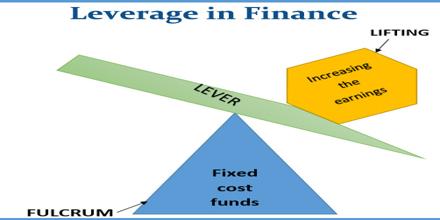

Leverage in Finance is also known as trading on equity. It is measured as the ratio of total debt to total assets. It involves buying more of an asset by using borrowed funds, with the belief that the income from the asset or asset price appreciation will be more than the cost of borrowing. It is most commonly used in real estate transactions through the use of mortgages to purchase a home. It may cause serious cash flow problems in recessionary periods because there might not be enough sales revenue to cover the interest payments.

Leverage in Finance