Bangladesh has a mixed banking system comprises of nationalized, private and foreign commercial banks. Bangladesh Bank (BB) has working as the central bank of the country since the independence of the country. Its prime jobs include issuing currencies, maintaining foreign exchange reserve and providing transaction facilities of all public monetary mattes. BB is responsible for planning and implementing the government’s monetary policy.

The banking sector of Bangladesh comprises of four categories of scheduled banks. These are nationalized commercial banks (NCBs), government owned development finance institutions (DFIs), private commercial banks (PCBs) and foreign commercial banks (FCBs). At present, there are four NCBs operating in Bangladesh. The second type is the DFIs which derive their funds mainly from the governments, other financial institutions, and supranational organizations. DFIs have taken a very specific form but most of them are oriented toward a specific economic activity or toward a region. There are five DFIs in Bangladesh. The third category, i.e. PCBs, finance the development of the currently industrialized countries. The profit motive stimulated the lending to promising sectors. In this category, there are thirty local PCBs and nine FCBs.

Banking system of Bangladesh:

Bank Types | No. of Banks | No. of Branches |

| NCBs | 4 | 3384 |

| DFIs | 5 | 1354 |

| PCBs | 30 | 1776 |

| FCBs | 9 | 48 |

| Total | 48 | 6562 |

The number of banks remained unchanged at 48 in 2006. These banks had a total number of 6562 branches as of December 2006. The number of bank branches increased from 6402 to 6562 due to opening of new branches by the PCBs mainly during the year. Structure of the banking sector with breakdown by type of banks is shown in Table below:

Table: Banking System Structure (billion tk)

| Bank Types | 2005 | |||||

| Number of Banks | Number of Branches | Total Assets | % of Industry Assets | Deposits | % of Deposits | |

| NCBs | 4 | 3386 | 763.1 | 37.4 | 621.3 | 40.0 |

| DFIs | 5 | 1340 | 197.2 | 9.7 | 89.5 | 5.8 |

| PCBs | 30 | 1635 | 934.3 | 45.6 | 731.3 | 47.0 |

| FCBs | 9 | 41 | 148.2 | 7.3 | 112.6 | 7.2 |

| Total | 48 | 6402 | 2042.8 | 100.0 | 1554.7 | 100.0 |

| 2006 | |||||

| Number of Banks | Number of Branches | Total Assets | % of Industry Assets | Deposits | % of Deposits |

| 4 | 3384 | 786.7 | 32.7 | 654.1 | 35.2 |

| 5 | 1354 | 187.2 | 7.8 | 100.2 | 5.4 |

| 30 | 1776 | 1147.8 | 47.7 | 955.5 | 51.3 |

| 9 | 48 | 284.9 | 11.8 | 150.8 | 8.1 |

| 48 | 6562 | 2406.7 | 100.0 | 1860.6 | 100.0 |

Banking Sector Performance, Regulation and Bank Supervision:

Framework for analysis:The major source of data for this study is annual report of Bangladesh Bank. Here banks are categorized into four broad categories: Nationalized Commercial Banks (NCBs), Government owned Development Financial Institutions (DFIs), Private Commercial Banks (PCBs) and Foreign Commercial Banks (FCBs).

In 2006 the nationalized commercial banks (NCBs) held 32.7 percent of the total industry assets as against 37.4 percent in 2005. Evidently, NCBs’ domination in this area is showing a declining trend, while PCBs’ share rose to 47.7 percent in 2006 as against 45.6 percent in 2005. The foreign commercial banks held 11.8 percent of the industry assets in 2006, showing a satisfactory increase by 4.5 percentage points over the previous year. The DFIs’ share of assets was 7.8 percent in 2006against 9.7 percent in 2005.

Aggregated Balance Sheet:

Assets: Aggregate industry assets in 2006 registered an overall increase by 17.8 percent over 2005. During this period, NCBs’ assets increased by 3.1 percent and those of the PCBs’ rose by 22.9 percent. Loans and advances played a major role on the uses of fund. Loans and advances amounting to Taka 1543.6 billion out of aggregate assets of Taka 2406.7 billion constituted a significant portion (64.1 percent). Cash in tills were Taka 21.8 billion (below 1.0 percent); deposits with Bangladesh Bank were Taka 135.2 billion or 5.6 percent; other assets were Taka 454.0 billion or 18.9 percent and investment in government bills and bonds accounted for 10.5 percent (Taka 252.1 billion) of the assets.

Liabilities: The aggregated liability portfolio of the banking industry in 2006 was Taka 2406.7 billion of which deposits constituted Taka 1860.6 billion, or 77.3 percent and continued to be the main sources of fund of banking industry. Capital and reserves of the banks were Taka 122.9 billion or 5.1 percent of aggregate liabilities in 2006, as against Taka 89.9 billion or 4.4 percent in 2005.

Earnings and Profitability: Strong earnings and profitability profile of a bank reflect its ability to support present and future operations. More specifically, this determines the capacity to absorb losses by building an adequate capital base, finance its expansion and pay adequate dividends to its shareholders. Although there are various measures of earning and profitability, the best and widely used indicator is returns on assets (ROA), which is supplemented by return on equity (ROE) and net interest margin (NIM).

Earnings as measured by return on assets (ROA) and return on equity (ROE) vary largely within the industry. Table 5.9 shows ROA and ROE by type of banks and Chart 5.9 shows the aggregate position of these two indicators for all banks. Analysis of these indicators reveals that the ROA of the NCBs have been almost zero percent considering huge provision shortfall and that of the DFIs even worse. PCBs had an inconsistent trend but satisfactory and FCBs’ return on assets ratio consistently declined from 3.5 percent in 1999 to 2.2 percent in 2006.

Profitability Ratios by Types of Banks (Percent) | ||||||||||||||||

| Bank Types | Return on Assets | Return on Equity | ||||||||||||||

| 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | |

| NCBs | 0.0 | 0.1 | 0.1 | 0.1 | 0.1 | -0.1 | -0.1 | 0.0 | -1.1 | 1.7 | 2.4 | 4.2 | 3.0 | -5.3 | -6.9 | 0.0 |

| DFIs | -1.6 | -3.7 | 0.7 | 0.3 | 0.0 | -0.2 | -0.1 | -0.2 | -29.4 | -68.0 | 12.3 | 5.8 | -0.6 | -2.1 | -2.0 | -2.0 |

| PCBs | 0.8 | 0.8 | 1.1 | 0.8 | 0.7 | 1.2 | 1.1 | 1.1 | 15.3 | 17.0 | 20.9 | 13.6 | 11.4 | 19.5 | 18.1 | 15.2 |

| FCBs | 3.5 | 2.7 | 2.8 | 2.4 | 2.6 | 3.2 | 3.1 | 2.2 | 41.8 | 27.3 | 32.4 | 21.5 | 20.4 | 22.5 | 18.4 | 21.5 |

| Total | 0.2 | 0.0 | 0.7 | 0.5 | 0.5 | 0.7 | 0.6 | 0.8 | 5.2 | 0.3 | 15.9 | 11.6 | 9.8 | 13.0 | 12.4 | 14.1 |

NCBs return on equity ratio rose from -1.1 percent in 1999 to 3.0 percent in 2003 but considered as zero percent in 2006. In case of DFIs, the ROE sharply rose from -68.01 percent in 2000 to 12.3 percent in 2001 and again declined to -0.6 percent in 2003 and remained worse (-2.0 percent) in 2006. The sharp rise in 2001 was due to booking of net profit amounting to Taka 1.01 billion in 2001 against net loss of Taka 5.2 billion in 2000 by the DFIs. The huge loss of the DFIs in 2000 was mainly due to making of provisions by debiting ‘loss’ in their books of accounts. In 2006, BKB and RAKUB and the Oriental Bank Limited incurred loss due to their huge operating expenses.

BRAC Bank Limited

BRAC Bank Limited is one of the latest generations of scheduled commercial banks in Bangladesh. It established in Bangladesh under the Banking Companies Act, 1991 and incorporated as private limited company on 20 May 1999 under the Companies Act, 1994.BRAC Bank Limited started its Journey on the 4th of July 2001 with a vision to be the absolute market leader through providing the entire range of banking services suitable to the needs of modern and dynamic banking business as well as to promote broad based participation in the Bangladesh economy through the provision of high quality banking services.

BRAC Bank Limited, with institutional shareholdings by BRAC, International Finance Corporation (IFC) and Shore Cap International has been the fastest growing Bank in 2004 and 2005. The Bank operates under a “double bottom line” agenda where profit and social responsibility go hand in hand as it strives towards a poverty-free, enlightened Bangladesh.

BRAC Bank is extending full range of banking facilities as per the directives of Bangladesh Bank. It intends to set standards as the absolute market leader in Bangladesh by providing efficient, friendly and modern fully automated on-line service on a profitable basis. Since inception, it has introduced fully integrated online banking service to provide all kinds of banking facilities from any of its conveniently located branches.

BRAC Banks envisages providing mass financing by increasing access to economic opportunities for all individuals and business in Bangladesh with a special focus on currently under-served enterprises across the rural-urban spectrum.

BRAC Bank is surviving in the large banking arena through its unique and competitive products and it is the only local bank providing 100% integrated on-line banking services.

In the last five years of operation, the Bank has disbursed over BDT 1500 crore in loans to nearly 50,000 small and medium entrepreneurs. The management of the Bank believes that this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh. Since inception in July 2001, the Bank’s footprint has grown to 36 branches, 392 SME unit offices and 67 ATM sites across the country, and the customer base has expanded to 200,000 deposit and 45,000 advance accounts through 2007.

Within this short time the bank has been successful in positioning itself as progressive and dynamic financial institution in the country. It has able to create an unique image for itself and earned significant solution in the banking sector of the country as a bank with a difference. In the years ahead BRAC Bank expects to introduce many more services and products as well as add a wider network of SME unit offices, Retail Branches and ATMs across the country.

Mission

According to the Bank their mission is to –

- Building a profitable and socially responsible financial institution focused on Marketing and Business with growth potential, thereby assisting BRAC and stakeholders build a “just, enlightened, healthy, democratic and poverty free Bangladesh”.

Vision

Their Visions are-

- Sustained growth in ‘Small & Medium Enterprise’ sector

- Continuous low-cost deposit growth with controlled growth in Retail Assets

- Corporate Assets to be funded through self-liability mobilization. Growth in Assets through Syndications and investment in faster growing sectors.

- Continuous endeavor to increase fee based income

- Keep our Debt Charges at 2% to maintain a steady profitable growth

- Achieve efficient synergies between the bank’s branches. SME unite offices and BRAC field offices for delivery of Remittance and Bank’s other products and services

- Manage various lines of business in a fully controlled environment with no compromise on service quality

- Keep a drivers, far flung team fully motivated and driven towards materializing the Bank’s vision into reality

Objectives

The objective of BRAC Bank Limited is specific and targeted to its vision and to position itself in the mindset of the people as a bank with difference. The objective of BRAC Bank Limited is as follows:

Building a strong customer focus and relationship based on integrity, superior service.

- To create an honest, open and enable environment

- To add value and respect people and make decisions based on merit

- To strive for profit & sound growth

- To value the fact that they are a member of the BRAC family – committed to the creation of employment opportunities across Bangladesh.

- To work as a team to serve the best interest of the owners

- To relentless in pursuit of business innovation and improvement

- To base recognition and reward on performance

- To responsible, trustworthy and law-abiding in all that we do

- To mobilize the savings and channeling it out as loan or advance as the company approve.

- To establish, maintain, carry on, transact and undertake all kinds of investment and financial business including underwriting, managing and distributing the issue of stocks, debentures, and other securities.

- To finance the international trade both in import and export.

- To develop the standard of living of the limited income group by providing Consumer Credit.

- To finance the industry, trade and commerce in both the conventional way and by offering customer friendly credit service.

- To encourage the new entrepreneurs for investment and thus to develop the country’s industry sector and contribute to the economic development.

Management of BRAC Bank Limited

Boards of directors are the sole authority to take decision about the affairs of the business. Now there are 6 directors in the management of the bank. All the directors have good academic background and have huge experience in business. Mr. Fazle Hasan Abed is the chairman of the bank. The board of directors holds meetings on a regular basis.

Treasury & Financial Institutions :

Treasury department is vested with the responsibility to measure and minimize the risk associated with Bank’s liquidity, foreign exchange exposure and asset liability management. Treausry continuously monitors price movement of foreign exchange and uses various hedging techniques to manage its open position in such a way that minimizes risk and maximizes return.

The Fl wing works as the trigger point of establishing new relationship with correspondent banks as well as to maintain the existing relationship to provide a smooth funding channel for all business units. BRAC Bank has a strong worldwide corresponded network with the world’s leading 20 banks to facilitate trade, remittance & other services to its client efficiently and profitably.

Central Operation:

Central Operations is the warden of all kinds of loan securities of the valued customers of BRAC Bank. It is a single point of contact of all loan documents and securities . Central operations support business and other operational uits through its following arms:

- Loan Archive

- Reconciliation

- Data Control

- Regional Operating Center

Enterprise Risk Management :

Enterprise Risk Management (ERM) is a new dimension for Brac Bank Ltd. ERM will set risk management strategy across the enterprise, designed to identify potential events that m ay affect the organization, and manage risk to be within its risk appetite, to provide reasonable assurance regarding the achievement of organizational objectives.

Financial Administration:

Financial Administration department has the responsibility of doing financial planning and management chart of A/C and control, budgetary planning, cost management and ensure financial control across the Bank. It also generates and disseminates all forms of internal and external financial reporting regulatory reporting and all business MIS.

General Infrastructure Services: General Infrastructure Services (GIS) plays the vital pivotal role to ensure all kind of infrastructure support services for the Bank. This Department consists of six functional units namely infrastructu8re Development, Infrastructure Management, Operations, Procurement , Logistics and Small and Medium Enterprise Administration Unit. With the combined roles and responsibilities of all these Units, GIS is actually the execution point for all administrative related activities including the development of infrastructure setups for new Head office Premises, Branch ATM Booths, Sales Center for BRAC-Bank Limited.

Credit Policy :

In order to minimize credit risk, BBL has formulated a comprehensive credit policy according to Bangladesh Bank Core Risk Management guidelines. Credit policy of BBL recommended through credit assessment and risk grading of all clients at the time of approval and Portfolio Review.

Consumer Service Delivery :

Consumer Service Delivery (CSD), an integral part of Bank’s business, complement the ever-flour8ishing retail business through account opening, customer statement generation, inter-bank cheque clearing, ATM & credit card production , cheque-book production and processing government bonds. The year highlighted 850,000 inter-bank clearing cheque processing, 132,000 new account opening and more than 716,000 account statement generation. In addition, CSD also produced 109,000 welcome packs, 1269,000 ATM and new initiative credit-card- operations produced 32,000 cards.

Company Secretariat : Company Secretariat is the flow line of all information to and from the Board of Directors. In the age of free economy, Company secretariat maintains a clear and distinct relation and liaison among investor, financiers, bankers donors, correspondents and many others of the market economy. The company secretariat of BRAC Bank limited is engaged to perform with a vital role in the management. There are two wings of company secretariat.

(a) Board Secretariat

(b) Share Division.

Impaired Assets Management :

Impaired Assets Management is new concept in the Banking arena. Impaired Assets Management (IAM) department of BBL is playing a pivotal role in managing non performing loan (NPL) and written off loan portfolio of BRAC and maintaining its portfolio at risk (PAR) at a low level. Separate segments of IAM department are engaged to monitor and follow-up NPLs of different business units.

Information Technology:

For BRAC Bank , technology is the silent strength behind its wide array of products and its 24/7 service delivery capabilities. The BRAC bank technology infrastructure now supports real time, online transactions between 36 branches for over 457, 126 customers throughout Bangladesh

PSRM :

PSRM is a new concept that deals with project Administrational and plays a pivotal role in coordinating ad fostering BRAC Bank driven projects.

Human Resources :

Human Resources Division plays a very important role in BRAC Bank. Managing almost 4400 employees is a challenging task and HRD is trying their best to do it in efficient manner.

The manpower of BRAC Bank is as follows:

| Particulars | 2007 | 2006 | 2005 | 2006 |

| Number of Employees | 4428 | 3047 | 1650 | 1216 |

HRD is also acting as a strategic business partner constantly with the business units in order to achieve the projected growth of Bank and in order to pursue the vision with the right blending of ethical commitments, we have created some core internal values which is called CRYSTAL all together . CRYTAL stands for

C= Creative, R= Reliable, Y= Young, S= Stable, T= Transparent, A= Accountable,

L= Loyal.

Marketing & Corporate :

Marketing & Corporate Affairs takes care of all forms of marketing and corporate communication, brand management, promotional activities, public relations and CSR activities . BRAC Bank aims to be the most preferred brand in its category and the Marketing and Corporate Affairs department works towards realizing that ambition.

Performance of BRAC Bank Limited

BRAC Bank Limited will be the most successful private sector commercial bank in our country, though it started its operation few years back. It has achieved the trust of the general people and made reasonable contribution to the economy of the country by helping the people investing allowing credit facility.

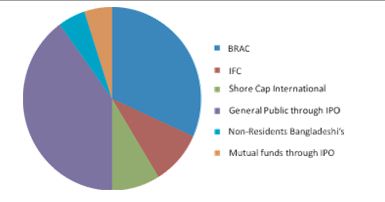

Shareholding Structure

The emergence of BRAC Bank Limited is an important event in the country’s financial sector at the inception of financial sector reform. The authorized capital of PBL is Tk. 1000 million and paid up capital of the same bank is Tk. 500 million.

Shareholding Structure

| Shareholders | Percent |

| BRAC | 31.74% |

| IFC | 9.50% |

| Shore Cap International | 8.76% |

| General Public through IPO | 40% |

| Non-Residents Bangladeshi’s | 5% |

| Mutual funds through IPO | 5% |

| Total | 100% |

Fig : Share Holder Structure

Analysis of Financial Statements

Operating Results Figure in million Taka

Sl No | Particulars | Particulars | 2006 | % of Change |

1 | Net Interest Income | 1984.00 | 1157.62 | 71% |

2 | Income from investment | 771.26 | 400.10 | 93% |

3 | Other Operating income | 791.00 | 519.73 | 52% |

4 | Operating Expenses | 1600.75 | 1027.02 | 56% |

5 | Loan Loss Provision | 681.16 | 345.05 | 97% |

6 | Net Profit Before taxes | 1264.34 | 705.36 | 79% |

7 | Provision for Taxes | 646.00 | 371.10 | 74% |

8 | Profit after taxes | 618.34 | 334.26 | 85% |

Interest income for the period has increased by 71% because of increase of loan by 61% and investment income by 93% over previous year; because of change in investment mix and inclusion of long term nature BGTB at higher interest rates. These factors cause the significant increase in operating margin over previous year.

Shareholder’s Equity

The Shareholders’ equity has increased by 45 percent over previous year. Paid up capital of the Bank is being raised from 1,000 million to 1 200 million in the year 2007 through issuance of bonus shares out of retained earnings in 2007. Besides this the bank also issued preference shares of Tk. 350 million in the year 2007. The statutory reserve also increased by Tk. 252.88 million over previous year balance of Tk.251 million. The Board of Directors recommended for raising paid up capital by issuing right share @ one for every five shares held at Tk. 500/- each including premium of Tk.400/- subject to approval of regulator authorities and EGM. However, Bank also proposed stock dividend of 10% which noticeably increase the capital base of the Bank.

Capital Adequacy

The Bank attained contentedly adequate capital of 12.28 % compared to the current regulatory requirement of 10.00%.}

| Capital Composition | 2003 | 2004 | 2005 | 2006 | 2007 |

| Capital -Core (Tier I)* | 395.92 | 590.20 | 782.88 | 1,967.14 | 2571.98 |

| Capital-Supplementary (Tier II)** | 28.40 | 60.08 | 206.00 | 529.14 | 1220.49 |

| Total Capital | 424.32 | 650.28 | 988.88 | 2,496.28 | 3792.47 |

* Core Capital (Tier I) includes Paid-up Capital, Share Premium Account, Statutory Reserve and Retained Earnings.

** Supplementary Capital (Tier II) includes General provision (on unclassified loans), Preference Share and Exchange Equalization Fund.Total Assets

Total Assets of the Bank rose to Tk. 46,382.59 million in 2007 from Tk. 30,011.82 million in 2006 registering a growth of 54.55%. Significant increases in assets documented in loans and advances, investments, fixed assets and cash assets maintained by bank.

Loans and Advances

Loans and advances increased to Tk. 32,461.10 million in 2007 from Tk. 19,557.17 million in 2006, thereby registering a growth of 65.99%.

SME sector, the main concentrated area for the bank financing since its inception, comprises of 58.58% of the total loans and advances. Sector-wise Credit Portfolio is shown in the figure below :

| No of Accounts | 2007 | 2006 | Increase |

| No. of deposit Accounts | 414,449 | 258,601 | 60.26% |

| No. of Loan Accounts | 96,867 | 61,526 | 57.44% |

| Total | 511,316 | 320,127 | 59.72% |

Deposits

Customer deposits of the Bank grew by 62.46% in 2007. The Bank ended to year 2007 with total customer deposits of Tk. 37,368.41 million compared to Tk. 23,001.92 million in the year 2006.

Deposit mix of the Bank stands at the followings:

Currently, the Bank’s deposits mostly comprises of fixed deposits. Since, almost 84% of total deposits are in the form of fixed & savings while only 15% are in the form of current deposits. This deposits mix scenario is quite similar to that in the previous year.

Investments

The Bank’s investment, during the year 2007, were made mostly in government securities which stood at Tk. 4,996.86 million as on December 31, 2007 as against Tk. 3,768.01 million in 2006.Out of total investment, 94.18% is concentrated in Covt. Treasury bills and bonds to maintain CRR and SLR of the bank comfortably and to use of our surplus fund in a cost effective means.

Earnings per share (EPS)

Earnings per share stood at Tk. 54.95 as on December 31, 2007 compared to Tk. 29.38 at the end of the previous year which is restated because of issuance of bonus shares during the year.Amount in BDT (Million)

Financial Position

Particulars | 2007 | 2006 | 2005 | 2004 | 2003 |

| Cash & bank balances | 6,279.13 | 5,107.59 | 2,254.00 | 2,198.37 | 1,041.80 |

| Investments | 4,996.86 | 3,768.01 | 2,163.81 | 1,625.91 | 529.54 |

| Loans & advances | 32,461.10 | 19,557.17 | 11,791.31 | 5,819.79 | 2,870.11 |

| Fixed assets | 942.93 | 389.38 | 156.36 | 30.68 | 7.45 |

| Other assets | 1,702.57 | 1,189.68 | 510.53 | 341.19 | 93.15 |

| Total Assets | 46,382.60 | 30,011.82 | 16,876.01 | 10,015.94 | 4,542.04 |

| Borrowings | 2,240.00 | 1,332.97 | 1,473.39 | 568.21 | 415.65 |

| Total deposits | 37,368.41 | 23,001.92 | 13,409.01 | 8,168.98 | 3,497.30 |

| Other liabilities | 3,702.16 | 3,559.73 | 1,210.68 | 688.54 | 233.17 |

| Equity | 3,072.03 | 2,117.19 | 782.93 | 590.21 | 395.92 |

| Total Liabilities | 46,382.60 | 30,01 1.82 | 16,876.01 | 10,015.94 | 4,542.04 |

| Credit deposit ratio | 86.87% | 85.02% | 87.94% | 71.24% | 82.07% |

| Interest earning assets | 44,445.21 | 28,774.45 | 16,278.38 | 9,704.67 | 4,475.59 |

| Non-Interest earning assets | 1,937.38 | 1,237.37 | 597.62 | 311.28 | 66.45 |

| Net assets value per share | 214.34 | 196.72 | 156.59 | 1 18.04 | 79.18 |

| Total contingent liabilities & commitments | 2,156.55 | 1,319.23 | 1,392.45 | 292.06 | 34.35 |

Profitability

Particulars | 2007 | 2006 | 2005 | 2004 | 2003 |

| Operating income | 3,546.25 | 2,077.43 | 1,173.32 | 679.45 | 233.30 |

| Operating expenses | 1,600.75 | 1,027.02 | 593.00 | 358.62 | 176.74 |

| Operating profit | 1,945.49 | 1,050.41 | 580.32 | 320.84 | 56.56 |

| Provisions for loans and others | 681.16 | 345.05 | 239.96 | 110.53 | 26.28 |

| Profit before tax | 1,264.34 | 705.36 | 340.36 | 210.30 | 30.28 |

| Provision for tax | 646.00 | 371.10 | 147.68 | 111.00 | – |

| Profit after tax | 618.34 | 334.26 | 192.68 | 99.30 | 30.28 |

| Portfolio Yield | 16.47% | 16.93% | 14.69% | 16.38% | 12.80% |

| Return on investment (ROD | 11.64% | 9.69% | 8.54% | 8.57% | 3.73% |

| Return on assets (ROA) | 1.62% | 1.43% | 1.43% | 1.36% | 0.92% |

| Cost of deposit | 8.91% | 8.47% | 7.58% | 7.23% | 7.50% |

| Weighted average earning per share | 53.68 | *29.38 | 38.54 | 23.16 | 12.09 |

| Net income per share | 49.99 | 32.08 | 38.54 | 19.86 | 7.48 |

Management Efficiency

Particulars | 2007 | 2006 | 2005 | 2004 | 2003 |

| Net Revenue Per Employee | 0.95 | 0.88 | 0.82 | 0.69 | 0.47 |

| Operating Cost per Employee | 0.43 | 0.44 | 0.41 | 0.37 | 0.36 |

| Cost to income ratio | 45.14% | 49.44% | 50.54% | 52.78% | 75.76% |

| Net Profit per employee | 0.57 | 0.46 | 0.41 | 0.35 | 0.08 |

Equity measures

Particulars | 2007 | 2006 | 2005 | 2004 | 2003 |

| Authorized capital | 2,000.00 | 2,000.00 | 1,000.00 | 1,000.00 | 1,000.00 |

| Paid-up capital | 1,200.00 | 1,000.00 | 500.00 | 500.00 | 405.02 |

| Capital – Core (Tier 1) | 2,571.98 | 1,967.15 | 782.89 | 590.21 | 395.92 |

| Capital – Supplementary (Tier II) | 1,220.49 | 529.14 | 206.00 | 60.09 | 28.40 |

| Total capital | 3,792.47 | 2,496.29 | 988.89 | 650.29 | 424.32 |

| Capital surplus/(deficit) | 704.41 | 835.66 | 40.57 | 73.68 | 157.18 |

| Share premium | 350.00 | 350.00 | – | – | – |

| Statutory reserve | 504.07 | 251.20 | 58.40 | 19.86 | – |

| Retained earnings | 517.91 | 365.94 | 224.49 | 70.35 | (9.10) |

| Capital adequacy ratio | 12.28% | 13.53% | 9.39% | 10.15% | – |

Asset Quality

Particulars | 2007 | 2006 | 2005 | 2004 | 2003 |

| Total loans & advances | 32,461.10 | 19,557.17 | 11,791.31 | 5,819.79 | 2,870.11 |

| Classified loans | 1,444.78 | 594.79 | 265.18 | 114.41 | 30.54 |

| Classified loans to total loans & advances | 4.45% | 3.04% | 2.25% | 1 .97% | 1.06% |

| Provision for Unclassified loan | 707.95 | 379.10 | 205.96 | 60.04 | 28.40 |

| Provision for Classified loan | 607.13 | 267.33 | 134.06 | 86.99 | 8.18 |

| Provision Adequicy Ratio ( times) | 1.04 | 1.02 | 1.09 | 1.38 | 1.00 |

Distribution network

Particulars | 2007 | 2006 | 2005 | 2004 | 2003 |

| Number of branches | 36 | 26 | 18 | 13 | 9 |

| Human Capital ( nos) | 4,428 | 3,047 | 1,650 | 1,216 | 746 |

| Number of ATM | 67 | 22 | 9 | ||

| Number of POS | 700 | 400 | 200 | ||

| Number of Zonal office | 107 | 89 | 51 | 36 | 16 |

| Number of Unit office | 392 | 355 | 292 | 265 | 157 |

* Last year figures have been rearranged to confirm current year’s presentation.

SME in BRAC Bank

Banking Industry is one of the most promising industries of our country. The importance of the sector revealed through its contribution in the economic growth of the country. And now a day worldwide SMEs are recognized as engines of economic growth (Ahmed 1999).So SME finance has become a remarkable topic in the finance sector of Bangladesh.

Brac Bank first fined out that the SME market in Bangladesh is large. From 2002 they have started to provide SMEs loan. From that time Brac bank special focus in promoting broad based participation by catering to the small and medium entrepreneur. Brac bank has already been established network of SME through out Bangladesh. Bank has adopted trust as a corporate value which is short form for team work, respect for all people, unquestionable integrity, excellence in everything Brac Bank of SME do, Sense of urgency in getting things done and total commitment. All employees are expected to conduct themselves in accordance with the rules and regulations of the bank. And now one of the major product and service of Brac Bank Ltd. is SME loan. Their main reasons for providing SME lone is to Support Small Enterprise, Economic Development, Spread the experience, Encourage Manufacturing, Profit Marking and Employment Generation Brac Bank start with a vision to be the absolute market leader in the number of loans given to small and medium sized enterprises through out Bangladesh.

Reason of SME program from the view point of BRAC Bank

The main focus of BRAC Bank is to develop human and economic position of a country. Its function is not limited only to providing and recovering of loan. But also try to develop economy of a country. So reason for this program from the viewpoint of BRAC Bank is:

- Support Small Enterprise: The small enterprise which requires 2 to 30 lacks taka loan, has no easy access to the banks/financial institutions. For example: 3 to 8 lacs amount of loans is provided without any kind of mortgage.

- Economic Development: Economic development of a country largely depends on the small and medium seal enterprises. Such as, if we analyze the development history of Japan, the development of small & medium scale enterprises expedite the development of that country.

- Employment Generation: The bank is generating employment opportunities by two ways:

Firstly, by providing loan to the small enterprises expanding, as these business requires more workers.

Secondly, Small & Medium Enterprise (SME) program requires educated and energetic people to provide savories to entrepreneurs.

- Profit Making: SME program is a new dimensional banking system in the banking world. Most of the CRO’s are providing door to door services to the entrepreneurs. The entrepreneurs are satisfied by the service of this bank and the bank also makes more profit.

- Encourage Manufacturing: A focus of BRAC Bank is to encourage manufacturing by the entrepreneurs who are producing by purchasing various types of materials. CRO’s try to educate them to produce material if possible because if they can produce in line of purchase profits will be high.

- Spread the experience: Another reason of BRAC Bank is to spread the knowledge of regarding various businesses. The customer services officer get knowledge from various businesses is and tries to help the entrepreneurs who have shortage of the gathered knowledge by CRO’s.Anonno Rin

“Anonno Rin” is a business loan designed to finance small scale trading, manufacturing and service ventures, especially to to help small and medium entrepreneurs to meet their short-term cash flow shortages and bridge the fund-flow gaps

Eligibility

- Entrepreneurs aged between 18 to 60 years

- Entrepreneurs with minimum 2 years experience in the same line of business

- A business which must be a going- concern with more than 1 year in operation

Maximum Amount

- From minimum BDT 3 lac up to maximum of BDT 9.5 lac

Features

- Loan without mortgage

- Loan for Working Capital Finance and/or fixed assets purchase

- Easy repayment system of monthly installment or Single Installment

- For excellent borrowers who have paid or are paying in due times, we offer discounted rates

- Quick, quality banking throughout the country

Loan Study | Installment (Principal) Repayment | Interest Repayment |

| 3 months-9 months | One single payment at maturity | Monthly |

| 12, 15, 18, 21, 24, 27, 30, 33, 36 months | Monthly installment | Monthly with installment |

Apurbo Rin

Apurbo is a loan facility for Small and Medium business. Apurbo loan has been designed and targeted for relatively bigger business units requiring loan above tk. 8 lacs to 30 lacs.

Eligibility

- Entrepreneurs having a minimum of 3 years of some business activities

- A business which must be a going concern for 3 years

- Age minimum 25 years and maximum up to 60 Years

Maximum Amount

- Starting from BDT 8 lac to maximum of BDT 30 lac

Features

- Without mortgage for loan below 10 lac

- Simple loan processing for expanding your business

- Quick disbursement

- Disbursement in one or two installments

- Flexible monthly repayment plan

Pathshala Rin

This is a loan designed to meet the needs of small and medium sized private educational institutions, such as kindergartens, schools and colleges etc.

Eligibility

- A small & medium educational institution that is in operation for minimum 3 years The institution should be sole proprietorship, partnership, Private Limited Company, or Society

- The educational institute must be a profit making concern

Maximum Amount

- Minimum BDT 3 lac to maximum BDT 30 lac

Features

- Without mortgage for loan below 10 lac

- Loan for fixed assets purchase & civil construction

- Loan repayment can be spread up to 4 years

- Minimum documentation

- Monthly repayment plan

- Quick disbursement

- Flexible interest rate based on security

Aroggo Rin

“Aroggo” is a loan allowed to various Health service Provider like private clinics, diagnostics centers and doctors’ chambers. The product offers fixed assets purchase financing under equated Monthly Installments.

Eligibility

- Minimum 2(two) years in operation

- Health center must be located in the same address for at least 6 months

- Health center must be a profit making concern

- Doctors having 5 years of experience can avail the loan in his/her personal name

Maximum Amount

- Minimum of 3 lac to maximum of 30 lac

Features

- Loan without mortgage up to 9.5 lac

- Easy loan processing

- Loan repayment schedule is spread up to 3 years

- 1% loan processing fee

- Flexible interest rate based on security and loan amount

Digoon Rin

This is a double loan on your deposit. Now you do not need to encash your savings rather you can take double amount of loan on your deposit for your business expansion.

Eligibility

- Entrepreneur having minimum 2 years of business activitie

- The business which must be a going concern for 2 years

- Cash security (BRAC Bank FDR) 50% of the loan amount.

Maximum Amount

- Minimum of 5 lac to maximum of 30 lac BDT

Features

- Double amount of loan on your deposit

- Attractive return against the deposit

- Flexible repayment plan in monthly installment and single installments

- Quick disbursement

Prothoma Rin

“PROTHOMA RIN” is a loan facility for small and medium sized business, which are operated by women entrepreneur. The product offers terminating loan facilities for the purpose of working capital finance and/or fixed assets purchase.

Eligibility

- Entrepreneurs with minimum 2 years experienc in the same line of business

- Minimum 1(One) year of continuous business history

Loan Limit:

- From minimum BDT 3 lac up to maximum of BDT 9.5 lac

Features

- Loan without Mortgage

- Easy repayment system

- Minimum documents

- Easy & faster processing

For excellent borrowers who have paid or are paying in due times, we offer discounted rates

Supplier Finance

Supplier Finance is a loan facility for the enlisted Suppliers of various large retailers, marketing companies, distributors, exporters etc. This product’s main objective is to help various Suppliers to meet their short-study cash flow shortages or bridge the fund-flow gaps.

Eligibility

- If you are an enlisted supplier of a corporate house with which BRAC Bank has a corporate tie- up

- Have minimum 3 years of continuous operation

- Have 1 year continuous relationship with the purchasing firm

Maximum Amount

- Minimum BDT 3 lac up to maximum BDT 30 lac

Features

- Equal monthly installment and revolving loan facility

- 1% of loan amount as the processing fee

BIZNESS Account

“Bizness Account” is an interest bearing current account for sole proprietorship business Entrepreneur.

Eligibility

- Small and medium sized business entrepreneur of a sole proprietorship business

- Opening balance only BDT-10, 000.00

Features

- 4% interest on daily balance

- Smart Business Card

- Cash withdrawal limit in ATM BDT 1,00,000 per day and any amount in POS

- 24 hour Access to ATMs/ POS

- Tk-50, 000 withdrawn facility (per day) from ATM & Tk-100, 000 from POS

- No Minimum Balance, No Ledger Fees, No hidden cost

Trade Plus is a composite facility for small & medium sized import-oriented businesses to meet their trade finance requirements.

The product benefits:

- Two types of Letter of Credit Facilities – One Off LC and Revolving LC

- LATR, Revolving Loan as well as Bank overdraft facilities

- Easy & faster processing.

Eligible to apply:

An importer of a company of last one year and having 2 (two) year’s experience in the same line of business and operating the current business for last one year you can avail BRAC Bank ‘ Trade Plus’

Documents need to get the loan:

Valid trade license, a copy of your IRC (import registration certificate), a V.A.T. Registration certificate, a T.I.N. Certificate and a copy of your Pro-Forma Invoice.

Purpose of use the Letter of Credit:

Use the Letter of Credit to import various legal commodities into Bangladesh, such as raw materials, finished products, etc.

Required LC margin:

Margin is negotiable, but not less than 10%.

Use FDR as Cash Margin:

Use FDR for possible to get this facility. FDR may be in the name of individual or Proprietorship Company or Limited Company. Third party FDR is acceptable to the Bank provided the relationship between the FDR holder & borrower is known and recorded.

Disbursement & repayment system of LATR:

Disbursement: Client will submit a request letter to retire the LC document from his/her Bizness account.

Full loan amount will be disbursed in the client’s link account (Bizness account) & full PAD will be adjusted from the Bizness Account.

Repayment: Single Installment at maturity of loan.

Disbursement & repayment system of Revolving Loan:

Disbursement: Customer can transfer full or partial value of loan limit as loan form the loan account to LC account for retirement of LC documents at the time of LC document retirement by submitting a request letter to the Bank. Customer will not allowed further withdrawal/transfer till the full adjustment of previous loan.

Repayment: Repayment shall be made in a single Installment or partly (Minimum 25% of loan) for each loan within the loan tenure by debit instruction from link account to loan account and interest will be served on a monthly basis on outstanding value.

Disbursement & repayment system of Overdraft:

Disbursement Mode: Limit will be set in your business account and you can withdraw or pay any amount (within limit).

Amount of Trade Plus:

The range of the products under Trade Plus are as follows:

| LC One-Off | BDT 3.00 Lac – BDT 30.00 Lac |

| LC (Revolving) | BDT 5.00 Lac – BDT 30.00 Lac |

| LATR | BDT 3.00 Lac – BDT 30.00 Lac |

| Revolving Loan | BDT 5.00 Lac – BDT 30.00 Lac |

| Overdraft | BDT 5.00 Lac – BDT 30.00 Lac |

Charges/fees for the facility:

Interest rate:

- For all funded facilities (i.e LATR, Revolving Loan and Overdraft), it is 18. % p.a. (Floating) Under commercial Lending Sector

- Processing Fee for funded facilities: 1% of loan amount + VAT

LC Schedule of Charges:

- LC Commission: 0.60% of the LC Amount plus VAT.

- Swift Charges: BDT 2750 + VAT

- Document Handling Charges: BDT 1000

- LC Application Form – Full Set: BDT 300 + Stamp Charges at Actual

Security requirement:

For LATR 3 lac to Below 10 lac: Usual charge documents, personal guarantee of spouse/family member, post dated cheque for full amount.

For Revolving loan 5 lac to below 10 lac: FDR as security for 20% of loan limit, other usual charge documents, personal guarantee of spouse/family member and post dated cheque for full amount.

For Revolving loan 10 lac to Below 30 lac: Registered mortgage of land property (minimum force sale value 125% of the loan amount) or Registered mortgage of land property + FDR (Face value of FDR and force sale value of Registered mortgage of land property = 100% of the loan limit), Hypothecation, post dated cheques, personal guarantor.

For Overdraft 10 lac to Below 30 Lac: Registered mortgage of land property (minimum force sale value 150% of the loan amount) or Registered mortgage of land property + FDR (Face value of FDR and force sale value of Registered mortgage of land property = 100%

Enterprise Selection Criteria

The success of SME will largely depend on the selection of a business and man behind it. In terms of the business (Enterprise), the following attributes should be sought:

- The business must be in operation for at least one year

- The business should be environment friendly, no narcotics or tobacco business

- The business should be legally registered, i.e., valid trade license, income tax or VAT registration, wherever applicable.

- The business should be in legal trade, i.e.; smuggling will not be allowed or socially unacceptable business will not be entertained.

- The business must have a defined market with a clear potential growth

- The business must be located ideally close to the market and the source of its raw materials/suppliers. It should have access to all the utilities, skilled manpower’s that are required.

- Any risk assessed by the management in turn will become a credit risk for the bank. So effort should make to understand the risk faced by the business

Entrepreneur Selection Criteria

In order to understand the capability of the management behind the business, the following should be assessed:

- The entrepreneur should be physically able and in good health, preferably between the age of 25-50. If he/she is an elderly person closer to 50, it should be seen what the succession process will be and whether it is clearly defined or not.

- The entrepreneur must have the necessary technical skill to run the business, i.e. academic background or vocational training, relevant work experience in another institution or years of experience in this line of business.

- The entrepreneur must have and acceptable social standing in the community (People should speak highly of him), he should possess a high level of integrity (Does not cheat anyone, generally helps people), and morally sound (Participates in community building)

- The entrepreneur must possess a high level of enthusiasm and should demonstrate that he is in control of his business (Confidently replies to all queries) and has the ability to take up new and fresh challenges to take the business forward.

- Suppliers or creditors should corroborate that he pays on time and is general in nature

- Clear-cut indication of source of income and reasonable ability to save.

Guarantor Selection Criteria

Equally important is the selection of a guarantor. The same attribute applicable for an entrepreneur is applicable to a guarantor. In addition he should posses the followings:

- The guarantor must have the ability to repay the entire loan and is economically solvent (Check his net worth)

- The guarantor should be aware about all the aspect of SEDF loan and his responsibility

- Govt. and semi-govt. officials can be selected as a Guarantor such as schoolteacher, college teacher, doctor etc.

- Police, BDR and Army persons, political leaders and workers, and Imam of mosque can not be selected as a guarantor.

- The guarantor should know the entrepreneur reasonable well and should preferably live in the same community

Terms and Conditions of SME Loan

The SME department of BRAC Bank will provide small loans to potential borrower under the following terms and condition:

- The potential borrowers and enterprises have to fulfill the selection criteria

- The loan amount is between tk 2 lacs to 30 lacs.

- SME will impose loan processing fees for evaluation / processing a loan proposal as following;

| Loan Amount | Loan Processing Fee |

| 2 lacs to 2.99 lacs | Tk 5000 |

| 3 lacs to 5 lacs | Tk 7500 |

| 5.01 lacs to 15 lacs | Tk 10,000 |

| 15.01 lacs to 30 lacs | Tk 15,000 |

Loan can be repaid in two ways:

a) In equal monthly loan installment with monthly interest payment, or

b) By one single payment at maturity, with interest repayable a quarter end residual on maturity

- Loan may have various validates, such as, 3 months, 4 months, 6 months, 9 months, 12 months, 15 months, 18 months, 24 months, 30 months and 36 months.

- The borrower must open a bank account with the same bank and branch where the SME has its account

- Loan that approved will be disbursed to the client through that account by account payee cheque in the following manner: Borrower name, Account name, Banks name and Branch’s name

- The loan will be realized by 1st every months, starting from the very next months whatever the date of disbursement, through account payee cheque in favor of BRAC Bank Limited A/C . With Bank’s named and branches name

- The borrower has to issue an account payable blank cheque in favor of BRAC Bank Limited before any loan disbursement along with all other security.

- The borrower will install a signboard in a visible place of business of manufacturing unit mentioned that financed by “BRAC Bank Limited”.

- The borrower has to give necessary and adequate collateral and other securities as per bank’s requirement and procedures.

- SME, BRAC Bank may provide 100% of the Net Required Working Capital but not exceeding 75% of the aggregate value of the Inventory and Account Receivables. Such loan may be given for periods not exceeding 18 months. Loan could also be considered for shorter periods including one time principal repayment facility, as stated in loan product sheet.

- In case of fixed asset Financing 50% of the acquisition cost of the fixed asset may be considered. While evaluating loans against fixed asset, adequate grace period may be considered depending on the cash generation after the installation of the fixed assets. Maximum period to be considered including grace period may be for 36 months.

Loan Sanction activities

- Select potential enterprise: For SME loan, in this step the CRO conduct a survey and identify potential enterprise. Then they communicate with entrepreneurs and discuss the SME program.

- Loan Presentation: The function of CRO is to prepare loan presentation based on the information collected and provided by the entrepreneur about their business, land property (Where mortgage is necessary)

- Collect confidential information: Another important function of a CRO is to collect confidential information about the client from various sources. The sources of information are suppliers regarding the clients payment, customers regarding the delivery of goods of services according to order, various banks where the client has account which shows the banks transactions nature of the client.

- Open clients accounts in the respective bank: When the CRO decided to provide loan to the client then he/she help the client to open an bank account where BRAC bank has a STD a/c. BRAC bank will disburse the loan through this account. On the other hand the client will repay by this account. Although there is some exception occur by the special permission of the authority to repay by a different bank account.

- Filled up CIB form: CRO give a CIB ( Credit Information Beurue) form to the client and the client fill and sign in it. In some case if the client is illiterate then the CRO fill the form on behalf of the client. Then CRO send the filled and signed form to the SME, head office.

- Sending CIB to Bangladesh Bank: The SME, head office collect all information and send the CIB form to Bangladesh Bank for clearance. Bangladesh Bank return this CIB form within 10-12 days with reference no.

- CIB report from Bangladesh Bank: In the CIB report Bangladesh Bank use any of the following reference no:

- NIL: if the client has no loan facility in any bank or any financial institution then BB (Bangladesh Bank) use ‘NIL’ in the report

- UC (Unclassified): if the client has any loan facility in any bank or financial institution and if the installment due 0 to 5.99 then BB use UC in the report

- SS (Substandard): if the client has any loan facility in any bank or financial institution and if the installment due 6 to 11.99 then BB use SS in the report

- DF(Doubtful): if the client has any loan facility in any bank or financial institution and if the installment due 12 to 17.99 then BB use DF in the report

- BL (Bad lose): if the client has any loan facility in any bank or financial institution and if the installment due 18 or above then BB use BL in the report. This report indicates that the client is defaulter and the bank should not provide loan the client.

- Loan decision considering CIB report: Considering CIB report, BRAC bank decide whether it will provide loan the client or not. If the bank decide to provide loan then the SME of head office keep all information and send all papers to the respective unit office to apply with all necessary charge documents.

Loan Sanction: The respective unit office sanction loan to the client if it is 2 to 5 lacs and they send the sanction letter including all necessary charge documents to the loan administration division for disbursement the loan. If the amount is higher than 5 lacs then the respective unit office send the proposal to SME, head office for sanction. The head of SME sanction the loan and send the sanction letter including all documents to the loan administration division for disbursement and inform the respective unit office regarding sanction of the loan.

Disbursement of SME loan

Pre Disbursement Manual Activities

- Prepare loan file: Receiving all documents, Loan Administration Division prepare a loan file with all documents received from the unit office.

- Charge documents checking: The loan administration division checks all charge documents. following charge documents are checked:

Money receipt (Risk fund)

Sanction letter

Demand promising note (With stamp of Tk 20/=)

Letter of arrangement (With stamp of Tk 150/=)

General loan agreement (With stamp of Tk 150/=)

Letter of undertaken (With stamp of Tk 150/=)

Letter of stocks and goods (With stamp of Tk 150/=)

Letter of hypothecation book debt and receivable(With stamp of Tk 150/=)

Letter of disbursement

Photocopy of trade license (attested by CRO)

Insurance (Original copy)

Blank claque with signature (one cheque for full amount and others same as no of installment on Favor of BRAC bank, no date, no amount)

Two guarantors ( one must be Spouse/parents)

If the loan provide for purchase of fixed assets or machineries and if the loan amount is over Tk 50,000/= then the stamp of a certain amount is require)

Prepare disbursement list: The loan administration division lists all new sanctioned clients details and send a request to the treasury through internal mail.

- Disbursement of the amount: Sending the list to the treasury of BRAC bank for disburse the amount, the treasury disburse the amount to the client through the mother account of the clients bank. BRAC bank disburse amount through any of the following banks corporate branch nearer the BRAC bank head office and the corporate branch of the respective bank send the amount to the client account in the respective branch. These banks are:

- BRAC Bank Limited

- The City Bank Limited

- Janata Bank

- Bangladesh Krishi Bank

- Pubali Bank

- Agrani Bank

Message sent to the unit office: Completing the disbursement, loan administration division sent a SMS to the respective CRO informing the disbursement of the sectioned loan.

MBS entries for loan disbursement

- Initial ID generation: After sending the list to the treasury, the loan administration division generates an initial ID against the borrower. Entering required information, the banking software MBS automatically provide a ID no for the borrower.

- Loan account opening: According to the ID, the loan administration division opens a loan account in MBS against the borrower. Entering all required information, the MBS automatically give an account no. for the borrower.

- Cost center assign: The loan administration division enter the following information in MBS:

- Security details set-up

- Guarantor details set-up

- Loan other details set-up

- Loan sanction details set-up

- Repayment schedule set-up and printing

- Loan activation

- Disbursement and CC wise voucher print

- Disbursement voucher posting

- Risk fund collection: The loan administration division opens a different account risk fund of the client. This is known as loan processing fees. Receiving the risk fund, the loan administration divisions print voucher and posting the voucher in the MBS. The amount of risk fund is not refundable.

- Activision of the loan: Loan administration division do the following tasks to activate the loan

Post Disbursement Manual Activities

Repayment schedule sent to unit office: Completing the disbursement of the sanctioned amount the loan administration division prepare a repayment schedule in MBS and send it to the unit office. CRO from the unit office collect it and reached to the respective client. The client repays the loan according to this schedule

Loan details MBS entry: The loan administration division enters details information regarding the loan in MBS. Each officer has an ID no in MBS and if there is any error found then the respective officer will be responsible for it. So every body remains alert at the time of MBS entry.

Document stamp cancellation: The loan administration division cancels all document stamps. In future if any client found defaulter and the bank file sued against him then stamps of these document help to get the judgment favor of the bank. But If these stamps are not canceled then the judgment may not on favor the bank.

Send the loan file to archive: completing all activities, loan administration division sends the loan file to the archive for future requirement. In future if any document of the loan account require then the bank can collect the file from archive and get the necessary document.

SME Loan Recovery Procedures

Receive SMS/Fax for installment deposits: When the borrower repays any installment of the loan then he/she informs it to the unit office/CRO. Then the unit office/CRO sends a SMS through mobile phone or a Fax to the loan administration division informing the repayment. Loan administration divisions collect these SMS /Fax and take a paper print of these SMS.

Entry the installment information to MBS: Loan administration division entry the repayment installment information to the banking software MBS.

Cross Check SMS/Fax and solve problems (If any): The loan administration is responsible for all entry in MBS. If the there is any error found in future then the respective officer who is entering these information in MBS will be liable for it. It will be easily identified by user ID. So they always aware to ensure the correct entry. Completing the entry of information, they print a hard copy and cross check it with the SMS/Fax. If there any error found then it is solved and ensure the correct information entry.

Closing procedures of SME loan in BRAC Bank:

Pre-closing manual activities

Receive SMS/Fax requesting for closing: The borrower repay the loan as per repayment schedule. When the repayment is being complete the borrower request the unit Office/ CRO to close his loan account. The unit office/CRO sends a SMS/Fax the loan administration division requesting to close the loan account of the respective borrower.

Print the SMS/Fax: Receiving the request from the respective unit office/CRO, the loan administration division takes a paper print and takes necessary steps to close the account

MBS entries for loan closing

Pre closing data entry: Completing the manual activities, the loan administration division enters some information to MBS for future requirement and complete following tasks:

- Interest/provision charging & print voucher

- Charges collection & print voucher

- Final repayment entry & print voucher

- Final repayment entry checking

- Repayment voucher posting

Activate account closing in MBS: Completing above mentioned tasks, the loan administration division finally close the requested loan account in MBS.

Post closing manual activities:

Re-checking with deposit slips: Completing MBS activities, the loan administration re-check all deposit sleeps of the loan account. If there is any error found then immediately resolves it otherwise the file sends to the archive for future requirements. The client may take repeat loan in future and then information from this file will help to approve and disburse loan which will minimize risk. If the client asks to return security then the loan administration releases security completing following tasks:

- Documents photocopy before security release

- Closing certificate issuing and security release

Daily MIS updating for loan closing: Finally the authorized officer of the loan administration division update the banking software MBS (Millennium Banking System) by closing the respective loan account.

Monitoring

Monitoring is a system by which a bank can keep track of its clients and their operations. So monitoring is an essential task for a CRO to know the borrowers activities after the loan disbursement. This also facilitates the build up of an information base for future reference. The CRO will monitor each business at least once a month. He/she will make a monitoring plan/ schedule at beginning of the month

Area of Monitoring

The purpose is to know the entire business condition and all aspects of the borrowers so that mishap can be avoided.

Business Condition:

The most important task of the CRO to monitor the business frequently, it will help him to understand whether the business is running well or not, and accordingly advice the borrower, whenever necessary. The frequency of monitoring should be at least once month if all things are in order.

Production:

The CRO will monitor the production activities of the business and if there is any problem in the production process, the CRO will try to help the entrepreneur to solve the problem. On the other hand the CRO can also stop the misuse of the loan other than for the purpose for which the loan was disbursed.

Sales:

Monitoring sales proceed is another important task of the CRO it will help him to forecast the monthly sales revenue, credit sales etc. which will ensure the recovery of the monthly loan repayments from the enterprise as well as to take necessary steps for future loans.

Portfolio analysis of SME loan

The main objective of this analysis is

- To see that how much loan bank provided for which product.

- To see that how much interest bank received from which product.

- Comparing the bank’s performance of its different products.

- Evaluating trends in the bank’s position over time.

Table: Loan and Advance portfolio analysis:

| Category | 2005 | 2006 | 2007 |

| (Loan Disbursed) | (TK) | (TK) | (TK) |

| Retail | 3,104,610,273 | 4,262,149,929 | 6,036,994,144 |

| Corporate | 3,440,055,448 | 4,890,889,834 | 5,508,974,188 |

| SME | 4,852,960,094 | 9,937,018,916 | 19,718,168,870 |

| Staff | 52,344,311 | 97,194,773 | 149,008,029 |

| Total | 11,449,970,126 | 19,187,253,452 | 31,413,145,231 |

Table: Interest on loan and advance portfolio analysis:

| Category | 2005 | 2006 | 2007 |

| (Interest received) | (TK) | (TK) | (TK) |

| Retail | 290,619,137 | 643,523,534 | 805,959,899 |

| Corporate | 291,491,605 | 575,372,015 | 712,097,870 |

| SME | 844,159,210 | 1,520,110,900 | 2,952,692,810 |

| Staff | 2,377,030 | 5,487,755 | 8,096,006 |

| Total | 1,428,646,982 | 2,744,494,204 | 4,478,846,585 |

The portfolio of loan has increased from 2005 to 2006 and also 2006 to 2007.

- Bank’s interest received on loan also going in to upper trend. After comparing three years portfolio it’s found that bank get highest interest income in the year 2007.

- In every sector (Retail, Corporate, Staff and SME) loan has increased year to year. But SME loan has increased at notable amount especially from 2006 to 2007.

- Bank also received also a notable amount of interest from SME loan.

Ratio analysis:

The main objective of this analysis is

- To see that how much percentage of loan bank provided for each product.

- To see that how much percentage of interest bank received from each product.

- To understand the bank’s performance of its different products.

Table: Ratio analysis:

| Category | 2005 | 2006 | 2007 | Category | 2005 | 2006 | 2007 |

| (Loan) | (%) | (%) | (%) | (Interest received) | (%) | (%) | (%) |

| Retail | 27.11 | 22.21 | 19.21 | Retail | 20.34 | 23.44 | 17.99 |

| Corporate | 30.04 | 25.49 | 17.55 | Corporate | 20.4 | 20.96 | 15.9 |

| SME | 42.4 | 51.79 | 62.77 | SME | 59.09 | 55.4 | 65.93 |

| Staff | 0.45 | 0.51 | 0.47 | Staff | 0.17 | 0.2 | 0.18 |

| Total | 100 | 100 | 100 | Total | 100 | 100 | 100 |

- After ration analysis of three years it found that almost in all sector their portfolio is decreasing but only in SME sector their portfolio is increasing. Their staff loan also increasing but its quantity is very low comparer to SME loan.

- SME covers the highest portion of their portfolio. In 2005 its 42.4%, in 2006 it is more than half of the total portfolio, and in 2007 it is 62.77% of the total portfolio. So here we found that from 2005 to 2006 SME loan increase 9.39% and from 2006 to 2007 its increase 10.78%. that means SME loan trend is upper word

- Now a days SME loan is more profitable that’s why Brac bank giving more importance on SME loan.

- Interest income from SME loan has also increased from 2005 to 2007 as well as 2006 to 2007.but in other sectored interest income is also decreasing as like its loan portfolio. Form 2005 to 2006 banks interest income from retail and staff loan was started to increasing but in 2007 it’s started to decrease a lot.

Market Segmentation

In terms of our country most financial institution starts out with extensive business and marketing plans to attract potential customers. For a good market plan first we need to segment our market and than started to provide our service. In our literature review we stated that we can segment our market in 4 ways these are Geographic, Demographic, Psychographic and Behavioral Segmentation. So now we see how BRAC bank follows it. For view market structure BRAC bank try to follows market segmentation strategy

- Geographic segmentation: In terms of SME loan, it targets every region around the country in terms of small business. Now the SME has almost 392 unit offices to provide credit facilities to the clients around the country. Each of the SME unit offices mainly setup the district levels around the city but not in the rural or undeveloped areas.

- Demographic Segmentation: In terms of SME loan, in some cases it is very strict. If some one who has Hindu religion and live close to the border, SME would have very careful to provide loans to those clients. SME provide loans 20-60 aged peoples. SME is restricted to provide loans more than age of 65.

- Psychographic Segmentation: In terms of SME loan, clients are differing in attitudes, interest and activity like some are time constrained and some are money constrained. So bank always tries to focus these things and than very careful provide loans to those clients.

- Behavioral Segmentation: In terms of SME loan, few clients would be found those who had done MS and most of customers are secondary or higher secondary pass. But basically SME segments customers at least whether the customers can understand his/her own business.

Target Marketing

As we know that there are too many different kinds of consumers with too many different kinds of needs. And we have to keeping them by delivering superior service. Therefore before target consumer and started to satisfy customers, bank first need to understand consumer needs and wants. In terms of SME loan, BRAC banks target market is small and medium enterprise. There are three sectors of target marketing which SME follows: Trading, Service and Manufacturing.

From the diagram we notice that in these 3 types of business there are different types of business sector. In our country now a day’s main business is garments and departmental store, few people want to do fast food business and very few people wants to started retail or bakery. As a result most of the demands go for trading business. Basically according to the customers demand, SME support them financially to develop their business.

But BBL scope is also much specified because they are restricted on leather, jewelry and alcohol business. So BRAC bank use a differentiating marketing strategy for decides to target several markets or niches and designs separate offers for each market. Most of the BRAC bank time they provide the loan within 25 days and to repay the loan they give the highest months than other banks. Their loan providing time and monthly repay system depends on the business size BRAC bank SME also categorizes the dealings with the customers in A, B & C groups.

- A-Categories officers are dealing with the high-educated clients, like MBA or PhD holder or highly social client.

- B-Categories officers are dealing with the undergraduate or normal standard clients.

Market Positioning

For competitive market positioning SME already establish different unit offices across the country. Each unit office consists of 2 or 3 CRO who provides door to door services, if needed than they work at night. For make a position in the market CRO clearly defines to the customers about SME policies and repayment schedules. The CRO of SME never say to the customer at the first impression that interest rate is 24%. They try to make understand to the clients mind that 2% per month or equal monthly payment as well as many benefits. To positioning in the market, SME not only provide loan but also they give some valuable ideas to develop the customers business and for economic development. For market positioning BRAC bank gives

- Reschedule System- If after taking SME loans any customers got serious problem in business then it gives reschedule to repay the clients loan.

- Quick Service- The main facility of SME is to provide quick service to the customers, they provide loan within 15 to 20 days.

- Direct Services- To get the loan all work are done by the CRO for customers so that customer get loan quickly and customer also don’t need to go in bank directly. If necessities CRO go to customers home and bring repayments of the loan. CRO also work in holidays for support their customers.

Developing Marketing Mix

Once the company decided on its overall marketing strategy, it’s ready to plan the marketing mix. In literature review we know about marketing mix and its variable. So now we see how BRAC bank plans about marketing mix.

- Product In view of SME loan, BRAC bank has 2 type loans Short term loan and mid term loan. Short term products means 3/6/9/12 months loan and mid term product means 15/18/24/30/36 months loan. After product plan company should plan about customer service strategy. BRAC banks CRO give quick and quality services to customers. Needs of target customers BRAC bank design its products and support services.

- Short Term Products:

Pick season’s product – For the customers these categories of products are easy to repay. Its pick season loan that means this loan for special season or occasion like in the Eid occasion most cloth merchants want short term loan to carryout a profitable business. In this special season or occasion there cloth sells like hot cakes so they easily can repay the loan to BRAC bank.

Off Pick season’s product – some time in off pick season many customers required short term loan to hold the tender or dealership. So for this type of customers BRAC bank also provide lone which is Shirt fund requirement.

- Mid Term Products

Easy repay- these types of loan for long time repayment schedule, so customers can repay the loan in a monthly basis.

Accurate utilization- some time customer wants mid term or long term lone for running there business so for these categories of customer BRAC bank provide 18 to 24 months loan. So clients can easily utilize the money regarding the prospect of the business.

- Price– In terms of SME loan, BRAC bank receives a certain amount of processing fees and stamp costs for giving the loan to the customer.

- Place: In terms of SME loan, bank tries to reach each and every small business enterprise to meet client’s demands. Brac bank already has 392 unit offices, which is spread throughout the country and 2000 staffs working under these unit offices.

- Promotion– one of the major elements of promotion is advertisement. SME is focus customers by printing various leaflets, magazines and showing banners in front of their respective unit offices.

- Free consultancy- for develop the business the officer of BRAC bank give moral advices without taking any money.

- Costly- BRAC bank SME interest rate is little bit costly compare to other banks. There interest rate is 24%. But BRAC bank take lees time to provide these lone compare to other banks. In this situation customer think about time value of money so they don’t think about the interest rate because at the right time they get the loan which they can exercise in their business.

- Availability: SME division has everywhere in Bangladesh to serve all respective customers. Bank has lots of unit offices so customer can easily get loan from any place.

Survey analysis in terms of questionnaire

A survey has been made analyze the customer behavior on SME loan of BRAC Bank Ltd.

Age limit of the client

In this survey, it found that a large numbers of customers are carrying out business whose ages are between 30 to 50.Only18% customers are on above 50 years. For SME banking in our country, it will be very risky to provide loans above 60 aged clients.

Educational qualification of the clients:

In this survey, it found that in our country the educational qualifications of the most clients are very poor at this business level. Most customers have passed SSC and only few completed Graduation or Masters. Long run decision-making might not help for low educational background. SME consider those customers who can understand his/her own business. For generate their business CRO also gives guidelines.

Purpose of loans:

In this survey, it found that most of the customers need loan to meet their working capital necessities. I also found that in our country every customer likes trading business rather than manufacturing business. Thus only 20% customers demand manufacturing loans to purchase of fixed assets. And many few customer need loan for other purpose.

Clients want fast service:

In this survey, it found that 60% of the customers want the loan below 15 days because after getting the loan clients buy the raw materials or order suppliers. 33% of the customers want the loan with in 20 days because these customers are not hurry for carry out business. Only 7% of customer want loan more than 20 days because in this case clients deposits land security. So automatically it takes more time to get the loan.

Different categories of business:

In this survey, it found that 52% of the clients are involved on trading business on the basis of banks enterprise scenario. In our country almost 32% clients are doing manufacturing business and 16% are engaged in service business.

Rate of interest:

In this survey, it found that 57% customers are satisfied on interest rate compare with other banks in terms of less security. 38% customers are not happy with interest rate. They claim interest rate should be reduced. 5% customers are not fully agreed to comment on this regard.

Repay monthly installment:

In this survey, it found that 75% customers are happy to repay the loan by equal monthly installment. They are happy because they know when where and how they will repay the money. So there is no argument between customers and CRO. And I found that 25% customers are not happy because for it some time they have to give more interest on there loan.

Services by the CRO of SME of BRAC Bank Limited:

In this survey, it found that that almost all customers are satisfied by service of CRO. CRO is all in all to provide loan to customers in SME. 27% customer are average satisfy about CRO service. Some times customers those who do not get loan from SME they become dissatisfied but they can complain to top management regarding CRO. In this case top level managers handle the situation to solve problem. For this reason only 8% customer are dissatisfied about CRO service.

Conclusion

After analyzing the report, I find some matter, which I want to discuss below:

- Fastest growing bank in the country for the last five years

- Leader in SME financing through 392 unit offices

- Biggest suit of personal banking & SME products

- Large ATMs (Automated Teller Machine) & POS (Point of Sales) network

- In the BRAC Bank basically the most of the users are business man. In our country there is various kind of businessman. We also found that above 50% users are businessman.

- Maximum client’s age is between 30 to 50 years.

- We know that Bangladesh is a poor country and the educational background of Bangladeshi people is not too high level. Our users, basically businessmen are not too educated and they have very poor decision making power. This is the main drawback in our Banking field.

- Most of the businessman are want to take SME loan for develop their business. This SME loan is very helpful for meet the daily expenses. That means they use this loan as working capital. Very less people use this kind of loan for purchase fixed assets.

- It is also found that the rate of interest is satisfactory than other Banks. That’s why the clients are very happy with our rate of interest.

- Time duration play a very major role in the mind of clients. Because they want to take loan easily & early with minimum difficulties. In our country maximum people know that loan taking is time consuming and very difficult.

- Maximum clients are happy to repay their loans in equal installments with very easy process.