Sensitivity analysis determines how, under a given set of assumptions, different values of an independent variable influence a particular dependent variable. Sensitivity analysis is commonly used in a broad variety of areas, from biology and geography to economics and engineering. The choice of sensitivity analysis method is usually determined by a number of constraints or settings of the problem. It is particularly valuable in the examination and investigation of a “Discovery Process” where the yield is a dark capacity of a few data sources. A hazy capacity or cycle is one which, for reasons unknown, can’t be examined and dissected.

Sensitivity analysis can be used to help make forecasts of publicly traded companies’ share prices or how interest rates impact bond prices. A Financial Sensitivity Analysis is most widely used by financial analysts to forecast the result of a particular action when conducted under such circumstances, often known as a What-If analysis or a What-If simulation exercise. It is an approach to foresee the result of a choice given a specific scope of factors. By making a given arrangement of factors, an expert can decide how changes in a single variable influence the result.

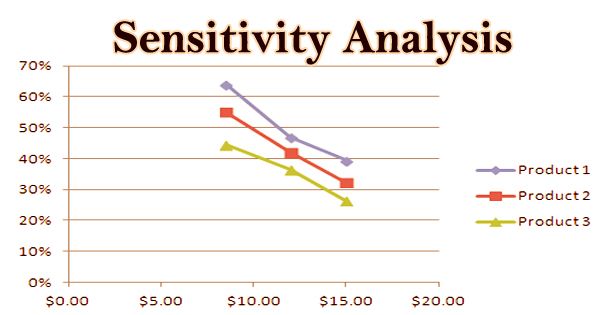

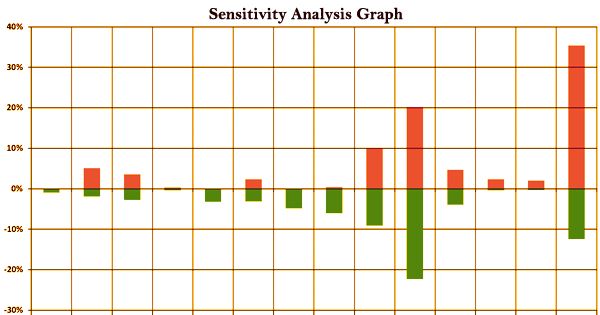

Sensitivity Analysis Graph

Sensitivity analysis, i.e. a sampling-based approach, is almost always done by running the model a (possibly large) number of times. This can be a major issue when it comes to,

It takes a considerable amount of time (minutes, hours, or longer) for a single run of the model. For very complex models, this is not uncommon.

The model has countless dubious sources of info. Affectability investigation is basically the investigation of the multidimensional information space, which fills exponentially in size with the quantity of data sources.

Financial Sensitivity Analysis is carried out within specified limits determined by the set of independent variables (input). Sensitivity analysis, for instance, can be used to research the impact of a rise in interest rates on bond prices when interest rates have risen by 1%. The issue of “what-if” would be: “What would happen to the price of a bond if interest rates were to increase by 1%?”. Sensitivity analysis may be used to address this issue.

Sensitivity analysis can be utilized to help make forecasts in the offer costs of public organizations. A portion of the factors that influence stock costs to incorporate organization income, the quantity of offers remarkable, the obligation to-value proportions (D/E), and the quantity of rivals in the business. Most basic affectability examination techniques accept freedom between model data sources, yet now and then information sources can be unequivocally associated. This is still an immature field of study and conclusive approaches are yet to be established. This model can also be used to calculate the impact on bond prices that increases in interest rates have. In this case, interest rates are the independent variable, while the dependent variable is bond prices.

Some approaches to sensitivity analysis, such as those based on linear regression, can calculate sensitivity inaccurately when the model response is nonlinear with respect to its inputs. Analysis of sensitivity enables historical, true data to be used to forecast. Significant decisions can be taken about firms, the economy, and about making investments by analyzing all the variables and the potential consequences. There are also major factors for sensitivity analysis to be carried out:

- By checking the model through a large range of possibilities, sensitivity analysis adds credibility to any form of a financial model.

- Financial Sensitivity permits the examiner to be adaptable with the limits inside which to test the affectability of the reliant factors to the autonomous factors. For instance, the model to consider the impact of a 5-point change in loan costs on security costs would be not the same as the monetary model that would be utilized to examine the impact of a 20-point change in financing costs on bond costs.

- Analysis of sensitivity lets us make educated choices. To understand how sensitive the output is to changes in some variables, decision-makers use the model. Therefore, in drawing tangible conclusions, the analyst will be helpful and be instrumental in making optimal decisions.

The sensitivity analysis is really founded on the factors that influence valuation, which money related model can portray utilizing the factors’ cost and EPS. It detaches these factors and afterward records the scope of potential results. Affectability examining has been particularly intended for an ill-disposed setting, where the idea of the proof, yet in addition, the level of sureness and vulnerability related to the proof, will be the subject of hardliner interests.

Using a model like this also has some disadvantages. As the variables are all based on historical evidence, the results are all based on assumptions. Sensitivity analysis is closely linked to the analysis of uncertainty; while the latter studies the general uncertainty in the study’s findings, sensitivity analysis seeks to determine which source of uncertainty weighs more on the conclusions of the study. When applying the analysis to future forecasts, there can be room for error.

Information Sources: