Interbank Lending Market is the medium by which banks extend loans to one another is called the interbank lending market. These are short-term instruments traded on rather risk-intolerant markets. The interbank lending market is a market in which banks lend funds to one another for a specified term. Most loans are made on a short-term basis, typically overnight. Most interbank loans are for maturities of one week or less, the majority being overnight. Such loans are made at the interbank rate (also called the overnight rate if the term of the loan is overnight). This has prompted the repayment interest rate to be dubbed “the overnight rate”.

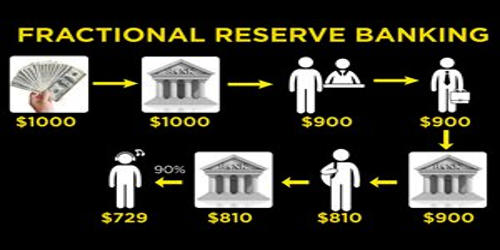

Interbank markets are traditionally considered to be dominated by overnight deposits and repos. Banks are required to hold an adequate amount of liquid assets, such as cash, to manage any potential bank runs by customers. Under reserve requirement regulations, or the cash reserve ratio, financial institutions are required to hold enough cash to ensure the bank can operate its key services for clients. If a bank cannot meet these liquidity requirements, it will borrow money in the interbank market to cover the shortfall. When banks have insufficient liquid assets to satisfy the regulation, they borrow on the interbank lending market. Some banks, on the other hand, have excess liquid assets above and beyond the liquidity requirements and will lend money in the interbank market, receiving interest on such loans. By the same account, banks that have a surplus of liquid assets, such as cash, will offer loans to other banks and receive an additional income from the rate of interest.

The interbank rate is the rate of interest charged on short-term loans between banks. The interbank rate is the rate of interest charged on short-term loans made between U.S. banks. Banks borrow and lend money in the interbank lending market in order to manage liquidity and satisfy regulations such as reserve requirements. Banks may borrow money from other banks to ensure that they have enough liquidity for their immediate needs, or lend money when they have excess cash on hand. The interest rate charged depends on the availability of money in the market, on prevailing rates, and on the specific terms of the contract, such as term length. The interbank lending system is short-term, typically overnight, and rarely more than a week. There is a wide range of published interbank rates, including the federal funds rate (USA), the LIBOR (UK), and the Euribor (Eurozone). The term interbank rate also refers to the interest rate charged when banks conduct wholesale transactions in foreign currencies with banks in other nations.