Introduction

Origin of the Report:

Without practical experience, no one can acquire complete knowledge. Value of theoretical knowledge is insignificant, if practical experience is not added. It is more realized in the study of Business where practical experience plays an important role.

Internship means receiving practical experience through attending particular work physically. Practically internship means a way through which an internee, can gather experience about the related subjects and be able to apply his/her theoretical experience in the field of real life action. Practical training is necessary to achieve complete knowledge about something. Internship program is actually a form of practical training.

As a student of BBA, internship is an academic requirement of the Department. After observing systematically, I have prepared this report on the basis of my findings and observation related to the topic. The report is being submitted to fulfil the partial requirement of my BBA program.

Background of the Study

The program, conducted by the University of Dhaka, is the systematic process for gathering, recording and analyzing of data about the subject that a student goes to learn on the program.

The aim of this Internship program is to relate theoretical knowledge with the field of practical knowledge. We live in a world of severe competition where practical knowledge along with the theoretical knowledge creates a bridge to grow further and becoming globalized.

As part of practical orientation program, I was attached to Investment Corporation of Bangladesh for 2 months on complementation of the practical orientation program. It supported me a lot to complete this report successfully.

For my internship I was sent to the Investment Corporation of Bangladesh (ICB), under the supervision of Imrana Yasmin, Associate Professor, Department of Marketing, University of Dhaka. I have chosen the topic “Branding of Investment Corporation of Bangladesh: An aspect of ICB Mutual Funds”. I have been doing the internship at ICB from 08.02.2013 to 16.04.2013.

Aim and Objectives of the Study:

Aims

The aim of this report is to understand how Mutual Fund helps in the overall branding of Investment Corporation of Bangladesh.

Objectives

- Primary objective of this study is to assess the overall performance of ICB Mutual Fund in branding the Investment Corporation of Bangladesh.

- Secondary objectives of this report are:

- To evaluate the investor attitude toward ICB Mutual Funds

- To understand how ICB can increase brand loyalty through the quality service of ICB Mutual Funds

- To focus on overall performance of ICB Mutual Funds and its effects on the Investment corporation of Bangladesh

- To recommend some measures for possible improvement of the activities of ICB Mutual Fund

Literature review

Customer satisfaction can be defined as a measurement of the ability of the products or services to fulfil the demands of the consumers (Skogland and Siguaw, 2004). It can be measured in terms of the consumer perception towards the products or services provided by the organization. On the other hand, Silva (2006) mentioned that consumer satisfaction and loyalty for the products or services can be considered as a brand for the organization (Sharma and Jyoti, 2009).

Yu et al., (2005) stated that the big challenge for today’s service relays on the excellent service quality and high customer satisfaction. Customer satisfaction refers to the customer’s overall evaluation of the performance of a service (Yee et al., 2008). However, Wansoo (2009) stated that anecdotal and limited evidence directly impact on the relationship between customer and employee satisfaction. A satisfied customer might become a repeat buyer, and this overall satisfaction has a strong positive effect on customer loyalty intentions and help organization to create loyalty base of customers (Vora (2004). At the time, the customer reaches or exceeds the expectative and satisfaction, he or she can become a loyal costumer, but it always depends on the personal experience and perception of quality (Voordt and Theo, 2004). Ugboro and Obeng (2000) explain that non-satisfied customer would prefer to buy the product or service anywhere else. On the other hand, a satisfied customer can be a positive word of mouth recommendation and improve loyalty. In contrast, a negative word-of-mouth leads to reduced customer satisfaction, if follows that satisfied customers spreading positive word-of-mouth might create new customers to the business (Topolosky, 2000). Services of high quality lead to customer satisfaction and higher profits. Customer’s perceptions of satisfaction are almost always dependent on the factors of quality, facilities, convenience, cooperation of the employees, feedback to the customers response, congenial atmosphere of the company and service that the company offers, resulting in loyal customers and favorable word of mouth exchanges (Storbacka et al., 1994). With the purpose of improving their competitive position, many financial institutions use some form of customer satisfaction programs for the evaluation and control of their services (Stern, 2003). As a result, customer satisfaction has been increased and finally it becomes profitable for the organization. So that it can be said that, customer satisfaction and service quality of the institution or corporation are closely related to each other and these connection is important for the profitability and performance for the organization. Hayday (2003) conducted an analysis about the leftover of the customers and clients from the organization. And from the investigation it can be said that in about 68% cases the clients left the organization due to the lack of concerns of the employees than the answers of the employees. So the customer satisfaction is the key element for the development of the organization.

Horible (2009) mentioned that consumer satisfaction and loyalty for the products or services can be considered as a brand for the organization. The importance of financial institution is indescribable in the country. The impact of the financial institution to the economic sector for the nations is very much important. A financial institution deal with the money and the main goal of the institution is to act like as a connective medium between the investors who are ready to invest their money and mostly their hope (Hayday, 2003). Today financial institution is very advanced and it deals with the money that is used for further investment or investment in the share market or buying of other bonds, which can be considered as the medium for buying and selling any types of goods or services (Lee-Ross, 2005). The relationship between the customer profitability and customer satisfaction is energetic and it should have to take into consideration. The prolonged existence of the relationship and the extent of customer profitability should have to count and this profitable relationship lead to the building of brand image of the company where customers become loyal with the repeated purchase and long term relationship with the company.

A financial institution can be able to meet the needs of the consumers during the transaction but the consumers may not use the services of the institution again. It depends on the consumer’s loyalty. In order to attract the consumer the financial institution should have to provide better services and opportunities to the consumer in order to make the consumer liable to the service. At first, the institution should have to gain the trust of their consumer and this trust will become a brand for the organization.

All the institutions with mutual fund facilities provide same types of services but they do not provide the same quality of services. Furthermore, customers today are more aware of alternatives and their expectations of service have increased. Service quality can, therefore, be used as a strategic tool to build a distinctive advantage over competitors (Reichheld and Sasser, 1990). Although quality cannot be improved unless it is measured, it can be defined from several perspectives, e.g., the ability to satisfy the needs and expectations of the customer (Bergman and Klefsjo, 1994), or the totality of features and characteristics of a product or service that bears on its ability to satisfy given needs (Evans and Lindsay, 1996). While there is an increasing recognition of the importance of quality in mutual fund services, its conceptualization and empirical assessment have remained limited. Quality is still an elusive construct for many human services organizations. This is due to the difficulty in shifting a customer-oriented viewpoint. Since the central tenet of the quality paradigm is the importance of understanding and utilizing customer data to drive operational and strategic decisions, defining quality from the outside-in based on customer information is critical. This shift in defining quality often necessitates a fundamental change in the way professionals, managers, staff, and policy makers think about and identify those who “buy” or “use” services.

Customers become loyal when company provides flexible credit term policy and fair charge to the investors in the mutual fund. It works as an overall brand image creation of the company and building reputation of the company. Internal marketing of the company is also important in creating customer loyalty base and long term relationship between company and customers (Gustafsson et al., 2005). In case of dividend giving policy customer will give priority to that organization which will give higher dividend and will invest in the profitable sector (Knonberg 2011).customers perceived value, expectation, flexible policy, trust, safety, support, loyalty all these things are important to build overall brand image of the company which will contribute to the long term profitability of the organization.

Variables that (are found from LR) determine brand loyalty and image:

- Quality of services

- Commitment and long term relationship

- Level of efficiency of the employee

- satisfactory service and internal environment of the company

- Dividend and credit policy of the organization

- Fair charge and decisional support

- Counselling and response to the feedback

- Brand reputation

- Overall service of the company

- Trust, safety, convenience

- Employee satisfaction

- Level of efficiency of the management

Methodology:

- I designed this report in a way where I can bring out the best result easily and accurately. However, there is no set of compulsory rules for the researcher to choose and to design method for completing the report. I need to select one or few methods in order to accomplish the study to have best results. Thomas (2003) said that, Quantitative and qualitative both are effective for the groundwork of a research, both approaches can be applied in a single research approach.

- Development of methodology will help me to understand the perception of customer about their loyalty level to the ICB mutual Funds. I will also develop methodology to analyze the brand power of the ICB through the contribution of ICB mutual fund. There are many sources from where I have collected the related data to know how ICB mutual Fund is contributing to the branding of Investment Corporation of Bangladesh.

- This report has been prepared on the basis of experience gathered during the period of internship. I have carefully observed the entire Department of ICB and I got some information from the responsible officers of concerning Department.

- For preparing this report, I have also gathered information from annual report of ICB Mutual Funds and website of the Investment Corporation of Bangladesh. The study covered based on both primary and secondary data.

- I have presented my experience and finding by using different charts and tables, which are presented in the analysis part.

The details of the work plan are furnished below:

Data collection method: Relevant data for this report has been collected primarily by direct investigations of different records, papers, documents, operational process and different personnel. The interviews were administered by formal and informal discussion. Structured questionnaire has been used. Information regarding office activities of the organization has been collected through consulting various records and discussion with personnel from various Departments.

Sampling Design: Population of the study represents all the listed investors of the ICB mutual funds as well as all the employers and employees and worker of ICB. An Overview on the point of view of the investors of ICB Mutual Funds. Total information is classified on the basis of the findings of ICB Mutual Funds

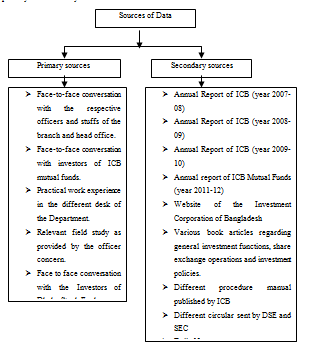

Data sources: The information and data for this report have been collected from both the primary and secondary sources.

Data processing: Data collected from primary and secondary sources have been processed manually and qualitative approach has been used through the study.

Data processing: Data collected from primary and secondary sources have been processed manually and qualitative approach has been used through the study.

Data analysis and interpretation: Qualitative approach has been adopted for data analysis and interpretation taking the processed data as the base. So the report relies primarily on an analytical judgment and critical reasoning about the performance of ICB Mutual funds that are contribution to the overall branding of ICB.

Scope of the Study

The scope of the report is basically the operations and practices of Investment Corporation of Bangladesh, in which I will undertake the internship program. The study confined only on the Head office and gave more concentration on it. The data comparison will be based on published information and an additional survey will perform to get in-depth information, as it helped to serve the attainment of objectives.

Limitations of the Study:

In preparing this report I have faced a little limitation. During this Internship Report I have worked all the departments of ICB one after another. So in this corporation, I tried to figure out the relationship among the concerning departments and how they are contributing with much dedication and sincerity. ICB is a large corporation, but study time two months are too short on an organization like ICB to figure out related all the information and this was the main limitations of my Internship Program. Another constraint did I face during the course of my study are as follows:

- Respondents of my Questionnaire survey were not that much spontaneous to give related information

- They were very busy to respond with sincerity

- ICB has 7 branches in the country. I could not able to visit all these branch offices.

- At the time of face to face discussion with officials, there were no sufficient chairs and tables.

- Inadequate information.

- Relevant papers and documents were not available.

- Official’s secrecy of ICB was also a problem to me.

Research Methodology Research Philosophy

Research philosophy defines why a particular research approach has been chosen or based on what philosophy the research is designed. Analyzing the research philosophies helps researcher to choose one particular philosophy. However, Bryman and Bell (2007)) and Saunders et al (2009) argued that choosing a research philosophy is vital because it has impact on the research. Moreover, the researcher has to justify why any particular philosophy has been chosen over others.

Saunders et al. (2007) stated that common research philosophies related with research are Positivism, Interpretive and Realism. Therefore, a researcher requires choosing a philosophy to decide how to view the information and how to achieve them. Several writers (Saunders et al., 2000), Ghauri et al. (1995), highlighted some core element of a research philosophy. Comparing two research philosophies, a researcher can set his or her research philosophy.

I also tried my best to follow the philosophy of any research where I have used the Survey questionnaire methods and make the respondents sure the information will totally be used only for educational purpose.

Research Approaches

For successful completion of the research, selection of appropriate research approach is very important. A research can be conducted in several ways; mainly researcher can identify the four basic approaches to conduct the research the research methodology: these are:

- Qualitative approach of research

- Quantitative approach of research

- Mixed Methods

- Advocacy and Participatory approach of research

However, researchers mainly use either qualitative or quantitative or mixed approach of research. Two ways to conduct a research/ or to collect research data, those are primary research, Secondary research. As this research is more related with the qualitative implication, so, I would like to choose the qualitative approach of research in this project, although in some case it has to deal with quantitative information when an initial understanding of customer brand support needs to develop and to understand the reasons and motivations of the customers about the ICB mutual Funds and the overall perception regarding the Investment Corporation of Bangladesh.

Denzin and Lincoln (2000), explained that, to have a deep understanding about the study and to focus on research quality, now researchers choose multi approach of research or mixed method of research. He also added that, in qualitative approach of research, a researcher could analyze different case studies along with distinctive quantitative approach. Easterby et al., (1991) said that quantitative research uses numbers and after statistical analysis, the inference is drawn.

Sampling/selection of respondent

The sampling frame is defined in terms of who the respondents are who can answer the questions that need to be addressed. To measure the investors’ attitudes towards ICB Mutual funds, I have selected 30 respondents.

Data collection

a. Primary data: Collecting data directly from the practical field is called primary sources of data. The method that will used to collect the primary data is as follows:

- Interview; Face to face conversation with the respective officers and staffs of the branch and head office helped me to collect information.

- Practical work experience; Working in different desk of the branch helped me to collect some information that makes the report informative. Notes taken during the internship program and related important information given by the officials of ICB Mutual Funds helped me a lot to the successful completion of this report.

- Survey Questionnaire: Containing 22 questions in the survey questionnaire.

b. Secondary data: The secondary data were collected from various departments of ICB. To clarify different conceptual matters, internet and different article published in the journals and magazines are used to best find the information about the ICB Mutual Funds. The secondary data had been collected with several relevant articles of the ICB.

These are given below:

- ICB Annual Report (2010-11).

- Annual Report of Mutual Fund (2010-11).

- Annual report of ICB Mutual Funds (2011-2012)

- Other supportive materials of the Investment Corporation.

- Published articles of Securities and Exchange Commission (SEC)

- Other related helpful sources.

Questionnaire framing techniques

In designing the questionnaire, I paid particular attention to the content and wording of the questions. I wanted to reduce the biasness of the respondents that’s why I structured the Questionnaires’ in a way which will reduce the biasness of the respondents. I used a mixture of questionnaire pattern which included Scaling, MCQ and open ended questions.

Data analysis

There are various options to gather data like questionnaires, interviews, observation and artefacts, case study etc. There are various possibilities of data gathering however, Thomas (2003) has mentioned that, there are some methods that can collect both primary and secondary information. In this research, I will only collect data from the questionnaire survey. Cameron and Price (2009) stated that, most of the questionnaire survey provides some pre-specified options to the respondents from where they can select the option they think suit with the questions asked. Questionnaire survey is an easy and more common approach for the many researchers to gather extensive primary data. As the sample of survey, I have selected the current customer of ICB Mutual Funds and investors from other companies. In data collection, a researcher has to consider the data quality, time limitations and costs as the core factors. Collected data will be analyzed through using the Microsoft excel and computers using SPSS software Qualitative information will be analyzed based on the nature of the information.

During the analysis of key questions, some questions are given utmost importance and some of the questions can be deleted or should not be analyzed. The main objective is to conclude an inference, that is, unnecessary findings will be deducted from the basic analysis. In this survey data were analyzed by comparing and contrasting the answers of the customers about the ICB Mutual Funds and its impact on ICB.

ICB AT A GLANCE

Historical Background

The emergence of Bangladesh as a sovereign country in 1971 is the culmination of the nine month long historic struggle of its people. Then the govt. of the infant country nationalized almost all the industries under the Bangladesh Industrial enterprise (nationalization) order 1972 popularly known as p 27.After liberation in view of socio – Economic change the scope for private sector investment in the economy was kept limited by allowing investment in projects up to taka 2.5 million. The new investment policy which was announced in July 1972 provided for an expanded role of private by allowing investment in a project up to tk30 million. One of the reasons among others was the institutional facilities, which provided underwriting support (like former investment corporation of Pakistan, (ICP) to industrial enterprises that was required to raise the much needed equity fund. Thus the need for reactivation of capital market/ stock market was keenly felt.

Government announced its decision to reactivate the stock exchange and examine the question of recreation of investment Corporation of Bangladesh. Accordingly a committee of officials examined the matter and recommended for recreation of ICB. After recommendation the Investment Corporation Of Bangladesh (ICB) was established on 1st October 1976, under “the investment corporation of Bangladesh Ordinance 1976”(no .XL of 1976).Through the enactment of the Investment Corporation of Bangladesh (Amendment) Act ,2000 (no.24 of 2000).Reforms in operational strategies and business policies have been implemented by establishing and operating subsidiary companies under ICB.

Vision

We will be leading, responsible and environment friendly financial institution operating. In such a way that our fellow competitors and the society watch, acknowledge, admire and emulate us as a role model of success.

Mission

- Bearing a responsible institution created by law, we will act in accordance with the mandates of ordinance for fostering rapid growth of Bangladesh economy.

- Bearing a financial architect, we will strive to establish a benchmark of values, attitudes, behaviour, and commitments with earnest endeavours in generating optimum profits and growth for our shareholders by efficient use of resources.

- Being an innovative solution provider, we put emphasis on formulating total solutions to foster mobilization of all domestic and NRB savings into potential investments.

Objectives of the ICB

The main objectives of ICB are as follows:

- To encourage and broaden the base of investments

- To develop the capital market.

- To mobilize savings.

- To promote and establish subsidiary companies for business development.

- To provide for matters ancillary thereto.

- Customer focus

- Passion to do the best

- Innovation for mankind

- Empowerment of people

- Compliance culture

- Continuous improvement

- High moral and ethical standards

Values ICB cherish Function of ICB:

- Direct purchase of shares and debentures including placement and equity participation

- Participating in and financing of joint-venture companies

- Providing lease finance singly and through syndication

- Managing existing investment accounts

- Managing Mutual funds and Unit funds.

- Managing Portfolios of existing shares

- Conducting computer training programmers

- Providing advance against ICB Unit and Mutual Fund certificates

- To act as Trustee and Custodian

- Providing Bank Guarantee

- Providing Consumer Credit

- Operating on the stock exchanges.

- Providing investment counselling to issuers and investors.

- Participating in and financing of joint venture projects.

- Dealing in other matters related to capital market operation.

- Introducing new business products suiting market demand

- To supervise and control the activities of the subsidiary companies.

Management of ICB

The Head office of the corporation as per the requirement of the ordinance of ICB is located at Dhaka. The general direction and superintendence of the corporation is created in a board of directors that consists of persons including the chairman and managing director of ICB.

The board of directors consists of the following directors:

- The chairman to be appointed by the government.

- The directors to be appointed by the government from among persons serving under the government.

- One director to be nominated by the Bangladesh Bank.

- Four other directors to be elected by the share holders other than the government, BB,BSB &BSRS.

- The managing directors of ICB to be appointed by the government. The board in discharging its functions acts on commercial consider rations with due regard to the interests of industry and commerce ,investment climate ,capital market, depositors, investors and to the public interest

- The managing director is the chief executive of the corporation. The corporation has an executive comprised of 5 people including managing director.

Number of Branches:

ICB is a statutory corporation & selling securities. In order to perform these activities effectively ICB has group of skilled manpower. For these purposes ICB has established seven branches in Bangladesh. Total branches are as follows:

- Chittagong Branch

- Rajshahi Branch

- Khulna Branch

- Barisal Branch

- Sylhet Branch

- Bogra Branch

- Local office Dhaka

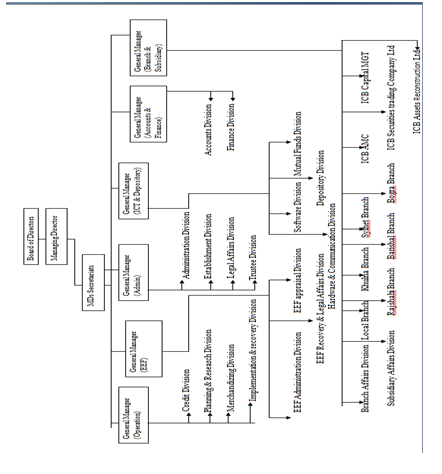

ICB Organizational structure and management:

Institutional framework of ICB:

Investment Corporation of Bangladesh is a cooperation body as per section 3 of Investment Corporation of Bangladesh Ordinance, 1976 and deemed to be a banking company within the meaning of the Banking Companies Ordinance, 1962 (L VII OF 1962). The shares of corporation are listed with the stock exchange. ICB is authorized broker of DSE.

Regulatory Framework of ICB:

As the mentioned earlier the regulatory framework of ICB is the, is the Investment Corporation of Bangladesh, 1976. This ordinance and regulations laid under the authority of the ordinance is the source of all power and authority of ICB. Through the recent enactment of “The Investment Corporation of Bangladesh (Amendment) Act200” (XXIV) of 2000, scope of ICB activities through the formation of subsidiaries have been expended. In addition to these , to resume its duties and functions , it has to compel by companies Act 1994, Trust Act 1882, Insurance Act 1983, Security and exchange commission Act 1993, banking companies 1993, Foreign exchange regulation 1974, Income tax Act etc

Management of ICB:

The head office of the corporation as per the requirement of the ordinance of ICB is located at Dhaka. The general direction and superintendence of the corporation is created in a board of directors, which consist of 12 persons including the chairmen and managing director of ICB. The board of directors consists of the following directors:

- The chairmen to be appointed by the government.

- The director to be appointed by the government from among persons serving under the government.

- One director to be nominated by the Bangladesh Bank.

- For other directors to be elected by the share holders other than the government, BB, BSB, & BSRS.

- The managing director of ICB to be appointed by the government.

- The managing director is the chief executive of the corporation. The corporation has an exclusive comprised of 5 people including managing director.

Board of Director of ICB:

The board is comprised of 10 directors. Exchange managing director, all directors are non- executive and independent and represent government, bank Insurance Corporation, financial institutions and general public. The board of director of ICB as on 30th June 2012 is as follows

Chairman of the board:

Dr.S.M.Mahfuzur Rahman

Professor, Department of International Business University of Dhaka

Subsidiary companies of ICB:

The Investment Corporation Of Bangladesh (amendment) Act,2000(XXIV of 2000) for Amendment of ICB ordinance1978,ICB has given power to create subsidiaries under the said amendment and according 3 subsidiary companies have been created namely-

- ICB Capital Management Ltd.

- ICB Asset Management Ltd.

- ICB Securities Trading Co. Ltd.

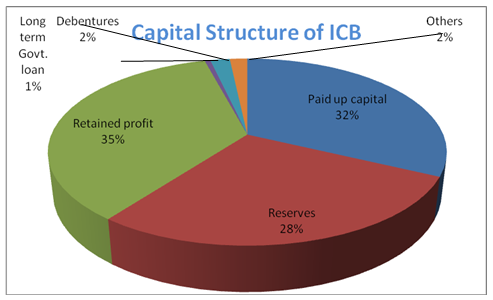

ICB capital Structure:

ICB is a merchant bank as well as a statutory corporation. It has own ordinance 1976. It is also public limited company. It is constructed by company Act. of 1949. The main source of capital is issuing of capital is issuing shares to the public, long term loans and debentures (www.secbd.org). The capital structure of ICB is given below as June 30, 2010:

Figure: capital structure of Investment Corporation of Bangladesh

Figure: capital structure of Investment Corporation of Bangladesh

Share Capital Ownership Pattern:

| Sl. No | Shareholders | No. of Shares | % of Shareholding |

| 1. | Govt. of Bangladesh | 670000 | 27.00 |

| 2. | Govt. Own commercial bank | 5681749 | 22.73 |

| 3. | Development financial institution | 6407749 | 25.63 |

| 4. | Insurance corporation | 3088905 | 12.86 |

| 5. | Denationalized private commercial banks | 2271312 | 9.08 |

| 6. | Private commercial banks | 1892 | .01 |

| 7. | Mutual fund | 200274 | 0.80 |

| 8. | Other institution | 65337 | 0.26 |

| 9. | General public | 532782 | 2.13 |

| 10. | Total | 25000000 | 100 |

Table : Classification of shareholder as on 31 December, 2012

Share Price:

ICB’s share price varied from lowest tk. 2170.5 to highest Tk. 5700 in the stock exchanges during the year. As on 30 June 2010, the market price of per share was Tk. 4991.75 and TK. 5020.0 in the DSE and CSE respectively.

Milestone of ICB:

Table : Milestone of Investment Corporation of Bangladesh

| Particulars | Date Of Establishment |

| ICB | 1st October 1976 |

| Investor’s Scheme | 13 June 1977 |

| ICB Chittagong Branch | 1 April 1980 |

| First ICB Mutual Fund | 25 April 1980 |

| ICB Unit Fund | 10 April 1981 |

| ICB Rajshahi Branch | 9 February 1984 |

| Second ICB Mutual Fund | 17 June 1984 |

| Third ICB Mutual Fund | 19 May 1985 |

| ICB Khulna Branch | 10 September 1985 |

| ICB Sylhet Branch | 15 December 1985 |

| Fourth ICB Mutual Fund | 6 June 1986 |

| Fifth ICB Mutual Fund | 8 June 1987 |

| Sixth ICB Mutual Fund | 16 May 1988 |

| ICB Barisal Branch | 31 May 1988 |

| Nomination as the Country’s Nodal DFI in SADF | 7 May 1992 |

| Seventh ICB Mutual Fund | 30 June 1995 |

| Eighth ICB Mutual Fund | 23 July 1996 |

| Purchase of own Land & Building | 11 December 1997 |

| Participation in Equity of SARF | 16 January 1998 |

| Advance against ICB Unit Certificates Scheme | 12 October 1998 |

| Lease Financing Scheme | 22 April 1999 |

| “The Investment Corporation of Bangladesh(Amendment) Act,2000” | 6 July 2000 |

International Activities

Figure: International activities

Figure: International activities

A SouthAsian Development Fund:

SAARC Fund for Regional Projects (SFRP) and SAARC Regional Fund (SRF) were established in 1991 with the collaboration of member countries of the SAARC. The establishment of SADF was officially declared by dissolving SFRP and SRF in a meeting of the member countries held in Dhaka in June 1996.SADF is an Umbrella Fund comprising three windows:

The Managing Director of ICB performed the responsibilities of the first chairman of the Governing Board of SADF and by rotation; the Chief Executive Officer of National Bank of Pakistan is the current Chairman of the Governing Board of SADF. Under Window –I of SADF ,identification and feasibility studies of 14 projects have been completed of which 9 projects are in Bangladesh and under window –ii training programmed were arranged in India.

B South Asian Regional Fund(SARF):

Investment in South Asia Regional Fund (SARF). To facilitate investments in SAARC member countries a development fund of US $ 200.0 million, namely, South Asia Regional Fund (SARF) was declared in the Commonwealth Summit held in 1997. The fund is managed by a wholly owned subsidiary of Commonwealth Development Corporation (CDC) incorporated in Mauritius. The objective of the fund is to achieve long term benefits through direct equity and equity related investments in private sector companies of SAARC countries.

Role of ICB in the Securities Market:

As in the previous years, ICB and its subsidiary companies played very important and expanded roles through participation in both the primary and secondary markets to quicken the pace of industrialization and to development and enlarge a vibrant and sustainable capital market in the country.

As on 30 June 2010,the members of ICB assisted securities were 139 out of 279 listed securities (excluding 171 Govt. treasury bonds) of the Dhaka Stock exchange Ltd. Out of 232 listed securities of the Chittagong stock Exchange Ltd.

In the reporting year, through the purchase and sale of securities for ICB’s investment portfolio, unit fund and mutual funds portfolios and on behalf of investment account holders ICB made significant contribution in maintaining stability, reliability and liquidity of the stock market.

ICB and its subsidiary companies’ contribution to total turnover of both the bourse has increased, simultaneously the transaction volume has increased, significantly during the year. The following table shows the position of transactions made by ICB and its subsidiary companies on DSE and CSE during 2009-2010 and 2008-0

Present Activities of ICB:

(A)Private placements:

ICB is authorized to act as an agent of the issuers and investors for private placements of securities. Under this arrangement, ICB places securities to individual/ institutions on behalf of the issuer for which it charges fees. ICB also acquires shares/securities for its own portfolio both in pre –IPO placement and equity investment.

(B) Custodian and Banker to the Issues:

To act as the custodian to the public issue of Opened & Closed –end Mutual funds. ICB provides professional services. It also acts as the Banker to the issues and provides similar services through the network of its branches. Fees in this regard are negotiable.

(C) Merger and Acquisitions:

Companies willing to expand their business through mergers or acquisitions or to Dis –investment projects that no longer viable into present capacity of operation can contact the Corporation. ICB provides professional service & advices in respect of shaping up the cost and financial structures to ensure best possible operational results. Besides, in case of divestment, the corporation ,through network and established business relationship, bring buyers and sellers together, help them to negotiate final agreement and advice on the emerging corporate structure.

(D) Corporate Financial Advice:

Government enterprises and companies intending to go public issue often seek professional &financial advice on corporate restricting & reengineering.ICB through its expertise provide such services through its expertise.

(E) Lease financing:

ICB provides lease finance mainly for procurement of industrial machinery, equipment and transport.ICB provides professional advice and financial assistance to the intending clients. The period of lease, rental, and charges and other terms and conditions are determined on the basis of type of assets and the extent of assistance required by the applicants. Since introduction of this scheme in 1999 good responses have been received from the intending leases.

(F) Investment Portfolio of ICB:

Being the largest institutional investor ICB contributes significantly to the development of the country’s capital market through active portfolio management which is one of the important functions of ICB .Up to 30 June 2004 ICB made a total investment of tk 41.08 crore in 27 companies through purchase of preference shares ,debentures, shares against pre-IPO placement and bonds of Tk.7.3 crore of 3 companies, tk. 9.5 crore of 3 companies ,Tk.11.33 crore of 12 companies and tk 5.0 crore of a company respectively through investment of Tk 7.95 crore in 8 companies as direct equity participation.

(G) Advance against Unit Certificates Scheme:

Advance against ICB Unit Certificates Scheme was introduced in 1998, especially designed for the ICB unit –holders to meet their emergency fund requirements. One can borrow maximum Tk.85 per unit by depositing his/her unit certificates under lien arrangement from any of the ICB offices where from such unit certificates were issued. The rate of interest on the loan is responsible and competitive.

(H)Advance against Mutual Fund certificates scheme:

Advance against ICB Mutual Fund certificates scheme was introduced in 2003,designed for the ICB Mutual Fund Certificates- holders to meet their emergency fund requirements. One can borrow maximum of 50% value of last one year’s weighted average market price of certificates at the time of borrowing by depositing his/her certificates under lien arrangement from any of the ICB offices. The rate of interest on the loan is responsible and also competitive.

Future Roadmap:

A great deal of planning effort of the Corporation has been towards future IT structure and related operations. In the roadmap the following goals have been set:

- The computerization plan should put emphasis on selection of hardware, network technology and platform software life RDBMS choice management support.

- Establishing ICB firmly on IT industry not only as a consumer but also as a formidable IT solution provider especially in the financial sector. ICB believes its huge experience over the years and infrastructure are something that can be offered in the financial arenas of Bangladesh and abroad on business basis in the future.

- ICB in the line of a unified system with end to end operational activity solution and MIS. With this in mind there is a plan for future integration and re-engineering of the existing software system into an integrated Enterprise Resource Planning (ERP)

- ICB is planning to collect all its branch operation online with its head office system. Online integrated branch banking with the central data depository in head office based on a strong WAN connection is the next in line.

The Managing Director of ICB performed the responsibilities of the first chairman of the Governing Board of SADF and by rotation; the Chief Executive Officer of National Bank of Pakistan is the current Chairman of the Governing Board of SADF. Under Window –I of SADF ,identification and feasibility studies of 14 projects have been completed of which 9 projects are in Bangladesh and under window –ii training programmed were arranged in India.

Organogram of ICB:

MUTUAL FUNDS

MUTUAL FUNDS

Introduction to Mutual Funds:

A Mutual Fund is a trust that pools the savings of a number of investors who share a common financial goal. The money thus collected is then invested in capital market instruments such as shares, debentures and other securities. The income earned through these investments and the capital appreciations realized are shared by its unit holders in proportion to the number of units owned by them. Thus a Mutual Fund is the most suitable investment for the common man as it offers an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost.

The flow chart below describes broadly the working of a Mutual Fund.

A Mutual Fund is a body corporate registered with the Securities and Exchange Commission that pools up the money from individual/corporate investors and invests the same on behalf of the investors/unit holders, in Equity shares, Government securities, Bonds, Call Money Markets etc, and distributes the profits. In the other words, a Mutual Fund allows investors to indirectly take a position in a basket of assets.

Mutual Fund is a mechanism for pooling the resources by issuing units to the investors and investing funds in securities in accordance with objectives as disclosed in offer document. Investments in securities are spread among a wide cross-section of industries and sectors thus the risk is reduced. Diversification reduces the risk because all stocks may not move in the same direction in the same proportion at same time. Investors of mutual funds are known as unit holders.

The investors in proportion to their investments share the profits or losses. The mutual funds normally come out with a number of schemes with different investment objectives which are launched from time to time. A Mutual Fund is required to be registered with Securities Exchange Commission which regulates securities markets before it can collect funds from the public.

Important Characteristics of a Mutual Fund

- A Mutual Fund actually belongs to the investors who have pooled their Funds.

- The ownership of the mutual fund is in the hands of the Investors.

- A Mutual Fund is managed by investment professional and other Service providers, who earn a fee for their services, from the funds.

- The pool of Funds is invested in a portfolio of marketable investments.

- The value of the portfolio is updated every day.

- The investor’s share in the fund is denominated by “units”. The value of the units changes with change in the portfolio value, every day. The value of one unit of investment is called net asset value (NAV).

- The investment portfolio of the mutual fund is created according to the stated Investment objectives of the Fund.

Types of Mutual Funds:

OPEN-ENDED MUTUAL FUNDS:

The holders of the shares in the Fund can resell them to the issuing Mutual Fund Company at the time. They receive in turn the net assets value (NAV) of the shares at the time of re-sale. Such Mutual Fund Companies place their funds in the secondary securities market. They do not participate in new issue market as do pension funds or life insurance companies. Thus they influence market price of corporate securities. Open-end investment companies can sell an unlimited number of Shares and thus keep going larger. The open-end Mutual Fund Company Buys or sells their shares. These companies sell new shares NAV plus a Loading or management fees and redeem shares at NAV. In other words, the target amount and the period both are indefinite in such fund

CLOSED-ENDED MUTUAL FUNDS:

A closed–end Fund is open for sale to investors for a specific period, after which further sales are closed. Any further transaction for buying the units or repurchasing them, Happen in the secondary markets, where closed end Funds are listed. Therefore new investors buy from the existing investors, and existing investors can liquidate their units by selling them to other willing buyers. In a closed end Funds, thus the pool of Funds can technically be kept constant. The asset management company (AMC) however, can buy out the units from the investors, in the secondary markets, thus reducing the amount of funds held by outside investors. The price at which units can be sold or redeemed Depends on the market prices, which are fundamentally linked to the NAV. Investors in closed end Funds receive either certificates or Depository receipts, for their holdings in a closed end mutual Fund.

Advantages of Mutual Fund:

- Mutual Fund substantially minimizes the investment risk of small investors through diversification in which funds are spread out into various sectors, companies, securities as well as entirely different market.

- Mutual Fund mobilizes the savings of small investor and channels them into lucrative investment opportunities. As a result, Mutual Fund adds liquidity to the market.

- Mutual Fund provides small investor’s access to the whole market that an individual level would be difficult if not impossible to achieve.

- Because funds are professionally managed, investors are relieved from the emotional strain associated with the day to day management of the fund. Thus the fund provides access to extensive local research and investment experience.

- The investor saves a great deal in transaction costs given that she/he has access to large number of securities by purchasing a single share of a Mutual Fund.

- Income will be tax free up to certain level, which is permitted as per Finance Act.

- Investment in the Fund would qualify for investment tax credit under section 44(2) of the Income Tax Ordinance 1984.

- SEC regularly monitors the performance of such funds. The laws governing mutual funds require exhaustive disclosures to the regulator and general public and, as such mutual funds are one of the most transparent investment vehicles in Bangladesh.

Organization and Management of Mutual Funds:

In Bangladesh Mutual Fund usually formed as trusts, three parties are generally involved

- Settler of the trust or the sponsoring organization.

- The trust formed under the Trust Act, 1882.

- Fund managers or The merchant-banking unit

- Custodians.

Mutual Funds Trust:

Mutual fund trust is created by the sponsors under the Trust Act, 1882 which is the main body in the creation of Mutual Fund trust.

The main functions and obligations of Mutual Fund trust are as follows:

- (Name of the Trustee)….. Shall be the Trustee of the Fund by Virtue of this Trust Deed.

- Planning and formulating Mutual Funds schemes.

- Seeking SEC’s approval and authorization to these schemes.

- Marketing the schemes for public subscription.

- The Trustee shall, as the guardian of the Fund hold all capital assets of the Fund in trust for the benefit of the unit holders, in accordance with the Securities and Exchange Commission (Mutual Fund) Rule 2001 and this instrument of Trust and the unit holders shall preserve only the beneficial interest in the Trust properties on pro rata basis of their ownership in the specific scheme of the Fund.

- The Trustee shall take all reasonable care to ensure that the schemes of the mutual fund floated and managed by the Asset Management Company are in accordance with the Trust Deed and the Securities and Exchange Commission (Mutual Fund) Rule 2001.

- The Trustee shall receive a quarterly report from the Asset Management Company and submit a six monthly report to the Commission on the activities of the schemes of the Mutual Fund.

- The Trustee shall have the right to call for any books of accounts, records, documents and such other information as considered necessary from the Asset Management Company as is relevant to the management of the affairs concerning the operation of the schemes of the Mutual Fund.

- The Trustee shall not participate in any decision making process for investments of the Fund and its various schemes.

- The Trustee shall be paid an annual Trusteeship Fee of @………% of the Net Asset Value (NAV) of the Fund on semi-annual in advance basis, during the life of the particular scheme or as may be agreed upon between the parties.

Custodians of mutual funds:

Responsibilities of custodians are:-

- Receipt and delivery of securities

- Holding of securities

- Collecting income

- Holding and processing cost

- (Name of the Custodian)….) shall be the Custodian of the Fund and its various Schemes as per the Securities and Exchange Commission (Mutual Fund) Rule 2001.

- The Custodian shall keep liaison with the CDBL and collect and preserve information required for ascertaining the movement of securities of the Fund.

- The Custodian shall keep the securities of the Fund in safe and separate custody and shall provide highest security for the assets of the Fund.

- The Custodian, among others, shall preserve the following documents and information as applicable as regards to the Fund:

- Details of acquisition and disposal of securities under custody;

- Details of receipt and disbursement of funds;

- Details about the right of the clients on the securities held on behalf of the clients:

- Details of registration of the securities, if any; under custody.

- Ledger of accounts of the clients;

- Details about the order received from and given to the clients;

- The Custodian shall have physical possession of the stock and securities of the Fund and be responsible for safekeeping of the securities. Applicable negotiated custodial service charges shall be paid to the Custodian by the Fund, which shall be competitive and market based and disclosed on the prospectus of the respective schemes.

- The Custodian shall also be responsible for the settlement, transfer and registration, dividend collection and corporate announcement dissemination services.

- The Custodian shall furnish to the Asset Management Company the interest that they may have in any company or financial institution or anybody corporate by virtue of their positions as director, partner, and managers or in which they may be associated with in other capacities.

How to Buy Existing Fund:

An investor can purchase any of the existing eight ICB Mutual Funds certificates through the Stock Exchanges at the prevailing Market Price. However, if an investor buys Mutual Fund certificates through the Stock Exchange he/she must be careful to submit the certificates along with duly filled-in transfer deed at ICB Head Office to ensure that the certificates arc registered in his/her name.

Launching:

Table : number of ICB mutual funds

| Mutual Fund | Date of Launching | Paid-up Capital |

| First ICB Mutual Fund | 25 April, 1980 | 50.00 |

| Second ICB Mutual Fund | 17 June, 1984 | 50.00 |

| Third ICB Mutual Fund | 19 May, 1985 | 100.00 |

| Fourth ICB Mutual Fund | 6 June, 1985 | 100.00 |

| Fifth ICB Mutual Fund | 8 June, 1987 | 150.00 |

| Sixth ICB Mutual Fund | 16 June, 1988 | 500.00 |

| Seven ICB Mutual Fund | 30 June, 1995 | 300.00 |

| Eight ICB Mutual Fund | 23 July, 1996 | 500.00 |

| Total = 1750.00 | ||

Declaration of Dividend

The net income received on investments of Funds on account of dividend, bonus, interest, capital gain etc. are distributed amongst the Certificate Holders as per decision of the Board of Directors of ICB. Board declares such income in form of dividend at the end of July each year. Dividends declared by ICB in the past on the Mutual Fund were very attractive. The year-wise per certificate dividend performance of the fund is given below:

To measure the dividend trend of the Mutual Fund we considered here the dividend often years. We calculated the average the dividends of eight Mutual Funds of last ten years. The trends of the dividends are shown in the graph below:

From trend analysis of ICB Mutual Fund it is found that there was an increasing each year. In year 2005-06 and year 2006-07 dividend increase very slowly. But in last three years it is increasing very rapidly. In year 2009-10 and 2010-11 it is double from the year 2008-09. O it is very clear from the figure the dividend trends of ICB Mutual Fund are upward.

NAV per certificate

| NAV (at Cost Price) | 2007 | 2008 | 2009 | 2010 | 2011 | as on 06.09.2012 |

| 1st ICB M.F. | 766.18 | 785.90 | 816.72 | 748.84 | 869.08 | 885.18 |

| 2nd ICB M.F. | 335.45 | 346.49 | 367.65 | 412.79 | 473.34 | 607.47 |

| 3rd ICB M.F. | 256.91 | 271.02 | 288.12 | 324.99 | 381.38 | 494.29 |

| 4th ICB M.F. | 270.78 | 276.48 | 291.58 | 325.32 | 379.59 | 455.59 |

| 5th ICB M.F. | 158.58 | 165.01 | 179.01 | 210.27 | 243.83 | 315.98 |

| 6th ICB M.F. | 129.65 | 135.69 | 143.23 | 162.87 | 182.87 | 188.31 |

| 7th ICB M.F. | 129.41 | 139.07 | 150.60 | 170.95 | 190.95 | 237.19 |

| 8th ICB M.F. | 128.86 | 133.77 | 140.90 | 158.60 | 176.45 | 212.31 |

Source: Annual Report of Investment Corporation of Bangladesh (ICB) Mutual Fund 2011- 2012

Portfolio Position, Market Price per Certificate and Number of Certificate Holders (as on 30June 2012)

Source: Annual Report of ICB Mutual Funds 2011-2012.

From the above table we see that, during the period 2011-12, Net income ICB 8th Mutual Fund is height and low 2nd ICB mutual fund. The distributable income per certificate and ex-dividend intrinsic value per certificate is height of ICB 1st Mutual fund and 6th & 7th ICB mutual fund is low.

Detailed Description of ICB Mutual Funds

ICB is the pioneer organization of initiating mutual fund in Bangladesh. The country’s first fund, the “First ICB Mutual Fund” was launched on 25 April 1980. Since then ICB had floated 8 mutual funds of total capital of TK.17.5 core up to investors as a rewarding and relatively safe investment instrument because of their strong and steady performance in terms of dividend and portfolio management.

First ICB Mutual Fund

The First ICB Mutual was established in April 1980, under regulation 29A of ICB (General) Regulation with a total capital of TK. 50,000 certificates of TK. 100 each. In the financial year 2006-07, one bonus certificates were issued against two certificates and capital fund raised by Tk. 25, 00,000. Now the paid-up capital of the fund stood at Tk. 755, 00,000 divided into 75000 certificates. The manager of the Fund is vested with ICB.

Dividend Income

The Fund has earned an amount of TK.89.24 lac as dividend from 56 securities during 2011-2012 of which a sum of TK. 59.96 lac (67.19 percent) was received in cash within 30June 2012.

Capital Gains on Sale of Investment

During 2009-10, the Fund earned TK.399.98 lac as capital gains by selling securities of 81 companies.

Income, Expenses and Distribute Income

During the year under review, the Fund has earned a gross income of TK. 505.30 lac. By way of dividend income of TK. 89.24 lac. Interest income of Tk. 14.04 lac. On bank deposits, capital gains of Tk. 399.98 lakh and other income. After deducting the total expenses of Tk. 20.14 lac. Incurred as staff expenses, interest on current account with ICB, management fee, printing and stationery, postage and telegram, bank charges, provision against investment and others the net income of the Fund stood at Tk. 485.23 lac. Taking into account the previous year’s undistributed income of Tk. 454.90 lac. The Fund had a net distributable income of Tk. 940.13 lac. As on 30 June 2012 resulting in distributable income per certificate of Tk. 1253.51.

Dividend

The Fund has declared dividend at the rate of 500.00 percent which was 400.00 percent for the previous year. After making provision of TK. 375.00 lac for payment of dividend the Fund had an undistributed income of TK 565.14 lace. The Year –wise dividend the Fund had an undistributed income of TK. 565.14 lace.

Dividend Performance of First ICB Mutual fund.

Year- wise dividend performance (TK. per Certificate)

| Name of the fund | Financial Year | ||||

| 2007-08 TK. | 2008-09 TK. | 2009-10 TK. | 2010-11 TK. | 2011-12 Tk. | |

| First ICB mutual fund | 190.00 | 265.00 | 310.00 | 400.00 | 500.00 |

Source: Annual Report of ICB Mutual Funds 2011-2012.

From the table we can see that, First ICB Mutual Fund Dividend performance (2010-11) is high (TK.500.00) and (2006-07) is low (TK.190.00).

Second ICB Mutual Fund

The Second ICB Mutual was established in June 1984, under regulation 29A of ICB (General) Regulation with a total capital of Tk. 50, 00,000 dividends into 50000 certificates of TK. 100 each. The manager of the Fund is vested with ICB.

Dividend Income

The Fund has earned an amount of TK. 35.42 lac as dividend and interest from 59 securities during 2011-2012 of which, Tk. 33.12 lac (92.46 percent) was received in cash within 30June 2012.

Capital Gains on Sale of Investments

During 2011-12, the Fund has earned TK. 264.35 lac as capital gains by selling securities of 62 companies.

Income, Expenses and Distribute Income

During the year under review, the Fund has earned a gross income of Tk. 308.05 lac. by way of dividend and interest income from investment in securities of Tk. 35.82 lac. Interest income of Tk. 4.49 lac. On bank deposits, capital gains of Tk. 264.35 lac. and other income. After deducting the total expenses of Tk. 142.95 lac. Incurred as staff expenses, management fee, printing and stationery, postage and telegram, interest on current account with ICB, bank charges, provision against investment and others, the net income of the Fund stood at Tk. 165.10 lac. Taking into account the previous year’s undistributed income of Tk. 159.89 lac the Fund had a net distributable income of Tk. 324.99 lac as on 30 June 2012 resulting in distributable income per certificate of Tk. 649.98.

Dividend

The Fund has declared dividend at the rate of 250.00 per certificate of Tk. 100.00 each for the year 2010-111, which was Tk. 200.00 per certificate in the previous year. After making provision of Tk. 125.00 lac for payment of dividend the Fund has an undistributed income of Tk 199.99 lac.

Dividend Performance Second ICB Mutual fund.

Year- wise dividend performance (TK. per Certificate)

| Name of Fund | Financial Year | ||||

| 2007-08 TK. | 2008-09 TK. | 2009-10 TK. | 2010-11 TK. | 2011-12 Tk. | |

| Second ICB Mutual fund | 62.00 | 75.00 | 95.00 | 200.00 | 250.00 |

Source: Annual Report of ICB Mutual Funds 2011-2012.

From above the table we can see that, the dividend performance of ICB Second Mutual Fund (2011-12) is high (TK.250.00) and (2006-07) is low (TK.62.00).

Third ICB Mutual Fund

The Third ICB Mutual was established in May 1985, under regulation 29A of ICB (General) Regulation with a total capital of Tk. 100, 00,000 dividends into 100000 certificates of Tk. 100 each. The manager of the Fund is vested with ICB.

Dividend Income

The Fund has earned an amount of Tk. 41.45 lac dividend and interest from 58 securities during 2009-2010 of which, Tk. 37.37 lac (90.16 percent) was received in cash within 30June 2011.

Capital Gains on Sale of Investments

During 2010-11, the Fund has earned Tk. 303.52 lac as capital gains by selling securities of 69 companies.

Income, Expenses and Distribute Income

During the year under review, the Fund has earned a gross income of Tk. 367.75 lac. by way of dividend and interest income from investment in securities of Tk. 41.45 lac. interest income of Tk. 20.19 lac. On bank deposits, capital gains of Tk. 303.52 lac. and other income. After deducting the total expenses of Tk. 119.41 lac. Incurred as staff expenses, management fee, printing and stationery, postage and telegram, interest on current account with ICB, bank charges, provision against investment and others, the net income of the Fund stood at Tk. 284.34 lac. Taking into account the previous year’s undistributed income of Tk. 236.89 lac the Fund had a net distributable income of Tk. 485.23 lac as on 30 June 2012 resulting in distributable income per certificate of Tk. 485.23.

Dividend

The Fund has declared dividend at the rate of 185.00 per certificate of Tk. 100.00 each for the year 2010-11, which was Tk. 140.00 per certificate in the previous year. After making provision of Tk. 180.00 lac for payment of dividend the Fund has an undistributed income of Tk 305.23.

Dividend Performance Third ICB Mutual fund.

Table-10 Year- wise dividend performance (TK. per Certificate)

| Name of the Fund | Financial Year | ||||

| 2007-08 TK. | 2008-09 TK. | 2009-10 TK. | 2010-11 TK. | 2011-12 Tk. | |

| Third ICB Mutual fund | 56.00 | 65.00 | 85.00 | 140.00 | 185.00 |

Source: Annual Report of ICB Mutual Funds 2011-2012.

From the table we can see that, the dividend performance of ICB Third Mutual Fund (2010-11) is high (TK.185.00) and (2006-07) is low (TK.56.00).The duration is (TK.129.00).Fourth ICB Mutual Fund

Dividend Income

The Fund has earned an amount of Tk. 50.20 lac as dividend and interest from 64 securities during 2009-2010 of which, Tk. 39.03 lac (77.74 percent) was received in cash within 30June 2011.

Capital Gains on Sale of Investments

During 2010-11, the Fund has earned Tk. 373.32 lac as capital gains by selling securities of 76 companies.

Income, Expenses and Distribute Income

During the year under review, the Fund has earned a gross income of Tk. 443.90 lac. by way of dividend and interest income from investment in securities of Tk. 50.20 lac. interest income of Tk. 16.09 lac. on bank deposits and capital gains of Tk. 373.32 lac. After deducting the total expenses of Tk. 209.87 lac. incurred as staff expenses, management fee, printing and stationery, postage and telegram, interest on current account with ICB, bank charges, provision against investment and others, the net income of the Fund stood at Tk. 234.02 lac. Taking into account the previous year’s undistributed income of Tk. 243.20 lac, the Fund had a net distributable income of Tk. 477.22 lac as on 30 June 2010 resulting in distributable income per certificate of Tk.477.22.

Dividend

The Fund has declared dividend at the rate of 165.00 per certificate of Tk. 100.00 each for the year 2010-11, which was Tk. 125.00 per certificate in the previous year. After making provision of Tk. 165.00 lac for payment of dividend the Fund has an undistributed income of Tk 312.22 lac..

Dividend performance Fourth ICB Mutual fund.

Year- wise dividend performance. (TK. per Certificate)

| Name of the Fund | Financial Year | ||||

| 2007-08 TK. | 2008-09 TK. | 2009-10 TK. | 2010-11 TK. | 2011-12 Tk. | |

| Fourth ICB mutual fund | 52.00 | 60.00 | 80.00 | 125.00 | 165.00 |

Source: Annual Report of ICB Mutual Funds 2011-2012.

From the table we can see that, Fourth ICB Mutual Fund (2010-11) dividend performance is high (TK.165.00) and (2006-07) is low (TK.52.00). The duration is (TK.113.00).

Fifth ICB Mutual Fund The Fifth ICB Mutual was established in June 1986, under regulation 29A of ICB (General) Regulation with a total capital of Tk. 15,000,000 dividend into 150,000 certificates of Tk. 100 each. The manager of the Fund is vested with ICB.

Dividend Income

The Fund has earned an amount of Tk. 67.07 lac as dividend and interest from 68 securities during 2011-2012 of which, Tk. 57.79 lac (85.65 percent) was received in cash within 30June 2011.

Capital Gains on Sale of Investments

During 2010-11, the Fund has earned Tk. 412.21 lac as capital gains by selling securities of 78 companies.

Income, Expenses and Distribute Income

During the year under review, the Fund has earned a gross income of Tk. 513.79 lac. by way of dividend and interest income from investment in securities of Tk. 67.47 lac. and interest income of Tk. 27.31 lac. on bank deposits, capital gains of Tk.412.21 lac. After deducting the total expenses of Tk.229.86 lac. Incurred as staff expenses, management fee, printing and stationery, postage and telegram, interest on current account with ICB, bank charges, provision against investment and others, the net income of the Fund stood at Tk. 283.93 lac. Taking into account the previous year’s undistributed income of Tk. 181.06 lac, the Fund had a net distributable income of Tk. 464.99 lac as on 30 June 2012 resulting in distributable income per certificate of Tk. 309.99.

Dividend

The Fund has declared dividend at the rate of Tk. 100.00 per certificate of Tk. 135.00 each for the year 2010-11, which was Tk. 100.00 per certificate in the previous year. After making provision of Tk. 202.50 lac for payment of dividend the Fund has an undistributed income of Tk 262.49 lac.

Dividend Performance Fifth ICB Mutual fund.

Year- wise dividend performance (TK. per Certificate)

| Name of the Fund | Financial Year | ||||

| 2007-08 TK. | 2008-09 TK. | 2009-10 TK. | 2010-11 TK. | 2011-12 Tk. | |

| Fifth ICB mutual fund | 33.00 | 45.00 | 56.00 | 100.00 | 135.00 |

Source: Annual Report of ICB Mutual Funds 2011-2012.

From the table we can see that, Fifth ICB Mutual Fund (2010-11) dividend performance is high (TK.135.00) and (2006-07) is low (Tk.33.00).

Sixth ICB Mutual Fund

The Sixth ICB Mutual was established in June 1986, under regulation 29A of ICB (General) Regulation with a total capital of Tk. 50,000,000 dividend into 5,00,000 certificates of Tk. 100 each.

Dividend Income

The Fund has earned an amount of Tk.73.81 lac as dividend and interest from 69 securities during 2010-11 of which, Tk. 66.61 lac (90.25 percent) was received in cash within 30June 2011.

Capital Gains on Sale of Investments

During 2010-11, the Fund has earned Tk. 541.64 lac as capital gains by selling securities of 80 companies.

Income, Expenses and Distribute Income

During the year under review, the Fund has earned a gross income of Tk.644.82 lac. by way of dividend and interest income from investment in securities of Tk.73.81 lac. interest income of Tk.21.94 lac. on bank deposits, capital gains of Tk. 541.64 lac. After deducting the total expenses of Tk. 115.95 lac. incurred as staff expenses, management fee, printing and stationery, postage and telegram, interest on current account with ICB, bank charges, provision against investment and others, the net income of the Fund stood at Tk.528.87 king into account the previous year’s undistributed income of Tk.298.98 Fund had a net distributable income of Tk.827.84 on 30 June 2011resulting in distributable income per certificate of Tk. 165.57.

Dividend

The Fund has declared dividend at the rate of Tk. 95.00er certificate of Tk. 100.00 each for the year 2010-11wich was Tk. 75.00 certificate previous year. After making provision of Tk.475.00 lac for payment fund has distributed income of Tk 352.84.

Dividend performance Sixth ICB Mutual fund.

Year- wise dividend performance (TK. per Certificate)

| Name of the fund | Financial Year | ||||

| 2007-08 TK. | 2008-09 TK. | 2009-10 TK. | 2010-11 TK. | 2011-12 Tk. | |

| Sixth ICB Mutual Fund | 23.00 | 30.00 | 37.00 | 75.00 | 90.00 |

Source: Annual Report of ICB Mutual Funds 2011-2012.

From the table we can that, the dividend performance of ICB Sixth Mutual Fund (2011-12) is high (Tk.90.00) and (2006-07) is low (Tk.23.00). The duration of dividend performance is (Tk.67.00).

Seventh ICB Mutual Fund

The Seventh ICB Mutual was established in June 1986, under regulation 29A of ICB (General) Regulation with a total capital of Tk. 3, 00, 00,000 dividends into 300000 certificates of Tk. 100 each.

Dividend Income

The Fund has earned an amount of Tk. 72.08 lac as dividend and interest from 76 securities during 2011-12 of which, Tk. 60.23 lac (83.56 percent) was received in cash within 30June 2012.

Capital Gains on Sale of Investments

During 2011-12, the Fund has earned Tk. 648.03 lac as capital gains by selling securities of 89 companies.

Income, Expenses and Distribute Income

During the year under review, the Fund has earned a gross income of Tk. 765.14 lac. by way of dividend and interest income from investment in securities of Tk. 72.08 lac., interest income of Tk. 37.25 lac. On bank deposits, capital gains of Tk. 648.03 lac. After deducting the total expenses of Tk. 361.03 lac. Incurred as staff expenses, management fee, printing and stationery, postage and telegram, interest on current account with ICB, bank charges, provision against investment and others, the net income of the Fund stood at Tk. 404.11 lac. Taking into account the previous year’s undistributed income of Tk. 257.31 lac, the Fund had a net distributable income of Tk. 661.42 lac as on 30 June 2012.

Dividend

The Fund has declared dividend at the rate of Tk. 95.00 per certificate of Tk. 100.00 each for the year 2010-11, which was Tk. 70.00 per certificate in the previous year. After making provision of Tk. 285.00 lac for payment of dividend the Fund has an undistributed income of Tk 376.42 lac.

Dividend Performance Seven ICB Mutual fund.

Year- wise dividend performance (TK. per Certificate)

| Name of the fund | Financial Year | ||||

| 2007-08 TK. | 2008-09 TK. | 2009-10 TK. | 2010-11 TK. | 2011-12 Tk. | |

| Seven ICB Mutual fund | 22.50 | 30.00 | 35.00 | 70.00 | 95.00 |

Source: Annual Report of ICB Mutual Funds 2010-11.

From above the table we can see that, the dividend performance of ICB Seven Mutual Fund (2011-12) is high (Tk.95.00) and (2006-07) is low (Tk.22.00). The different of two dividend performance is (Tk.73.00).

Eighth ICB Mutual Fund

The Sixth ICB Mutual was established in June 1986, under regulation 29A of ICB (General) Regulation with a total capital of Tk. 5, 00, 00,000 dividends into 500000 certificates of Tk. 100 each.

Dividend Income

The Fund has earned an amount of Tk. 81.51 lac as dividend and interest from 70 securities during 2011-2012 of which, Tk. 71.80 lac (88.09 percent) was received in cash within 30June 2012.

Capital Gains on Sale of Investments

During 2011-12, the Fund has earned Tk. 711.38 lac as capital gains by selling securities of 83 companies.

Income, Expenses and Distribute Income

During the year under review, the Fund has earned a gross income of Tk. 843.53 lac. By way of dividend and interest income from investment in securities of Tk. 81.51 lac. Interest income of Tk. 43.98 lac. On bank deposits, capital gains of Tk. 711.38 lac. After deducting the total expenses of Tk. 227.24 lac. Incurred as staff expenses, management fee, printing and stationery, postage and telegram, interest on current account with ICB, bank charges, provision against investment and others, the net income of the Fund stood at Tk. 616.29 lac. Taking into account the previous year’s undistributed income of Tk. 360.87 lac, the Fund had a net distributable income of Tk. 977.16 lac as on 30 June 2012 resulting in distributable income per certificate of Tk. 195.43

Dividend

The Fund has declared dividend at the rate of Tk. 90.00 per certificate of Tk. 100.00 each for the year 2011-12, which was Tk. 65.00 per certificate in the previous year. After making provision of Tk. 450.00 lac for payment of dividend the Fund has an undistributed income of Tk 527.16 lac.

Dividend Performance Eight ICB Mutual fund.

Year- wise dividend performance (TK. per Certificate)

| Name of fund | Financial Year | ||||

| 2007-08 TK. | 2008-09 TK. | 2009-10 TK. | 2010-11 TK. | 2011-12 Tk. | |

| Eight ICB Mutual Fund | 18.00 | 25.00 | 32.00 | 65.00 | 90.00 |

Source: Annual Report of ICB Mutual Funds 2011-2012.

From the table we can see that, the performance of Eight ICB Mutual Fund (2011-12) is high (Tk.90.00) and (2006-07) is low (Tk.18.00).

Consolidated Portfolio Statement

As on 30 June 2012 cost price and market price of eight Mutual Funds were TK. 9222.44 lace and TK. 33863.24 lace respectively. A consolidated statement of the portfolio of the Funds is given in the following table:

Table: Consolidated position of portfolios of ICB Mutual Funds as on June 2011-12.

| Sl | Particulars | 1st Mutual Fund | 2nd Mutual Fund | 3rd Mutual Fund | 4th Mutual Fund | 5th Mutual Fund | 6th Mutual Fund | 7th Mutual Fund | 8th Mutual Fund |

| 1 | No. of Companies | 128 | 126 | 143 | 142 | 159 | 190 | 185 | 180 |

| 2 | No. of Securities | 129 | 130 | 146 | 145 | 162 | 195 | 190 | 181 |

| 3 | Total investment at cost (TK In Lac) | 925.25 | 679.39 | 749.59 | 835.44 | 1091.92 | 1486.99 | 1555.76 | 1898.10 |

| 4 | Market Value (TK.in lac) | 8801.05 | 1899.79 | 2674.97 | 2808.21 | 3747.11 | 4305.13 | 4444.78 | 5182.24 |

.

Source: Annual Report of ICB Mutual Funds 2011-2012.

From the above table we see that, during the period 2011-12, the consolidated position of portfolios of ICB 1st Mutual Fund market value is high (Tk. 8801.05) as on 30 June 2012

PRICE MOVEMENT

During the year under review, certificates of eight Mutual Funds were actively traded on the floor of the Dhaka Stock Exchange Ltd and Chittagong Stock Exchange Ltd. The highest and lowest price of the eight Mutual Funds certificates on Dhaka Stock Exchange Ltd and position of total transaction during 2011-12 are shown in the following table.

Table: Market prices of ICB Mutual Funds during 2011-12.

| Sl. No | Mutual Funds | Highest market price (Taka) | Lowest market price (Taka) | Closing Market Price (Tk as on |

Source: Annual Report of ICB Mutual Funds 2011-2012.

ANALYSIS and FINDINGS

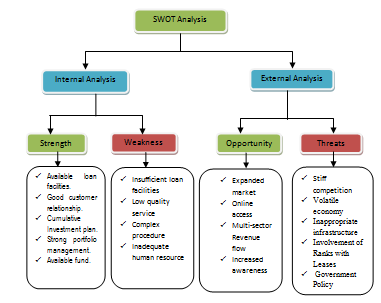

SWOT ANALYSIS

Factors of SWOT Analysis

SWOT analysis is an effective tool for analyzing of the efficiency and effectiveness of an organization. Here I tried to figure out the SWOT analysis of the ICB Mutual Funds. It is consist of four words which are Strengths:

Strengths:

Available loan facilities: Since ICB Mutual funds have huge opportunity to give loan facilities as the operation of ICB is huge and it continuously working on the development of its operation through offering loan facilities

Good customer relationship: ICB Mutual Funds maintain good customer relationship by giving profitable return, timely service and high dividend.

Cumulative investment plan: ICB Mutual Funds sometimes provide CIP certificates instead of dividend. It is helpful both for the investors as well as ICB. Because ICB gets the money again to its fund and investors get one more certificate.

Strong portfolio management: maintaining strong portfolio, ICB generates high profit that ultimately goes to investors pockets and this helps the ICB mutual fund to seek help from the organization whenever needed.

Available fund: ICB manages a number of funds to bring diversification in investment sectors and help its other subsidiary organization to make the necessary funds available when needed.

Weaknesses:

Insufficient loan sanction: Because of not recovering previous funds from the investors ICB Mutual Funds are reluctant to provide more to the investors.

Low quality service: Since it is a government corporation, it cannot keep pace with the private sectors. At the same time, it needs to maintain a lot of formalities that’s why its service is of low quality.

Complex procedure: in delivering loan to the investors and in giving profit it needs to maintain a lot of formalities which makes the procedure complex

Inadequate human resources: The human resources are not sufficient in terms of its service providing system. It has to maintain a number of formalities to recruit employees.

Opportunities:

Expanded market: As new industries are coming into the market, capital market is being large enough and long term financial demand is being created.

Online access: ICB Mutual Fund is trying to enter into the online facilities and enriching itself by introducing online access in its operations which will not require investors to physically come to the organization.

Multi-sector Revenue flow: Because of offering various financial tools, ICB Mutual funds generate revenue flows from different sectors.

Increasing awareness: Today’s investors are becoming more aware of capital market. They participate in the primary and secondary markets as well as in the diversified investment scheme.

Threats:

Stiff competition: previously ICB Mutual Funds were one of the financial corporations. But now a large number of financial institutions are involving in long term financing. That’s why ICB Mutual Funds are facing stiff competition.

Volatile economy: The economy of Bangladesh as well as that of the investment company is tied with the overseas. Rise in interest rate and events like terrorist attacks are likely to affect the Bangladesh economy and the margin of leasing companies also affecting this. The changing nature of share market also affecting the smooth operation of ICB Mutual Funds.

Inappropriate infrastructure: the lack of sufficient legal framework to penalize the defaulter takes this organization into a tough situation.

Involvement of Ranks with Leases: These days’ banks have come up with leases. This has further increased competition.

Government Policy: policy changes connected to the operation of finance companies might create an unfavourable impact on the investment industry. The decision to withdraw the accounting practices accelerated depreciation and extra shift depreciation has decreased the profitability of the Mutual Funds

Positioning helps an organization to occupy a distinct position in the minds of customers. Because of this positioning company can maintain a long term relationship with the customers because of its distinctive service or features which stimulate customers to purchase from the organization and becoming a loyal customer.