaka Bank’s cash position was not that good in 2010. It improved significantly in 2011. From then, it again worsened in 2012. The improvement in 2011 was caused by a massive increase in deposits, while the deteriorations in 2012 were caused by big changes in total assets.

Liquid Securities Indicator

Liquid securities indicator compares the most marketable securities a bank can hold with the overall size of its asset portfolio. The greater the proportion of short term securities, the more liquid the bank’s position tends to be. Dhaka Bank’s liquid securities indicator is given below.

The higher the liquid securities indicator, the better. So, Dhaka Bank’s liquid securities indicator has improved over the years. This was caused by big increases in shorter term securities. Short term securities almost tripled from 2011 to 2012, leading to a massive improvement of the liquid securities indicator.

Capacity Ratio

Capacity ratio is the ratio of net loans and leases to total assets. It is a negative liquidity indicator, because loans and leases are often among the most illiquid assets that a bank can hold. Dhaka Bank’s capacity ratio is given below.

The lower the capacity ratio of a bank, the better. So the ratio worsened in 2010 and further deteriorated in 2011. From then, it improved in 2012. Improvements in the capacity ratio can be attributed to a comparatively faster growth in total assets than total loans and advances, and vice versa.

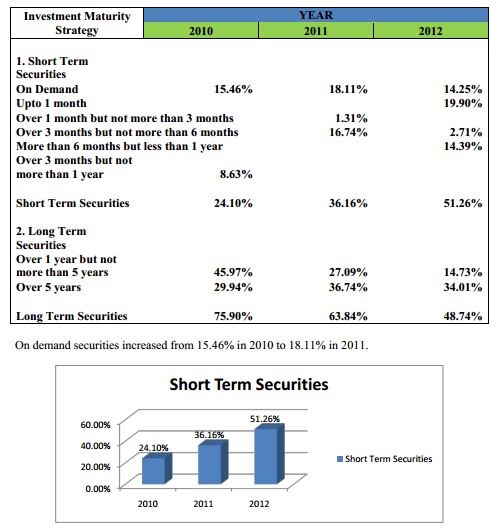

Investment Maturity Strategy

Investment maturity strategy is the distribution of a bank’s security holdings over time, i.e. over securities of different maturities. There are five broad categories of investment maturity strategy. They are ladder, front-end load, back-end load, barbell and rate expectation strategy. Dhaka Bank’s investment maturity strategy is described below.

However, it dropped to 14.25% in 2012. Securities with maturity upto one month amounted to 19.90% of total in 2012. Securities with maturity of over 1 month but not more than 3 months dropped was 1.31% in 2011. Securities over 3 months but not more than 6 months dropped from 16.74% in 2011 to 2.71% in 2012. Securities more than 6 months but less than 1 year amounted to 14.39% in 2012. Securities over 3 months but not more than 1 year was 8.63% in 2010. These are all short term securities, with maturities below one year.

Long term securities have maturities over one year. Securities over 1 year but not more than 5 years was 45.97% in 2010. From then on, it dropped to, to 27.09% in 2011, to 14.73% in 2012. Securities with maturity over 5 years rose from 29.94% in 2010 to 36.74% in 2011 and again dropped to 34.01% in 2012.

Dhaka Bank followed a back-end load strategy, with more emphasis on long term securities from 2010 to 2011. However, the ratio of long term securities to short term securities has been decreasing constantly over the years. In 2012 however, the bank changed its strategy to front-end load, with more weight given to short term securities. This indicates that the bank has gradually shifted from a back-end load strategy to a front-end load strategy. Over the years, securities with longer term maturities have been substituted by shorter term investments. This indicated a slow change in the bank’s outlook of its investment maturity strategy.

Internal Capital Growth Rate (ICGR)

A measure of how fast a bank can allow its assets to grow so that its capital-to-assets ratio does not decline. In other words, how fast a bank’s earnings grow to keep its capital-to-assets ratio protected if the bank continues paying the same dividend rate to its stockholders.

ICGR = ROE × Retention ratio

The ICGR percentage trend shows that an immense increase took place from 2010 to 2011. This is because the retention ratio of the bank increased in this time period. On the other hand, from 2011 to 2012 it decreased significantly because of the drop in return on equity.

Leverage Ratio

Leverage ratio is the proportion of capital base to total assets that is required to be held by the bank, according to the Basle Act. Dhaka Bank’s leverage ratio is described below

Dhaka Bank was adequately capitalized in 2012, as the leverage ratio was between 4% – 5%. In 2010 and 2011, the bank was well capitalized, as the ratio was above 5%. In general, the bank’s leverage ratio shows a sound capital base, in proportion to total assets.

Cash Ratio

It is the ratio of a company’s total cash and cash equivalents to its current liabilities. The cash ratio is most commonly used as a measure of company liquidity. It can therefore determine if, and how quickly, the company can repay its short-term debt. A strong cash ratio is useful to creditors when deciding how much debt, if any, they would be willing to extend to the asking party.

The fall of 2010 and 2011 can be attributed to the growing loans and deposits given and accepted by the bank. Growing loans make the cash in hand and at banks smaller, while growing total deposits made the denominator of the cash ratio larger, thereby making the numerical figure of the ratio smaller.

The growth rate of both deposits and credits fell in 2011 but in 2012 cautious investments increased cash in hand and at banks, while a small increase in deposits made the cash ratio grow when compared to the previous years.

CREDIT RISK RATIOS

Credit risk ratios are used to calculate the financial leverage of a company to get an idea of the company’s methods of financing or to measure its ability to meet financial obligations. There are several different ratios, but the main factors looked at include debt, equity, assets and interest expenses. It measures the credit risk of the company in terms of its dependence on debt financing versus equity financing. Credit risk ratios include equity to asset, equity to net loans and debt to equity.

Equity to Asset

The equity ratio is a financial ratio indicating the relative proportion of equity used to finance a company’s assets. It is used to help determine how much shareholders would receive in the event of a company-wide liquidation. The ratio, expressed as a percentage, is calculated by dividing total shareholders’ equity by total assets of the firm, and it represents the amount of assets on which shareholders have a residual claim. The figures used to calculate the ratio are taken from the company’s balance sheet.

The ratio was 7.30% in 2010. In 2011 however, equity to asset shot up to an unprecedented level that is 8.85%. The increase was caused solely by the increase in owner’s equity. It decreased again in 2012 to 7.32%. The reason was significant increase of asset rather than equity.

Equity to Net Loans

This ratio forms part of the Capital and Funding ratios of a bank, and measures a company’s financial leverage by calculating the proportion of equity and debt the company is using to finance its assets. Total equity covers total equity reserves, total share capital and treasury stock. Net loans include loans to banks or credit Institutions, customer net loans and loans to group companies.

It was 10.35% in 2010 and rose to 12.23% in 2011. It dropped again to 10.86% in 2012. The fluctuations in the ratio from 2010 to 2012 can be explained by changes in the manner of financing. Both the total equity and net loans increase in 2011 which results in greater equity to net loans ratio. But in 2012 the net loans increased significantly which took the ratio down again.

Recommendations

Some recommendations based on the financial performance of Dhaka Bank Limited’s financial performance are given below-

• Before giving long-term loan a bank should consider that whether a bank has long term deposit or not. Otherwise the bank will surely face the liquidity problem.

• A bank should increase the non-funded income in order to increase the operating income ratio.

• After giving the loan to the customers, a banker should also perform certain duties to the customers to decrease the bad debt problem. Like-monitoring, supervising and follow up the loan that is taken by the customers.

• Bangladesh Bank should impose the rule of uniformity for all types of schemes. By this way customers can decide from where they will receive service based on the service quality and organizational environment.

• Director’s interference in case of giving loan should be lessening because in this way risk may increase and bad debt may also increase.

• “Employee Recruitment Process”- should be done in a fare process so that appropriate and talented employees are selected through the recruitment process and increase the productivity and quality of the service.

• The most important thing that has come to my mind concerning their promotional activities is that they should go for print or broad cast media for advertisement to make their customer aware about their range of services and make the strong place in the customers‟ mind.

Conclusion

Modern Commercial Banking is exacting business. The reward are modest, the penalties for bad looking are enormous. And Commercial banks are great monetary institutions, important to the general welfare of the economy more than any other financial institution. Dhaka Bank Limited is one of the leading commercial banks in our country. In all economic condition of our country Dhaka Bank Limited has been working with great confidence and competing tremendously with Government oriented bank, local commercial banks along with the multinational banks also. Dhaka Bank Limited always tried its level best to perform financially well. In spite of trying to do well in some aspects Dhaka Bank Limited faced some financial problems from time to time. Some of the problems were-excessive bad loans, shortage of loans and advances, scarcity of cash in hands due to vault limit etc. These problems arouse time to time due to economic slowdown, interest rate fluctuation, emerging capital market, inflation in the money market and so on.

Fighting with all these problems and competing with other banks every moment the bank is trying to do better to best. If this thing continues we hope that Dhaka Bank Limited will develop even more in the future.

Appendix