1.1 One bank Ltd-Retail Banking

1.2 Introduction of Topic

Banking sector, considered as ever growing child, in any country plays a pivotal role in setting the economy in motion and in its development process, while the banking structure -the number and size distribution of banks in a particular locality and the relative market power of specific banking institutions determines the degree of competition, efficiency and performance level of the banking industry. Bangladesh’s banking sector consists of Central Bank (named as Bangladesh Bank), Commercial Banks, Development Banks and Specialized Financial Institutions. The Commercial Banks comprise of Nationalized Commercial Banks (NCB), Local Private Banks, Foreign Private Banks, and Islamic Banks. In recent years, it is observed a mushroom growth in the banking sector in Bangladesh.

The very active and lively presence of private sector has stirred competition among the traditional Commercial Banks. The shadow of fierce competition in banking industry can be observed through the recent achievement of the Private Commercial Banks.

The competition to pursue clients and imitate one another is so intense that one bank lures efficient staff of another bank offering higher facilities to get better edge. Private Commercial Banks often introduce new and diversified financial products to provide wider option to customers. Without having an effective customer base, it becomes difficult for any bank to compete and sustain in the competitive market for the banking services.

In order to retain and attract new customers towards any particular bank, the bank management needs to have a clear operational efficiency and must thoroughly analyze the scopes for further development. Therefore it is a key area for the commercial banks to closely monitor their performance level, which comprises the functional units, that provides services to its clients.

So, taking the opportunity to highlight the analysis of the performance of the different functional units and prepare the study for my internship, I was allowed to share the practical experience with ONE Bank Limited, Gulshan Branch.

1.3 Rationale of the Study

The study was conducted on the Retail Banking Department of ONE Bank Limited, Gulshan Branch. Gulshan Branch of ONE Bank Limited is considered to be one of their prior concerned branches, as there are many business and financial institutions located in the adjacent areas near Gulshan. Therefore, the activities carried out by the personnel of the Retail Banking Department needs to be well acquainted with the customer oriented services. So, being a business graduate it was challenging experience for me to concentrate on customer services being provided by ONE Bank Limited. Meeting the customer requirements with the well-maintained operations of the departments was figured out and analyzed. Apart from the educational knowledge, the study put extra weight regarding the practical field and real life activities followed in the bank. Moreover, the study carried out also added value to the technical mechanisms and operations of the OBL. Along with my experience, the bank will be able to identify their flow of operations and can identify in which functional departments, the bank needs to put extra concentration so that the operations are well acquainted with the desired services offered by the bank to its clients.

1.4 Scope of the Report

The basic scope of conducting this study is to analyze the performance of Retail Banking Department of ONE Bank Limited considering the Gulshan Branch. Through investigation and analysis of the respective departments over the years of operation can highlight the banks performance when compared to other commercial banks operating in the country. Due to modern concept in the banking operations are being practiced by different banks, the banking arena is considered to be very competitive. Therefore in keeping up with the performance through customer oriented services, ONE Bank Limited must be aware of its total operation procedure which can be determined by the performance of the respective departments.

In this research work, the overall view of the banking system, its history and mechanism, policies and appraisal of ONE Bank Limited and other areas of activity is extensively analyzed and the findings is clarified along with in depth study. The main part of the study covers the operational scenario of Retail Banking Departments of ONE Bank Limited, Gulshan Branch. This will eventually refer that how the bank help the customers securing their cash and assets, getting credit facility, exporting and importing the goods and how it remits money of the foreign clients, etc.

1.5 Objective of the Report

1.5.1 Broad Objective

The broad objective of the study is to conduct the performance analysis of the Retail Banking Department of ONE Bank Limited, Gulshan Branch over the years of its operation in the Commercial Banking sector in Bangladesh.

1.5.2 Specific Objectives

The specific objectives of this study are as follows:

Relate theoretical knowledge with practical experience in several functions of the bank.

Identify and evaluate different functional services offered by the bank to its clients.

The process and the personnel involved in the Retail Banking Department of the bank.

To know about the pattern of the clientswho are taking the services from the bank.

To analyze the financial performance of the Retail Banking Department of ONE Bank

Limited, Gulshan Branch over the years of banking operations.

Influence of Marketing Strategies in the operations of ONE Bank Limited,

Gulshan Branch

Analyze the possible Internal Factors (Strengths and Weaknesses) and External

Factors (Opportunities and Threats) for ONE Bank Limited.

1.6 Methodology

1.6.1 Area of Investigation:

As the Banking Sector is very large, therefore I only focused on specific department of banks and taking only consideration of the operations of ONE Bank Limited, Gulshan Branch, where I have been assigned to serve as an Internee. I have highlighting the operations of:

Retail Banking Department

1.6.2 Source of Information:

The study is conducted on the basis of both primary and secondary data.

1.6.2.1 Primary Data:

The primary information was gathered through interviews, observation and group discussion. The primary data are collected from Retail Banking Department of ONE Bank Limited, Gulshan Branch by interviewing personnel of the respective departments. The heads of the department or senior executives have been interviewed. However, the analysis and the explanation are the authors’ own.

1.6.2.2 Secondary Data

The secondary information was gathered through Annual Reports, Periodic Publication of the Bank, Bangladesh Accounting Standards, General Banking Manuals, Financial Statements of the banks, websites, etc. The data of the study are based on a review of existing brochures, documents and database of ONE Bank Limited.

1.6.3 Sampling Plan

1.6.3.1 Sampling Procedure:

The sampling procedure was conducted on the Deliberate Sampling method, where the respondents and the interviewees are considered on my convenience and priority.

1.6.3.2 Sampling Unit

In order to carry out the research work, I focused on taking the interviews of the Personnel involved in the Retail Banking Department, Manager and Senior Level Employees, Business Clients.

1.6.4 Data Processing & Analyzing

The collected data was processed through computer encoding as well as manually, depending on the nature of the query being solved. The processed data was being analyzed. Finally, on the basis of the analysis results, the study concluded the answers to the research objectives for the final stage of the study and the report preparation.

1.7 Limitations

In every research work there exist some limitations that the researcher faces while conducting different activities. In the process of the research work, I came across certain limitations that hamper the actual findings and analysis of my research work. Some of the constraints that I have faced while conducting the research work are as follows:

- The interviewees, who are the personnel involved in the Retail Banking Department of the bank, may not be well acquainted with the formal procedures of the research work. The respondents may be biased on certain issues that hamper the total evaluation of the research work.

- The study conducted can be hampered, as the total evaluation of the industry cannot be covered in a short period of time. In the cumulative time period of 10 weeks the actual phenomenon on the performance of the Retail Banking Department of the bank can just be highlighted and some issues were overlooked.

- A structured filing procedure is often neglected which also poses difficulty in understanding the sequential procedure.

- The personnel of the bank are usually busy with their daily activities and routine tasks; therefore interacting with them during their office hours was difficult sometimes. Although most of the officers were very helpful and friendly but as because they have been busy with their works, they could not give much time to light up my knowledge about the Bank’s activities.

- Lack of proper books, journals and articles available for the banks, sometimes created limitations for me to understand the banking terms and conditions.

- The banking policies and manuals of OBL are of confidential in nature and thus it is difficult to collect the necessary literature and documents within this short time.

None the less, I tried my level best to make this report a good one and despite of many limitations in my approach, I expect that the reader of this report will have a broader view and idea about the different services and the performance rendered of the Retail Banking Department of ONE Bank Limited concerning the Gulshan Branch.

2.1 Background of the Organization

ONE Bank Limited was incorporated in May 1999 With the Registrar of Joint Stock Companies under the Companies Act. 1994, as a commercial bank in the private sector. The Bank is pledge-bound to serve the customers and the community with utmost dedication. The prime focus is on efficiency, transparency, precision and motivation with the spirit and conviction to excel as ONE Bank Limited in both value and image.

The name ‘ONE Bank’ is derived from the insight and long nourished feelings of the promoters to reach out to the people of all walks of life and progress together towards prosperity in a spirit of oneness.

ONE Bank Limited is a private sector commercial bank dedicated in the business line of taking deposits from public through its various saving schemes and lending the fund in various sectors at a higher margin. However, due attention is given in respect of risk undertaking, risk hedging and if not appropriately hedged, reflection of the same in pricing. The banks financing concentrate in both, working capital finance and long-term finance. OBL has major concentration of financing in medium and large industries. Since the short-term finance carries low risk compared to long-term finance; the financing strategy of OBL will assist the bank to keep the risk at minimal.

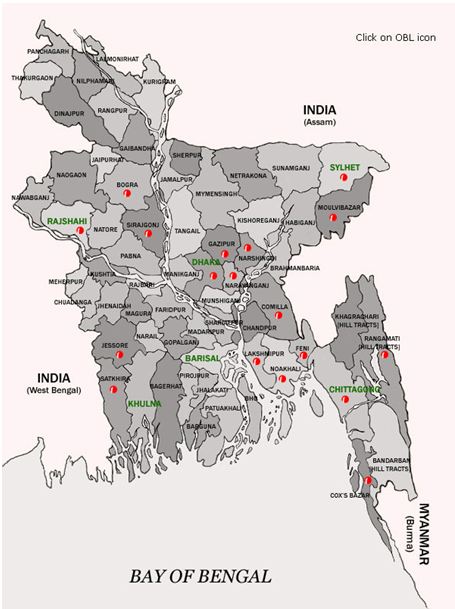

While financing the industrial sector, the major concentration of the bank appeared to be in the textile and RMG sector; both the above sectors cover 30.89% of the total portfolio. OBL also involved in cement construction and transport sector financing. In the investment portfolio, OBL have substantial investment in quoted and non-quoted shares of different organization including some very prospective financial institutions. The bank has shown its acumen in reducing its exposure from ship scrapping sector, steel re-rolling where the bank had investment earlier. With the increase in exposure to RMG, the bank has increased its non-funded business income substantially. With an age of only 8 years, the OBL has taken initiative to launch IT based banking products like ATM facilities, E-banking etc that are praiseworthy. At present OBL is operating 26 branches across Bangladesh, out of which 12 branches are in Dhaka and the remaining 14 branches are operating in different areas of the country.

2.2 Corporate Mission and Vision Statements & Corporate Slogan of ONE Bank Limited

2.2.1 Vision Statement

To establish ONE Bank Limited as a Role Model in the Banking Sector of Bangladesh and to meet the needs of the Customers, provide fulfillment for the People and create Shareholder Value.

2.2.2 Mission Statement

Constantly seek to better serve the valued Customers.

Be pro-active in fulfilling the Social Responsibilities for the company.

Review all business lines regularly and develop the Best Practices in the industry.

Working environment to be supportive of Teamwork, enabling the Employees to perform to the very best of their abilities.

2.2.3 Corporate Slogan:

…WE MAKE THINGS HAPPEN

2.3 Corporate Information

| Name of the Company | ONE Bank Limited

|

| Genesis | The One Bank Limited (hereinafter called OBL) is a third generation private sector bank incorporated on May 12, 1999 as a public limited company under Companies Act 1994 and listed in Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE). |

| Date of Incorporation | 12th May 1999 |

| Date of Functioning | 14th July 1999 |

| Registered Office | Corporate Head Quarter 2/F, HRC Bhaban, 46 Kawran Bazar C/A, Dhaka-1215 |

| Web page | www.onebankbd.com |

| obl@onebankbd.com | |

| Auditor | ATA KHAN & Co. Chartered Accountants |

| Lawyer | Lee, Khan & PartnersMr. Mahbubur Rahman Mr.Ali Asgar Chowdhury |

Board of Directors:

1) Mr. Sayeed Hossain Chowdhury (Chairman)

2) Mr. Zahur Ullah (First Vice Chairman)

3) Mr. Hefazatur Rahman (Second Vice Chairman)

4) Mr. Asoke Das Gupta

5) Ms. Farzana Chowdhury

6) Mr. M. H. Choudhury

7) Mr. A.S.M. Shahidullah Khan

8) Mr. Kazi Rukunuddin Ahmed

9) Mr. Ajmalul Hossain QC

10) Mr. Shawket Jaman

11) Mr. Khandkar Sirajuddin Ahmed

12) Mr. Farman R Chowdhury (Managing Director)

Company Secretary: Mr. John Sarkar

Chief Consultant: Mr. Mirza Ejaz Ahmed

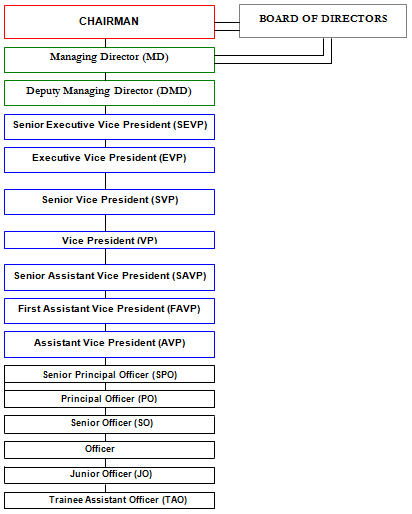

2.4 Management Hierarchy of ONE Bank Limited

2.5 Branches of ONE Bank Limited

Serial No. | Branch Name | Address |

1 | Corporate HQ | 2/F, HRC Bhaban, 46 Kawran Bazar C/A, Dhaka-1215 |

2 | Principal Branch | ‘Zaman Court’, 45, Dilkusha C/A, Dhaka |

3 | Motijheel Branch | SharifMansion (Ground Floor) 56-57 Motijheel Commercial Area Dhaka 1000 |

4 | Gulshan Branch | 97, Gulshan Avenue, Dhaka |

5 | Kawran Bazar Branch | G/F, HRC Bhaban, 46 Kawran Bazar C/A, Dhaka-1215 |

6 | Uttara Branch | House # 14, Road # 14B, Sector # 4 UttaraModelTown, Dhaka-1230 |

7 | Imamganj Branch | 18, Roy Iswar Chandra Shill Bahadur Street,(1st floor) Imamganj, Dhaka-1100 |

8 | Dhanmondi Branch | House # 21, Road # 8, Dhanmondi R/A, Dhaka |

9 | Mirpur Branch | Plot # 2, Road # 11 Section-6, Block-C Mirpur-11, Dhaka |

10 | Banani Branch | Plot 158, Block E Banani R.A. Dhaka |

11 | Kakrail Branch | MusafirTower, 90 Kakrail, Dhaka |

12 | Progoti Sarani Branch | Ridge Dale Cha-75/2, Uttar Badda, Dhaka |

13 | Ganakbari (EPZ) Branch | SomserPlaza (2nd Floor) Ganakbari, Savar, Dhaka |

14 | Joypara Branch | Monowara Mansion, Joypara Bazar Latakhola, Raipara Dohar, Dhaka |

15 | Narayangonj Branch | HaquePlaza, Plot # 05, B.B. RoadChasharaC.A. Narayangonj |

16 | Agrabad Branch | 95, Agrabad C/A, Chittagong |

17 | Khatungonj Branch | 110-111, Khatungonj, Chittagong |

18 | Jubilee Road Branch | KaderTower, 2nd Floor, Tinpool, 128 Jubilee Road, Chittagong |

19 | ChittagongPort Booth | Terminal Bhaban, ChittagongPort Authority Chittagong |

20 | Cox’s Bazar Branch | Monora Complex, East Laldighir Par, Court Hill Lane, Main Road, Cox’s Bazar |

21 | Sylhet Branch | ‘Firoz’ Centre (Ground floor) 891/KA, Chouhatta, Sylhet |

22 | Islampur Branch, Sylhet | Kaium complex, (1st floor) Islampur Bazar, Sylhet |

23 | Sherpur Branch | Royel Market (1st Floor), Sherpur, Moulvi Bazar, Sylhet |

24 | Chowmuhuni Branch | Bhuiyan Market, D.B. Road Railgate, Chowmuhuni, Noakhali |

25 | Chandragonj Branch | Chandragonj Bazar Lakshmipur |

26 | Jessore Branch | M.S. Orchid Centre 44 M.K.Road, Jessore |

2.6 Location Map of the Branches of

ONE Bank Limited in Bangladesh

ATM Locations

Dhaka

| Sl No. | Place | Address |

| 1 | Banani Branch ATM | Plot 158, Block E, Banani R.A., Dhaka |

| 2 | Basabo ATM | 1/Ga, Central Basabo, Police Station – Sabujbagh, Dhaka. |

| 3 | Dhanmondi Branch ATM | House No. 21, Road No. 8, Dhanmondi R/A, Dhaka |

| 4 | Elephant Road Branch ATM | Globe Center(1st Floor), 216, Elephant Road, New Market, Dhaka. |

| 5 | Gulshan Branch ATM | 97, Gulshan Avenue, Dhaka |

| 6 | Joypara Branch ATM | Monowara Mansion, Joypara Bazar, Latakhola, Raipara, Dohar, Dhaka |

| 7 | Kakrail Branch ATM | Musafir Tower, 90 Kakrail, Dhaka |

| 8 | Kawran Bazar Branch ATM | HRC Bhaban, 46, Kawaran Bazar C/A, Dhaka |

| 9 | Mirpur Branch ATM | Plot No. 2, Road No. 1, Section No. 6, Block No. C, Mirpur-11, Dhaka |

| 10 | Moghbazar ATM | 1/B, Outer Circular Road, Moghbazar Wireless, Police Station- Ramna, Dhaka- 1217. |

| 11 | Motijheel Branch ATM | Sharif Mansion (Ground Floor), 56-57, Motijheel C/A, Dhaka |

| 12 | Narayangonj Branch ATM | Haque Plaza, Plot 05, B.B. Road, Chashara C.A., Narayangonj |

| 13 | Nawabgonj Branch ATM | Sikder Plaza, Bagmara Bazar, Nawabgonj |

| 14 | Uttara Branch ATM | House No.14, Road No. 14B, Sector No. 4, Uttara Model Town, Dhaka |

ATM Locations

Chittagong Division

| Sl No. | Place | Address |

| 1 | Agrabad Branch ATM | 95, Agrabad C.A., Chittagong |

| 2 | CDA Avenue ATM | CDA Avenue, Yunusco Tower, O.R. Nizam Road, Chittagong |

Rajshahi Division

| Sl No. | Place | Address |

| 1 | Bogra Branch ATM | Jamil Building, Borogola, Bogra |

Sylhet Division

| Sl No. | Place | Address |

| 1 | Sylhet Branch ATM | Firoz Center, 891/KA, Chouhatta, Sylhet |

2.7 Financial Highlights of ONE Bank Limited for the

Last Two Years

Taka in Million

| SI No |

Particulars |

2009

|

2008 |

1 | Authorized Capital | 1,200 | 1,200 |

2 | Paid up Capital | 888 | 807 |

3 | Statutory Reserve | 381 | 262 |

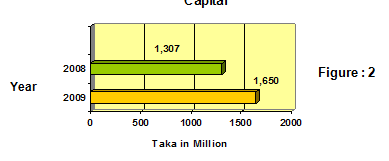

4 | Capital | 1,650 | 1,307 |

5 | Total Deposits | 20,253 | 18,030 |

6 | Total Loans & Advances | 15,681 | 13,851 |

7 | Investment | 3,321 | 2,165 |

8 | Import Business Handled | 21,601 | 17,435 |

9 | Export Business Handled | 16,360 | 11,916 |

10 | Guarantee Business Handled | 947 | 1,367 |

11 | Total Income | 2.886 | 2,007 |

12 | Total Expenditure | 2,211 | 1,520 |

13 | Net Interest Income | 398 | 315 |

14 | Operating Profit | 674 | 626 |

15 | Operating Expenses | 452 | 310 |

16 | Profit after tax and provisions | 347 | 302 |

17 | Total Assets | 23,143 | 20,105 |

18 | Number of Correspondents | 270 | 268 |

19 | Number of Employees | 580 | 386 |

20 | Number of Branches | 23 | 18 |

21 | Loan Deposit Ratio | 77.43% | 76.82% |

22 | Capital Adequacy Ratio | 10.03% | 9.47% |

23 | Tier-1 (Capital) | 8.69% | 8.44% |

24 | Return on Assets | 3.12% | 2.87% |

25 | Earnings per Share | 39.06 | 37.46 |

26 | Dividend | ||

| Cash | 10% | 15% | |

| Bonus Share | 17% | 10% | |

27 | Net Asset Value (Book Value/ Shareholders’ Equity per Share | 171.03 | 159.34 |

Source: ONE Bank Limited Annual Report, 2009

2.7.1 Profit Performance of the last Two Years

ONE Bank’s profit is continuously increasing. ONE Bank Limited is a high profit earning organization. Its performance shows an uplift trend. It is shown in the following graph: The operating profit for the bank increased 7.67%. (See Figure 1)

Taka in Million

| Year | 2008 | 2009 |

| Growth in Operating Profit | 626 | 674 |

2.7.2 Capital and Reserve

Capital and reserve of the bank as on 31st December, 2009 was Tk. 1,650 Million, which was Tk.1,307 Million in 2005. The paid up capital of the bank rose to Tk. 888 Million as on 31st December 2009. The bank raised the Statutory Reserve from Tk. 262 Million in 2005 to Tk. 381 Million in the year under review. (See Figure 2)

2.7.3 Deposits

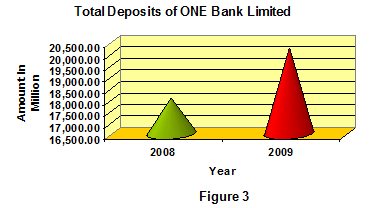

At the end of December 31, 2009 the deposit of the ONE Bank Limited was Tk. 20,253 Million against Tk. 18,030 Million during the corresponding period of the year 2008. The growth in deposit is 31.42% compared to the previous year. (See Figure 3)

2.7.4 Loans and Advances

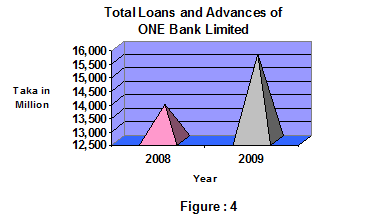

The Loans and Advances of the Bank showed an average growth in 2009. The total loan and advances amounted to Tk. 15,681 Million as on 31st December 2009 against Tk.13,851 million in year 2008, which shows an increase of 13.21%. In the year 2008, the growth was more impressive of an increase of 44.09%. (See Figure 4)

2.7.5 International Trade

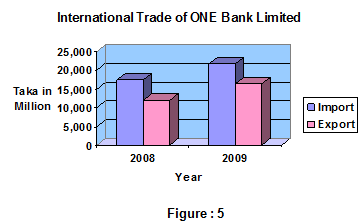

The International Trade constitutes major business activities conducted by ONE Bank Limited. The import business of the bank indicated a significant increase in the year. The import business during the year 2009 reached Tk. 21,601 Million against Tk. 17,435 Million of the year 2008, which reflects a growth of 24 %. Main import items were industrial raw materials, cement clinkers, yarn & fabrics for the RMG industry, vessels for scrapping, edible oil and customer items.

The export business during the year 2009 was Tk 16,360 Million compared to Tk.11,916 Million in the previous year, which reflects a growth of 37.29% Planned and calculated thrust to finance the leading Ready Made Garments (RMG) units contributed towards improving the Bank’s performance in the export sector. The growth in export business can be further achieved but due to catastrophe in geographical arena, micro economic instability and the instable political condition made the growth slower than it was expected. (See Figure 5)

2.8 Total Number of Employees of

ONE Bank Limited, Gulshan Branch

Designation | Number |

Vice President/ Manager | 1 |

Assistant Vice President | 2 |

Senior Principal Officer | 3 |

Principal Officer | 3 |

Senior Officer | 3 |

Officer | 5 |

Junior Officer | 4 |

Assistant Officer | 3 |

Trainee Assistant Officer | 4 |

Messenger | 2 |

Gardener | 1 |

Driver | 1 |

Total Number of Employees | 32 |

The Topic Analysis and Description are subjected to the specific objectives that have been identified and based upon those criteria’s; these factors are evaluated in the perspective of Retail Banking department of ONE Bank Limited, Gulshan Branch.

3.4 Retail Banking Department

Nowadays Retail Banking is considered to be a very important department in terms of increasing the marketing and sales of the schemes provided by the banks. Using different kinds of promotional activities and direct personal selling, the activities are carried out. The banks introduces various packages for the clients as saving schemes which helps the banks to earn interests and give benefits for clients as they are able to secure their savings through the attractive schemes offered by the banks.

ONE Bank Limited also provides Retail Banking to its clients. ONE Bank Limited, Gulshan Branch does have a department of Retail Banking, some of the activities are controlled by Gulshan Branch and other are looked after by the ONE Bank Limited, Corporate Head Quarter.

At present, OBL does have different schemes for the clients. The Schemes of OBL under Retail Banking are as follows:

Credit Card (ONE BANKMasterCard)

ONE BANKCAR LOAN

ONE23 Scheme

MARRYSAVE

MONEY- SPINNER P L A N

PENSAVE

EDUSAVE

SME Loan

3.4.1 Credit Card (ONE BANK MasterCard)

ONE BANK MasterCard (Gold & Silver)

ONE BANK Credit cards are widely accepted at departmental stores, shops, restaurants, hotels, airlines, travel agencies, hospitals, diagnostic centers etc. across the country wherever the MasterCard logo is displayed. ONE Bank Limited issue in two versions: Gold & Silver. (See Appendix 2, pg 81)

Credit Limit

Assigned Credit Limits are dependent on various criteria line applicant’s age, income and profession. Once approved the limit will be communicated to the applicant.

Credit Period

Cardholder may enjoy between 15 and 45 days of interest free credit, from the date of transaction. On receipt of the monthly statement the options are to either pay in full or only 10% of the current balance indicated. If the client’s current balance is less than BD Tk 500, then the client have to pay in full amount.

Credit Interest

Outstanding amount of monthly statement will attract interest @ 2.5% per month and will be calculated on a daily basis on the card amount from the posting date.

Who can apply for a card?

If any person between 21 and 60 years of age and have a steady job or income that pays the applicant at least BD Tk 120,000 annually (gross), the person can apply for a ONE BANK MasterCard.

Card Annual Fee

ONE BANK MasterCard Gold: BD Tk 2,000 and ONE BANK MasterCard Silver: BD Tk 1,000

These prices are excluding applicable VAT charges.

Supplementary/ Add-on cards

Additionally, two supplementary/ add-on cards may be issued. Additional cardholder’s transactions will be automatically debited to the principal cardholder’s monthly statement.

Cash Advance Facility

ONE BANK MasterCard allows the facility to draw cash up to the extent of 50% of the client’s credit limit. Cash advance is available at ONE Bank branches and ATMs displaying the MasterCard Logo. Availing cash advance attracts applicable fee and amount withdrawn will be subject to interest from the transaction date.

For Lost/ Stolen Card

If the card is lost or stolen, the cardholder can simply call ONE Bank’s 24-hour Help Desk. The cardholder can report the loss by fax to ONE Bank Limited within 24 hours. These steps are essential to prevent fraudulent transactions on the lost card.

Account with ONE Bank Limited

The Credit Cardholders are recommended to maintain an account (not Mandatory) with ONE Bank Limited, thereby enabling convenience of auto monthly, settlement of the bills, by filing a ‘ Standing Instruction’ to this effect.

Apply for the card

The applicant can just visit any ONE Bank branch or contact ONE Bank Limited, Retail banking Division, Card Services for more information. The employees will be happy to help the client with the application.

These are the activities that the client can follow to apply for a ONE BANK MasterCard and get the benefit of the new generation banking services. Since the banks operating in Bangladesh are all focusing in improving the facilities of Credit and Debit cards and the clients are also looking for further benefits, therefore it is a challenge for ONE Bank Limited to prosper the use of Cards among the clients.

3.4.2 ONE BANKCar Loan

This Loan serves to fulfill the clients “life style aspirations”. Now it is very easy to purchase the car of the client’s choice. Attractive interest rates and equated monthly installment (EMI) repayment, makes decision very easy and straightforward for the clients taking the loan. (See Appendix 3, pg 83)

With ONE BANK CAR LOAN the clients can purchase:

A brand new vehicle of any brand

Reconditioned vehicle (TOYOTA brand preferred)

ONE Bank will finance up to 80% for a brand new car and 70% for a reconditioned vehicle’s quoted price.

Loan Amount

Minimum: Taka 300,000 (Three Lacs)

Maximum: Taka 50, 00,000 (Fifty Lacs)

Loan can be availed up to 18 (Eighteen) times of the gross monthly income of the clients applying for the loan. Additionally, if quasi-cash or other securities acceptable to the bank are provided, the bank at its discretion may allow preferential interest rates.

Eligibility

Bangladeshi nationals between the ages of 21-54 years, a monthly income of at least Taka 30,000 and having a minimum of two years working or business experience (reputed local companies, multinational firms, Government organizations, autonomous bodies, engaged in business or a self employed professional).

Repayment

The maximum repayment period is 60 months for a brand new car and 48 months for a reconditioned car. Based on the client’s convenience, they can choose from 12, 24, 36, 48 or 60 equated monthly installments (EMI) to repay the loan.

How can the customers apply?

The clients can visit any of the branches of ONE Bank Limited, fill up the loan application form and provide copies of required supporting documents.

Completed application will be processed on a priority basis.

Members of ONE Bank Direct Sales Team can also contact with the clients with details of the bank’s Retail Banking products and schemes.

The clients can themselves contact with the sales personnel for further assistance at any of the branches of ONE Bank Limited.

ONE BANK CAR LOAN proved to be a successful scheme for ONE Bank Limited in the years of operation. Many middle and upper middle class customers, who are not able to purchase a car with a large amount of capital, are able to apply for easy term loan from the bank. As OBL have given the customers the scope to purchase a car, so the customers are having the benefits to finance the amount required for the purchase. Many applicants have submitted the proposal of buying a car of their own, the bank needs to evaluate the proposal and sanction the loan under ONE BANK CAR LOAN Scheme. The bank has long term plan to develop this scheme and introduce new ideas so that more and more client can take the benefit out of it.

3.4.3 ONE2 3 Scheme

ONE2 3 Scheme is a lucrative offer from ONE Bank Limited making the clients deposits grow by folds over a certain period of time. ONE2 3 Scheme requires a fixed deposit of Tk. 5,000/- or its multiple for the chosen tenor. (See Appendix 4, pg 85)

ONE2 3 Scheme offers the clients the following facilities:

The clients can go for one or more schemes, even with different deposit amounts and tenors. In the event of premature encashment, OBL will still give the clients attractive interest rates.

ONE2 3 Scheme will make the clients deposit:

- Double in 7 years and 6 months

- 2.5 times in 9 years and 6 months

- Triple in 11 years and 6 months

ONE2 3 Scheme is also another popular scheme introduced by ONE Bank Limited. Since its launch, the scheme seemed to be very popular among the clients. The scheme of doubling the clients saving in certain offered time is seen as a lucrative and profitable offer by the customers wishing to open this scheme. It is a secured and risk free program for the applicant and day-by-day more people are eager to take the scheme. OBL is emphasizing more into the development of this scheme and other benefits related to it.

3.4.4 MARRYSAVE

MARRYSAVE is the marriage scheme brought to the clients by

ONE Bank Limited. The scheme is equally attractive to parents and also the younger generation having plans to start a family in near or distant future.

MARRYSAVE can relieve the worries of the clients at the time of marriage by financing a part of the whole expenditure involved. This saving scheme will provide the financial security during occasion of the marriage. (See Appendix 5, pg 87)

MARRYSAVE can also support starting up a new family in a new home by funding the costs involved at the initial stage.

Some more information about the MARRYSAVE Scheme:

- The clients receive the amount mentioned in the table on maturity.

- The clients can just open an account with OBL and pay the monthly installment by giving the bank a standing instruction.

- The clients are free to choose more than one scheme with different installment amounts and tenors.

- If the clients are the lucky winner of the OBL’s monthly raffle draw, ONE Bank will contribute to the clients account next month’s installment.

- In the event of premature encashment OBL will still give the clients interest at the Savings Deposit rate.

Installment | Tk. 500 | Tk. 1,000 | Tk. 1,500 | Tk. 2,000 | ||

Tenor | Amount Payable on Maturity | |||||

| 5 Years | Tk. 41,243 | Tk. 82,486 | Tk. 1,23,730 | Tk. 1,64,973 | ||

| 8 Years | Tk. 80,763 | Tk. 1,61,527 | Tk. 2,42,290 | Tk. 3,23,053 | ||

| 10 Years | Tk. 1,16,170 | Tk. 2,32,339 | Tk. 3,48,509 | Tk. 4,64,678 | ||

3.4.5 MONEY- SPINNER P L A N

Earn while you save.

Under the scheme, the clients can earn Tk. 86,250 in 5 years by simply making an initial deposit of Tk 10,000. (See Appendix 6 pg 89)

How does it work?

Simple! If the client has a saving of Tk. 10,000 and wish to invest it for a higher return, they can put the fund in the Money-spinner Plan. OBL will add 4 times to the amount and invest a sum of Tk. 50,000. All the client has to do is to repay Tk. 40,000 through 60 monthly installments of Tk. 888. At the end of the fifth year, the client will collect from OBL an amount of Tk. 86,250. The yield is 14.50% per annum.

Money-spinner is available in units of Tk. 50,000.

3.4.6PENSAVE

PENSAVE is a specially designed scheme for the socially conscious citizens. This special saving scheme will provide the financial security during retirement days of the respective clients.

PENSAVE is a secured future of the years ahead.

To know more about PENSAVE scheme introduced by ONE Bank Limited.

- The client will receive the amount mentioned in the table on maturity.

- Just open an account with OBL, and pay the monthly installment by giving the bank a standing instruction.

- The clients are free to choose more than one scheme with different installment amounts and tenors.

- If the clients are the lucky winner of the monthly raffle draw, ONE Bank Limited will contribute to the client’s account next month’s installment.

- In the event of premature encashment OBL will still give the client interest at the Savings Deposit Rate

Installment | Tk. 500 | Tk. 1,000 | Tk. 1,500 | Tk. 2,000 | ||

Tenor | Amount Payable on Maturity | |||||

| 5 Years | Tk. 41,243 | Tk. 82,486 | Tk. 1,23,730 | Tk. 1,64,973 | ||

| 8 Years | Tk. 80,763 | Tk. 1,61,527 | Tk. 2,42,290 | Tk. 3,23,053 | ||

| 10 Years | Tk. 1,16,170 | Tk. 2,32,339 | Tk. 3,48,509 | Tk. 4,64,678 | ||

3.4.7 EDUSAVE

Education is getting more and more expensive day by day. Hence

EDUSAVE is a far-sighted scheme that bridges customer’s dream and

reality.EDUSAVE can support the expenditure for higher study at home or abroad.

The interested applicant can know more about EDUSAVE and some of the attractivenessofthe EDUSAVE Scheme is:

- The client will receive the amount mentioned in the table on maturity.

- Just open an account with OBL, and pay the monthly installment by giving us a standing instruction.

- The clients are free to choose more than one scheme with different installment amounts and tenors.

- If the clients are the lucky winner of the monthly raffle draw, ONE Bank Limited will contribute to client’s account next month’s installment

- In the event of premature encashment OBL will still give interest at the Savings Deposit rate.

Installment | Tk. 500 | Tk. 1,000 | Tk. 1,500 | Tk. 2,000 | ||

Tenor | Amount Payable on Maturity | |||||

| 5 Years | Tk. 41,243 | Tk. 82,486 | Tk. 1,23,730 | Tk. 1,64,973 | ||

| 8 Years | Tk. 80,763 | Tk. 1,61,527 | Tk. 2,42,290 | Tk. 3,23,053 | ||

| 10 Years | Tk. 1,16,170 | Tk. 2,32,339 | Tk. 3,48,509 | Tk. 4,64,678 | ||

EDUSAVE is a Deposit Scheme that offers the client to select from monthly installment amounts of TK. 500 / 1 ,000 / 1 ,500 / 2,000 and a tenor of 5 / 8 / 10 years, on the applicant’s convenience.

3.4.8 SME Loan

Small Business Loan Scheme product was developed for providing financial assistance to small business units at urban and rural areas who cannot offer tangible securities. The Bank has incorporated easy terms and conditions and provide client counseling. ONE Bank Limited is one of the few banks that receive Bangladesh Bank’s refinance for supporting the growth of SME sector. The Bank has established one window service for SME Financing in line with the Government’s focus on development of this potential sector.

SME Requirements

- Trade License Number

- Tax Identification Number (TIN)

- Daily Sales Report

- Stock Report of the warehouse

- Statement for Debt/ Credit

The tenor assigned for SME Loan is 2 years and the applicant can pay in quarterly payment system. The bank gives the guidelines for the procedure and the payment schedule.

3.4.9 The Needed Information Required for

“Consumer Credit Loan” Facilities

Particulars |

Personal Loan |

Car Loan |

Professional Loan |

| Target Customer | ºSalaried Personnel of Reputed Organizations

ºTax Paying Businessmen

º Self-Employed tax paying individuals having a reliable source of income.

| ºSalaried Personnel of Reputed Organizations

ºTax Paying Businessmen

º Self-Employed tax paying individuals having a reliable source of income.

| ºSalaried Personnel of Reputed Organizations

ºTax Paying Businessmen

º Self-Employed tax paying individuals having a reliable source of income. |

|

Purpose of Loan | For Purchase of TV, Refrigerator/Freezer, DVD/VCD system, Video Camera, Washing Machine, Cooking Range, Home Furniture, Small Generator, IPS, Computer, Printer, etc | Car, Jeep, Station Wagon, 4 Wheeler, Microbus for private use, Brand New – Any Brand Vehicle, Reconditioned – TOYOTA brand only | Purchase of different Equipments, Tools and Small machineries, X Ray Machine, Medical Beds, Ultra-sonogram machine, PC, IPS, etc |

| Tax Identification Number (TIN) Certificate | Mandatory | Mandatory | Mandatory |

| Income | Minimum Tk 8000/- per month | Minimum Tk 30,000/- per month | Minimum Tk 8000/- per month |

|

Loan Amount |

12 times monthly Gross Income

Minimum: Tk 30,000/- Maximum: Tk 300,000/- |

18 times monthly Gross Income

Minimum: Tk 30,000/- Maximum: Tk 20,00,000/- | Rural Area Minimum: Tk 30,000/- Maximum: Tk 300,000/-

Urban Area Minimum: Tk 50,000/- Maximum: Tk 360,000/- |

| Interest Rate | 17% | 15% per annum | 17% |

| Tenor | 12-36 months | Brand New – 12-60 months Reconditioned – 12-48 months | 12-48 months |

| Particulars |

Personal Loan

|

Car Loan

|

Professional Loan

|

| Processing Fee | 1% of the loan amount | 1% of the loan amount | 1% of the loan amount |

| Age | 21-54 years | 21-54 years | 21-54 years |

| Telephone | Residence telephone/ mobile phone mandatory | Residence telephone/ mobile phone mandatory | Residence telephone/ mobile phone mandatory |

| Guarantor | 2 Personal Guarantor: 1 Spouse/ Parent and 1 reliable person. | 2 Personal Guarantor: 1 Spouse/ Parent and 1 reliable person. | 2 Personal Guarantor: 1 Spouse/ Parent and 1 reliable person. |

|

Down Payment | — |

Brand New – 20% Reconditioned – 30%

| — |

| Minimum Length | Minimum 2 years total, Minimum 6 months current job

Businessmen – Minimum 2 years in current business.

Professional – Minimum 2 years in current practice | Minimum 2 years total, Minimum 6 months current job

Businessmen – Minimum 2 years in current business.

Professional – Minimum 2 years in current practice | Minimum 2 years total, Minimum 6 months current job

Businessmen – Minimum 2 years in current business.

Professional – Minimum 2 years in current practice |

| CIB Report | Mandatory | Mandatory | Mandatory |

| Know Your Customer Report (KYC) | Mandatory | Mandatory | Mandatory |

From the Topic Analysis and Description Chapter of this Report, the overall process and the analysis of Retail Banking Department have been clarified. Now in the Findings Chapter, the Report will focus on the actual outcome that was the result of the topic analysis.

The Industry Analysis which includes Industry Life Cycle Model, Porter’s Five Forces Model, The Role of the Key External Forces that have an impact on the Business Environment of ONE Bank Limited, Marketing Strategies of Bank Services implemented by ONE Bank Limited, Stages in Consumer Decision Making and Evaluation of Services, Service Development and Design of ONE Bank Limited, Gulshan Branch

4.1 Industry Analysis

An Industry can be defined as a group of companies offering products or services that are close substitutes for each other. Close substitutes here refer to products or services that satisfy the same basic consumer needs. In order to understand an entity’s business, one needs to take a closer look at the industry where the entity is operating. Here, the banking industry of Bangladesh will be analyzed through the usage of two models, namely Industry Life Cycle Model and the Porter’s Five Forces Model.

4.1.1 The Industry Life Cycle Model

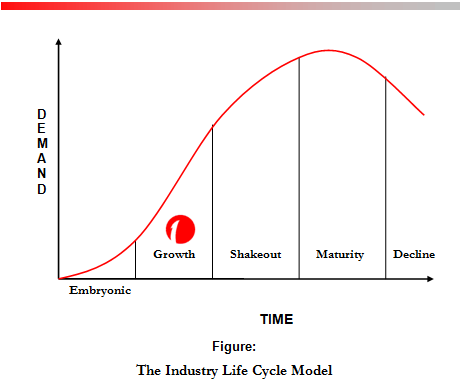

The Industry Life Cycle Model is a useful tool for analyzing the effects of an industry’s evolution on competitive forces. Using this model, we can identify five industry environments, each linked to a distinct stage of an industry’s evolution. The stages are:

- Embryonic Industry Environment

- Growth Industry Environment

- Shakeout Industry Environment

- Mature Industry Environment

- Declining Industry Environment

It is very important for a business entity to have a clear idea regarding the industry life cycle. Each stage of the life cycle requires unique and differentiated strategy formulation. If we analyze all the characteristics of the Life Cycle Model, we can see that the banking industry especially the private commercial banks of Bangladesh are in growth stage.

ONE Bank Limited falls in the Growth Stage of the Industry Life Cycle. Since its establishment in the year 1999, the bank has passed the Embryonic or the introduction stage. Through its services provided to the clients, OBL has been able to create the customer base required to run the banking services. OBL has developed their market position in the banking industry and have established itself in the Growth Stage of the Industry Life Cycle. (See The Figure )

In the Growth Stage, OBL is marked by a rapid climb is the sales of the schemes it provides. Early adopters like the services and additional consumers start to buy the services. New competitors enter, attracted by the opportunities. OBL introduces new service features and expand the number of branches

In this stage, OBL uses several strategies to sustain rapid market growth as long as possible. Some of the possible strategies are:

- It improves the product quality that it offers to the client and adds new product features and improved styling of the branches.

- It enters new market segments and look for the opportunities to expand the customer base or the number of clients.

- It opens up new branches in the most attractive business centers, where the bank can create more businesses.

- It lowers price to attract the next layers of price sensitive buyers.

- Implies new and attractive promotional activities to attract the clients to render the services offered by OBL.

In the growth stage, the demand for the industry’s product begins to take off. It is quite evident that the demand for banking services in Bangladesh has increased gradually, throughout the years. The increasing number of banks and their differentiated offerings bolsters this fact. Rivalry among the competing banks is getting intense day by day. However, the rivalry among competitors in a typical growth industry is low. High rivalry begins at the shakeout stage. However, many authors do not distinguish between these two stages. The justification of low rivalry among companies is that all of them keep themselves indulged in market share building. As demand is ample and supply is comparatively low, anyone can enter the market and get their share of the profit. Banks in our country passed through that stage, and now the market is shrinking day by day. The growth rate has fallen, and slowly the demand is approaching the saturation point. Most banks have prepared themselves for the intense competition, which is the core characteristic of the shakeout stage. It is expected that interest rates and service charges for the different banking services will sharply decline in the coming years.

However, the Shakeout stage does not seem too far a reality and in order to maximize the profits and the turnover ration, ONE Bank Limited needs to further develop the strategies and innovate new product offerings for the clients. Creating loyal customer base should be the primary focus and the Marketing Mix identified should support the offerings well enough.

Competitive Analysis : Porter’s Five Forces Model and the key External Forces having an effect on ONE Bank Limited

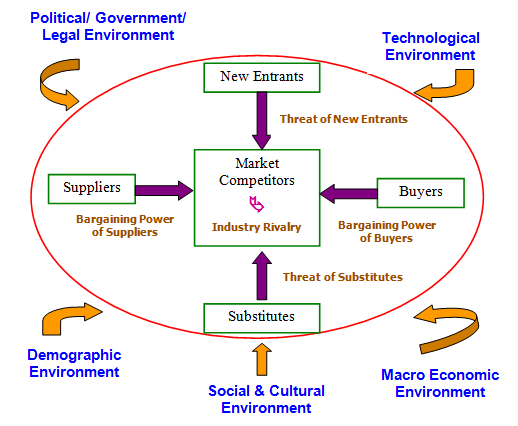

4.1.2 Porter’s Five Forces Model

Porter’s Five Forces Model of competitive analysis is a widely used approach for developing strategies in many industries. The intensity among firms varies widely across different industries. In the banking industry, the competition level among the different pubic and private banks is also seen. Due to the emergence of many commercial banks in Bangladesh, there exists a competitive environment as all the banks try their level best to stay in the challenging competitive environment. (See Figure)

I have also considered the Porter’s Five Forces Model and the key external factors that effect the operations of ONE Bank Limited.

According to Porter, the nature of competitiveness in a given industry can be viewed as a composite of five forces. They five forces of Porter’s Model that have the effect on the operations of ONE Bank Limited are as follows:

4.1.2.1 Rivalry among Competing Firms

4.1.2.2 Threat of New Entrants

4.1.2.3 Bargaining Power of Buyers

4.1.2.4 Bargaining Power of Suppliers

4.1.2.5 Threat of New Substitutes

Porter argues that the stronger each of these forces is, the more limited is the ability of established companies to raise prices and earn greater profits. Thus, a strong competitive force can be regarded as a threat since it depresses profit. Similarly, a weak competitive force can be viewed as an opportunity, for it allows a company to earn greater profits.

4.1.2.1 Rivalry among Competing Firms

Rivalry among competing firms is usually the most powerful of the five competitive forces. The strategies pursued by one firm can be successful only to the extent that they provide competitive advantage over the strategies pursued by rival firms. Changes in strategy by one firm may be met with retaliatory countermoves, such as lowering prices, enhancing quality of services, adding features to the existing services and increasing promotional tools to attract customers.

The intensity of rivalry among competing firms tends to increase as the number of competitors increases. Such as the case for the banks in Bangladesh, where the competition is having effect on the banking industry and this environment is growing day by day. As the emergence of many new commercial banks has taken place, therefore the banks are trying to get the competitive advantage over their rival banks. By introducing new schemes and attracting customers through promotional activities, the banks are having a close and interactive competition in the industry.

Such is the case for ONE Bank Limited also. In the years of operation, since its establishment, the bank has faced stiff competition from the competing banks. To stay in the market, OBL has to concentrate on improving the quality of service and introduce attractive schemes and packages to attract new and retail the existing clients. Therefore continuous development and market research regarding the services offered has to be conducted.

The extent of rivalry among established companies within an industry is largely a function of three factors:

a) The Industry’s Competitive Structure

b) Demand conditions

c) The height of exit barriers in the industry

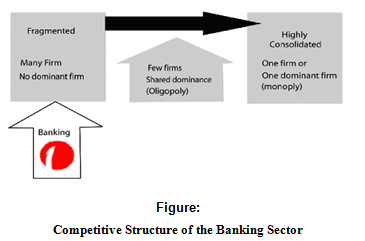

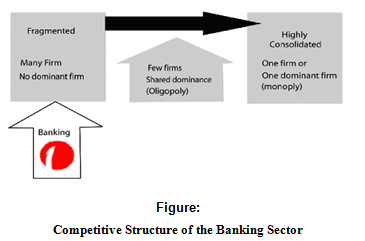

4.1.2.1.1 The Competitive Structure

Competitive structure refers to the number and size distribution of companies in an industry. Structures vary from fragmented to consolidated and have different implications for rivalry. (See Figure). A fragmented industry contains a large number of small or medium-sized companies, none of which is in a position to dominate the industry. A consolidated industry may be dominated by a small number of large companies (oligopoly) or in extreme cases, by just one company (a monopoly). In many countries, banking is a consolidated industry, with a few major players in the market. But in our country, the industry is very much fragmented, as a whole.

Competitive Structure of the Banking Sector

The prime characteristics of a fragmented industry are low entry barriers and identical product offering from the firms. Such is the case in our banking industry. Banks operate with pre-fixed and unanimously agreed interest rates, and their offerings are somewhat identical. The only way to differentiate product offerings from those of the competitors is to lower prices. Such phenomenon occurs as new entrants flood into a booming fragmented industry. This also creates excess capacity. A vicious price war is usually followed by the situation of excess capacity. It can be expected that our banking industry will experience severe price cuts in the following years. As a whole, a fragmented industry increases competition, and it also depresses overall industrial profitability.

4.1.2.1.2 Demand Conditions

An industry’s demand conditions are another determinant of the intensity of rivalry among established companies. Growing demand from either new customers or additional purchases by existing customers tends to moderate competition by providing greater room for expansion. Growing demand tends to reduce the rivalry because all companies can sell more without taking market share away from other companies. In the case of banking, the demand has been growing at a satisfactory rate, throughout the last decade. However, it is not certain whether the trend will sustain or not.

4.1.2.1.3 Exit Barriers

Exit barriers are economic, strategic and emotional factors that keep companies in an industry even when returns are low. If exit barriers are high, companies can become locked into an unprofitable industry in which overall demand is static or declining. The common exit barriers are:

- Investment in plant and equipment that have no alternative uses and cannot be sold off.

- High fixed costs of exit

- Emotional attachments to an industry

- Economic dependence on the industry

4.1.2.2 Threat of New Entrants

Whenever new firms can easily enter a particular industry, the intensity of competitiveness among firm increases. New Entrants are companies that are not currently competing in an industry but have the capability to do so if they choose. The banking industry in our country is still in its growth stage. So the threat of potential New Entrants is quite high. Usually the existing companies try to deter potential competitors by setting certain entry barriers. Barriers to entry are factors that make it costly for companies to enter an industry. The common barriers to entry are Brand Loyalty, Absolute Cost Advantage, Learning Curve Effect, Economies of Scale and Government Regulations. In Bangladesh, the question of Brand Loyalty is somewhat evident in the

banking industry. A person who is a loyal customer of a local or government owned bank usually does not prefer an account in a multinational bank, whatever lucrative the benefits seem. This creates barriers for new entrants. No bank enjoys an absolute cost advantage, due to the fragmented nature of the industry. Most of the government banks and some local banks enjoy learning curve effect as well as the scale of economy; due to the fact that they have been doing business for quite a long time, they have gathered a long time experience of operating in Bangladeshi environment, and they have branches all over the country. The multinational banks are also on the process of achieving scale of economy. The increasing number of branches supports this statement. Government regulation is quite supportive towards the formation and operation of new banks. So this factor is not a significant entry barrier in this sector. For ONE Bank Limited, there also exist Threats of New Entrants as these new banks sometimes enter the banking industry with higher quality products, lower prices and substantial marketing resources. Therefore, OBL has to concentrate on the current and future market condition so that new entrants do not penetrate the market and take the market share.

4.1.2.3 Bargaining Power of Buyers

When customers are concentrated or large or buy the products services in volume, their bargaining power represents a major force affecting the intensity of competition in an industry. Rival firms may offer extended warranties or special services to gain customer loyalty whenever the bargaining power of consumers is substantial. Bargaining power of consumers also is higher when the products being purchased are standard or undifferentiated. Bargaining power of the buyer can be viewed as a competitive threat when they are in a position to demand lower prices from the company or when they are in a position to demand better service that can increase operating costs. On the other hand, when buyers are weak, a company can raise its prices and earn greater profits. For the banking industry buyer means customers who take loan from the banks.

4.1.2.4 Bargaining Power of Suppliers

The bargaining power of suppliers affects the intensity of competition in an industry, especially when there is a large number of suppliers, when there are only a few good substitute products or when the cost of switching the services is especially costly.

Bargaining power of suppliers can be viewed as a threat when the suppliers are capable of forcing up the price that a company must pay for its inputs or reduce the quality of the inputs they supply, thereby depressing the company’s profitability. On the other hand, if suppliers are weak, this gives the company the opportunity to force down prices and demand higher input quality. For the bank the main supplier of fund is the depositor. Bank also gets its funds from the directors.

4.1.2.4.1 Number of Supplier

Bargaining power of the fund suppliers is low in banking industry because there are lots of individual savings in the economy but banks don’t have too many opportunities for investment.

4.1.2.4.2 Threat of Forward Integration

Sometimes suppliers of funds can give threat to the bank as well. Corporations or big multinational companies can give threat to the private bank that they will form another bank for depositing their money. They will not supply any fund to other banks. We all know that bank makes money by investing other’s money. So, this can lead to a higher competition in procurement of fund.

Therefore, OBL have to be concerned about the issues of the suppliers in carrying out the day to day operations regarding the services provided to its valuable clients.

4.1.2.5 Threat of New Substitutes

In many industries, firms are in close competition with producers of substitute products and services in other industries. Competitive pressures arising from substitute products increase as the relative price of substitute products declines and as consumer’s switching

costs decrease. Substitute products are those of industries that serve consumer needs in a way that is similar to those being served by the industry. Loans, the major banking product, have some substitutes. All informal sources and channels of financing are treated as viable substitutes. Some wealthy individuals lend out money at a very high interest rates. These loans do not often require securities, and also do not require any special conditions, e.g. age, certain service time, set monthly income, etc. which makes them a very lucrative option. However, most of these activities are illegal, and therefore bears high risk. For this reason, most people tend to avoid these channels. Thus it appears that the threat of substitute products is not that much prevalent in the banking sector of Bangladesh, till date.

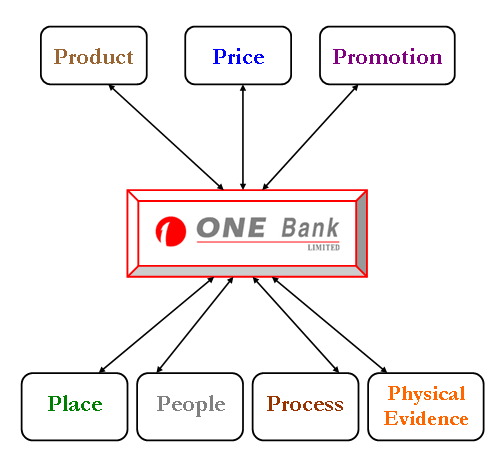

4.2 Marketing Strategies of Bank Services implemented by ONE Bank Limited

Marketing of bank services refers to the process of gearing the operation of a bank to serve the needs of its customers, potential customers and general public. It is the entire banking operation looked at from the standpoint of the customers, potential customers and the general people. Thus marketing of bank services does not mean development of new services only, but it is to make endeavor to produce and provide services to the customers according to their needs and satisfaction, whether new or existing.

Marketing Strategies are being followed by OBL as well as any other firm. Marketing strategies are the key factors in achieving a bank’s goals and objectives by way of giving various services to its customers, potential customers and general people. It is very important for a bank to determine its marketing strategy critically and more rationally so that the strategies formulated and implemented are realistic and practical in nature.

The Banks are engaged in marketing their services; so banking is categorized under the service marketing strategy. (See Figure 38)

The service marketing strategy follows 7 Ps of Marketing Mix. They are:

Product

Price

Place

Promotion

People

Process

Physical Evidence

Marketing Strategies of ONE Bank Limited

4.2.1 Product

All business concerns earn a profit through selling either a product or a service. A bank does not produce any tangible product to sell but does offer a variety of financial services to its customers. Similarly ONE Bank Limited offers the desired services to its clients as the other banks. General banking is the starting point of all the banking operations. It is the department, which provides day-to-day services to the customers. Everyday it receives deposits from the customers and meets their demand for cash by honoring Cheques. It opens new accounts, remit funds, issue bank drafts and pay orders etc. The credit department of the OBL offers several attractive credit facilities to give financial support to the customers. To facilitate the import and export procedure the Foreign Exchange department offers many other financial services.

All the banks offer similar products or services. But the challenge is, how to differentiate these similar services compared to others and how to make these services attractive to the customers. For this purpose, the Banks are trying to improve their service quality as well as providing timely service.

4.2.2 Price

Price is a vital issue for in case of providing banking services. Almost all banks offers similar price. So the competition among the banks regarding price is very high. Each bank tries to attract the customers by reducing their price of services. But it is quite tough to gain profit by reducing price in the banking sector. So number of well-known banks are trying to provide high quality service in a timely manner and charging a reasonably higher price to earn profit. Being a third generation bank where there are many private commercial banks operating, the area is very competitive. To stay up with the competition with the other banks, OBL also tries to fix the price of the services at the reasonable price compared to other banks. Competition based pricing method is usually followed by the bank, where the services are standard across the other commercial banks.

4.2.3 Place

Place is the branches and head office where the customer can get the service. At present ONE Bank Limited has 25 branches, 12 branches are situated within Dhaka City and the remaining 13 branches are situated in different commercial areas of the country, which reflects that OBL are eager to provide their services all around Bangladesh. In Dhaka city all of the branches are situated in the commercial and busy areas where people can render the financial services most. As the main commercial zones attract new and existing businesses, therefore in order to facilitate trade and commerce in respective areas, OBL has established branches to provide the financial services to the clients. ONE Bank Limited, Gulshan Branch is considered to be one of the most priority and important branch in terms of trade and financial services to the clients. Considering the importance of the location OBL has established their branches and in future the bank is looking forward in setting up more branches in the business highlighted zones.

4.2.4 Promotion

The application and use of modern day promotional tools are considered to be very important for any organization. Especially in Banking Services promotion plays a major role in marketing the services to the clients. The clients are being known about the services offered by the banks through the awareness programs created by the banks. Without having a proper promotional campaign and awareness programs, it becomes difficult for any bank to attract the customer. Similarly, ONE Bank Limited also carries out promotions to make the new and existing customers aware of the different schemes and packages. In different occasions of the bank, OBL gives advertisements in the newspapers, provides press release to the paper to inform the citizens what they are now doing at moment. In different areas they provide billboards, this step is taken to fulfill its objective to popularize the bank. Leaflets and brochures are also being supplied to the clients to make them aware of the new schemes and packages offered by OBL. In Gulshan Branch, customers are often given leaflets and any queries of the customers are

answered by the respective employees. Personal Selling through the Retail Banking Department is also carried out in ONE Bank Limited, Gulshan Branch. Organized steps regarding the promotional activities can be beneficial for the bank.

4.2.5 People

From the beginning of the bank, the authority of the bank believes that highly qualified, energetic, enthusiastic, cooperative employees can improve the bank’s services in the modern day competition. That is why the authority recruits those people who have these qualities. The recruitment procedure of OBL is therefore done and the employee selection process is carried out in an extensive manner. Once the employees are selected, the bank posts the employees in the respective departments in the different branches based on their skills and qualifications.

The bank also arranges training programmes for the employees to develop their skill and knowledge regarding the subject manner in which the employees work. Similarly, in Gulshan Branch, different levels of employees are offered training programmes at different times. Motivation and rewards are also offered to the employees and good performance at constant level can result for promotion for the employees.

4.2.6 Process

The banking services by nature have very lengthy and time consuming processes and these processes are quite sensitive, because it involves financial transactions and any mistake can cause serious loss as well as can hamper reputation of the Bank. While dealing with the clients and offering services, the employees have to be very careful. To eliminate or reduce the chance of mistakes and provide smooth services ONE Bank Limited is providing latest technology in their branches. Each and every transaction is closely monitored and proper filing of the required documents of the clients is carefully done. In Gulshan Branch, clients have developed a well maintained relationship with the employees, as they have been offered the high services by the employees through the delivery of work.

4.2.7 Physical Evidence

Physical Evidence nowadays has proved greater impact on the organization’s performance. It is the environment in which the service is delivered and where the firm and the customer interact and any tangible components that facilitate performance or communication of the service. The “Servicescape” where the employee of the bank interacts with the customers, is to be considered as a vital component for any bank when they render service to the clients. OBL have given considerable concentration over the years of operation towards the facility design and the equipments used. Red, which is the base color of OBL have been used for the color of furniture available at different branches. This unique color has created a distinctive image in the customer’s mind. Proper signages of the facilities in different branches are maintained in order to make it easier for the customers who are looking for different services. The employees are also well dressed in formal attires for both the male and female employees working in the bank.

4.3 Stages in Consumer Decision Making and

Evaluation of Services

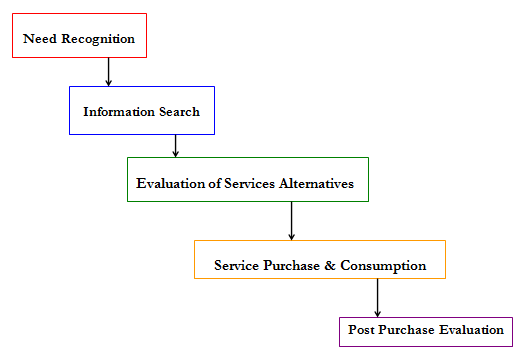

4.3.1 Need Recognition

The process of buying a service begins with the recognition that a need or want exists. The customers of bank feel the need of their desired services and their need recognition for a particular service or bundled of services arises. When the customers need any kind of financial services, they take the assistance of the services offered by the banks. Similarly, the customers of ONE Bank Limited at the initial stage, recognizes their respective needs and wants.

4.3.2 Information Search

After the customer identifies their respective needs and wants, they obtain information about the desired products and services from the personal sources (like friends, family members or experts) and from non-personal sources (such as mass or selective media). When purchasing services, consumers seek and rely largely on personal sources. Customers of banks usually looks for the service offers such as packages and schemes offered by the banks, compare the interest rates and seek benefits offered by the banks. The customers also evaluate the perceived risks involved for the services that they desire to purchase. After the customers have gathered the information, they now make the choice that which bank offers them better packages at the reasonable price.

4.3.3 Evaluation of Services Alternatives

After the information is gathered, concerning the services offered by the different banks, the customer considers the acceptable option from the group of services. In order to purchase a banking product or services, the customers visit the banks and make the choices based on the personal experience or visit. As there are many banks offering similar kind of products and services in a given geographic area, the customers have many alternatives to choose the desired bank. For example, in the Gulshan Avenue, there are branches of many banks and among the banks; the services are more or less similar. Therefore, the customers have to choose the best possible bank to render the service offered by the bank.

4.3.4 Service Purchase and Consumption

After the customer, evaluate the alternatives and choose the best possible bank, that serves the need of the customer, it is now time for making the decision by the customer to purchase the desired service. When customers visit a bank and seeks all the information available practically, the customer approaches for the actual consumption. For example, a customer is in a requirement of taking a loan for some reasons, may apply to many banks, but choose a particular bank to get the loan as it offers favorable terms and conditions against the loan offer. Therefore, considering the long-term benefits and advantages the customer purchase the services offered by a bank.

4.3.5 Post Purchase Evaluation

After the customer purchase the service offered, the customer now becomes an actual client of a bank. The banks usually treat their clients with the best possible solutions available. To retain the existing clients and attract potential clients in future, have to be evaluated by the bank. The clients always appreciate better quality of service encounters. Favorable interactions of the employees will create brand loyalty and help the bank to increase the brand image.

Clients of ONE Bank Limited are always given the top priority and any problems faced by the clients are solved as early as possible by the bank authority. The new concept Know Your Customer (KYC) is being practiced in ONE Bank Limited where customer details and profiles are kept. This introduction of the concept has been able to make effective post purchase evaluation of the services and in the long run can benefit both the client as well as the bank.

4.4 Service Development and Design of

ONE Bank Limited, Gulshan Branch

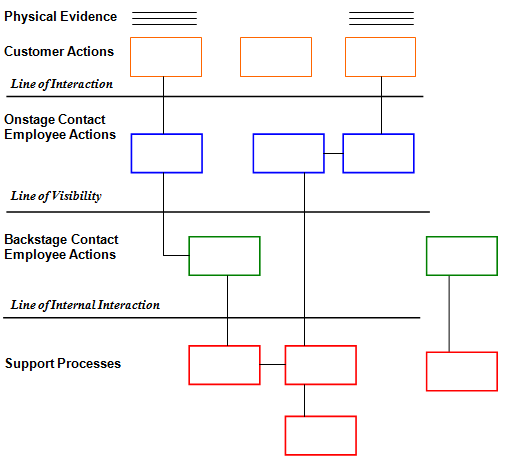

4.4 Service Blueprinting

A service blueprint is a picture or map that accurately portrays the service system so that the different people involved in providing it can understand and deal with it objectively regardless of their roles or their individual point of view. Blueprints are particularly useful at the design and redesign stages of service development. A service blueprint visually displays the service by simultaneously depicting the process of service delivery, the points of customer contact, the roles of customers and employees and the visible elements of the service.

ONE Bank Limited being a service providing organization also maintains Service Blueprint in the branches. The key components of service blueprints followed in the Gulshan Branch are shown in the Figure 40. They are Customer Actions, “Onstage” contact Employee Actions, “Backstage” contact Employee Actions and Support Processes.

Service Blueprint Components

4.4.1 Customer Actions

Customer Action area encompasses the steps, choices, activities, and interactions that the customer performs in the process of purchasing, consuming and evaluating the service. Clients of ONE Bank Limited, Gulshan Branch come to the counters to deposit their money, withdraw cash, write pay order or take any kind of financial service offered by the bank. They meet face to face with the employees and take the required service from the employees.

4.4.2 Onstage Employee Actions

Paralleling the customer actions are two areas of contact employee actions. The steps and activities that the contact employee performs that are visible to the customer are the Onstage Employee Actions. The customers or the account holders of ONE Bank Limited, Gulshan Branch comes in contact with the employees, who are directly interacting with the clients, such as in cash section, general banking, etc.

4.4.3 Backstage Contact Employee Actions

Those contact employee actions that occur behind the scenes to support the onstage activities are the Backstage Contact Employee Actions. In the example of ONE Bank Limited, Gulshan Branch, the employees of the front desk comes into contact with the backstage employees to facilitate the services and provide better assistance to the clients. The front desk employees give the work to the backstage employees, to process the work further for better and faster delivery of output.

4.4.4 Support Processes

The Support Processes section of the blueprint covers the internal services, steps, and interactions that take place to support the contact employees in delivering the service. In ONE Bank Limited, Gulshan Branch, the support process activities are carried out by the higher officials who make the critical decisions regarding any issues. They internally support the employee actions, which are not seen by the customers sometimes.

The four key action areas are separated by three horizontal lines. First is the Line of Interaction, representing direct interactions between the customer and the organization. Anytime a vertical line crosses the horizontal line of interaction, a direct contact or a service encounter between the customer and the bank has occurred. The next line is the critically important Line of Visibility. This line separates all service activities that are visible to the customer from those that are not visible. The third line is the Line of Internal Interaction, which separates contact employee activities from those of other service support activities and people. Vertical lines cutting across the line of internal interaction represent internal service encounters.

5.1 Internal Factors

5.1.1 Strengths

- The top management of the ONE Bank Limited who are the key personnel involved from the very beginning of the bank’s operation, has contributed heavily towards the growth and development of the bank.

- The branches of OBL are situated in the important commercial areas of the country, such as Motijheel, Gulshan, Imamgonj, Agrabad and other important areas, where the banking service is mostly required.

- Relationship with existing clients is very strong. OBL have developed professional relationship with their clients and customer orientation is highly acclaimed.

- Installation and use of highly sophisticated, automated system that enables the bank to have on time communication with all branches reduces excessive paperwork and saves time for valued customer transaction.

- Strong network through out the country and provide quality of service to every level of customer.

- Form the very beginning OBL tries to furnish their work surroundings with modern equipment and facilities. Online Banking is one of the main attractions, which gave this bank a better position among private Banks.

- The corporate culture of OBL is very much interactive compare to our other local organizations. Management and owners (directors) share a very good relationship.

- Correlation with foreign banks is very effective. They have relationship with more than 200 foreign banks. The foreign Banks also give preference to this Bank, which helps to give smooth services to the exporter and importer through this bank.

- OBL provides Diversified Product Lines to its clients, which attracts the clients to render the services offered by the bank..

5.1.2 Weaknesses

- Advertising and promotion is one of the weak points of ONE Bank Limited. There is a marketing department but this department has very low exposure and does not have any effective plan for aggressive marketing activities.

- Higher service charge in some areas of banking operation than that of nationalized banks discourages customers from opening or maintaining accounts with this bank.

- Most of the time the management hire employees for high post from other banks instead of promoting the Bank’s employees, which hampers the motivation of the employees.

- Does not have own training institute for the employees. If any training is required, the Bank authority has to look for other training institutes for the employees. This incurs extra cost for the bank.

- Dependency on term deposit. The bank has to depend a lot on the term deposit by the clients rather than any other source.

5.2 External Factors

5.2.1 Opportunities

- Government of Bangladesh has rendered its full support to the banking sector for a sound financial status of the country, as it is becoming one of the vital sources of employment in the country nowadays. Such government concern will facilitate and support the long-term vision for ONE Bank Limited.

- Investment in SME and Agro based industry can give more opportunity for the bank to expand its market share. As new ventures are being undertaken by many entrepreneurs, therefore a new sector in investment is being created. OBL can give loans to start up the business ventures.

- The online Banking and SWIFT facility will open more scope for OBL to reach the clients not only in Bangladesh but also in the global arena. It will also facilitate wide area network in between the Entrepreneurs and the Bank for smooth operations in order to meet the desired need with least deviation.

- OBL can recruit experienced, efficient and knowledgeable workforce as it offers attractive salary packages and good working environment.

- OBL can pursue diversification strategy in expanding its current line of business. The management can consider more options for developing the retail banking sector or diversity in to leasing and insurance. By expanding business portfolio, ONE Bank Limited can shrink business risk.

- The credit and loan facility offered by ONE Bank Limited has attracted security and status conscious Entrepreneurs and as well as service holders with higher income group. Further improvement in the respective sectors can create a loyal customer base.

- The application of Management Information System is continuously developing and development in future process can attract more potential customers

5.2.2 Threats

- Default culture is very much familiar in our country. For a bank, it is very harmful. As ONE Bank Limited is comparatively new than other older banks; it has not faced it seriously yet. However, as the bank grows older it might create difficulties in recovering money from the clients.

- Bangladesh Bank exercises strict control over all banking activities in local banks. Sometimes the restriction imposed, can create barrier in the normal operations and policies of the bank.

- Rival bank can easily copy the product offering of OBL. Therefore the bank is in continuous of product innovation to gain competitive advantage over its Competitors.

- The worldwide trend of mergers and acquisition in financial institutions is causing concentration in the industry and competitors are increasing in power in their respective areas.

- Due to the emergence of new commercial banks in recent years, there is a slight decline in the overall market share for the banking industry.

5.3.1 The Internal Factor Evaluation (IFE) Matrix of

ONE Bank Limited