Introduction

Banks are financial institutions or financial intermediary that collect fund from people as deposit and lend this fund as loans and advances to the borrowers in different sectors of the economy against interest for certain period. Banks play a very important role in both national and international trade. Moreover, banks provide some other non-traditional services like factoring, issuing bank guarantees etc. which are very supportive to modern business.

In Bangladesh, there are government Banks, Private Banks and foreign Banks. The Trust Bank Limited is one of the leading private sector commercial bank in Bangladesh.

Origin of the report

This report titled Exploring Employee Perception Regarding Compensation Practices of the Trust Bank Limited is prepared for fulfilling a partial requirement of both the BBA and the internship programs. The Trust Bank Limited is the host organization for the three months internship program which began on July 15th 2012 and ended on October 15th 2012. To prepare the report as an apprentice have taken necessary assistance from Ms. Ayesha Tabassum who authorized me to prepare this report.

Objective of the report

The objectives of the report are two fold:

- The broad objective of the report is:

To explore employee perception regarding compensation practices of The Trust Bank Limited.

- The specific objectives of this report are:

- To identify employee perception about different features of salary package in Trust Bank Limited.

- To explore the employee satisfaction regarding the salary package of Trust Bank Limited.

- To identify employee perception about different features of benefit programs offered by Trust Bank Limited.

- To explore the employee satisfaction regarding those benefits provided by Trust Bank Limited.

Importance of the study

Large Industry setup requires a huge amount of capital. But Bangladesh is poor country. It is very difficult for a developing country like Bangladesh to finance large-scale industries. It is not easier to fulfill the employee demand by their compensation. We know compensation includes Salary and Benefits. But in the developing country like Bangladesh any organization can not afford their employee demands. But in the developed country like Japan, they can afford their employee demands. On the other hand, we need profit in our organization. So we need to know properly the satisfaction level of our organizations employee. And we should try to improve the satisfaction level on the basis of their working ability. Then our country organization will be gain profit more than previously.

Methodology

Data Collection Technique:

The report is exploratory and quantitative in nature. The report has been prepared based on both primary and secondary data. The sources are described below.

- Primary Source:

Structured questionnaire survey for collecting data about employee perception about the compensation practices.

Secondary source:

- Annual Report of Trust Bank Limited for writing organization overview.

- Books and Journals for writing literature review.

- Internet for writing literature review and organization overview.

- Sample size:

My sample size is 30.

- Sampling technique:

The sampling technique was Non-probability sampling technique. The sample size was selected on the basis of convenience. For the research, one branch; Uttara Corporate branch was taken under consideration on the basis of convenience for formulating the sample.

Scope of the Study

The report will mainly focus on the basis of the employee perception regarding compensation package of “The Trust Bank Limited”. It will also focus on their employee perception of their organizations.

After studying that whole report anyone can learn and get understand about “The Trust Bank Limited” employee satisfaction level on their overall compensation. And they can help easily further their employee development.

Limitation of the Study:

The study has suffered from a number of barriers:

- As the report was conducted on compensation practices, the employees were afraid of providing the correct answer due to the lack of confidentiality.

- Most of the employees are not very willing to give the answers of the questionnaire. They take it as threat for their job.

- Data were collected from only one branch of the bank. Thus the result cannot be generalized in terms of the total bank.

Overview of trust bank limited

Trust Bank Limited is one of the leading private commercial bank having a spread network of 42 branches across Bangladesh and plans to open few more branches to cover the important commercial areas in Dhaka, Chittagong, Sylhet and other areas in 2010. The bank, sponsored by the Army Welfare Trust (AWT), is first of its kind in the country. With a wide range of modern corporate and consumer financial products Trust Bank has been operating in Bangladesh since July 1999 with an authorized capital of TK 1,000 million divided into 1 million ordinary shares of TX 1,000 each and has achieved public confidence as a sound and stable bank.

In 2001, the bank introduced automated branch banking system to increase efficiency and improve customer service. In the year 2005, the bank moved one step further and introduced ATM services for its customers. Since bank’s business volume increased over the years and the demands of the customers enlarged in manifold, our technology has been upgraded to manage the growth of the bank and meet the demands of our customers. In January 2007, Trust Bank successfully launched Online Banking Services which facilitate Any Branch Banking, ATM Banking, Phone Banking, SMS Banking, & Internet Banking to all customers. Customers can now deposit or withdraw money from any Branch of Trust Bank nationwide without needing to open multiple accounts in multiple Branches. Via Online Services and Visa Electron (Debit Card), ATMs now allow customers to retrieve 24×7 hours Account information such as account balance checkup through mini-statements and cash withdrawals.

Trust Bank has Visa Credit Cards to serve its existing and potential valued customers. Credits cards can now be used at shops & restaurants all around Bangladesh and even internationally. This bank is also introducing Western Money Union Transfer where their client’s can remit their money easily and quickly. Trust Bank is a customer oriented financial institution. It remains dedicated to meet up with the ever growing expectations of the customer because at Trust Bank, customer is always at the center.

In order to provide up-to-date information on the bank at fingertips to the trade and business communities of the world, their own IT team has developed an E-mail address and a web page for the bank. It can be accessed to under the domain: tbl@global-bd.net and www.trustbankbd.com

In addition to ensuring quality, Customer services related to general banking also have the passport services facilities, phone banking, SMS banking, and Internet banking facilities 24 hours a day. On the other hand, this bank has extended credit facilities to almost all the sector of the country’s economy. The bank has plans to invest extensively in the country’s industrial and agricultural sectors in the coming days.

It also promotes the agro-based industries of the country. The bank has already participated in syndicated loan agreement with other banks to promote textile sectors of the country. Such participation would continue in the future for greater interest of the overall economy. Keeping in mind the client’s financial and banking needs the bank is engaged in constantly improving its services to the clients and launching new and innovative products to provide better services towards fulfillment of growing demands of its customers.

Trust bank limited at the end of the year 2006 changed their name from “The Trust Bank Limited” to “Trust Bank Limited” and also changed their logo to bring the bank more closely to the general public.

| Corporate Information at a Glance | |

| Banking License received on | 15th July. 1999 |

| Certificate of incorporation received on | 17th June 1999 |

| Certificate of Commencement of business received on | 17th June 1999 |

| First branch licenses on | 9th August 1999 |

| Formal inauguration on | 29th November 1999 |

| Sponsor Shareholders | Army Welfare Trust |

| No of Branches | 45 |

| No of Foreign Correspondents | 23 |

| No of Employees | 3750 |

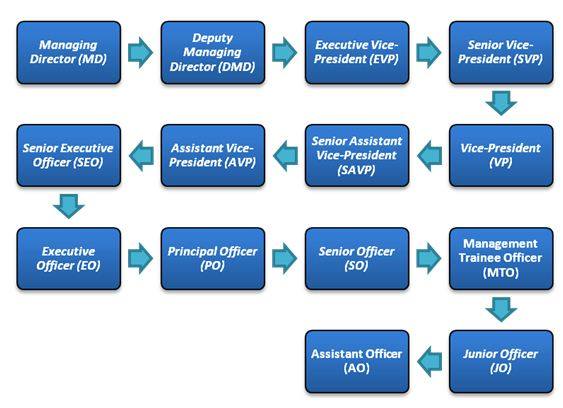

Board of Directors

Organizational Structure of Trust Bank Ltd.

Vision of TBL:

Trust Bank Limited has a Vision of providing financial services to meet customer expectations so that customers feel TBL is always there when they need them, and can refer bank to their friends with confidence. TBL wants to be a preferred bank of choice with a distinctive identity.

Mission of TBL:

Mission of TBL is to make banking easy for their customers by implementing one-stop service concept and provide innovative and attractive products & services through technology and their qualified human resources. TBL always look out to benefit the local community through supporting entrepreneurship, social responsibility and economic development of the country.

Positioning statement

Trust Bank is a contemporary, upbeat brand of distinctive quality of service and solution that offers a rewarding banking experience as preferred choice of banking partner every time, everywhere.

Value Proposition:

- Trustworthy

- Dependable

- Reliable

- Professional

- Dynamic

- Fair

Functions of trust bank limited

The Bank accomplishes its functions through different functional divisions/ departments. The divisions/departments along with their major functions are listed below:

| Financial Division | Credit and risk management | Information Technology (IT) Department | Human Resource Division (HRD) | Branches Control & Inspection Division | Retail Division |

| Financial planning, budget preparation and monitoring | Loan administration | Software development | Recruiting | Controlling different functions of the branches and search for location for expansion | ATM card, Credit and system operation and maintenance |

| Payment of salary | Loan disbursement | Network management and expansion | Training and development | Conducting internal audit and inspection both regularly and suddenly | SWIFT operation |

| Controlling inter-branch transaction | Project evaluation | Software and Hardware management | Compensation, employee benefit, leave and service rules program and purgation | Ensuring compliance with Bangladesh Bank (BB), monitoring BB’s inspection and external audit reports | Credit Card Operation |

| Disbursement of bills | Processing and approving credit proposals of the branches | Member banks reconciliation | Placement and performance appraisal of employees | Customer and vendor relationship | |

| Preparation of financial reports and annual reports | Documentation, CIB (Credit Information Bureau) report etc | Data entry and processing | Preparing related reports | ||

| Preparation/Review of returns and statements | Arranging different credit facilities | Procurement of hardware and maintenance | Reporting to the Executive Committee/ Board on related matters | ||

| Maintenance of Provident Fund, Gratuity, Superannuation Fund | Providing related statements to the Bangladesh Bank and other departments | Promotional campaign and press release | |||

| Reconciliation |

Service in Trust Bank Ltd

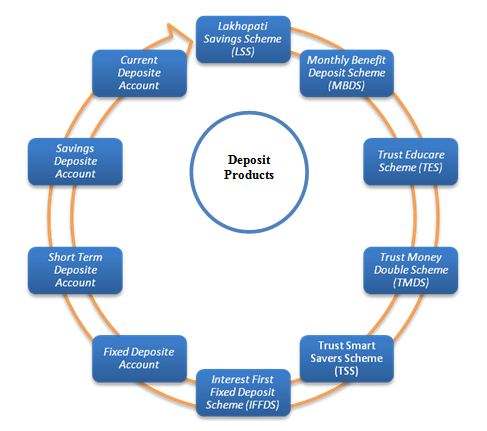

Deposit Products:

There are several products under deposit product offered by Trust Bank Limited.

Figure: Deposit Products

Current Deposit Account:

Current Deposit Account is the net flow of current transactions with no restriction, including services and interest payments. It is an easy-to-use, convenient current

Savings Deposit Account:

A Saving Bank account (SB account) is meant to promote the habit of saving among the people. It also facilitates safekeeping of money. In this scheme fund is allowed to be withdrawn whenever required, without any condition. Hence a savings account is a safe, convenient and affordable way to save your money. Bank also pays you a minimal interest for keeping your money with them.

Short Term Deposit Account:

Short Term Deposit Account is the net flow of current transactions including services and interest payments. It is an easy-to-use, convenient current account with instant access and withdrawals to your money anywhere in Bangladesh.

Fixed Deposit Account:

A fixed deposit is meant for those investors who want to deposit a lump sum of money for a fixed period; say for a minimum period of 30 days to one year and above, thereby earning a higher rate of interest in return. Investor gets a lump sum (principal + interest) at the maturity of the deposit. Bank fixed deposits are one of the most common savings scheme open to an average investor.

| Amount/slab wise Deposit | Tenure | |||

| 01 Month | 03 Months | 06 Months | 12 Months & above | |

| Any amount | 7.00% | 12.00% | 12.00% | 12.00% |

Table: Interest Rates on Fixed Deposit Account

Trust Smart Savers Scheme (TSS):

The name of the scheme is ‘Trust Smart Savers Scheme (TSS)’ and an Account holder subscribing to this scheme will be called TSS Account holder.

| Monthly Deposit | Amount payable at maturity (3 years) | Amount payable at maturity (5 years) | Amount payable at maturity (7 years) | Amount payable at maturity (10 years) |

| 500 | 20,897 | 38,514 | 59,801 | 1,00,000 |

| 1,000 | 41,794 | 77,027 | 1,19,601 | 2,00,000 |

| 2,000 | 83,588 | 1,54,055 | 2,39,202 | 4,00,000 |

| 3,000 | 1,25,380 | 2,31,100 | 3,58,800 | 6,00,000 |

| 4,000 | 1,67,170 | 3,08,100 | 4,78,400 | 8,00,000 |

| 5,000 | 2,08,970 | 3,85,100 | 5,98,000 | 10,00,000 |

Table: TSSS Scheme

Trust Money Double Scheme (TMDS):

The objective of this scheme is to double the deposited amount in the following way:

Deposit Value | Maturity Value | Years |

| 10,000/- or multiple thereof | 20,000/- or multiple thereof | 6 years |

Table: TMDS Scheme

In case of discontinuation of the scheme, account will be settled as below:

Trust Educare Scheme (TES):

Students who are eligible to receive refunds from Bank are encouraged to enroll in this deposit.

The deposit with interest is payable is maturity either in lump-sum or as monthly allowances for 3/5 years starting from the completion of the term.

| Terms | Deposit Tk. | Monthly Educare allowance after maturity with 3 years continuity | Lump-sum amount payable at maturity |

| 3 years | Tk.10,000 | Tk.430 | Tk.13,400 |

| 5 years | Tk.10,000 | Tk.520 | Tk.16,000 |

Table: TES Scheme

Monthly Benefit Deposit Scheme (MBDS):

The benefit of the scheme will be paid on monthly basis. As such this is called Monthly Benefit Deposit Scheme (MBDS).

Target Group

- The benefit of the persons who intend to meet the monthly budget of the families from the income out of their deposit. It may be retired service holders, housewife of businessman & other professionals

- Trust and Foundations or other associations, which award monthly scholarship/stipends to students etc

Lakhopati Savings Scheme (LSS)

At the maturity the depositor will get TK. 1.00 Lac by the depositing monthly installment as per following arrangement:

Monthly installment size, tenor and terminal benefit of the scheme will be as follows:

| Monthly payable amount (Installment in BDT) | Duration/Period of the Scheme | Amount payable at maturity (BDT) | Rate of interest |

| 490.00 | 10 Years | 1,00,000.00 | 9.50% |

| 1,280.00 | 5 Years | 1,00,000.00 | 10.47% |

| 2,390.00 | 3 Years | 1,00,000.00 | 10.10% |

Table: LSSS Scheme

Interest First Fixed Deposit Scheme (IFFDS):

Interest First Fixed Deposit works like normal Fixed Deposit. In this deposit the customer receives interest in advance. The customer does not have to wait for maturity of the fixed deposit; instead he/she can use the interest immediately and keep the investment intact till the maturity. This is a smart scheme in the sense; depositor gets the interest first and can reinvest it.

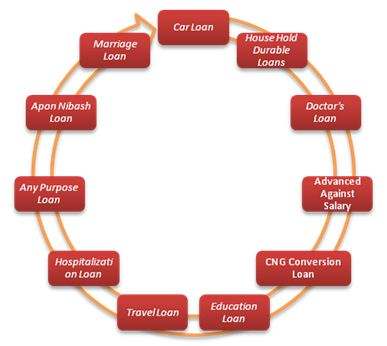

Retail Products:

There are several products under retail product offered by Trust Bank Limited. These are:

Figure: Retail Products

Car Loan:

Now a car is no longer luxury but necessity. Moreover, a car is more than a symbol of prestige. TBL offers you to materialize your dream of owning a car through TBL car loan facility.

Household Durables Loan:

Need are constantly changing phenomena in human life to improve the standard of living. Sometimes your saving is not good enough to meet your requirements. At, the Trust Bank, we take care of your financing needs and you can trust on us as your financial partner indeed.

TBL Doctor’s Loan:

Medical is a noble profession which is evolving fast. In a country like ours it is important to be a part of those changes as we cannot afford to be lag behind. Keeping that in mind and with a vision to support and promote health services, TBL is at your side with our Doctors’ Loan.

TBL Advance against Salary Loan:

Life is continuously facing unforeseen events. For which sudden financial support is essential. We are at your side to meet up your urgency at any moment through our “Advance against salary” scheme.

Education Loan Scheme:

A substantial amount of finance is required to give your child the best education or to get a higher degree either at home or abroad. TBL, “Education Loan” relief you from this burden and ensure uninterrupted study through steady flow of cash.

Travel Loan:

When you plan to travel local or global exotic location, financing is the key issue. TBL Travel loan is ready to provide instant financial support.

Hospitalization Loan:

Employees of confirmed service holders, Businessman, Professionals can avail this loan.

Any Purpose Loan:

We have so many needs, some are attainable with our means & standing and some are unattainable. The unattainable needs can be met by TBL. “Any Purpose Loan’

Apon Nibash Loan:

TBL offers Apon Nibash (House Finance) to you with easy repayment schedule matching your affordability. You have unlimited options of choosing your home with limited means and standing. Here, TBL Apon Nibash helps you to match your long cherished dream.

CNG Conversion Loan:

Confirmed service holders, Businessman, Professionals (Owner of the vehicle or valid user of the vehicle) & Corporate Clients (for more than one Car). Any other persons who have adequate cash flow to repay the loan installment. Maximum age limit of the borrower – 60 yrs; in exceptional case, MD can relax the age limit up to any age depending on the merit of the case.

TBL Marriage Loan:

Tying the marital knot is an event of a life time and its celebration and memories should last forever. TBL “Marriage Loan” will help you to arrange celebrate the marriage in style.

Credit Cards:

There are several options for credit cards offered by Trust Bank Limited. These are:

Figure: Credit Card Products

Visa Gold Local:

Visa Gold Local is an unsecured credit line operable only within Bangladesh. Bank may issue credit line for up to BDT 100,000 upon proper verification of all required documents.

Visa Classic Local:

Visa Classic Local is an unsecured credit line operable only within Bangladesh. Bank may issue credit line for up to BDT 50,000 upon proper verification of all required documents.

Visa Classic International:

Visa Classic International is an unsecured credit line operable outside Bangladesh only. Bank may issue credit line for up to USD 1,000 upon proper verification of all required documents.

Visa Gold International:

Visa Gold International is an unsecured credit line operable outside Bangladesh only. Bank may issue credit line for up to USD 3000 upon proper verification of all required documents. However, higher than USD 3000 may be approved if the qualified applicant maintains FC or RFCD account with TBL and the account has sufficient fund to justify the higher limit.

Visa Dual Card:

An unsecured credit line is issued against this card. The card is operable both inside and outside Bangladesh. Bank may issue credit line in both currencies. The combined limit is determined by the Credit Card Approval Committee.

Trust International Prepaid Card (Will be introduced soon):

Debit card generally carry the same features as a standard debit card, with integrated functions available. Prepaid Debit cards are commonly being developed with features such as online functionality, where the card can be just like a credit card providing service

- ATMs

- POS

- Online Purchase

The customer will use the Int’l prepaid card like cash to pay for products and services at accepting retail locations, restaurant and hotels abroad and anywhere in the world.

SME Financing:

There are several products under SME Financing offered by Trust Bank Limited. These are:

Figure: SME Finance

Agri-Business Loan:

Features

- Loan facility from TK. 2.00 lac to 50.00 lac to setup Agro Processing Units or to meet up working capital requirement of the business.

- No Mortgage or Equitable Mortgage for Loans up to TK. 5 lac.*

- Repayment Period: 01(One) year for Time Loan/OD and maximum 03(Three) for Term Loan

- Repayment of loan by Equated Monthly Installment (EMI) or from sales proceeds.

Eligibility

- Any sole Proprietorship or Partnership firm or Private Ltd. Co. having 03 years successfully business operation

- Monthly cash flow to repay the proposed Loan installment

- Owners in the age group of 25 to 60 years

Entrepreneurship Development Loan:

- This product is specially designed for retired other rank army personnel.

- Features

- Any Business Purpose Loan from Tk. 2.00 lac to 20.00 lac is to purchase Machinery & Equipment or to meet up Working Capital requirement.

- No Mortgage or Equitable Mortgage for loans up to Tk. 5 lac.*

- Tenor of Loan For working capital maximum 01 year and for fixed assets purchase maximum 03 years.

- Repayment of Loan by Equal Monthly Installment (EMI) or from sales proceeds

Eligibility

- Any Sole Proprietorship or Partnership firm preferably having 02 years successful business operation.

- Monthly cash flow in support of proposed loan installment.

- Owners in the age group of 35 to 60 years having completed at least 18 years of service.

Loan for Light Engineering:

Features

- Loan facility from Tk. 2.00 lac to Tk. 40.00 lac for Working Capital or to purchase Machinery & Equipment.

- No Mortgage or Equitable Mortgage for loans up to Tk. 5 lac.*

- Loan Repayment Period: Maximum 01(One) year for Time Loan/OD and for Term Loan maximum 05 years.

- Repayment of Loan by Equal Monthly Installment (EMI) or from sales proceeds.

Eligibility

- Any Sole Proprietorship or Partnership firm or Private Ltd. preferably having 03 years successful business operation.

- Monthly cash flow to support the proposed loan installment.

- Owners in the age group of 25 to 60 years.

Loan for Poultry Farm:

Features

- Loan facility from Tk. 2.00 lac to Tk. 20.00 lac for Poultry Business to meet up working capital requirement.

- No Mortgage or Equitable Mortgage for loans up to Tk. 5 lac.

- Tenor of loan not exceeding 01 (One) year.

- Loan to be repaid by Equal Monthly Installment (EMI) or from sales proceeds.

Eligibility

- Any Sole Proprietorship or Partnership firm or Private Ltd. Co. having 03 years successful business operation.

- Cash flow in support of the proposed loan installment.

- Owners in the age bracket of 25 to 60 years.

Loan for Shopkeepers:

Features

- To purchase inventory Shopkeepers may enjoy credit facility from Tk. 2.00 lac to 20.00 lac.

- No Mortgage or Equitable Mortgage for loans up to Tk. 5 lac.*

- Tenor of loan not exceeding 01 (One) year.

- Facility may be adjusted by Equal Monthly Installment (EMI) or from sales proceeds.

Eligibility

- Any Sole Proprietorship or any Partnership firm having 03 years successful business operation.

- Monthly cash flow to support the proposed loan installment.

- Owner’s age: 25 to 60 years.

Peak Seasons Loan:

Features

Loan Facility from Tk.2.00 lac to 20.00 lac is for purchasing inventory to meet peak season’s demand for different festivals.

Loan Repayment Period: Maximum 03(Three) months.

Repayment of loan by Installment or in Lump Sum within loan period.

Eligibility

Any Sole Proprietorship or Partnership firm or Private Ltd. Co. having 03 years successful business operation.

Cash flow in support of proposed loan installment.

Age of the owners in the range of 25 to 60 years.

Women Entrepreneur Loan:

Features

- Any business purpose loan from Tk.1.00 lac to Tk. 50.00 lac.

- No Mortgage or Equitable Mortgage for loans up to Tk. 15 lac.*

- Loan Repayment Period: 01 year for working capital finance and maximum 05 year for fixed assets purchase.

- To be repaid by Equal Monthly Installment (EMI) or from sales proceeds.

- Eligibility

- Any Sole Proprietorship or any Partnership firm preferably having 02 years successful business operation.

- Monthly cash flow to support the proposed loan installment.

- Owners in the age group of 20 to 55 years.

Automated Banking:

There are 3 types of automated banking offered by Trust Bank limited. Those are

Internet Banking:

It is time of Internet and one can access his/her account from anywhere in the world by using his/her unique user id and password. Here a User can see his/her account balance as well as take print out of transactions with specific date range and can preserve it as a document.

Phone Banking:

You may not have the time to get to a Trust Bank branch or it may be after regular business hours-so how do you access your account? Trust Bank has easy way to serve your banking needs using any phone, whether you are at home, office, or on the road. Trust Bank’s phone banking is absolutely free. This service performs balance query and mini statement of a customer via phone. Mini statement contains last five debit and credit transactions including balances. This service will soon include utility bill and fund transfer facilities. Phone Banking is available 24 hours a day, seven days a week.

Locker Service:

| Bangladeshi Locker | ||

| Lockers | Size | Rent (yearly) |

| Big | 21.5″x14.5″x9.75″ | Tk. 2000.00 |

| Medium | 21.5″x14.5″x5″ | Tk. 1500.00 |

| Small | 21.5″x7″x5″ | Tk. 1000.00 |

| Godrej Indian Locker | ||

| Lockers | Size | Rent (yearly) |

| Big | 20″x14″x11″ | Tk. 30,000.00 |

| Medium | 20″x14″x5″ | Tk. 20,000.00 |

| Small | 20″x7″x5″ | Tk. 15,000.00 |

Table: Feature of Locker Service

Islamic Banking:

Trust Islamic Banking is solely committed to conduct and manage the banking system abiding the Islamic law. Islam has given right to attain and own assets. At the same time Islam has also provided the processes and responsibilities for this. Following these processes and responsibilities absolutely will ensure the blessings in our life here and hereafter

Islamic Banking is Trade based banking system. Trade is mainly of two kinds- buy/sell and investment and both segment avoid the Interest completely. According to Islamic Shariah, buy/sell is process of purchasing of goods in a certain price with the buyer and seller’s consent. Shariah has the explanations for different kinds of purchasing contracts. On the other hand, investment is a business based on profit-loss sharing. There are Shariah compliant explanations for it and Islamic banking is managed complying all the Shariah commandments.

Success of Islamic Banking mostly depends on the commitment and knowledge of all the participators (bank and customer). Trust Bank is committed to offer the finest and modernized Islamic Banking system by means of its administrative professionalism and dedication.

Trust Bank offering Tree types of Islamic Products and those are

Financial Performance

The most important indicator of the Banks’ performance is their financial performance. If any organization is financially sound, it is assumed that organization is sound in its all dimensions. Financial performance is function of the all variables. The various dimensions of financial performance of The Trust Bank Limited are given below:

Capital Structure

Capital Structure consists of authorized Capital, paid up Capital, share money deposit, statutory reserve & retained earnings. Capital structure of Trust Bank from 2002 to 2007 is shown in the following table:

Table:

Figure in million Taka

SL. No. | Capital Components | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

1 | Authorized Capital | 2000 | 2000 | 2000 | 2000 | 2000 | 2000 |

2 | Paid up Capital | 1166 | 500 | 500 | 500 | 350 | 350 |

3 | Share money deposit | 330 | 200 | 200 | 200 | 150 | – |

4 | Statutory reserve | 61 | 214 | 113 | 67 | 24 | 10 |

5 | Retained earnings | 362 | 362 | 239 | 178 | 102 | (70) |

Analysis: Authorized capital of the bank was TK. 2000 million from its inception but its paid up capital has changed in the different years. In the year 2002 & 2003 the paid up capital was 350 million, in the year 2004, 2005 & 2006 it was 500million, & in the year 2007 it was 1166 million.

Other financial Performance Indicator

Table:

Figure in million Taka

SL. No. | Indicators | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

1 | Total Assets | 30,382 | 21,197 | 14,782 | 12,085 | 7,858 | 3,424 |

2 | Loans & Advances | 18,682 | 13,188 | 9,738 | 6,804 | 4,358 | 1,897 |

3 | Deposits | 19,252 | 18,985 | 12,704 | 9,042 | 4,483 | 2,991 |

4 | Total Equity | 2,154 | 1,154 | 991 | 870 | 454 | 236 |

5 | Other Liabilities | 28,228 | 20,043 | 13,791 | 11,251 | 7,404 | 3,118 |

6 | Net Interest Income | 667 | 400 | 167 | 130 | 79 | 105 |

7 | Net Profit After Tax | 239 | 262 | 121 | 216 | 68 | (140) |

Analysis: Total equity is very low compared to total liabilities. In the year 2002, total liabilities were 3,118 million where as in 2007 it was 28,228 million. In the year 2002, total equity was 236 million where as in 2007 it was 2,154 million.

Analysis: There was TK. 140 million losses in 2002. Net profit after tax was maximum TK. 262 in 2006. In 2007 Net profit after tax had slightly decreased because of the expansion of the branches. It was TK. 239 million in 2007.

Analysis: The trend of Net interest income is increasing day by day. In 2002 it was TK. 105 million & in 2007 it was maximum in figure TK. 667 million which was about six times from 2002. It was minimum in figure 79 million in the year 2003

Analysis: The trend of the total assets has been increasing. In 2002, it was TK. 3,424 million where in 2007 it was TK. 30,380 million which was about six times from 2002.

Analysis: Deposits & Loans has an increasing trend in the Trust Bank Limited. In 2002 deposit was TK. 2,391 million whereas in 2007 it was TK. 19,252 million. On the other hand, in 2002 loans was TK. 1,897 million whereas in 2007 it was TK. 18,682 million.

Ratio Analysis

Ratio Analysis is done to compare data & to various decisions about financial matter. Ratio analysis of the different aspects of the Trust Bank is given below:

SL. No. | Contents | Amount in | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

1 | Operating Income Ratio | % | 39 | 38 | 35 | 40 | 39 | 46 |

2 | Net Income Ratio | % | 7 | 11 | 8 | 20 | 12 | (40) |

3 | Return on Assets Ratio | % | .89 | 1.24 | .82 | 1.79 | .87 | (4.09) |

4 | Return on Equity Ratio | % | 17 | 22 | 12 | 24 | 15 | (59) |

5 | Earnings Per Share | Taka | 28 | 52 | 24 | 44 | 194 | (532) |

6 | Return on Investment | % | 9 | 20 | 11 | – | – | – |

Analysis: The operating income percentages in the different years are almost stable from financial year 2002 to 2007 it was 46, 39, 40, 35, 38 & 39 percent respectively.

Analysis: Net income ratio has been fluctuating from the inception. In 2002, it was in 40% loss. It was maximum in 2004. In 2005, 2006 & 2007, the net income ratio was low due to new branches expansion & the losses of the new branches.

Analysis: Return on asset has been fluctuating from the inception. In 2002, it was negative that is -4.09%. It was maximum in 2004. In 2005, 2006 & 2007, Return on asset was low due to new branches expansion & the losses of the new branches.

Analysis: Return on equity has been fluctuating from the inception. In 2002, it was negative i.e., -4.09. It was maximum in 2004. In 2005, 2006 & 2007, Return on equity was low due to new branches expansion & the losses of the new branches.

Analysis: Earning Per Share (EPS) was negative i.e., TK. -532in 2002. It was maximum i.e., TK.194 in 2003. In 2004, 2005, 2006 & 2007, EPS was low due to new branches expansion & the losses of the new branches.