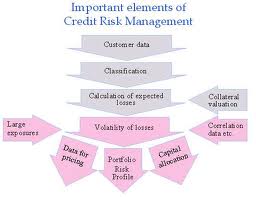

Prime objective of this report is to discuss and analysis on Credit Risk Management in State Bank of India. Other objectives are explain the different methods available for credit Rating and understanding the credit rating procedure used in State Bank of India. Here also focus on the credit risk management activities of the State Bank of India and analysis the RBI Guidelines regarding credit rating and risk analysis. Finally discuss on the credit policy adopted Comparative analyses of Public sector and private sector.

Credit Risk Management in State Bank of India