Executive Summary

Banks, Non-bank financial institutions (NBFIs), & General Insurance sector represents the most important parts of a financial system. In Bangladesh, NBFIs are new in the financial system as compared to banking financial institutions (BFIs). Credit rating is an assessment of the creditworthiness of an individuals or firms or it securities which is generally conducted by an independent credit rating agency. It measures the probability of the timely repayment of principal and interest of a bond. We have tried to analyze the credit rating system of Banks, NBFIs & General insurance Company in Bangladesh. And then we analyze the credit rating of IFIC Bank Ltd., GSP Finance (BD) Ltd & Agrani Insurance Company Limited. For this purpose we have done some analysis here.

First- we have tried to show some qualitative analysis. In this segment we have done

- Industry Risk

- Keys to succeeds

- Diversification factors

- Firm Size

- Evaluation of Management

- Accounting Quality: Income recognition, depreciation and inventory pricing methods and off balance sheet items

- Profitability

- Profit Margins

Second- we have tried to show some quantitative analysis. This segment includes-

- Ratio Analysis

- Credit Rating based on Regression model.

And finally we have tried to show the creditworthiness of the company. After analyzing all aspects of these three sector industry, we have assigned rating what should be awarded.

Company Background

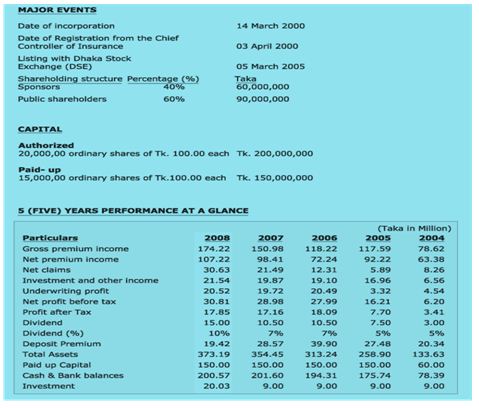

Agrani Insurance started its business on 03 April 2000 after obtaining registration from the Department of Insurance, government of the Peoples Republic of Bangladesh. The company is enlisted with Dhaka Stock Exchange in March 2005. The company is financially sound and has been declaring dividend since 2004. The company has been assigned “A-“(pronounced as “A” minus) denotes high claim paying ability, protection factors are good and there is an exception of variability in risk over time due to economic and/ or underwriting conditions.

Industry Risk Analysis

Industry risk is the key determinant for the credit rating of a firm. There have been positive and negative impacts on the credit rating due to the industry risk. This type of risk usually comes from the existing conditions of the industry. These conditions are not an isolated part, rather being affected by various macro economic variables in the industry as well as the country. This type of risk can be estimated by:

- Historical profit and profit prospect

- Risk of the expected profit.

The first one can be estimated by observing the basic performance variables of the industry. Growth of the insurance industry with the previous year is almost double. In the year 2008 the Market Capitalization of the insurance sector was 6% of the total market capitalization but in year 2009 it reached to almost 11% of total market capitalization up to June 2009.

- There is no risk of expropriation (nationalization) from the government body.

- The industry has well established rules and operating guidelines from regulatory authority, which can ensure more transparency within the operations and outside of the firm.

- Separate Credit risk manual-Since the nature of business as well as leverage level of Insurance Companies is different from that of other entities, the need for a separate Credit Risk Grading Manual has been felt. Keeping this in mind and with a view to properly risk rate a insurance companies in order to set up counter party limits for providing credit products extended by insurance company to a another company.

- Insurance industry is not very much globally controlled and this also provides some type of protection for the industry, as we do not have to bear outside risk.

- Insurance industry can operate independently without the deposits from the people significantly. This type of self-dependency indicates more careful strategy followed by the companies.

Industry and sector analysis of Agrani Insurance Ltd. research reports contain detailed information on the current infrastructure and future growth potential, attractiveness of different sectors, through review on different companies in the sector through comparable and valuation analysis. Research also provides macroeconomic, political and market outlook of Bangladesh to foreign institutional investors.

Agrani Insurance Limited is one of the largest insurance companies and fastest growing institutions in Bangladesh. Insurance is nothing but a system of accepting risk of the Insured by the Insurer having consideration in the form of premium to safeguard his interest from any accident. In case of big risk the Insurer needs to transfer the risk to re-insurer. Re-Insurance means spreading of risk of one onto the shoulder of many. In brief, Re-Insurance means Insurance of Insurance. Whilst it becomes somewhat impossible for a man to bear by himself 100% loss to his own property or interest arising out of an unforeseen contingency, insurance is a method or process which distributes the burden of loss on number of persons within the group framed for this particular purpose. The concept of grouping together or risk sharing was in existence in very ancient times but gradually developed in its present state through a process of evolution to meet the growing needs of the people in the field of general business and industries.

Agrani Insurance started its business on 03 April 2000 after obtaining registration from the Department of Insurance, government of the Peoples Republic of Bangladesh. The company is enlisted with Dhaka Stock Exchange in March 2005. The company is financially sound and has been declaring dividend since 2004. The company has been assigned “A-“(pronounced as “A” minus) denotes high claim paying ability, protection factors are good and there is an exception of variability in risk over time due to economic and/ or underwriting conditions.

| Rating | Rate |

| Industry risk | 8 |

Interest rate risks

Volatility of money market, which ultimately imposes upward pressure on interest rate structure, may erode Organization’s profitability. The company has procured vehicles for its officers on bank financing, any adverse change in interest rates may decrease the profitability to negligible mount, and on the other hand, any upward change in the rate of bank interest will increase the interest income earned on company’s paid-up capital and fixed deposits.

Exchange rate risks

Devaluation of local currency against major international currencies may affect company’s marine insurance business adversely. The above effect will be overcome by the increased business on other areas.

Liberalization of permission to set up more insurance companies by government may result in severe competition amongst insurers resulting in reduction of premium income and profitability of the company.

Though liberalization of permission to set up more insurance companies by government may be encouraging to new entrants resulting tough competition, AIL does not apprehend any loss of business due to its competent and highly experienced management team and expanding trend of insurance business in the country. AIL has already proved its leading role by its attractive earning performance.

The coverage of natural calamities like cyclone, flood by insurance may severely weaken the financial strength of the company by accruing heavy claims on its own retained account. The estimated losses arising from natural calamities are covered by higher rates of premium and reinsurance coverage for such losses. Management has taken into consideration statistical assessment of occurrence of natural calamities in setting its rates of premium and reinsurance risks. Moreover, most of our trained port folios (Fire including flood, cyclone risks) are protected under catastrophic Excess of Loss Treaty with S.B.C.

Market & Technology related-risks

To be competitive in the market, insurance companies need to develop new products and offer excellent clientele services and also to expand the market by bringing more and more items under the purview of insurance otherwise the competitors may take away company’s business. Insurance business globally is increasing. New items are coming under the cover of insurance as days pass by; the market is expanding as people are realizing the importance of insurance. Because of our excellent services and introduction of new products, the company does not envisage any market & technological related risks.

Potential or existing government regulations

Government policy change in respect of rates of premium, underwriting commission, agent’s commission, reinsurance commission, interest on deposits etc. may affect income and profitability.

Operational risks

Political and social condition may affect smooth operation of the business resulting in drastic fall to the value of its investment. Political unrest in the past could not reduce the premium income of the company as the shortfall overcome by increased income in subsequent period.

Porters Five forces Approach

To analyze a firm’s profit potential, analyst has to first assess the profit potential of each of the industries in which the firm is competing because the profitability of various industries vary systematically and predictably over time. We have used Porters five forces model to analyze insurance industry.

- Threat of New Entrants in the Industry

Threat of new entry is one of the factors influencing the profitability of the industry. To earn abnormal profit, the new entrants may be attracted in the industry. The ease with which a new firm can enter an industry is a key determinant of its profitability. The other parameter attracting investments are economies of scale, first mover advantage, and access to channels of distribution and relationship and legal barriers maybe cited. As the said industry requires large economies of scale as well as investment, the threat of new entrants is moderate. On the other hand, the customer switching cost and high initial investment may be a barrier. The law for this particular sector is not so strict which allow common investors to invest in this sector.

- Bargaining Power of the Industry’s Suppliers

There are many suppliers available in this sector. It results high control over the industry to be put by the suppliers. This provides the industry-selecting supplier as per the choice of the industry.

- Bargaining power of the industry’s customers

The choice of the final product is depends on the consumers can choose any company’s product because the products of various companies’ are of different in nature. The products of this industry are mainly sold as per the comparative high benefit of the depositors. They can switch over any company’s product without incurring any cost. Hence, customer’s switching cost is very low resulting bargaining power of buyer is very high.

- Rivalry among Existing Competitors in the Industry

In most industries, the average of profitability is primarily influenced by the nature of rivalry among existing firms. Both the price and non-price rivalry are seen in this industry. The industry is growing very rapidly. So the incumbent firms need not grab market share from each other to grow. There are some big firms in this sector that create undesirable competition among them to maintain their market shares because the companies cannot leave the industry easily. An individual firm cannot set price.

- Threats of Substitute Products

In this industry there exists substitute product in this industry. The banking organizations provide better benefit to the depositors.

- Membership at both the Dhaka Stock Exchange and Chittagong Stock Exchange

- Global access to offer best possible services

| Rating | Rate |

| Key success factor | 7 |

Diversification Factor:

Product portfolio

The product portfolio of the company is very much well palled and well diversified. The investment mix mostly consists of Life Insurance, Marine Insurance and Miscellaneous Insurance.

Product diversification

Insurance is nothing but a system of accepting risk of the Insured by the Insurer having consideration in the form of premium to safeguard his interest from any accident.

As such we have the pleasure to introduce ourselves as one of the leading Insurance Company of the Country in private sector fully owned by Bangladeshi entrepreneurs. It has already occupied a strong position amongst it’s competitors and has made significant contribution in the field of Insurance Industry in the economy. Members of the Board of Directors are well-reputed business personalities and leading industrialists of the Country.

| Rating | Rate |

| Diversification Factor | 5 |

Firm Size:

| Rating | Rate |

| Firm size | 7.5 |

Evaluation of MGT:

| Rating | Rate |

| Evaluation of MGT | 6 |

Track Record

Agrani Insurance Limited is one of the largest insurance companies and fastest growing financial institutions in Bangladesh. The Company started its business on 03 April 2000 after obtaining registration from the Department of Insurance, government of the Peoples Republic of Bangladesh. The company is enlisted with Dhaka Stock Exchange in March 2005. The company is financially sound and has been declaring dividend since 2004. The company has been assigned “A-“(pronounced as “A” minus) denotes high claim paying ability, protection factors are good and there is an exception of variability in risk over time due to economic and/ or underwriting conditions.

Accounting Quality:

The financial statements, namely, Balance Sheet, Profit and Loss Account, Cash Flow Statement, Statement of Changes in Equity, Liquidity statement and relevant notes and disclosures thereto, of the Bank and Insurance company are prepared under the historical cost convention and in accordance with the first Schedule of Financial Institution Act 1993, Bangladesh Bank circulars, International Accounting Standards, including those that have been so far adopted by the Institute of Chartered Accountants of Bangladesh, the Companies act 1994, the Securities and Exchange Ordinance 1969, Securities and Exchange Rules 1987 and other laws and rules applicable thereto.

| Rating | Rate |

| Accounting quality | 8 |

PART B: QUANTITATIVE ANALYSIS OF AGRANI INSURANCE

Two parts are included in the quantitative analysis of Agrani Insurance:

- Ratio Analysis

- Credit Rating based on Regression model.

Ratio Analysis:

Ratios provide meaningful relationship between individual values in the financial statements. By ratio analysis we measure the performance of the firm on historical basis. Ratios provide better performance measurement than absolute numbers.

| Factor Name | Agrani | peer group |

| Factor : 1 Market Share Ratio | 0.000 | 1.168618 |

| Factor: 2 Operating and Underwriting Quality | ||

| Loss Ratio | 0.432 | 0.189426 |

| Net Claims | 47.177 | 0.80222 |

| Factor :3 Capital Adequacy | ||

| Gross Underwriting Leverage | 1.747 | 2.65 |

| Gross Reserve | 26.141 | 0.8025 |

| Factor : 4 Profitability | ||

| ROIC | 0.078 | 0.3523 |

| ROA | 0.096 | 0.0306 |

| ROE | 0.196 | 0.1901 |

| Factor : 5 Financial Flexibility | ||

| Financial Leverage | 1.082 | 2.32 |

| Total Debt | 142.946 | 0.681 |

| Shareholders Equity | 146.141 | 2.32 |

| Factor: 6 Liquidity and Funding Factor | ||

| Current Ratio | 1.686 | 1.95 |

| Claim Ratio | 0.615 | 0.14 |

| Cash Flow Earning Index | 2.398 | 0.996 |

| Cash flow Adequacy | 0.97 | 0.0365 |

STATISTICAL MODEL:

In Quantitative analysis, we have set up a multiple regression equation with peer groups with their respective credit rating. The ratios are used as independent variable in the model.

Assign Rating No: Used for Rating

| CRAB | Rating no. | CRISIL | Rating no. |

| AAA | 20 | AAA | 20 |

| AA1 | 19 | AA+ | 19 |

| AA2 | 18 | AA | 18 |

| AA3 | 17 | AA- | 17 |

| A1 | 16 | A+ | 16 |

| A2 | 15 | A | 15 |

| A3 | 14 | A- | 14 |

| BBB1 | 13 | BBB+ | 13 |

| BBB2 | 12 | BBB | 12 |

| BBB-3 | 11 | BBB- | 11 |

| BB1 | 10 | BB+ | 10 |

| BB2 | 9 | BB | 9 |

| BB3 | 8 | BB- | 8 |

| B1 | 7 | B+ | 7 |

| B2 | 6 | B | 6 |

| B3 | 5 | B- | 5 |

| C | 4 | CCC+ | 4 |

| D | 3 | CCC | 3 |

Ratios Used for Rating

Independent variables name | |

| X Variable 1 | Return on Equity |

| X Variable 2 | Net Profit Margin |

| X Variable 3 | Financial Leverage |

| X Variable 4 | Combined Ratio |

| X Variable 5 | Technical Reserve ratio |

| X Variable 6 | Gross Underwriting Leverage |

Rating = 14-(24.1673*X1) + (1.274022*X2) – (0.0459*X3) +(1.466817*X4) + (2.58*X5) + (1.110589*X6)

| Intercept | 14.504 | 14.504 | |

| X Variable 1 | -24.1673 | 0.196422 | -4.74699 |

| X Variable 2 | 1.274022 | 0.078 | 0.09923 |

| X Variable 3 | -0.04559 | 1.082 | -0.04933 |

| X Variable 4 | 1.466817 | 0.777 | 1.139044 |

| X Variable 5 | 2.582797 | 0.197 | 0.50881 |

| X Variable 6 | 1.110589 | 1.747 | 1.940318 |

13.39508 |

Weight Ratio Analysis:

Weight | Rating | Weight*Rating | |

| 1. Market Position, Brand and Distribution | 0.1 | 4 | .4 |

| 2. Operating and Underwriting Quality | 0.1 | 9 | .9 |

| 3. Capital Adequacy | 0.2 | 9 | .8 |

| 4. Profitability | 0.2 | 12 | 2.4 |

| 5. Financial Flexibility | 0.2 | 8 | 1.6 |

| 6. Liquidity and Funding Factor | 0.2 | 12 | 2.4 |

Total |

| 8.5 | |

Qualitative factors:

| Qualitative factors | Individual Weight | Individual rating | Weight*Rating |

| INDUSTRY RISK | 0.2 | 8 | 1.4 |

| KEY TO SUCCESS FACTOR | 0.1 | 7 | 0.8 |

| DIVERSIFICATION FACTOR | 0.2 | 5 | 1 |

| FIRM SIZE | 0.1 | 7.5 | 0.85 |

| EVALUATION OF MANAGEMENT | 0.2 | 6 | 1.6 |

| ACCOUNTING QUALITY | 0.2 | 8 | 1.62 |

| Total | 6.85 |

TOTAL COMPOSITE CREDIT RATING:

weight | Rating | Final rating | |

| Qualitative factors | 0.6 | 6.85 | 4.11 |

| Statistical Model | 0.10 | 13.39 | 2.0085 |

| Quantitative factors | 0.30 | 8.5 | 2.125 |

Total | 7.99 |

Ratings Awarded From Our Analysis:

Long Term Credit Rating: “A-” |

Rationale:

We have assigned the long term rating of Agrani Insurance Company Ltd. to “A-”. We performed the rating based on latest financial statements and other relevant The company has been assigned “A-“(pronounced as “A” minus) denotes high claim paying ability, protection factors are good and there is an exception of variability in risk over time due to economic and/ or underwriting conditions.