Historical Perspective of Social Islami Bank Ltd.:

Social Islami Bank Limited (SIBL) started its operation on the 22nd November, 1995 as on Second Generation Islamic Bank in close co-operation and assistance of some renowned personalities of the Islamic Worked. H.E. Dr. Hamid Al Gavid, Former secretary General of OIC and Prime Minister of Niger, H.E. Dr. Abdullah Omar Nasseef, Deputy Speaker of Saudi Shoura Council and Ex-Secretary General of Rabeta Al-Islami, H.E. Ahmed M. Salah Jamjoom, Former Commerce Minister of Saudi Government, H.E. Prof. Dr. Ahmed El-Naggar (Egypt) participated to this noble Endeavour as sponsor shareholders. Targeting poverty, Social Islami Bank Limited is indeed a concept of 21st century participatory three sector banking model in one: in the formal sector, it works as an Islamic participatory Commercial Bank with human face approach to credit and banking on the profit and loss sharing. Second is a Non-formal banking with informal finance and credit package that empowers and humanizes real poor family and create local income opportunities and discourages internal migration; it is a Development Bank intended to monetize the voluntary sector and management of Waqf, Mosque properties, Non-Muslim Trust Properties in the Country. In the formal corporate sector, this Bank would, among others, offer the most up to date banking services through opening of various types of deposit and investment accounts, financing trade, providing letters of guarantee, opening letters of credit, collecting of bills, effecting domestic and international transfer, leasing of equipment and consumers durable, hire purchase and installment sale for capital goods. Investment in low-cost housing and management of real estates, participatory investment in various industrial, agricultural, transport, educational and health projects and so on.

In addition, SIBL offers special services for the Bangladeshi expatriates which include managing their foreign currency accounts, providing express home remittance services, introducing Cooperative Investment schemes, Foreign wages earners rehabilitation scheme etc. At the operational level, all three sectors activities would be mutually interdependent through Social Fund, Social Assignment Schemes, thereby making all these activities economically, socially and ethically transparent and revealed, once they are operationalzed. Islam provides us a complete lifestyle. Main objective of Islamic lifestyle is to be successful both in our mortal and immortal life. Therefore in every aspect of our life we should follow the doctrine of Al-Qur’an and lifestyle of Hazrat Muhammad (Sm.) for our supreme sources.

Mission:

Efforts for expansion of our activities at home and abroad by adding new dimensions to our banking services are being continued unabated. Alongside, we are also putting highest priority in ensuring transparency, account ability, improved clientele service as well as to our commitment to serve the society through which we want to get closer and closer to the people of all strata. Winning an everlasting seat in the hearts of the people as a caring companion in uplifting the national economic standard through continuous up gradation and diversification of our clientele services in line with national and international requirements is the desired goal we want to reach.

- High quality financial services the latest technology.

- Fast, Accurate and Satisfactory

- Optimum return on shareholders’ equity customer service.

- Balanced & sustainable growth strategy.

- Introducing innovative Islamic Banking products.

- Attract and retain high quality human resources.

- Empowering real poor families and create local income opportunities.

- Providing support for social benefit organizations – by way of mobilizing funds and social services.

Vision:

Ensuring highest standard of clientele services through best application of latest information technology, making due contribution to the national economy and establishing ourselves firmly at home and abroad as a front ranking bank of the country are our cherished vision. Social Investment Bank Ltd started its journey with the concept of 21st Century Islamic participatory three sector banking model:

i) Formal Sector- Commercial Banking with latest technology;

ii) Non-Formal Sector – Family Empowerment Micro-Credit & Micro-enterprise program an

iii) Voluntary Sector – Social Capital mobilization through CASH WAQF and others.

iv) “Reduction of Poverty Level” is our Vision, which is a prime object as stated in Memorandum of Association of the Bank with the commitment “Working Together for a Caring Society”.

Objective:

- To encourage and motivate the new entrepreneurs to establish industries and business for the development of national economy.

- To boost up investment in private sector by financing independently or under syndication arrangement.

- To financing foreign trade of the country both in export and import.

- To enhance saving tendency of the people by offering attractive and lucrative saving scheme.

- To develop the standard of living of the limited income group by offering consumer credit.

- To boost up mobilization of savings both from urban and rural areas.

- To develop the model of participatory banking.

- To develop competitive, most modern scientific and social welfare oriented banking institution of the country.

- To finance the industry, trade and commerce through conventional way as well as by offering various customer friendly credit product.

- Create shareholder wealth.

- Make the stock as being superior long term investments so that investors come forward to buy SIBL stocks.

- Through commitment to the bank and the customers whom SIBL serve, National Bank should become the best in Bangladesh providing a very efficient customer service at a competitive price.

Functions of Social Islami Bank Ltd:

Some general function of National Bank are given below –

To maintain all types of Deposit Accounts.

To make investment.

To conduct of reign exchange business.

To conduct other Banking services.

To conduct social welfare activities.

To work for continues business innovation and improvements.

To bui1d up strong-based capita1ization of the country.

To ensure the best uses of its creativity, well disciplined, well manages and perfect growth.

Organization Structure:

Functional oriented structure Organization structure plays an important role on the profitability of any organization. Social Islami Bank Ltd is a centralized organization and operates in a. That is, its activities are designed on the basis of traditional banking business, such as credit, international division, investment, administration, and operation etc. SIBL has a formal organizational structure that is highly specialized and centralized.

Organizational setup of the Social Islami Bank Ltd is consisting of three organizational domains. Firstly the central top management, which contains Board of Directors, Managing Director, Additional Managing Director and Deputy Managing director, Major responsibilities of this are to take central decision and transmit it to the second step. Secondly, Central executive level management, which contains executive vice president, senior vice president, vice president and Assistant vice president. Major responsibilities of this part are to supervise and control division/ department. Thirdly, branch operation management, which contains branch manager and other mid/ lower level management. Major responsibilities of this part are to the 107 branches of this bank and report to the Head office from time to time.

Management Structure of Social Islami Bank Ltd.:

In 2008 Social Islami Bank Ltd made commendable progress in all business, like deposit, credit, fund management, investment, foreign remittance, credit card & foreign exchange related business. Bank has expended business activities as holding previously & parallels by diversification its investment to a new product, as a major financier remarkable portion of total exports of the country.

Planning:

The strategic planning approach in SIBL is top-down. Top management formulates strategy at the corporate level, and then it is transmitted through the division to the individual objectives. Board of directors or Executive committee usually takes the decision. In this process lower level manager are detached in making process, even brainstorming of lower level manager is absent in decision-making and planning process.

Organize:

Organizing of the Social Islami Bank Ltd is based on Departmentalization. The organization is divided into twelve departments headed by Executive vice President or Senior Vice President. In the Social Islami Bank Ltd the whole operation is centralized and authority is delegated by written guidelines. These guidelines are:

Operational manual approved by Head Office, where each aspect or banking operation is elaborately defined.

Advance manual including advances limit for different management level.

Bad and doubtful recovery manual.

Code of conduct.

Foreign banking guidelines.

Central bank directives.

Different management position holders in departments and branches practice their authorized power in different cases with administrative loophole.

Staffing:

Entry-level recruitment process of the Social Islami Bank Ltd is conducted in three ways. One way is recruitment of probationary officer. Each probationary officer has one year probation period. After completion of probation period the officer joins as officer grade III (b). The career path of probationary officer is headed toward different management positions. Second way of recruitment is to recruit non-probationary officer who joins as an assistant officer. The career path of an assistant officer is lengthier than probationary officer. The third way of recruitment is recruitment of staff and sub-staff such as typist, messenger, driver, guard, attendant, cleaner and other lower level positions. Promotion policy of SIBL is basically based on seniority basis. Sometimes, employees are promoted to the higher position for their outstanding performance. However, it is found that the average length of a position held by an employee is around five years.

Controlling

The bank has strict control over its all-organizational activities. The Bangladesh Bank directives indicate some control measures. The central bank conducts credit inspection by a team. The Social Islami Bank Ltd has audit and inspection department to take controlling measures in internal operations. Audit and inspection team send to the branches now and then and is responsible for preparing report that will be submitted to the chief Administration to take necessary actions.

Hierarchy of the Bank:

Management Committee:

SL No | Name | Position |

1 | Major (Retd.) Dr.Md. Rezaul Haque | Chairman |

2 | Mr.Md. Humayun Kabir Khan | Vice Chairman |

3 | Alhaj Nasiruddin | Vice Chairman |

4 | Alhaj Sultan Mahmud Chowdhury | Director |

5 | Mr. Abdul Awal Patwary | Director |

6 | Mr. Anisul Haque | Director |

7 | Mrs. Nargis Manana | Director |

8 | Mrs. Zohra Alam | Director |

9 | Mr. Kamal Uddin Ahmed | Director |

10 | Mr. Ahmed Akbar Sobhan | Director |

11 | Alhaj Sk. Mohammad Rabat Ali | Director |

12 | Mr.Md. Sayedur Rahman | Director |

13 | Mr. Munshi Akhtaruzzaman | Director |

14 | Mr. K.M. Ashaduzzaman | Managing Director |

Functional Departments of SIBL:

The functional departments of SIBL can be divided into two wings. It is shown below:

Division of SIBL:

Audit & Inspection Division.

ATM Card Division

Board Secretariat

Budget & Monitoring Division.

Credit Division-1.

Credit Division. -2.

Credit Card Division.

Classified Loan Recovery Division.

Financial Administration Division.

General Banking Division.

Human Resources Division.

International Division.

Information System & Technology Division.

Law & Recovery Division.

Marketing Division.

Merchant Banking Division.

Public Relations Division.

Protocol Division.

Reconciliation Division.

System & Operations.

Head Office & Branches

The Head office of the bank is situated at 15, Dilkusha C/A, Dhaka-1000, Bangladesh. There are 49 branches of the bank situated in different locations of Bangladesh. The principal branch of the Bank is also situated at 15, Dilkusha C/A, Dhaka-1000, Bangladesh.

| SI. No. | Name of the Branch & Date of Opening | Address | Telephone No. |

| 1. | Principal Branch 22-11-1995 | 15, Dilkusha C/A, Dhaka, Bangladesh | 9559241, 9550195, 01713018779 |

| 2. | Agrabad Branch 10-04-1996 . | 103, Agrabad C/A, Chittagong, Bangladesh | 031-714041 Fax: 031-710084 |

| 3 | Khulna Branch 20-06-1996 | 2 Sir Iqbal Road, Khulna, Bangladesh | 041-722133,041-730533 |

| 4 | Sylhet Branch 27-06-1996 | CentralPlaza, Ambarkhana, Sylhet, Bangladesh | 0821-711282,01711946325 |

| 5 | Rajshahi Branch 10-08-1996 | 219 Shaheb Bazar main Road, Rajshahi, Bangladesh | 0721-812317,0721-812452 |

| 6 | Gulshan Branch 22-04-1998 | HosnaCenter, 106, Gulshan Avenue, Dhaka, Bangladesh | 8829137,8813793, , 01819-215161 |

| 7 | Babu Bazar Branch 26-04-1998 | Sultana Super Market, 18/4 Armenian Street, Dhaka. | 7395118-9 |

| 8 | Moulvi Bazar Branch 30-09-1998 | 77/7 Wahid Center (1st Floor), Moulvi Bazar, Dhaka. | 7316225, 7315323, 7312911 |

| 9 | Bogra Branch 25-10-1998 | Tin Potty, Borogola, Bogra, Bangladesh. | 051-65833, 051-63943 |

| 10 | Sirajgonj Branch 26-10-1998 | Zaman Complex, S. S. Road, Sirajgonj, Bangladesh. | 0751-63203 |

| 11 | IDB Bhaban Branch 23-09-1999 | E/8a, IDB Bhaban, Rokeya Sarani, Sher-e-Bangla Dhaka. | 8115789, 8141671 |

| 12 | Khatungonj Branch 19-12-1999 | 96, Khatungonj, Chittagong, Bangladesh | 031-639014, 624682-3, 636358 |

| 13 | Panthapath Branch 17-12-2000 | BasundharaCity, Level-2, Dhaka, Bangladesh | 9135229, PABX: 9143517 |

| 14 | Chandaikona Branch 19-12-2000 | Pabna Bazar, Roygonj, Sirajgonj, Bangladesh | 07526-56122, 01715805435 |

| 15 | Sonargaon Branch 09-06-2001 | Mogra Para, Sonargaon, Narayangonj, Bangladesh | 0189-251709, 01819251709 |

| 16 | Foreign Ex. Branch 04-02-2002 | 141-143 Motijheel C/A, BIWTA Bhaban, Dhaka-1000 | 9571254,9571100, 01817530004 |

| 17 | Halishahar Branch 09-02-2002 | VIPPlaza, Plot # 5/A, Road # 2, Block #G, Halishahar | 031-717201,031-815702 |

| 18 | Hasnabad Branch 17-04-2002 | Hasnabad Super Market, Suvadda, Dhaka | 01711565893 |

| 19 | Dhanmondi Branch 14-05-2002 | House #84 (old 176), Road # 7A, Dhanmondi, Dhaka | 9120088,9144682, 01819274072 |

| 20 | Nawabpur R. Branch 26-07-2003 | 82, Nawabpur Road (1st Floor), Dhaka | 7174994-5, 7174921 |

| 21 | Jubilee Road Branch 30-07-2003 | 610/11, Jubilee Road (1st Floor), Chittagong | 031-628288,031-627155 |

| 22 | Uttara Branch 07-12-2003 | Latif Emporium 27, Uttara, C/A, Road#7,S#3, Dhaka | 8959731-33,8961124 |

| 23 | Fatullah Branch 23-12-2003 | Fatulla Bazar, Narayongonj | 7602144, 01911358157 |

Five Year’s Performance at a Glance:

(Taka in million)

| Particulars | 2004 | 2005 | 2006 | 2007 | 2008 |

| Authorizes Capital | 1000.00 | 1000.00 | 2450.00 | 2450.00 | 2450.00 |

| Paid-up Capital | 516.33 | 619.59 | 805.47 | 1208.20 | 1872.72 |

| Reserve Fund | 1345.99 | 2115.03 | 2468.79 | 3360.18 | 4253.55 |

| Deposits | 28973.39 | 32984.05 | 40350.87 | 47961.22 | 60195.25 |

| Loans And Advances | 23129.65 | 27020.21 | 32709.68 | 36475.74 | 49665.07 |

| Investment | 4374.17 | 3564.82 | 6239.83 | 7760.38 | 10162.81 |

| Import Business | 22028.30 | 31648.20 | 42458.50 | 62759.00 | 78226.32 |

| Export Business | 17105.30 | 21344.10 | 28019.20 | 31824.00 | 36284.44 |

| Remittance Income | 9035.50 | 13618.20 | 21353.90 | 27560.80 | 39877.80 |

| Profit Before Tax | 484.21 | 581.13 | 1058.73 | 2035.10 | 2828.82 |

| Profit After Tax | 170.02 | 271.67 | 507.49 | 1238.11 | 1517.43 |

| Fixed Assets | 895.35 | 1431.23 | 1627.29 | 1842.28 | 1981.60 |

| Total Assets | 35127.30 | 38400.37 | 6796.04 | 56526.96 | 72212.86 |

| Net Assets Value Per Share | 360.68 | 441.36 | 406.50 | 378.12 | 327.13 |

| Market Value Per Share | 475.25 | 756.50 | 760.50 | 1494.00 | 1014.25 |

| Earning Per Share | 27.44 | 43.85 | 63.01 | 66.11 | 81.03 |

| Dividend Per Share | 20% | 30% | 50% | 55% | 52% |

| Credit Deposit Ratio | 79.83% | 81.92% | 81.06% | 76.05% | 82.51% |

| Cost of Fund | 5.47% | 5.31% | 6.15% | 6.35% | 7.76% |

| Yield on Loans And Advances | 10.32% | 10.02% | 12.28% | 12.13% | 12.94% |

| Return on Assets | 0.48% | 0.74% | 1.19% | 2.40% | 2.36% |

| Return on Equity | 18.26% | 11.82% | 16.89% | 31.57% | 28.38% |

| Debt Equity Ratio (Times) | 10.88 | 7.55 | 8.13 | 6.77 | 6.99 |

| Number of foreign Corresponds | 410 | 391 | 400 | 405 | 405 |

| Number of Employees | 2133 | 2183 | 2270 | 2432 | 2737 |

| Number of Branches | 76 | 76 | 91 | 101 | 106 |

Capital & Reserve Fund: Taka in Million

Year | 2004 | 2005 | 2006 | 2007 | 2008 |

| Authorized capital | 1000 | 1000 | 2450 | 2450 | 2450 |

| Paid up capital | 516.33 | 619.69 | 805.47 | 1208.2 | 1872.72 |

| Reserve fund & Surplus | 1345.99 | 2115.03 | 2468.79 | 3360.18 | 4253.55 |

Fig – Capital & Reserve Fund

Stock Dividend of 55 percent was declared for the year 2007 which increased the paid-up capital of the bank from Tk. 1,208.21 million to Tk. 1,872.72 million in 2008 while its authorized capital was Tk. 2,450 million. The statutory reserve enhanced by Tk.565.60 million in 2008 after maintaining 20 percent pre-tax profit. The total equity of shareholders of the bank stood at Tk. 6,126.30 million at the end of the year 2008.

Loans and Advances: Taka in Million

Year | 2004 | 2005 | 2006 | 2007 | 2008 |

| Loans and advances | 23129.65 | 27020.21 | 32709.68 | 36475.74 | 49665.07 |

Fig – Loans & Advance

Social Islami Bank Ltd designed appropriate credit risk management criteria and strategies for balanced lending mix commensurate with sound capacity to finance in the short term and long term credit. SIBL succeeded to increase its loans and advances despite the current wave of global recession registering a growth of 36.16 percent with total loans and advances portfolio of tk. 496651 million in 2008 compared to tk. 36475.7 million of 2007. The growth was due to injecting significant amount of fund in new ventures of Syndicated loan, project loan, Lease finance, SME, Agriculture loan, etc. and usual growth in Foreign Trade.

SIBL was cautious in the later half of the year when the global economy started to meltdown into a possible recession. Financing trade and commerce remained a strong focus on multi-dimensional industries in textile, telecommunication, and pharmaceuticals sectors. To uplift the base further export growth financing on RMG sector was given extensive support.

Deposit & Advanced: Taka in Million

Year | 2004 | 2005 | 2006 | 2007 | 2008 |

| Deposit | 28973.39 | 32984.05 | 40350.87 | 47961.22 | 60195.25 |

| Advances | 23129.65 | 27020.21 | 32709.68 | 36475.74 | 49665.07 |

Fig – Deposit & Advance

The deposit base of the bank registered a growth of 25.51 percent it the reporting year over the last year and stood at Tk. 60,195.20 million. Expansion of branch network, competitive interest rate and innovative deposit products contributed to the growth. The customs of the bank were individual’s corporations, financial institutions government and autonomous bodies etc.

Import & Export:

Year | 2004 | 2005 | 2006 | 2007 | 2008 |

| Import | 22028.30 | 31648.20 | 42458.58 | 62759.06 | 79226.52 |

| Export | 17125.30 | 21344.10 | 28019.20 | 31824.00 | 35284.44 |

The Bank opened a total number of 21,210 LCs amounting USD 1,130.96 million in import trade in 2008 with a growth of 25 percent over the previous year. The main commodities were scrap vessels, rice, wheat, edible oil, capital machinery, petroleum products, fabrics & accessories and other consumer items. The Bank has been nursing the export finance with a special attention since its inception. In 2008 it handled 16,234 export documents valuing USD 531.03 million with a growth of 14 percent over the last year. Export finances were made mainly to readymade garments, knitwear, frozen food and fish, tanned leather, handicraft, tea etc.

Investment:

Taka in Million

Year | 2004 | 2005 | 2006 | 2007 | 2008 |

Investment | 4374.17 | 3564.82 | 6239.83 | 7760.38 | 10162.81 |

Fig – Investment

Domestic savings GDP ratio decreased from 20.4 percent of FY07 to 20.1 percent FY08 and investment GDP ratio also decreased marginally from 24.5 percent to 24.2 percent during the same period. Savings investment gap as percentage of GDP remain static. The banking system showed improvement during the year under report. Non-performing loan to total loan ratio of the banking sector decreased. The interest rate spread also narrowed down. Country’s banking sector remained shielded from the global financial turmoil mainly due to low level of global integration, prudent regulation and sound management. Though there was a bullish trend in capital market in the first half of 2008, all the indicators slightly declined in the last part of the year. In view of the present global crisis the important issue is to ensure good risk management for capital market institutions enabling them to take risk and reap returns.

Net Profit after Tax:

Year | 2004 | 2005 | 2006 | 2007 | 2008 |

Net profit after tax | 170.02 | 271.67 | 507.49 | 1238.11 | 1517.43 |

Stock Dividend of 55 percent was declared for the year 2007 which increased the paid-up capital of the bank from Tk. 1,208.21 million to Tk. 1,872.72 million in 2008 while its authorized capital was Tk. 2,450 million. The statutory reserve enhanced by Tk.565.60 million in 2008 after maintaining 20 percent pre-tax profit.The total equity of shareholders of the bank stood at Tk.6,126.30 million at the end of the year 2008.

Capital Management of the Bank is to maintain an adequate capital base to support the projected business and regulatory requirement. NBL always maintain a prudent balance between Tier- 1 and Tier-2 capital.The Bank has maintained overall capital adequacy at 13.42 percent in 2008 of which 10.83 percent and 2.59 percent as Tier-1 and Tier -2 capital respectively against Bangladesh Bank’s requirement of 10 percent.

The deposit base of the bank registered a growth of 25.51 percent it the reporting year over the last year anc stood at Tk.60,195.20 million. Expansion of branch network, competitive interest rate and innovative deposit products contributed to the growth.The customes of the bank were individuals corporations, financial institutions government and autonomous bodies etc.

The Bank opened a total number of 21,210 LCs amounting USD 1,130.96 million in import trade in 2008 with a growth of 25 percent over the previous year. The main commodities were scrap vessels, rice, wheat, edible oil, capital machinery, petroleum products, fabrics & accessories and other consumer items. The Bank has been nursing the export finance with a special attention since its inception. In 2008 it handled 16,234 export documents valuing USD 531.03 million with a growth of 14 percent over the last year. Export finances were made mainly to readymade garments, knitwear, frozen food and fish, tanned leather, handicraft, tea etc.

Domestic savings GDP ratio decreased from 20.4 percent of FY07 to 20.1 percent FY08 and investment GDP ratio also decreased marginally from 24.5 percent to 24.2 percent during the same period. Savings investment gap as percentage of GDP remain static.The banking system showed improvement during the year under report. Non-performing loan to total loan ratio of the banking sector decreased. The interest rate spread also narrowed down. Country’s banking sector remained shielded from the global financial turmoil mainly due to low level of global integration, prudent regulation and sound management. Though there was a bullish trend in capital market in the first half of 2008, all the indicators slightly declined in the last part of the year. In view of the present global crisis the important issue is to ensure good risk management for capital market institutions enabling them to take risk and reap returns.

Social Islami Bank Ltd generated an operating profit of Tk.3, 123.80 million in 2008 which was Tk.2, 215.10 million in 2007 registering a growth of 41.02 percent. Net Profit after tax grew by 22.56 percent to Tk.1, 517.40 million in 2008 after making provision for loan loss and income tax for Tk.295.00 million and Tk.1, 310.00 million respectively.

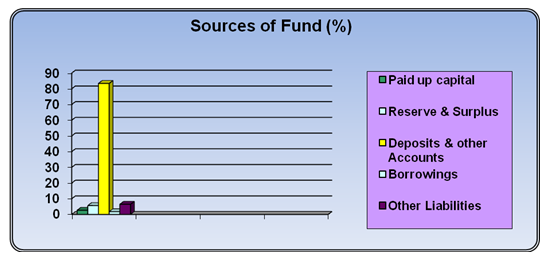

Sources of Fund:

| Paid up capital | 2.59 |

| Reserve & Surplus | 5.59 |

| Deposits & other Accounts | 83.36 |

| Borrowings | 1.74 |

| Other Liabilities | 6.42 |

Total liabilities increased by 27.19 percent to Taka 66,086.60 million as of 31 December, 2008. This was mainly due to increase in customer’s deposits and keeping provision for income tax, gratuity and loan loss, etc.

Reference:

Books:

Theory and Practice of Banking (B-101), BangladeshInstitute of Bank Management, Dhaka, 2000.

Andley, K. K & Mattoo, V. J., Foreign Exchange Principles and Practices, Sultan Chand & Sons, New Delhi, 1996.

Balchandran, P., Foreign Exchange: A Mannual for Managers, Skylark Publications, New Delhi, 1991.

Chakraborty, P., The Negotiable Instrument Act, 1881, Swarna Prokashani, Dhaka.

Choudhury, T. A., An Overview of Banks and Their Services, Reading Materials on Banking Service.

Web Site:

- www.sibl.com.bd/

- www.scribd.com/

- www.privatebanking.com/bangladesh/banks/social-sislam-bank-ltd.