Relationship between the ACI Limited employees with their customers

ICI Bangladesh Manufacturers Limited was a subsidiary of world renowned multinational ICI Plc and was a listed public limited company under Dhaka Stock Exchange. In 1992 ICI Plc divested its shareholding through a management buyout and the company name was changed from ICI Bangladesh Manufacturers Limited to Advanced Chemical Industries (ACI) Limited. ACI Formulations Limited, a subsidiary of ACI, became a public listed company through direct listing.

ACI’s mission is to achieve business excellence through quality by understanding, accepting, meeting and exceeding customer expectations. ACI follows International Standards on Quality Management System to ensure consistent quality of products and services to achieve customer satisfaction. ACI also meets all national regulatory requirements relating to its current businesses and ensures that current Good Manufacturing Practices (cGMP) as recommended by World Health Organization is followed properly. ACI has been accepted as a Founding Member of the Community of Global Growth Companies by the World Economic Forum which is the most prestigious business networking organization. (Corporate: ACI Limited Bangladesh)

History

Advanced Chemical Industries (ACI) Limited is one of the leading and largest local conglomerates in Bangladesh. ACI consists of different business groups namely: Pharmaceuticals, Consumer brands, Agro-Business. ACI is the first company in Bangladesh who achieved both the ISO9001 certification of Quality Management System in 1995 and the ISO14001 Certification for Environment Management System in 2000. ACI is a public limited company listed in DSE and CSE. Beside this, the company has a large list of international associates and partners with trade and business agreement. Today ACI is one of the fastest growing companies in Bangladesh.

ACI was so named in 1992. But the history of ACI dates back to 1926, when Imperial Chemical Industries (ICI) was incorporated in the United Kingdom as four companies namely Novel Industries Limited, British Dyestarts Corporation, Brunner Mond and Company Limited and United Alkali Company merged. Since then ICI plc has been operating worldwide as a multinational company.

In the year of formation ICI started operation in the Indian subcontinent in the name of ICI (India) limited. After separation of the India and Pakistan in 1947, the Karachi office of ICI (India) Limited renamed to be ICI (Pakistan) Limited.

Product and Services of ACI

ACI has diversified into four major strategic business divisions which include Health Care, Consumer Brands, Agribusinesses and Retail Chain.

Strategic Business Units:

- Pharmaceuticals

- Consumer Brands

- Agribusiness

- Animal Health

- Crop care & Public health

- Fertilizer

- Cropex

- Seeds

Subsidiaries:

- ACI Formulations Ltd.

- ACI Agrgochemicals

- Apex Leathercrafts Limited

- ACI Salt Limited

- ACI Pure Flour Limited

- ACI Foods Limited

- Premiaflex Plastics Limited

- Creative Communication Limited

- ACI Motors Limited

- ACI Logistics Limited

Joint Ventures:

- ACI Godrej Agrovet Private Limited

- Tetley ACI (Bangladesh) Limited

- Asian Consumer Care (Pvt) Limited

Credit Procedure of ACI Limited

Purpose of the Policy

The Company does not permit credit to be used as the only tool for increasing sales. Credit may be offered to customers to facilitate their process of purchase. Credit should not be extended to those who cannot otherwise afford to purchase or whose credit record is not clean. Credit is expensive if it turns into bad debt and therefore credit is to be offered with caution and care. Credit given to a wrong customer will ultimately result in bad debt and collection efforts may create bad relationship with the defaulted customer. It is better to sell less quantity or at a lesser margin in cash rather than sell more on credit to customer who would not pay.

The granting of credit is a powerful selling aid and is a fundamental foundation upon which all trading relationships are built. Keeping that in mind, the company recognizes the necessity of allowing credits to intending customers in line with current industry practice. It is felt that under current business scenario, achieving expected business growth would be difficult unless we have a prudent credit policy to support the deserving customers. It is expected that credit facilities will allow us to achieve our business objectives. However, at the same time it is also to be ensured that field personnel will maintain appropriate balance between increased sales through enhanced credit facilities and risks associated with default credits.

This Credit Policy will be effective from 01 February 2014.

Types of Credit Customers

- Deposit Credit Customer

The company offers handsome Bonus against cash deposit and extends credit to such customers up to a limit of cash deposit. Financial Return will only be applicable when the customer will ensure complete security for the credit offered to him. For such cash deposits the Bonus is calculated at the rate of 9% per annum. The Bonus is paid half-yearly in July and January into the depositor‟s account. The Bonus is payable only if the credit outstanding is settled by the customer within the credit period. The deposit can be withdrawn by the customer fully or partially at any time without prior notice and without any penalty, after full adjustment of the entire outstanding credit balance. An agreement is to be signed outlining the conditions of payment of Bonus and the facilities available for deposit credit customers as per “Annexure C 1”. In addition, the application for credit facility has to be made as per “Annexure A 1” (only application form) and “Annexure A”. Credit is given for 30 days and the entire amount invoiced is to be settled by the due date.

- Credit to Dealer

Dealers are not consumer themselves but they facilitate in the business process. They are to invest capital in order to be able to run a business. The credit to dealer must be supported by an undated MICR cheque made out favoring of ACI Limited.

Credit proposal is to be made with a letter (Annexure A1) and on a form (Annexure A). The proposal goes through proper security, verification of the credentials and credit worthiness of the customer. The process takes at least 01 week and cannot be rushed. If credit facility is approved, credit limit is fixed and the customer is to provide an undated cheque for the amount of the credit limit. The signature on the cheque has to be verified by Bank. The customer is to sign an agreement (Annexure C2).

Generally credit is given for 30 days and the entire amount invoiced is to be settled by the due date. However, 15 days buffer facility can be allowed for this group of customers only for single invoice. Credit limit will be automatically blocked once the customer exceeds payment due date. Default in timely payment or failure to return the goods unsold along with payment of the balance, will result in suspension of credit facility. Continued default will result in cancellation of credit agreement and stating of proceeding to recover the total outstanding amount.

Credit limit will be initially fixed on the basis of potential of the customer. After several transactions the sales manager may propose revision of credit limit to a higher or lower level, based on the value and the frequency of transaction with the customer.

- Credit to small, medium & large private organization:

Private organizations have limitations in providing blank cheque. In such cases normal credit procedure will be followed and the requirement of providing security cheque may be exempted by the Executive Director for specific customers at his discretion by keeping Finance-credit informed.

In this category of customers, credit is provided against the work order/purchase order of the customers. The credit is provided for maximum 30 days period. Credit limit is fixed by the value of valid work order. As soon as the invoices against the work order are raised the credit limit will automatically be blocked.

Before providing the credit facility an official format of work order/purchase order along with the signature of the persons who are authorized to issue purchase order need to be submitted. A valid work order must contain the followings:

- Date of order

- Name and quantity of the product order

- Total value of the order

- Date of delivery

- Seal and signature of the authorized personnel of the company

- Date of payment

- Tender Credit

Tender credit will require special approval from the Executive Director. He will consider them on a case to case basis and all such approvals of credit will be in writing and specific to

a particular tender, mentioning bid bond (if any) required for the tender and outlining the entire tender procedure and timeline of follow up and recovery of the bid bond and obtaining the payment. A copy of such written approval will be provided to Finance to monitor the credit and chase the Bid Bond.

- Credit to Government, Autonomous and Semi-Autonomous Institutions:

If the customer is found to be satisfactory pay master from past dealings, credit could be extended to government institutions. The credit period would be for 30 days and limit will be fixed by the tender value/work order value.

Quite often credit to government institutions remain outstanding for such a long time that financing cost of the amount is sometimes greater than the margin made by the company in that transaction. The government institutions that are well known for the delay in payment should be encouraged to buy on cash. A discounted price may be negotiated as an inducement to buy against cheque. Large supply in one lot should be discouraged because that may lead to large volume leakage to traders and result in under rating. In all these cases sales/business will apply due diligence as well as other measures to encourage quick return of company‟s money.

- Super Market / Modern Trade:

In case of providing credit facility to this category of customers all necessary documents and application forms has to be fulfilled as provided in “Annexure A1” and “Annexure A”. Credit to super market must be supported by an undated cheque amounting equal to the approved credit limit, made in favor of ACI Ltd by the proprietor himself from his own personal/company account. Here the amount of submitted un-dated cheque will act as the credit limit of the super market. The owner of the super market or his authorized nominee has to sign an agreement with ACI Ltd as attached in “Annexure C 2”.

- Short Term Credit (STC)

Short term credit (STC) means a particular pre-approved customer whose accounts revolve within a calendar month without any security instrument. The customer has to have a shop in a suitable location for Electrical Business.

To improve market share and volume of sales, penetrate small customers in root level, pick up periphery market, achieve our national sales target with significant growth, company desired to pick these type of customers through employee (to secure debtors). The terms and conditions of STC are described below:

- Marketing Officer/Sales Officer will find out suitable customer and propose to Area Sales Manager (ASM) or Area Sales Executive (ASE) by fulfilling the prescribed form as stated in the Annexure H. ASM/ASE forwards the list to Head of Sales/Sales Manager (SM) for his comments and scrutiny. HOS/SM will provide STC customer list using Annexure I to BM for his recommendation and send the proposal to Finance-Credit for verification.

- Finance-Credit will assess those proposals and give their comments on the proposal regarding past transaction and credit worthiness which will duly be approved by ED, CB once he is satisfied with the findings.

- STC credit will not exceed tk.80, 000 for an individual ASE/ASM.

- STC will not be applicable for existing credit customers.

- A customer will be allowed multiple orders for STC if the total order amount within approved credit limit of tk.80, 000.

- If any customer fails to pay STC within the calendar month, the respective field personnel are encouraged to take back the goods to adjust the account by last day of each month. However, it may allow another 30 days to settle the account as special case if HOS/SM gives special permission to do the same.

- Both MO/SO & ASM/ASE will be responsible to collect this STC credit. If MO/ASE fails to maintain the STC as per policy, proportionate salary & monthly expenses will be deducted from next month (after 60 days) under the advice of HOS/SM. In case of misappropriation of sales proceeds and products, the unsettled STC credit will be adjusted from his final settlement under the advice of BM, CB.

- MO/SO will bring the unsold products from the customers‟ outlet in his own risk and handover to depot in-charge and make necessary adjustments. In voice part return will be allowed according to distribution policy.

Supply on Credit

On basis of a written order by a customer, a Credit In voice or a Delivery Challan will be raised by Distribution Department. The goods must be delivered directly to the customer or his authorized agent. Signature and seal of authorized agent should be obtained on the delivery document. Distribution Department must not deliver goods to any company employee or to any third party. Products should be either collected by the customer or delivered to the customers‟ business premises by the Distribution Staff. Sales Staff should not be involved with the delivery of products to customers. If customer needs redistribution support from ACI, he/she will first receive products with seal and signature.

Central Credit Coding

To have the better control over credit operation, central credit coding has been introduced. Finance-Credit will initiate every new Credit Code and will modify the credit limit of existing credit customer as modified by the Executive Director. No single customer should be allowed to open multiple credit accounts. Exceptions can be made only for institutions having different delivery points or different companies, which will require written approval of the Executive Director.

SWOT Analysis

SWOT analysis refers to analysis of strengths, weaknesses, opportunities and threats of an organization. This facilitates the organization to make its future performance improved in comparison to its competitors. An organization can also study its current position through SWOT analysis. For all of these, SWOT analysis is considered as an important tool for making changes in the strategic management of an organization. Through direct observation and discussion with the ACI officials I am able to point out some major strength and weaknesses as well as some threats and opportunities regarding the various issues of ACI such as –

- Service level

- Operational efficiency

- Technology

- Employee efficiency etc. along with many other issues

Strengths

Top Management

ACI Limited is operated by a very efficient management group. The top management officials have all worked in reputed organizations and their years of experience, skill, and expertise will continue to contribute towards further expansion of the organization. So, the top management of the organization is the major strength for ACI Limited.

Corporate Culture

ACI has an interactive corporate culture. The working environment of ACI is very friendly, interactive and informal. And, there are no hidden barriers or boundaries while communicate between the superior and the employees. This corporate culture works as a great motivation factor among the employees.

Various Products and Services

ACI offers various types of products and services to their customers. So those, Customers can choose the right products that will fulfill their needs.

Strong employee bonding and belongings

ACI employees are one of the major assets of the company. The employees of ACI have a strong sense of commitment towards organization and also feel proud and a sense of belonging towards ACI. The strong organizational culture of ACI is the main reason behind its strength

Weakness

Competitive market

ACI Limited has many competitors in the market. When they setup their product price or promoting new new product, they always have to think about their competitors and they are bound to setup the lower price. Therefore, it is heavily affect on their profit.

Cost

Cost is very much important for manufacturing company. They always have to think about their cost. As we know that manufacturing company year by year gradually reduce their cost but ACI limited are unable to reduce their cost that much.

Opportunities

Growing demand

Day by day ACI product demands are increasing and this is a great opportunity for the ACI to introduce new product for their customers. If they are utilizing their opportunity in future, they will earn more profit.

New acquisitions

Already ACI acquire some company and they earn lot of profit from those acquiring company. In future if they do some acquisition contract with some renowned brad then they can earn more profit from this segment.

New products and services

As their competitors, introduce new product and services frequently. ACI Limited should introduce new product and services for their customers.

Threats

Similar products are offered by others

ACI Limited introduces lots of product but these are very much similar with their competitor. So ACI have to more creative to introduce new product and should do some barites on their product.

Increase in labor costs

For manufacturing company labor cost is a very big threat for the organization. ACI labor cost comparatively higher than their compactors.

Increased competition in the market

ACI Limited doing their business in competitive market. So this is big threat for ACI limited to doing business in competitive market.

Findings:

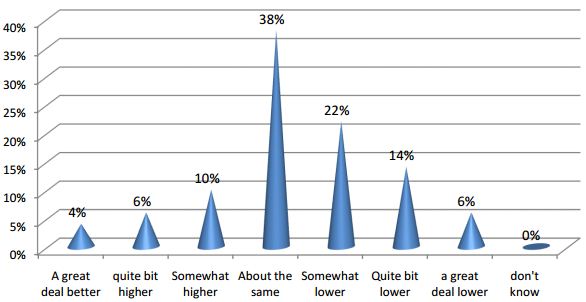

- Compared to our competitors, are our prices higher, lower, or about the same?

Findings:

Price is very sanative thing for the customer. They always try to buy the better product at minimum price. As we know, that ACI Limited has many competitors so they are very conscious about price and they put price considering their competitors price. From the graph, we can see that 38% customers say the price is same the price of our competitors. But the positive thing is that 42% customers say our product price is lower compare to our competitors. Only 20% customers say our product price is higher than our competitors.

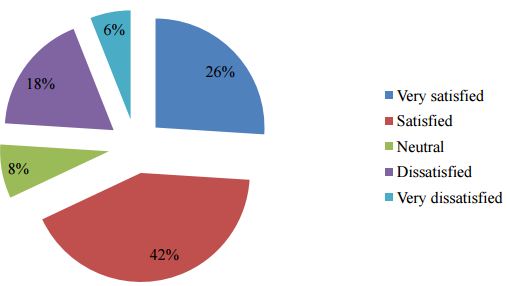

- In terms of the service, you received from the credit officer(s), how satisfied was you with the following.

Findings:

Credit officer play a big role for ACI limited. They provide the almost all services to the customer. They investigate the customer‟s showroom and provide the product to the customer against the advance cheque. Credit officer also verifies the customer all documents. In the above graph, we see that 42% clients are very satisfied and 26% are satisfied with the credit officer service. Only 26% are dissatisfied with the credit officer services.

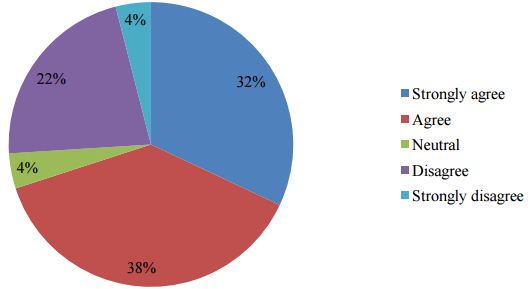

- ACI Limited understands the service needs of my organization.

Findings:

From the survey, I have found that 32 percent of the total sample size is strongly with the statement. 38 percent agree and 4 percent neutral and 22 percent are disagree and only 4 percent strongly disagree with the statement. It means the overall opinion of clients is positive and ACI Limited understands the service needs of their organization.

Employee Satisfaction

The success of every organization depends on its employees. The satisfaction level of employees creates an impact on the satisfaction level of customers. If employees stay satisfied in the organization then it will result to an effective work. Employees will be more efficient in the field of their work and ultimately it will reflect as customer satisfaction. If customer stays satisfied, the goal of an organization ultimately can be achieved. (About: Retail: Shaken Not Stirred by Kevin Ertell)

The satisfaction level of an employee has an effect on employee commitment and employee loyalty. It also has an impact on product quality as well as service quality. All these variables lead to customer satisfaction.

When an employee stays satisfied, he or she always stays committed towards work and also stays loyal towards the organization. The employee loyalty is also responsible for the movement of employee commitment. Product quality and service quality somewhat depend on employee commitment. Perceived product quality and service quality follows to perceived value, which ultimately creates Customer Satisfaction.

Relationship between the ACI Limited employees with their customers

In our project, we tried to relate the customer satisfaction with employee satisfaction. Here we show some relationship between the ACI Limited employees with their customers. In some point, the employees of ACI limited are satisfied and they try to deal with their customers with an arranged manner. They try to provide all the necessary documents within proper time. They maintain customer information in a separate book for each and every customer, which ultimately make the report of every customer organized. For that reason, the customers of ACI Limited can get to know about their business status any time without any hassle.

As there are only two persons to attend the customer‟s call, sometimes it becomes too difficult to attend every call, as the number of ACI customer is huge. It creates a negative impact on the customer.

The number of employees in credit department is very few in contrast of their business unit. It makes difficulties to perform their job effectively.

Recommendation

As we all know that ACI Limited is one of the well-known organizations in our country. From my little knowledge, it is quite hard to give recommendation to such a well-established organization. Still from my learning and observation, I am giving following recommendation to follow:

- In our customer survey, we have seen that customers are not happy with the customer service representative and they have lots of complain regarding this department. Only two employees are working to attend the customer‟s call. ACI Limited needs to recruit at list two more employees on this department. After recruiting two more employees, the customer satisfaction level will increase and they will happy to get the service form “service representative officer”.

- In our customer survey, we can see that 38% clients say that our products price is same with our competitors. Here ACI need to more concentrate to setup the price and they have to put the lower price as much as they can.

- In our employees survey we can see that 55% employees believe- they are not utilizing their skills and ability. Most of the time ACI employees do the the same repeatedly. So ACI needs to diversify the employees. For that, they can open different type of project.

- In our employees survey 75% employees are unhappy with the tools and resources of ACI Limited. Employees say their computer, software and other resources are not performing well. For that reason, they need more time to complete the work. Here ACI need to upgrade their computer, software and other resources.

- ACI Limited need more concentrate on loan and installment policy. And they need to offer attractive loan and installment packages to their customer.